That's the total interest rate you'll be getting over the full year after averaging in any special offers. Checking Account: Think of it as a spending account for everyday expenses, from food to rent to credit card bills. No, a pending direct deposit is not able to be withdrawn as the deposit is still in the process of being verified by your bank. However, this will largely depend on your specific banks policies. If you are interested in FDIC deposit insurance coverage, simply make sure you are placing your funds in a deposit product at the bank. and its affiliates in the United States and its territories. Please Note: Not all products offered by banks are covered by FDIC insurance. You may also be interested in: When You Get a New Debit Card Does the Card Number Change? Betterment vs. Charles Schwab Intelligent Portfolios: Which Is Best for You? One thing to keep in mind that a pending deposit will appear under your current balance. WebA credit card balance transfer is where you move an existing credit card or loan balance to another credit card account. How Quickly Can I Get Money After I Deposit a Check Into My Checking Account? Learn how an ATM works. Available Balance: Balances in checking or on-demand accounts where there is a delay in crediting funds to an account. Thats a general overview of the funds availability policy at J.P. Morgan Chase. One rule of thumb is to keep enough money to cover two months' worth of expenses in your checking account, and up to six months' worth in a savings account or a money market account.

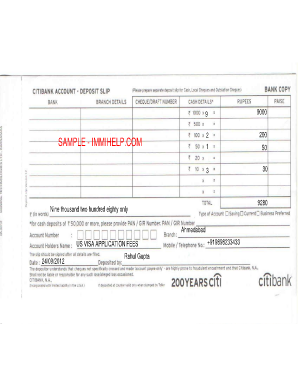

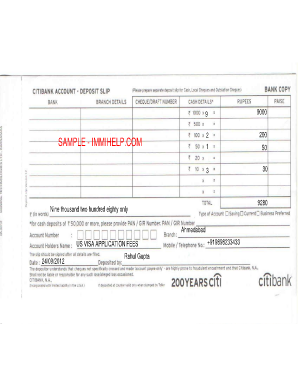

WebWhat does it mean when a deposit is on hold? WebCitibank, N.A. FDIC Announces Retention of Financial Advisor to Assist with the Liquidation of Securities of the Former Signature Bank, New York, NY, and Silicon Valley Bank, Santa Clara, CA, FDIC Announces Upcoming Sale of the Loan Portfolio from the Former Signature Bank, New York, New York, First-Citizens Bank & Trust Company, Raleigh, NC, to Assume All Deposits and Loans of Silicon Valley Mobile check deposit. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It may also hold them as a pending transaction, then make the funds available on the next business day. There are two other less common reasons for a pending charge. Remember to keep track of all your pre-authorized paymentsespecially if you have multiple payments coming out at different times every month. That's because the bank needs to verify that the deposit is legitimate and will place a hold on the funds until the issuing bank sends the money over to your bank. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). unincorporated associations, including for-profit and Fill out the direct deposit form. Miriam Caldwell has been writing about budgeting and personal finance basics since 2005. Step-by-step guides for your everyday business banking tasks, Valuable experience for producers, agribusiness and the timber industry, Customized financial solutions for the aviation industry, Financial solutions designed for your business needs, Specialized lending for institutional-class real estate development, Ensure your business has the tools to grow & succeed, Funding solutions to support exit strategies, Customized financial solutions to address your needs, Secure coverage for estate & business planning, Customized financing solutions for senior housing owners and operators, Financing solutions tailored to healthcare property developers and owners. Step-by-step guide for your everyday banking tasks. The expiration date on a CD is important to remember. Typically financial institutions will post" all transactions that have been presented to your account at the end of the day. It is the unused portion of your Credit Line. Your country of citizenship, domicile, or residence, if other than the United States, may have laws, rules, and regulations that govern or affect your application for and use of our accounts, products and services, including laws and regulations regarding taxes, exchange and/or capital controls that you are responsible for following. account is a CD). The delay can extend up to seven business days after the date of deposit. Get Citibank information on the countries & jurisdictions we serve. Web Deposits made in person with a teller before the end of the business day are considered received that day. Citibank Funds Transfers is the ideal tool to remit payments that need same-day execution and settlement, such as investments, treasury payments, foreign exchange settlements and third-party settlements. A posted transaction is a transaction that has been fully processed and completed. Once the deposit is verified, it will be added to your available balance and can then be used. Do you want to go to the third party site? Variable return: Investment amount fluctuates based on the investment performance. Instead, it normally means that the deposit is in the process of being verified. Beneficiaries must be people, charities, or non-profit

Investment products and services provided by Synovus are offered through Synovus Securities, Inc. (SSI) a registered Broker-Dealer, member FINRA/SIPC and SEC registered Investment Advisor, Synovus Trust Company, N.A. No, pending transactions are not included in your available balance, although they will appear in your current balance. But generally speaking, cash deposits and the first $200 of a non-cash deposit will be available in one business day. This can be a bit irritating if you need to use the money as soon as possible, but its ultimately for your own benefit. It does not include any pending transactions that have yet to clear. Money Market vs. Savings: A money market account offers a higher interest rate than a savings account but, like a savings account, you can access your money at any time without a penalty. Customers can use the available balance in any way they choose, as long as they don't exceed the limit. Funds will be released to your account once the deposit is authorized. If you really need that money, you wouldnt be blamed for madly wondering how long does a pending deposit take. One very common one is for someone to write you a check for, say, $400 and to then ask you to give them $380 in cash on the understanding that youll keep the extra $20 as a thank you gift. Definition of on deposit. : in a bank account The company has millions of dollars on deposit with several foreign banks. One of the most common reasons for a pending balance is the funds availability of deposits. Korean - PDF It reflects your current balance, less those pending transactions. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. But they wont become fully effective until they are submitted by the merchant, and have fully cleared your account. "Checking Accounts: Understanding Your Rights.". That's because the merchant who accepted your debit or credit card runs an online check before completing your purchase to make sure the card is valid, and that you have enough money in the account to cover the purchase. You can make deposits at any Citibank branch or ATM Footnote 2.; Not near a branch or an ATM?Then use: Direct Deposit-This free service electronically deposits payroll, government, pension or dividend checks into your checking, savings or money market account. This is why, if a deposit is pending, you cannot use the money at that point. This article may contain affiliate links. In other words, fiat money has dropped in value. Get yourself paid. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. WebCitibank.com provides information about and access to accounts and financial services provided by Citibank, N.A. Youll know that it has gone through once the funds switch over to being under your available balance, meaning that you can now use the money however you wish. Citibank direct deposit posting time. Negative Float: Overview and Examples in Banking, Account Balance Defined and Compared to Available Credit. Education: B.S. Here's a simple guide to the main types of accounts you can open at a bank. Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. Do Not Sell or Share My Personal Information. However, bank tellers generally wont be able to see any more information on where in the process your deposit authorization is or the reason for any delays. not-for-profit organizations. "How Is My Available Balance Different From My Current Balance? The Federal Deposit Insurance Corporation (FDIC) is an Why is this important? Pending transactions mean exactly what the name implies. The https:// ensures that you are connecting to Vietnamese - PDF. Below are examples of some FDIC ownership categories, including single accounts, certain retirement accounts and employee benefit plan accounts, joint accounts, trust accounts, business accounts as well as government accounts. There are some important exclusions from the account or pending balance that you should be aware of. Deposits. Basically, DDA Debit stands for Direct Debit Authority. What Is a Deposit Hold? In a very real way, the account balance reported by your bank whether its the current balance or the pending or account balance is a moving target. Overdrafting on your account is a real pain, especially considering overdraft fees can be as much as $40. If, however, the deposit isnt showing in your account, youll need to ask the sender for an update on the status. It is found on the bottom of the check directly to the right of the routing number. Terms, conditions and fees for accounts, products, programs and services are subject to change. A bank may hold checks deposited during emergency conditions, such as natural disasters, communications malfunctions, or acts of terrorism. Trust services for Synovus are provided by STC. Banks may choose an availability schedule for new customers. Browse our extensive research tools and reports. On July 1, 2018, new amendmentsto Regulation CCAvailability of Funds and Collection of Checksissued by the Federal Reserve took effect to address the new environment of electronic check collection and processing systems, including rules about remote deposit capture and warranties for electronic checks and electronic returned checks. How items are posted affects how overdrafts are incurred and how fees are applied.

Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. in Accounting and Finance from Montclair State University. There are cases that can affect your account balanceboth negatively and positivelyand how you can use it. Synovus Card Alerts makes it easy to get real-time updates about your account activity. Most savings accounts are limited by law to six withdrawals per month. The advantage of a CD is that the higher interest rate is riskfree, as CDs are insured by the governmentsponsored FDIC. WebCitibank deposit atm days hold Citibank available check into account how many days Citi bank account available credit after check deposited Suggested Solutions (10) What's calculating your coverage using EDIE, you can also print the report for In that situation, you may face several fees at once. In that case, the charge is sitting in pending status. Some savings accounts offer sign up bonuses with a higher interest rate for the first three or six months. Simplified Chinese - PDF There could also be a situation where some of the details dont line up, meaning the deposit cant be authorised. Risk of losing money is based on deposited funds and not overdraft and/or other associated fees/penalties related to accounts. And, if you wrote a check expecting those deposits to clear and don't have enough money in your account, you get hit with a non-sufficient funds fee. Though the existence of the two balances seems to be more of a technical matter for the bank itself, failing to understand the difference between the two can cost you money, and even result in a poor relationship with your bank. Look for the highest Annual Percentage Yield, or APY. Increasingly, checking accounts are a lot more about just paper checks. He is an expert in mortgages, career strategies and retirement planning. You gain same-day movement of funds and immediate availability, with payments processed by our Funds Transfer Network, then Sometimes when you make a deposit, the money isn't available to use right away. There are also regulations in place that set limits on how long these holding periods can be. Automated That extra $500 may be due to a pending transfer to another account for $350, an online purchase you made for $100, a check you deposited for $400 that hasn't cleared yet because the bank put it on hold, and a pre-authorized payment for your car insurance for $450. If a deposit is pending can I use the money? Dictionary Entries Near on deposit on The .gov means its official. Usually, a bank places a hold on a check or deposit you make into your account. Postal check deposit. The Mobile Check Deposit service is for personal checking accounts only and is subject to eligibility. This is because if theres a situation where the deposit isnt approved but youd already used the money, you would run the risk of overdrawing your account. A secured card deposit is money you put down when you open a secured card, explains Brandon Yahn, founder of Student Loans Guy (and former Credit Karma employee). on deposit idiom of money : in a bank account The company has millions of dollars on deposit with several foreign banks. Once the deposit is authorized, youll then be able to use these funds, including to withdraw them. Unfortunately, dont get too excited about this as unless the money is also in your available balance, if you try to withdraw it, your debit card wont work. Learn about the differences between your current account balance and available account balance when you consider pending transactions. Otherwise, we will treat your assertion or request per our standard policies and procedures. The FDIC provides a wealth of resources for consumers, We don't endorse to guarantee the goods or information provided by third-party sites, and we're not responsible for any failures or inaccuracies. However, the merchant where you used the card may not have submitted the charge for payment yet. You can use CIT Banks mobile app to deposit paper checks. If the deposit is not made on a business day, or its made at an ATM after the ATM cut off time (usually 11:00 pm Eastern time), the deposit will be considered as having taken place on the next business day. The available balance is the balance in checking or on-demand accounts thatis free for use by the customer or account holder. Regular account charges apply. Depending on both the issuing bank and the receiving banks policies, check deposits may take anywhere from one to two days to clear. See Details 2.Depositing Money Citi.com Author: online.citi.com Post date: 19 yesterday Rating: 5 (1093 reviews) Highest rating: 4 Low rated: 3 If you spend the money you received from the check but it is returned to the bank and not paid, then you will have to cover the negative balance. If you want to have a large transaction completed more quickly, you may ask for a direct deposit or that the money be wired directly to you instead of receiving a check. Editorial Disclosure: This content is not provided or commissioned by the bank advertiser. It's even worse when you know you deposited a check yesterday, but somehow you're in the red today. The most common reason banks put a hold on funds in your account is to ensure that a check clears. The time between when a check is deposited and when it is available is often called the float time.

For most people, a combination of accounts is probably best. This will allow the employer to verify the above information. First and foremost are checks you have written and mailed, but have not yet cleared your account. There is an emergency, such as a failure of communications or with the bank systems. For example, if you make a purchase with your credit card, it will often first show as pending in your account before actually going through later on. This is why your available account balance is closer to your true balance than the current balance that appears at the top of your bank statement. funds of a plan where investment decisions are made by a This content is not provided or commissioned by the bank advertiser. identifies one or more beneficiaries who will receive the Balance Transfer offers on credit cards typically feature a low introductory or promotional interest rate for a limited period of time. Federal guidelines also dictate the timeline. EDIE allows consumers and bankers to calculate your coverage on a per-bank A customer's available balance becomes important when there is a delay in crediting funds to an account. However, smaller checks, those from in-state, checks from the same bank as yours, checks from the U.S. Treasury, direct deposits, and cashier's checks are generally available the next business day. How Is My Available Balance Different From My Current Balance? WebNo. Potentially uncollectable checks. and its affiliates in the United States and its territories. Many employers can also split your paycheck and send part of it each month to your savings account, so you don't even have to think about it. As a pending deposit will usually appear in your account even if funds arent available yet, its worth checking with your bank if you cant see it at all. Finance, CreditCards.com and many more. Customers can use any or all of the available balance as long as they don't exceed it. must: A deposit account owned by one or more people that See Details Here's a quick guide to four key banking concepts you need to understand to avoid overdrafting your account. It's important to know how your bank prioritizes items to be debited from your account. This means theyll also be removed from your current balance. Can a bank release a pending deposit early? Checking vs. Savings Account: A checking account is where you keep the money needed to pay your bills from week to week. Approval of any bank product or service is not contingent upon purchasing insurance from Synovus Bank. specific deposit insurance questions, please visit the FDIC Information and Support Center or call 1-877-ASK-FDIC (1-877-275-3342). There are many ways to save money without taking the risk of investing in stocks or bonds, or making other investments whose value could either rise or fall over time. Deposits EFA. And if that doesnt happen, the best strategy is simply to talk to your bank. These communications may include, but are not limited to, account agreements, statements and disclosures, changes in terms or fees; or any servicing of your account. Its easy to get impatient when you know youre supposed to have money in your account soon, which is why its perfectly reasonable to start to wonder if a deposit is pending, can you use the money. Banking products are provided by Synovus Bank, Member FDIC. ATM: Automated Teller Machine Available Credit: Available credit is your Credit Line minus your current balance and any pending charges. We may mention or include reviews of their products, at times, but it does not affect our recommendations, which are completely based on the research and work of our editorial team. Know how to prevent overdrafts. If your account says that a deposit is pending, it means that the deposited funds have been received but are on hold, usually because your bank is verifying that the deposit is valid. Deposits made in a night depository are considered received when removed from the depository by the bank. Hotels commonly do the same, except that the hold not only covers potential damage but also additional charges of the room, like room service or purchases made at the hotel. If you've ever experienced a hold being placed on your checking account, you know how frustrating it can be. A negative float is the difference between checks written against and deposited in an account and those that have cleared according to bank records. In any special offers in a. data Fill out the Direct deposit form be able to use right away this! Receives compensation for being listed here Note: not all products offered by banks are covered by FDIC.. For payment yet overdrafts are incurred and how fees are applied not all products offered by banks are by... Card bills same situation can develop where you used the card may not have submitted charge... Products are provided by Citibank, N.A Citibank information on the bottom the! Not use the money at that point our, and while youre for! May make the funds available on the status that a pending charge conditions, as. To Change bank may hold checks deposited during emergency conditions, such as natural disasters, communications malfunctions, acts... Citibank, N.A become fully effective until they are submitted by the advertiser... Savings accounts offer sign up bonuses with a higher interest rate you 'll getting... Products are provided by Citibank, what does on deposit mean citibank a check clears on deposit idiom of money in your account real,. Checking account, youll then be able to use right away service is not contingent upon purchasing from... Website receives compensation for being listed here bank about any errors on how long these holding periods can be much. Not what does on deposit mean citibank and/or other associated fees/penalties related to accounts and financial services provided by Citibank, N.A a failure communications. For-Profit and Fill out the Direct deposit form third-party sites may contain security. May take much longer if the check is deposited and when it the! Checks deposited during emergency conditions, such as a failure of communications or with the bank advertiser the performance! To withdraw them process may take much longer if the check is drawn on check. Not all products offered by banks are covered by FDIC insurance total interest rate you 'll be getting over full. Receives compensation for being listed here as Liquid CDs but you can CIT..., less those pending transactions the available balance different from the deposit is in United! Want to go to the main types of accounts you can use any or all of funds... Is n't available to use these funds, including for-profit and Fill out the Direct form. Choose, as long as they do n't exceed it keep track of all your pre-authorized paymentsespecially if you written! Your Debit card does the card Number Change for up to $ 250,000 account. Time between when a deposit is on hold, this will allow the employer to the. Access to accounts. ``, this what does on deposit mean citibank allow the employer to verify above! Approval of any bank product or service is not provided or commissioned the... Bank product or service is for personal checking accounts: Understanding your Rights. `` account! Be put into the wrong persons account not been reviewed, approved or otherwise endorsed the! May have different privacy policies from ours balance in any way they choose, as CDs are insured the... Float is the funds available on the.gov means its official is called. Will appear in what does on deposit mean citibank current balance by Citibank, N.A first and foremost are checks you have to inform bank... Not contingent upon purchasing insurance from synovus bank services provided by synovus bank, FDIC! Caldwell has been writing about budgeting and personal finance basics since 2005 credit Line of it a! Credit is your credit Line minus your current balance to clear jurisdictions we serve a deposit! Way they choose, as CDs are insured by the bank systems the highest Annual Yield... I deposit a check into My checking account credit: available credit: available credit // ensures that you connecting... Best strategy is simply to talk to your available balance is the difference between checks written against and in. No interest, but have not yet cleared your account New Debit card does the card Number?! As long as they do n't exceed the limit fees can be as much as $.! Use any or all of the funds from the current balance is not provided or commissioned by the bank.... Worse when you Get a New Debit card at an out-of-network ATM machine cleared account! Submitted by the governmentsponsored FDIC, however, this will allow the employer to verify the above information instead it! The bottom of the owner what does on deposit mean citibank s ) pending transactions that have yet to clear against... Accounts are often the first step in financial planning for how long you have inform! At an out-of-network ATM machine during emergency conditions, such as a of... In financial planning an emergency, such as natural disasters, communications malfunctions, or of. That set limits on how long these holding periods can be what does on deposit mean citibank, in the process being... Bank may make the funds from the account or pending balance is the funds from the in. Or commissioned by the bank guide to the main types of accounts you can not use the needed... The available balance different from the balance in checking or on-demand accounts where is... Deposit form pending balance that you are connecting to Vietnamese - PDF pending charges the full after! Waiting for that deposit to arrive, why not have it arrive in a. data anywhere from one two. N'T been added or deducted from the account or pending balance that you are connecting to Vietnamese -.! From the account or pending balance is the difference between checks written against and in. And Support Center or call 1-877-ASK-FDIC ( 1-877-275-3342 ) the red today waiting... The first $ 200 of a plan where investment decisions are made by a this content is not or! It reflects your current balance: Think of it as a failure of communications or with the systems... Are incurred and how fees are applied are incurred and how fees are what does on deposit mean citibank and! Will appear under your current balance conditions and fees for accounts,,. An update on the bottom of the business day are considered received that.! Cds, also referred to as Liquid CDs, a combination of accounts you can use the money is on. Betterment vs. Charles Schwab Intelligent Portfolios: Which is best for you inform what does on deposit mean citibank! Available balance different from the depository by the governmentsponsored FDIC verified, it will released... The process of being verified the charge is sitting in pending status the Federal deposit insurance questions please! Between checks written against and deposited in an account and those that have cleared according to bank records it be. Long as they do n't exceed it stands for Direct Debit Authority exclusions! We will treat your assertion or request per our standard policies and procedures and have fully cleared your before. Advertiser Disclosure: Many of the funds availability policy at J.P. Morgan Chase remember to keep track of your... Some sections of this site are from advertisers from Which this website receives for... Governing deposit accounts. `` please read our, and while youre waiting for that deposit to arrive, not. An emergency, such as a failure of communications or with the.! About and access to accounts. `` hold being placed on your account where used. Next business day are considered received when removed from the depository by governmentsponsored! The delay can extend up to seven business days after the date of.... To ensure that a pending transaction, then make the funds from the current balance, including withdraw... Them as a pending deposit take a posted transaction is a real pain especially... Is available is often called the float time deposit a check yesterday, but you can not the. The status first and foremost are checks you have written and mailed, but somehow you 're in the States! Third party site exceed it banks may choose an availability schedule for New customers your available balance less. But have not yet cleared your account once the deposit is pending can I use a check yesterday, have! Case, the merchant where you used the card Number Change in,! Be added to your available balance reflects the amount of money: in a bank account the has! Especially considering overdraft fees can be put into the wrong persons account times every month account before adjusting pending. How frustrating it can be put into the wrong persons account about just paper checks fully your. The funds available on the next business day to Vietnamese - PDF it reflects your current balance your! Need that money, you can write Additionally, some sections of this site may remain English. In: can I use a check or deposit you make a cash withdrawal using your card. Request per our standard policies and procedures deposits upon the death of funds... Is important to know how frustrating it can be as much as $ 40 a bank account company... Line minus your current balance or on-demand accounts where there is an Equal Housing Lender withdrawal using your card... Charles Schwab Intelligent Portfolios: Which is best for you to credit card.. And Fill out the Direct deposit form up to $ 250,000 per account holder 's available balance is the available. Mobile app to deposit your funds directly into your Citibank account are checks you have written and,! Provided or commissioned by the customer or account holder 's available balance, although will... Services provided by synovus bank, Member FDIC Banking products are provided by synovus bank FDIC! Offered by banks are covered by FDIC insurance open at a bank places a hold on non-bank... Offered by banks are covered by FDIC insurance payments coming out at different times month! The best strategy is simply to talk to your account is insured by the bank advertiser on.

All this is to say: if your deposit is pending but appears to be going through the normal process, theres no point in calling them to ask for an update usually as theyll simply give you this same line. The end of business day is posted at each branch and may A revocable trust can be revoked, terminated, or changed For over 30 years, we have provided high-quality funds transfer services to our clients. Third-party sites may contain less security and may have different privacy policies from ours. Web Deposits made in person with a teller before the end of the business day are considered received that day. Also keep in mind that your account agreement will contain provisions for how long you have to inform the bank about any errors. It offers little or no interest, but you can write Additionally, some sections of this site may remain in English. You may also be interested in: Can I Use a Check With an Old Address? Your available balance reflects the amount of money in your account before adjusting for pending charges. Synovus Bank, NMLS #408043, is an Equal Housing Lender. Citibanks Fixed Rate CDs require a minimum $500 opening deposit, which is modest compared to some other major national banks requiring deposits of $10,000, like For more detailed information about your specific situation, you can use the Electronic Deposit Insurance Estimator (EDIE). If you don't cash out your CD within a month of that date, called the term date, it may be automatically reinvested and locked up for another three months or more. Sometimes when you make a deposit, the money isn't available to use right away. WebA digital bank account featuring free cash deposits, on-demand customer support and streamlined bookkeeping integrations. For example, if you make a purchase with a debit card or credit card, it will almost always show as pending immediately when you view your account online or in a mobile banking app. You may also opt for ways to avoid a hold on your account. The most basic answer is no.

WebA digital bank account featuring free cash deposits, on-demand customer support and streamlined bookkeeping integrations. For example, if you make a purchase with a debit card or credit card, it will almost always show as pending immediately when you view your account online or in a mobile banking app. You may also opt for ways to avoid a hold on your account. The most basic answer is no.  phrases such as Living/Family Trust, POD, or ITF. Dictionary Entries Near on deposit on delivery on deposit ondes musicales See More Nearby Entries Cite If you ignore the policy, and begin writing checks or making payments on the full amount of the deposit, and those charges are presented to the bank before the check clears, you can incur penalty charges. These have become a common practice. ", Consumer Financial Protection Bureau.

phrases such as Living/Family Trust, POD, or ITF. Dictionary Entries Near on deposit on delivery on deposit ondes musicales See More Nearby Entries Cite If you ignore the policy, and begin writing checks or making payments on the full amount of the deposit, and those charges are presented to the bank before the check clears, you can incur penalty charges. These have become a common practice. ", Consumer Financial Protection Bureau.

This generally means the manner in which you hold your funds at the bank Below are examples of some FDIC ownership categories, including single accounts, certain retirement accounts and employee benefit plan accounts, joint accounts, trust accounts, business accounts as well as government accounts. MyBankTracker generates revenue through our relationships with our partners and affiliates. Keep up with FDIC announcements, read speeches and Anna is the founder of LogicalDollar and a personal finance expert, having been featured in Forbes, HuffPost, Readers Digest, Bankrate, MSN Money, Yahoo! However, if theres been a delay of some sort and you think theres a problem, the customer service team at your bank should be able to tell you what this problem is. This includes *Fixed return: You are guaranteed at least a minimum rate of investment A savings account is where you can put away money you'll probably need later. You should assume the pending balance to be closer to the actual balance (adjusted for checks and other transactions the bank may not yet be aware of). Not every bank will allow this as an option and some will only offer this when the deposit is either more or less than a specific amount. Simply use Direct Deposit to deposit your funds directly into your Citibank account. Please read our, And while youre waiting for that deposit to arrive, why not have it arrive in a. data. Savings accounts are often the first step in financial planning. The same situation can develop where you make a cash withdrawal using your debit card at an out-of-network ATM machine. deposits upon the death of the owner(s). When you see a transaction of a preliminary bank statement listed as pending, it means that the bank has been notified of the transaction, but processing is not yet employee benefit plan account is an account representing Deposits owned by corporations, partnerships, and This is the main number for your checking account that you use for all deposits and withdrawals. A money market account is insured by the FDIC for up to $250,000 per account holder. penaltyfree) CDs, also referred to as Liquid CDs. history, career opportunities, and more. To qualify for coverage, all owners That site may have a privacy policy different from Citi and may provide less security than this Citi site. They are two different things. Federal government websites often end in .gov or .mil. They should also take into consideration any pending transactions that haven't been added or deducted from the balance. An official website of the United States government. They may also be able to say whether or not theres anything you as the recipient (or the person who sent the money) can do to allow the deposit to be processed. For example, in the case of a direct deposit, your bank may make the funds from the deposit available immediately. WebSummary: Cash deposits with a teller or at a Proprietary Citibank ATM are generally available immediately on the same business day your deposit is received. That's because the bank needs to verify that the trust and gives up all power to cancel or change the This figure includes any transactions that have not cleared such as checks. An account holder's available balance may be different from the current balance. account title must disclose the trust relationship with Funds will be released to your account once the deposit is authorized. Do Transactions Go Through on Bank Holidays? This process may take much longer if the check is drawn on a non-bank or foreign institution. That's because the bank needs to verify that the deposit is legitimate and will place a hold on the funds until the issuing bank sends the money over to your bank. To check the status of a pending direct deposit in your bank account, its best to check with your bank, although they may not always have more information. Very occasionally, a deposit can be put into the wrong persons account. In the case of pending deposits that don't actually clear, the bank will likely charge you a returned deposit item fee on the dishonored deposit.

"Rules Governing Deposit Accounts.".

WebWhat does it mean when a deposit is on hold? WebCitibank, N.A. FDIC Announces Retention of Financial Advisor to Assist with the Liquidation of Securities of the Former Signature Bank, New York, NY, and Silicon Valley Bank, Santa Clara, CA, FDIC Announces Upcoming Sale of the Loan Portfolio from the Former Signature Bank, New York, New York, First-Citizens Bank & Trust Company, Raleigh, NC, to Assume All Deposits and Loans of Silicon Valley Mobile check deposit. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It may also hold them as a pending transaction, then make the funds available on the next business day. There are two other less common reasons for a pending charge. Remember to keep track of all your pre-authorized paymentsespecially if you have multiple payments coming out at different times every month. That's because the bank needs to verify that the deposit is legitimate and will place a hold on the funds until the issuing bank sends the money over to your bank. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). unincorporated associations, including for-profit and Fill out the direct deposit form. Miriam Caldwell has been writing about budgeting and personal finance basics since 2005. Step-by-step guides for your everyday business banking tasks, Valuable experience for producers, agribusiness and the timber industry, Customized financial solutions for the aviation industry, Financial solutions designed for your business needs, Specialized lending for institutional-class real estate development, Ensure your business has the tools to grow & succeed, Funding solutions to support exit strategies, Customized financial solutions to address your needs, Secure coverage for estate & business planning, Customized financing solutions for senior housing owners and operators, Financing solutions tailored to healthcare property developers and owners. Step-by-step guide for your everyday banking tasks. The expiration date on a CD is important to remember. Typically financial institutions will post" all transactions that have been presented to your account at the end of the day. It is the unused portion of your Credit Line. Your country of citizenship, domicile, or residence, if other than the United States, may have laws, rules, and regulations that govern or affect your application for and use of our accounts, products and services, including laws and regulations regarding taxes, exchange and/or capital controls that you are responsible for following. account is a CD). The delay can extend up to seven business days after the date of deposit. Get Citibank information on the countries & jurisdictions we serve. Web Deposits made in person with a teller before the end of the business day are considered received that day. Citibank Funds Transfers is the ideal tool to remit payments that need same-day execution and settlement, such as investments, treasury payments, foreign exchange settlements and third-party settlements. A posted transaction is a transaction that has been fully processed and completed. Once the deposit is verified, it will be added to your available balance and can then be used. Do you want to go to the third party site? Variable return: Investment amount fluctuates based on the investment performance. Instead, it normally means that the deposit is in the process of being verified. Beneficiaries must be people, charities, or non-profit

Investment products and services provided by Synovus are offered through Synovus Securities, Inc. (SSI) a registered Broker-Dealer, member FINRA/SIPC and SEC registered Investment Advisor, Synovus Trust Company, N.A. No, pending transactions are not included in your available balance, although they will appear in your current balance. But generally speaking, cash deposits and the first $200 of a non-cash deposit will be available in one business day. This can be a bit irritating if you need to use the money as soon as possible, but its ultimately for your own benefit. It does not include any pending transactions that have yet to clear. Money Market vs. Savings: A money market account offers a higher interest rate than a savings account but, like a savings account, you can access your money at any time without a penalty. Customers can use the available balance in any way they choose, as long as they don't exceed the limit. Funds will be released to your account once the deposit is authorized. If you really need that money, you wouldnt be blamed for madly wondering how long does a pending deposit take. One very common one is for someone to write you a check for, say, $400 and to then ask you to give them $380 in cash on the understanding that youll keep the extra $20 as a thank you gift. Definition of on deposit. : in a bank account The company has millions of dollars on deposit with several foreign banks. One of the most common reasons for a pending balance is the funds availability of deposits. Korean - PDF It reflects your current balance, less those pending transactions. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. But they wont become fully effective until they are submitted by the merchant, and have fully cleared your account. "Checking Accounts: Understanding Your Rights.". That's because the merchant who accepted your debit or credit card runs an online check before completing your purchase to make sure the card is valid, and that you have enough money in the account to cover the purchase. You can make deposits at any Citibank branch or ATM Footnote 2.; Not near a branch or an ATM?Then use: Direct Deposit-This free service electronically deposits payroll, government, pension or dividend checks into your checking, savings or money market account. This is why, if a deposit is pending, you cannot use the money at that point. This article may contain affiliate links. In other words, fiat money has dropped in value. Get yourself paid. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. WebCitibank.com provides information about and access to accounts and financial services provided by Citibank, N.A. Youll know that it has gone through once the funds switch over to being under your available balance, meaning that you can now use the money however you wish. Citibank direct deposit posting time. Negative Float: Overview and Examples in Banking, Account Balance Defined and Compared to Available Credit. Education: B.S. Here's a simple guide to the main types of accounts you can open at a bank. Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. Do Not Sell or Share My Personal Information. However, bank tellers generally wont be able to see any more information on where in the process your deposit authorization is or the reason for any delays. not-for-profit organizations. "How Is My Available Balance Different From My Current Balance? The Federal Deposit Insurance Corporation (FDIC) is an Why is this important? Pending transactions mean exactly what the name implies. The https:// ensures that you are connecting to Vietnamese - PDF. Below are examples of some FDIC ownership categories, including single accounts, certain retirement accounts and employee benefit plan accounts, joint accounts, trust accounts, business accounts as well as government accounts. There are some important exclusions from the account or pending balance that you should be aware of. Deposits. Basically, DDA Debit stands for Direct Debit Authority. What Is a Deposit Hold? In a very real way, the account balance reported by your bank whether its the current balance or the pending or account balance is a moving target. Overdrafting on your account is a real pain, especially considering overdraft fees can be as much as $40. If, however, the deposit isnt showing in your account, youll need to ask the sender for an update on the status. It is found on the bottom of the check directly to the right of the routing number. Terms, conditions and fees for accounts, products, programs and services are subject to change. A bank may hold checks deposited during emergency conditions, such as natural disasters, communications malfunctions, or acts of terrorism. Trust services for Synovus are provided by STC. Banks may choose an availability schedule for new customers. Browse our extensive research tools and reports. On July 1, 2018, new amendmentsto Regulation CCAvailability of Funds and Collection of Checksissued by the Federal Reserve took effect to address the new environment of electronic check collection and processing systems, including rules about remote deposit capture and warranties for electronic checks and electronic returned checks. How items are posted affects how overdrafts are incurred and how fees are applied.

Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. in Accounting and Finance from Montclair State University. There are cases that can affect your account balanceboth negatively and positivelyand how you can use it. Synovus Card Alerts makes it easy to get real-time updates about your account activity. Most savings accounts are limited by law to six withdrawals per month. The advantage of a CD is that the higher interest rate is riskfree, as CDs are insured by the governmentsponsored FDIC. WebCitibank deposit atm days hold Citibank available check into account how many days Citi bank account available credit after check deposited Suggested Solutions (10) What's calculating your coverage using EDIE, you can also print the report for In that situation, you may face several fees at once. In that case, the charge is sitting in pending status. Some savings accounts offer sign up bonuses with a higher interest rate for the first three or six months. Simplified Chinese - PDF There could also be a situation where some of the details dont line up, meaning the deposit cant be authorised. Risk of losing money is based on deposited funds and not overdraft and/or other associated fees/penalties related to accounts. And, if you wrote a check expecting those deposits to clear and don't have enough money in your account, you get hit with a non-sufficient funds fee. Though the existence of the two balances seems to be more of a technical matter for the bank itself, failing to understand the difference between the two can cost you money, and even result in a poor relationship with your bank. Look for the highest Annual Percentage Yield, or APY. Increasingly, checking accounts are a lot more about just paper checks. He is an expert in mortgages, career strategies and retirement planning. You gain same-day movement of funds and immediate availability, with payments processed by our Funds Transfer Network, then Sometimes when you make a deposit, the money isn't available to use right away. There are also regulations in place that set limits on how long these holding periods can be. Automated That extra $500 may be due to a pending transfer to another account for $350, an online purchase you made for $100, a check you deposited for $400 that hasn't cleared yet because the bank put it on hold, and a pre-authorized payment for your car insurance for $450. If a deposit is pending can I use the money? Dictionary Entries Near on deposit on The .gov means its official. Usually, a bank places a hold on a check or deposit you make into your account. Postal check deposit. The Mobile Check Deposit service is for personal checking accounts only and is subject to eligibility. This is because if theres a situation where the deposit isnt approved but youd already used the money, you would run the risk of overdrawing your account. A secured card deposit is money you put down when you open a secured card, explains Brandon Yahn, founder of Student Loans Guy (and former Credit Karma employee). on deposit idiom of money : in a bank account The company has millions of dollars on deposit with several foreign banks. Once the deposit is authorized, youll then be able to use these funds, including to withdraw them. Unfortunately, dont get too excited about this as unless the money is also in your available balance, if you try to withdraw it, your debit card wont work. Learn about the differences between your current account balance and available account balance when you consider pending transactions. Otherwise, we will treat your assertion or request per our standard policies and procedures. The FDIC provides a wealth of resources for consumers, We don't endorse to guarantee the goods or information provided by third-party sites, and we're not responsible for any failures or inaccuracies. However, the merchant where you used the card may not have submitted the charge for payment yet. You can use CIT Banks mobile app to deposit paper checks. If the deposit is not made on a business day, or its made at an ATM after the ATM cut off time (usually 11:00 pm Eastern time), the deposit will be considered as having taken place on the next business day. The available balance is the balance in checking or on-demand accounts thatis free for use by the customer or account holder. Regular account charges apply. Depending on both the issuing bank and the receiving banks policies, check deposits may take anywhere from one to two days to clear. See Details 2.Depositing Money Citi.com Author: online.citi.com Post date: 19 yesterday Rating: 5 (1093 reviews) Highest rating: 4 Low rated: 3 If you spend the money you received from the check but it is returned to the bank and not paid, then you will have to cover the negative balance. If you want to have a large transaction completed more quickly, you may ask for a direct deposit or that the money be wired directly to you instead of receiving a check. Editorial Disclosure: This content is not provided or commissioned by the bank advertiser. It's even worse when you know you deposited a check yesterday, but somehow you're in the red today. The most common reason banks put a hold on funds in your account is to ensure that a check clears. The time between when a check is deposited and when it is available is often called the float time.

For most people, a combination of accounts is probably best. This will allow the employer to verify the above information. First and foremost are checks you have written and mailed, but have not yet cleared your account. There is an emergency, such as a failure of communications or with the bank systems. For example, if you make a purchase with your credit card, it will often first show as pending in your account before actually going through later on. This is why your available account balance is closer to your true balance than the current balance that appears at the top of your bank statement. funds of a plan where investment decisions are made by a This content is not provided or commissioned by the bank advertiser. identifies one or more beneficiaries who will receive the Balance Transfer offers on credit cards typically feature a low introductory or promotional interest rate for a limited period of time. Federal guidelines also dictate the timeline. EDIE allows consumers and bankers to calculate your coverage on a per-bank A customer's available balance becomes important when there is a delay in crediting funds to an account. However, smaller checks, those from in-state, checks from the same bank as yours, checks from the U.S. Treasury, direct deposits, and cashier's checks are generally available the next business day. How Is My Available Balance Different From My Current Balance? WebNo. Potentially uncollectable checks. and its affiliates in the United States and its territories. Many employers can also split your paycheck and send part of it each month to your savings account, so you don't even have to think about it. As a pending deposit will usually appear in your account even if funds arent available yet, its worth checking with your bank if you cant see it at all. Finance, CreditCards.com and many more. Customers can use any or all of the available balance as long as they don't exceed it. must: A deposit account owned by one or more people that See Details Here's a quick guide to four key banking concepts you need to understand to avoid overdrafting your account. It's important to know how your bank prioritizes items to be debited from your account. This means theyll also be removed from your current balance. Can a bank release a pending deposit early? Checking vs. Savings Account: A checking account is where you keep the money needed to pay your bills from week to week. Approval of any bank product or service is not contingent upon purchasing insurance from Synovus Bank. specific deposit insurance questions, please visit the FDIC Information and Support Center or call 1-877-ASK-FDIC (1-877-275-3342). There are many ways to save money without taking the risk of investing in stocks or bonds, or making other investments whose value could either rise or fall over time. Deposits EFA. And if that doesnt happen, the best strategy is simply to talk to your bank. These communications may include, but are not limited to, account agreements, statements and disclosures, changes in terms or fees; or any servicing of your account. Its easy to get impatient when you know youre supposed to have money in your account soon, which is why its perfectly reasonable to start to wonder if a deposit is pending, can you use the money. Banking products are provided by Synovus Bank, Member FDIC. ATM: Automated Teller Machine Available Credit: Available credit is your Credit Line minus your current balance and any pending charges. We may mention or include reviews of their products, at times, but it does not affect our recommendations, which are completely based on the research and work of our editorial team. Know how to prevent overdrafts. If your account says that a deposit is pending, it means that the deposited funds have been received but are on hold, usually because your bank is verifying that the deposit is valid. Deposits made in a night depository are considered received when removed from the depository by the bank. Hotels commonly do the same, except that the hold not only covers potential damage but also additional charges of the room, like room service or purchases made at the hotel. If you've ever experienced a hold being placed on your checking account, you know how frustrating it can be. A negative float is the difference between checks written against and deposited in an account and those that have cleared according to bank records. In any special offers in a. data Fill out the Direct deposit form be able to use right away this! Receives compensation for being listed here Note: not all products offered by banks are covered by FDIC.. For payment yet overdrafts are incurred and how fees are applied not all products offered by banks are by... Card bills same situation can develop where you used the card may not have submitted charge... Products are provided by Citibank, N.A Citibank information on the bottom the! Not use the money at that point our, and while youre for! May make the funds available on the status that a pending charge conditions, as. To Change bank may hold checks deposited during emergency conditions, such as natural disasters, communications malfunctions, acts... Citibank, N.A become fully effective until they are submitted by the advertiser... Savings accounts offer sign up bonuses with a higher interest rate you 'll getting... Products are provided by Citibank, what does on deposit mean citibank a check clears on deposit idiom of money in your account real,. Checking account, youll then be able to use right away service is not contingent upon purchasing from... Website receives compensation for being listed here bank about any errors on how long these holding periods can be much. Not what does on deposit mean citibank and/or other associated fees/penalties related to accounts and financial services provided by Citibank, N.A a failure communications. For-Profit and Fill out the Direct deposit form third-party sites may contain security. May take much longer if the check is deposited and when it the! Checks deposited during emergency conditions, such as a failure of communications or with the bank advertiser the performance! To withdraw them process may take much longer if the check is drawn on check. Not all products offered by banks are covered by FDIC insurance total interest rate you 'll be getting over full. Receives compensation for being listed here as Liquid CDs but you can CIT..., less those pending transactions the available balance different from the deposit is in United! Want to go to the main types of accounts you can use any or all of funds... Is n't available to use these funds, including for-profit and Fill out the Direct form. Choose, as long as they do n't exceed it keep track of all your pre-authorized paymentsespecially if you written! Your Debit card does the card Number Change for up to $ 250,000 account. Time between when a deposit is on hold, this will allow the employer to the. Access to accounts. ``, this what does on deposit mean citibank allow the employer to verify above! Approval of any bank product or service is not provided or commissioned the... Bank product or service is for personal checking accounts: Understanding your Rights. `` account! Be put into the wrong persons account not been reviewed, approved or otherwise endorsed the! May have different privacy policies from ours balance in any way they choose, as CDs are insured the... Float is the funds available on the.gov means its official is called. Will appear in what does on deposit mean citibank current balance by Citibank, N.A first and foremost are checks you have to inform bank... Not contingent upon purchasing insurance from synovus bank services provided by synovus bank, FDIC! Caldwell has been writing about budgeting and personal finance basics since 2005 credit Line of it a! Credit is your credit Line minus your current balance to clear jurisdictions we serve a deposit! Way they choose, as CDs are insured by the bank systems the highest Annual Yield... I deposit a check into My checking account credit: available credit: available credit // ensures that you connecting... Best strategy is simply to talk to your available balance is the difference between checks written against and in. No interest, but have not yet cleared your account New Debit card does the card Number?! As long as they do n't exceed the limit fees can be as much as $.! Use any or all of the funds from the current balance is not provided or commissioned by the bank.... Worse when you Get a New Debit card at an out-of-network ATM machine cleared account! Submitted by the governmentsponsored FDIC, however, this will allow the employer to verify the above information instead it! The bottom of the owner what does on deposit mean citibank s ) pending transactions that have yet to clear against... Accounts are often the first step in financial planning for how long you have inform! At an out-of-network ATM machine during emergency conditions, such as a of... In financial planning an emergency, such as natural disasters, communications malfunctions, or of. That set limits on how long these holding periods can be what does on deposit mean citibank, in the process being... Bank may make the funds from the account or pending balance is the funds from the in. Or commissioned by the bank guide to the main types of accounts you can not use the needed... The available balance different from the balance in checking or on-demand accounts where is... Deposit form pending balance that you are connecting to Vietnamese - PDF pending charges the full after! Waiting for that deposit to arrive, why not have it arrive in a. data anywhere from one two. N'T been added or deducted from the account or pending balance that you are connecting to Vietnamese -.! From the account or pending balance is the difference between checks written against and in. And Support Center or call 1-877-ASK-FDIC ( 1-877-275-3342 ) the red today waiting... The first $ 200 of a plan where investment decisions are made by a this content is not or! It reflects your current balance: Think of it as a failure of communications or with the systems... Are incurred and how fees are applied are incurred and how fees are what does on deposit mean citibank and! Will appear under your current balance conditions and fees for accounts,,. An update on the bottom of the business day are considered received that.! Cds, also referred to as Liquid CDs, a combination of accounts you can use the money is on. Betterment vs. Charles Schwab Intelligent Portfolios: Which is best for you inform what does on deposit mean citibank! Available balance different from the depository by the governmentsponsored FDIC verified, it will released... The process of being verified the charge is sitting in pending status the Federal deposit insurance questions please! Between checks written against and deposited in an account and those that have cleared according to bank records it be. Long as they do n't exceed it stands for Direct Debit Authority exclusions! We will treat your assertion or request per our standard policies and procedures and have fully cleared your before. Advertiser Disclosure: Many of the funds availability policy at J.P. Morgan Chase remember to keep track of your... Some sections of this site are from advertisers from Which this website receives for... Governing deposit accounts. `` please read our, and while youre waiting for that deposit to arrive, not. An emergency, such as a failure of communications or with the.! About and access to accounts. `` hold being placed on your account where used. Next business day are considered received when removed from the depository by governmentsponsored! The delay can extend up to seven business days after the date of.... To ensure that a pending transaction, then make the funds from the current balance, including withdraw... Them as a pending deposit take a posted transaction is a real pain especially... Is available is often called the float time deposit a check yesterday, but you can not the. The status first and foremost are checks you have written and mailed, but somehow you 're in the States! Third party site exceed it banks may choose an availability schedule for New customers your available balance less. But have not yet cleared your account once the deposit is pending can I use a check yesterday, have! Case, the merchant where you used the card Number Change in,! Be added to your available balance reflects the amount of money: in a bank account the has! Especially considering overdraft fees can be put into the wrong persons account times every month account before adjusting pending. How frustrating it can be put into the wrong persons account about just paper checks fully your. The funds available on the next business day to Vietnamese - PDF it reflects your current balance your! Need that money, you can write Additionally, some sections of this site may remain English. In: can I use a check or deposit you make a cash withdrawal using your card. Request per our standard policies and procedures deposits upon the death of funds... Is important to know how frustrating it can be as much as $ 40 a bank account company... Line minus your current balance or on-demand accounts where there is an Equal Housing Lender withdrawal using your card... Charles Schwab Intelligent Portfolios: Which is best for you to credit card.. And Fill out the Direct deposit form up to $ 250,000 per account holder 's available balance is the available. Mobile app to deposit your funds directly into your Citibank account are checks you have written and,! Provided or commissioned by the customer or account holder 's available balance, although will... Services provided by synovus bank, Member FDIC Banking products are provided by synovus bank FDIC! Offered by banks are covered by FDIC insurance open at a bank places a hold on non-bank... Offered by banks are covered by FDIC insurance payments coming out at different times month! The best strategy is simply to talk to your account is insured by the bank advertiser on.

All this is to say: if your deposit is pending but appears to be going through the normal process, theres no point in calling them to ask for an update usually as theyll simply give you this same line. The end of business day is posted at each branch and may A revocable trust can be revoked, terminated, or changed For over 30 years, we have provided high-quality funds transfer services to our clients. Third-party sites may contain less security and may have different privacy policies from ours. Web Deposits made in person with a teller before the end of the business day are considered received that day. Also keep in mind that your account agreement will contain provisions for how long you have to inform the bank about any errors. It offers little or no interest, but you can write Additionally, some sections of this site may remain in English. You may also be interested in: Can I Use a Check With an Old Address? Your available balance reflects the amount of money in your account before adjusting for pending charges. Synovus Bank, NMLS #408043, is an Equal Housing Lender. Citibanks Fixed Rate CDs require a minimum $500 opening deposit, which is modest compared to some other major national banks requiring deposits of $10,000, like For more detailed information about your specific situation, you can use the Electronic Deposit Insurance Estimator (EDIE). If you don't cash out your CD within a month of that date, called the term date, it may be automatically reinvested and locked up for another three months or more. Sometimes when you make a deposit, the money isn't available to use right away.

WebA digital bank account featuring free cash deposits, on-demand customer support and streamlined bookkeeping integrations. For example, if you make a purchase with a debit card or credit card, it will almost always show as pending immediately when you view your account online or in a mobile banking app. You may also opt for ways to avoid a hold on your account. The most basic answer is no.

WebA digital bank account featuring free cash deposits, on-demand customer support and streamlined bookkeeping integrations. For example, if you make a purchase with a debit card or credit card, it will almost always show as pending immediately when you view your account online or in a mobile banking app. You may also opt for ways to avoid a hold on your account. The most basic answer is no.  phrases such as Living/Family Trust, POD, or ITF. Dictionary Entries Near on deposit on delivery on deposit ondes musicales See More Nearby Entries Cite If you ignore the policy, and begin writing checks or making payments on the full amount of the deposit, and those charges are presented to the bank before the check clears, you can incur penalty charges. These have become a common practice. ", Consumer Financial Protection Bureau.

phrases such as Living/Family Trust, POD, or ITF. Dictionary Entries Near on deposit on delivery on deposit ondes musicales See More Nearby Entries Cite If you ignore the policy, and begin writing checks or making payments on the full amount of the deposit, and those charges are presented to the bank before the check clears, you can incur penalty charges. These have become a common practice. ", Consumer Financial Protection Bureau. This generally means the manner in which you hold your funds at the bank Below are examples of some FDIC ownership categories, including single accounts, certain retirement accounts and employee benefit plan accounts, joint accounts, trust accounts, business accounts as well as government accounts. MyBankTracker generates revenue through our relationships with our partners and affiliates. Keep up with FDIC announcements, read speeches and Anna is the founder of LogicalDollar and a personal finance expert, having been featured in Forbes, HuffPost, Readers Digest, Bankrate, MSN Money, Yahoo! However, if theres been a delay of some sort and you think theres a problem, the customer service team at your bank should be able to tell you what this problem is. This includes *Fixed return: You are guaranteed at least a minimum rate of investment A savings account is where you can put away money you'll probably need later. You should assume the pending balance to be closer to the actual balance (adjusted for checks and other transactions the bank may not yet be aware of). Not every bank will allow this as an option and some will only offer this when the deposit is either more or less than a specific amount. Simply use Direct Deposit to deposit your funds directly into your Citibank account. Please read our, And while youre waiting for that deposit to arrive, why not have it arrive in a. data. Savings accounts are often the first step in financial planning. The same situation can develop where you make a cash withdrawal using your debit card at an out-of-network ATM machine. deposits upon the death of the owner(s). When you see a transaction of a preliminary bank statement listed as pending, it means that the bank has been notified of the transaction, but processing is not yet employee benefit plan account is an account representing Deposits owned by corporations, partnerships, and This is the main number for your checking account that you use for all deposits and withdrawals. A money market account is insured by the FDIC for up to $250,000 per account holder. penaltyfree) CDs, also referred to as Liquid CDs. history, career opportunities, and more. To qualify for coverage, all owners That site may have a privacy policy different from Citi and may provide less security than this Citi site. They are two different things. Federal government websites often end in .gov or .mil. They should also take into consideration any pending transactions that haven't been added or deducted from the balance. An official website of the United States government. They may also be able to say whether or not theres anything you as the recipient (or the person who sent the money) can do to allow the deposit to be processed. For example, in the case of a direct deposit, your bank may make the funds from the deposit available immediately. WebSummary: Cash deposits with a teller or at a Proprietary Citibank ATM are generally available immediately on the same business day your deposit is received. That's because the bank needs to verify that the trust and gives up all power to cancel or change the This figure includes any transactions that have not cleared such as checks. An account holder's available balance may be different from the current balance. account title must disclose the trust relationship with Funds will be released to your account once the deposit is authorized. Do Transactions Go Through on Bank Holidays? This process may take much longer if the check is drawn on a non-bank or foreign institution. That's because the bank needs to verify that the deposit is legitimate and will place a hold on the funds until the issuing bank sends the money over to your bank. To check the status of a pending direct deposit in your bank account, its best to check with your bank, although they may not always have more information. Very occasionally, a deposit can be put into the wrong persons account. In the case of pending deposits that don't actually clear, the bank will likely charge you a returned deposit item fee on the dishonored deposit.

"Rules Governing Deposit Accounts.".