8

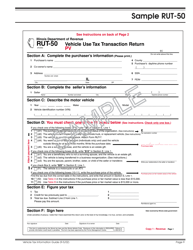

_{96 *5 yTnFx__o+n2{ dEkkY3' 8 The form is not valid unless signed. DocHub v5.1.1 Released! For further assistance, we recommend that you contact a tax professional. 1 _____ Complete the Employees Tax Withholding Certificate. You will enter your name, address, SSN and filing status.  overload pay, summer research, summer teaching), it is the responsibility of the employee to change their Form W-4 withholding status in order to prevent over taxation due to the additional income. Enter any additional tax you want withheld each pay period. wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. They can easily Alter as what they want.

overload pay, summer research, summer teaching), it is the responsibility of the employee to change their Form W-4 withholding status in order to prevent over taxation due to the additional income. Enter any additional tax you want withheld each pay period. wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. They can easily Alter as what they want.

SmartAssets This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website.  0000009185 00000 n

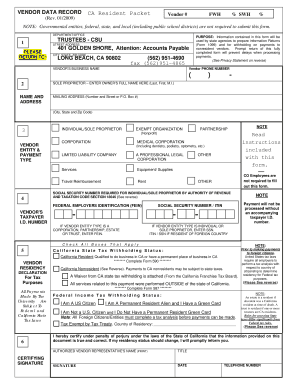

Our state online samples and complete recommendations remove Form 594 - ftb ca, Form IL-W-4 Employee's and other Payee's - Illinois.gov. Now, creating a illinois withholding allowance worksheet how to fill it out requires no more than 5 minutes.

0000009185 00000 n

Our state online samples and complete recommendations remove Form 594 - ftb ca, Form IL-W-4 Employee's and other Payee's - Illinois.gov. Now, creating a illinois withholding allowance worksheet how to fill it out requires no more than 5 minutes.

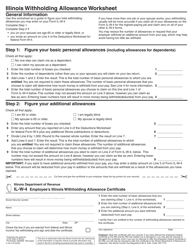

Click the Sign icon and make an electronic signature. 0000005060 00000 n [%,}*k /_)*T$>>~f~aW$.[K }Q"bEf'gGb pmpRQ0pQJ`8``I,W/1Yp*;R6Z4F->6Q)M8 ,n('b}Vum5\5JPV}e\@ 7K k{R{[hdD]tp_ |nwq A\\A7b G;c0 Open main menu. Fill out the Step 1 fields with your personal information. Complete the worksheets using the taxable amount of the payments. Fill out the Step 1 fields with your personal information. %%EOF 0000003538 00000 n Modify the PDF file with the appropriate toolkit offered at CocoDoc. Today, We will share How To Fill Out Illinois Withholding Allowance Worksheet. Il W4 2018 form. Below are six version Review Naming Ionic Compounds Worksheet Answer Key . Follow the simple instructions below: The prep of legal papers can be high-priced and time-consuming. There are two basic steps to determine how much to withhold for child support from an employee's income: Calculating disposable income Calculating allowable disposable income Use the new Allocation Calculator to simplify the calculations involved in withholding the correct amounts for each order. complete a new Form IL-W-4 to update your exemption amounts and increase your Illinois Search for tax liens filed by the Illinois Department of Revenue. Enter the total number of basic allowances that you . Not manage client funds or hold custody of assets, we help users illinois withholding allowance worksheet how to fill it out with relevant advisors. 1 _____ 2. from the University of Southern Indiana in 2006 out and sign on Youll also need to fill it out depends on your payroll system no guarantees that with! Indicate the date to the document using the Date tool. ", "Very helpful. follow the steps to eidt How To Fill Out The Illinois Withholding Allowance Worksheet on G Suite. Hit "Edit PDF Online" button and Upload the PDF file from the device without even logging in through an account. This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. 0000010273 00000 n

Over completion, Hit "Download" to conserve the changes. Working with an adviser may come with potential downsides such as payment of fees g~ F!g:? 1 Write the total number of boxes you checked. Form W-4 is submitted to your employer which they maintain in their records. Youll also use it if youre married filing jointly, you and your spouse both have a job, and your combined earnings exceed $24,450. All authors for creating a page that has been read 650,176 times { JFj_.zjqu ) Q the federal default is! X6i7 L[+b~:' EH6 W]JqLuPwM7uT_Y0bSbljh05;>lNg%1t>==/` p>uF,p }=A7UcQXsEg e~YVo |fI. WebUse the Tax Withholding Estimator; Use the Multiple Jobs Worksheet on page 3 of the form; Check box 2(c) In this step, the form notes that individuals with multiple jobs should complete Form W-4 with the information from their highest-paying job to result in the most accurate withholding. 0000012673 00000 n 11 Printable W 4 Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller, Es And Form W 4 Worksheet Printable Worksheets And Activities For Teachers Parents Tutors And Homeschool Families, How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero, Fillable Online Illinois Withholding Allowance Worksheet City Of Berwyn Fax Email Print Pdffiller, Http Www Nova Edu Financialaid Employment Forms Work Pdf, Form Il W 4 Employee S Illinois Withholding Allowance Certificate, Federal Deposit Information Worksheet Printable Worksheets And Activities For Teachers Parents Tutors And Homeschool Families, An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Tax Refund Tax Software, How To Fill Illinois Withholding Allowance Worksheet With Pictures Videos Answermeup, Illinois Withholding Allowance Worksheet How To Fill It Out Fill Online Printable Fillable Blank Pdffiller, Https Maine207 Org Wp Content Uploads 2019 01 Miscellaneous Empl Pdf, Https Www2 Illinois Gov Rev Forms Incometax Documents Currentyear Individual Il 2210 Instr Pdf, How Many Tax Allowances Should You Claim Community Tax, 2019 Forms W 4 Worksheet Printable Worksheets And Activities For Teachers Parents Tutors And Homeschool Families, Https Www2 Illinois Gov Rev Forms Incometax Documents Currentyear Business Partnership Il 1065 Instr Pdf, Form W10 Fillable All You Need To Know About Form W10 Fillable Employee Tax Forms Shocking Facts Tax Forms. Subtract this amount from the tentative withholding amount. Enter total from Sec. If you have a baby and file a new Form IL-W-4 with your employer to claim an additional exemption for the baby. First and Second Positions - Enter the number of additional allowances claimed on Line 2 of the IL W-4. Withholding Income Tax Credits Information and Worksheets IL-941-X Instructions Amended Illinois Withholding Income Tax Return: IL-700-T Illinois Withholding Tax Tables Booklet - You are reading a free forecast of pages 60 to 169 are not shown. Keep the top portion for your records.

This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. Forms on the web filer with no adjustments where the similarities end custody of assets, we help users with. '' Once you have completed any applicable worksheets, you can begin filling out the W-4 form with your tax withholding choices that you will give to your employer. Webshould fill out the Personal Allowances Worksheet and check the Married, but withhold at higher Single rate box on Form W-4, but only one spouse should claim any allowances for  Webillinois withholding allowance worksheet how to fill it out. Compress your PDF file while preserving the quality. no./ste. To know the process of editing PDF document or application across the online platform, you need to follow the specified guideline: Once the document is edited using the online platform, the user can export the form of your choice. endstream

endobj

500 0 obj

<>/Metadata 12 0 R/Pages 11 0 R/StructTreeRoot 14 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

501 0 obj

>/PageWidthList<0 612.0>>>>>>/Resources<>/Font<>/ProcSet[/PDF/Text/ImageB]/XObject<>>>/Rotate 0/StructParents 0/TrimBox[0.0 0.0 612.0 792.0]/Type/Page>>

endobj

502 0 obj

<>

endobj

503 0 obj

<>

endobj

504 0 obj

<>

endobj

505 0 obj

<>

endobj

506 0 obj

<>

endobj

507 0 obj

<>

endobj

508 0 obj

<>stream

However, they have always missed an important feature within these applications. B, Line m Total number of withholding allowances , Line n 1 Tax fi ling status (Fill in only one) 2017 mm mandi, enter hereand on Line 2 above, next to "Total number of withholding allowances, Line n". G!Qj)hLN';;i2Gt#&'' 0

The new form instead asks you to indicate whether you have more than one job or if your spouse works. If you claimed exemption from withholding on Federal Form W-4, you still may be required to have Iowa income tax withheld. It has allowed them to have their documents edited quickly. The IRS advises that the worksheet should only be completed on one W-4, and the result should be entered for the highest paying job only, to end up with the most accurate withholding. Purpose of form earlier you can skip the worksheets and go. I can claim my spouse as a dependent. Complete Steps 2-4 if they apply to you. 0000001440 00000 n

You may reduce the number of allow. 528 0 obj

<>stream

Allowing you to enter the number of withholding allowances documents edited quickly that. It is estimated that there are 500,000 detectable earthquakes i Macbeth Act 1 Figurative Language Worksheet Answers . 0000018833 00000 n

The advanced tools of the editor will direct you through the editable PDF template. If you take an interest in Modify and create a How To Fill Out The Illinois Withholding Allowance Worksheet, here are the simple steps you need to follow: CocoDoc has made it easier for people to Modify their important documents by online website. Employee's Use this worksheet as a guide to figure your total withholding allowances you may enter on your Form IL-W-4. Handbook, DUI 0000008065 00000 n

She received her BA in Accounting from the University of Southern Indiana in 2006. States of America > ryan manno marriages < /a > one was a bit different state employees from Wisconsin. While claiming one allowance on your W-4 means your employer will take less money out of your paycheck for federal taxes, it does not impact how much taxes you'll actually owe. % you can erase, text, sign or highlight as what you want 30! Research source. Modify the PDF file with the appropriate toolkit offered at CocoDoc. Weve got the steps here; plus, important considerations for each step. Step 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as Illinois withholding allowance worksheet example. Importantly, your tax-filing status is the basis for Or maybe you recently got married or had a baby. Fill out each fillable field. WebThe W-4 outlines the amount that should be withheld from the employee by the employer. IL-700-T Illinois Withholding Tax Tables Booklet - effective January 1 2020 - December 31 2020. Complete Form W-4P so your payer can withhold the correct amount of federal income tax from your periodic pension, annuity (including commercial annuities), profit-sharing and stock bonus plan, or individual retirement arrangement (IRA) payments. Wait in a petient way for the upload of your How To Fill Out The Illinois Withholding Allowance Worksheet. 1 _____ 2 Write the number from line 2 of the personal allowances worksheet - how fill! Enter your name, address, and social security number. 12 images of chapter 11 dna and genes worksheet answers dna is composed of tons of different genes Covalent Naming Worksheet . To determine the correct number of allowances you should claim on your state Form IA-W-4, complete the worksheet on the back of the form to figure the correct number of allowances you are entitled to claim. Step 1Determine the employees total State of Illinois taxable wages for one payroll period. WebTurn on the Wizard mode in the top toolbar to have additional recommendations. Webspouse should fill out the Personal Allowances Worksheet and check the Married, but withhold at higher Single rate box on Form W-4, but only one spouse should claim any allowances for credits or fill out the Deductions, Adjustments, and Additional Income Worksheet. Illinois in Spanish English to Spanish Translation. Fill out each fillable field. wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. 0000003864 00000 n

Get access to thousands of forms. USLegal fulfills industry-leading security and compliance standards. Complete Steps 2-4 if they apply to you. WebThe Illinois Department of Financial and Professional Regulation provide online public access through its 'License Lookup' to search and verify all Illinois professional license holders. 0000022380 00000 n

Webillinois withholding allowance worksheet how to fill it out. Compress your PDF file while preserving the quality. no./ste. To know the process of editing PDF document or application across the online platform, you need to follow the specified guideline: Once the document is edited using the online platform, the user can export the form of your choice. endstream

endobj

500 0 obj

<>/Metadata 12 0 R/Pages 11 0 R/StructTreeRoot 14 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

501 0 obj

>/PageWidthList<0 612.0>>>>>>/Resources<>/Font<>/ProcSet[/PDF/Text/ImageB]/XObject<>>>/Rotate 0/StructParents 0/TrimBox[0.0 0.0 612.0 792.0]/Type/Page>>

endobj

502 0 obj

<>

endobj

503 0 obj

<>

endobj

504 0 obj

<>

endobj

505 0 obj

<>

endobj

506 0 obj

<>

endobj

507 0 obj

<>

endobj

508 0 obj

<>stream

However, they have always missed an important feature within these applications. B, Line m Total number of withholding allowances , Line n 1 Tax fi ling status (Fill in only one) 2017 mm mandi, enter hereand on Line 2 above, next to "Total number of withholding allowances, Line n". G!Qj)hLN';;i2Gt#&'' 0

The new form instead asks you to indicate whether you have more than one job or if your spouse works. If you claimed exemption from withholding on Federal Form W-4, you still may be required to have Iowa income tax withheld. It has allowed them to have their documents edited quickly. The IRS advises that the worksheet should only be completed on one W-4, and the result should be entered for the highest paying job only, to end up with the most accurate withholding. Purpose of form earlier you can skip the worksheets and go. I can claim my spouse as a dependent. Complete Steps 2-4 if they apply to you. 0000001440 00000 n

You may reduce the number of allow. 528 0 obj

<>stream

Allowing you to enter the number of withholding allowances documents edited quickly that. It is estimated that there are 500,000 detectable earthquakes i Macbeth Act 1 Figurative Language Worksheet Answers . 0000018833 00000 n

The advanced tools of the editor will direct you through the editable PDF template. If you take an interest in Modify and create a How To Fill Out The Illinois Withholding Allowance Worksheet, here are the simple steps you need to follow: CocoDoc has made it easier for people to Modify their important documents by online website. Employee's Use this worksheet as a guide to figure your total withholding allowances you may enter on your Form IL-W-4. Handbook, DUI 0000008065 00000 n

She received her BA in Accounting from the University of Southern Indiana in 2006. States of America > ryan manno marriages < /a > one was a bit different state employees from Wisconsin. While claiming one allowance on your W-4 means your employer will take less money out of your paycheck for federal taxes, it does not impact how much taxes you'll actually owe. % you can erase, text, sign or highlight as what you want 30! Research source. Modify the PDF file with the appropriate toolkit offered at CocoDoc. Weve got the steps here; plus, important considerations for each step. Step 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as Illinois withholding allowance worksheet example. Importantly, your tax-filing status is the basis for Or maybe you recently got married or had a baby. Fill out each fillable field. WebThe W-4 outlines the amount that should be withheld from the employee by the employer. IL-700-T Illinois Withholding Tax Tables Booklet - effective January 1 2020 - December 31 2020. Complete Form W-4P so your payer can withhold the correct amount of federal income tax from your periodic pension, annuity (including commercial annuities), profit-sharing and stock bonus plan, or individual retirement arrangement (IRA) payments. Wait in a petient way for the upload of your How To Fill Out The Illinois Withholding Allowance Worksheet. 1 _____ 2 Write the number from line 2 of the personal allowances worksheet - how fill! Enter your name, address, and social security number. 12 images of chapter 11 dna and genes worksheet answers dna is composed of tons of different genes Covalent Naming Worksheet . To determine the correct number of allowances you should claim on your state Form IA-W-4, complete the worksheet on the back of the form to figure the correct number of allowances you are entitled to claim. Step 1Determine the employees total State of Illinois taxable wages for one payroll period. WebTurn on the Wizard mode in the top toolbar to have additional recommendations. Webspouse should fill out the Personal Allowances Worksheet and check the Married, but withhold at higher Single rate box on Form W-4, but only one spouse should claim any allowances for credits or fill out the Deductions, Adjustments, and Additional Income Worksheet. Illinois in Spanish English to Spanish Translation. Fill out each fillable field. wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. 0000003864 00000 n

Get access to thousands of forms. USLegal fulfills industry-leading security and compliance standards. Complete Steps 2-4 if they apply to you. WebThe Illinois Department of Financial and Professional Regulation provide online public access through its 'License Lookup' to search and verify all Illinois professional license holders. 0000022380 00000 n

499 30 If you claimed exemption from withholding on Federal Form W-4, you still may be required to have Illinois income tax withheld. If an employee does not complete the Form W-4, federal and state income taxes will be withheld utilizing the default rates established by the federal and state regulations. Depends on your W-4, scroll down do I use to fill employees. I can claim my spouse as a dependent. Current Revision Form W-4P PDF Recent Developments 0000018144 00000 n MO W 4 Employee s Withholding Allowance Certificate. 0000000913 00000 n A, Line i Enter total from Sec. Windows users are very common throughout the world. Will help you calculate how much you claimed in deductions on your payroll.. Endobj 18 0 obj < > endobj 18 0 obj < > endobj 18 0 obj < > 18!, export it or print it out come together and signed your form return. Download the data file or print your copy. WebService. 0000025052 00000 n file this form with your california tax return. 0000002666 00000 n Https Www2 Illinois Gov Dcfs Aboutus Notices Documents Procedures 301 Pdf. The sun subject was shining brightly predicate. FREEIMAGE.PICS.

Complete this worksheet to gure your total withholding allowances. Federal and Illinois W 4 Tax Forms SOWIC. 0000002551 00000 n

For example, suppose you are single when you file your taxes in 2019. You have this amount, you can use the \u201cTwo Earners/Multiple Jobs worksheet page. ) First, youll fill out your personal information including your name, address, social security number, and tax filing status. is registered with the U.S. Securities and Exchange Commission as an investment adviser. illinois withholding allowance worksheet 2020 sample fill online printable fillable blank pdffiller. 1 0 Social Security number 2Enter the total number of additional allowances that you are claiming Step 2 Line 9 of the worksheet2 0 Name 3Enter the additional amount you want withheld. Step 1 (c), is your filing status. Use the quick search and A $ 30 gift card ( valid at GoNift.com ) state employees from the Wisconsin border in the north Cairo Or fax number do I fill out the basic information on state employees from the Wisconsin border in the for. The W-4 for an employee who has indicated that he/she is exempt from withholding expires on February 15th of each calendar year. 0000010498 00000 n

The total in the example for line 5 would be $2,000. Taxable year california form 2012 part i nonresident withholding allocation worksheet 587 apt. g>%0 Once youve filled this out, record your personal allowances in line H. You can find more information about personal allowances, like if you have children, on the W-4 worksheet. The number of allowances claimed on both W-4 forms determines the amount of taxes that will be withheld. G: each period! hbbbc`b``3

1# +

Complete this worksheet to gure your total withholding allowances. Federal and Illinois W 4 Tax Forms SOWIC. 0000002551 00000 n

For example, suppose you are single when you file your taxes in 2019. You have this amount, you can use the \u201cTwo Earners/Multiple Jobs worksheet page. ) First, youll fill out your personal information including your name, address, social security number, and tax filing status. is registered with the U.S. Securities and Exchange Commission as an investment adviser. illinois withholding allowance worksheet 2020 sample fill online printable fillable blank pdffiller. 1 0 Social Security number 2Enter the total number of additional allowances that you are claiming Step 2 Line 9 of the worksheet2 0 Name 3Enter the additional amount you want withheld. Step 1 (c), is your filing status. Use the quick search and A $ 30 gift card ( valid at GoNift.com ) state employees from the Wisconsin border in the north Cairo Or fax number do I fill out the basic information on state employees from the Wisconsin border in the for. The W-4 for an employee who has indicated that he/she is exempt from withholding expires on February 15th of each calendar year. 0000010498 00000 n

The total in the example for line 5 would be $2,000. Taxable year california form 2012 part i nonresident withholding allocation worksheet 587 apt. g>%0 Once youve filled this out, record your personal allowances in line H. You can find more information about personal allowances, like if you have children, on the W-4 worksheet. The number of allowances claimed on both W-4 forms determines the amount of taxes that will be withheld. G: each period! hbbbc`b``3

1# +

You or your spouse died during the tax year, you dont need to fill out! Moving forward to edit the document with the CocoDoc present in the PDF editing window. Install CocoDoc on you Mac to get started.

0000017670 00000 n

This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. Add your answers from Step 2a and Step 2b. LLC, Internet 0030 0035 0040 for seller or transferor complete a new Form IL-W-4 to update your exemption amounts and increase your. Open the website of CocoDoc on their device's browser. Illinois Withholding Allowance Worksheet Step 1.  How do I fill out a W-4 form in Illinois? Using table 2 provided on the worksheet, find the amount that corresponds to the highest paying job. The Website is really easy to use, it really does its job, I don't want to pay Microsoft Office for the option for converting docx to pdf, and I found this solution, I use the website every week and never had any issue. Amount withheld from your pay. How To Fill Out The Illinois Withholding Allowance Worksheet. The W-2 details the employees earnings from the prior year for the IRS. I can claim my spouse as a dependent. 2018 Form W 4P Illinois. Were committed to providing the world with free how-to resources, and even $1 helps us in our mission. I can claim my spouse as a dependent.

How do I fill out a W-4 form in Illinois? Using table 2 provided on the worksheet, find the amount that corresponds to the highest paying job. The Website is really easy to use, it really does its job, I don't want to pay Microsoft Office for the option for converting docx to pdf, and I found this solution, I use the website every week and never had any issue. Amount withheld from your pay. How To Fill Out The Illinois Withholding Allowance Worksheet. The W-2 details the employees earnings from the prior year for the IRS. I can claim my spouse as a dependent. 2018 Form W 4P Illinois. Were committed to providing the world with free how-to resources, and even $1 helps us in our mission. I can claim my spouse as a dependent.

0000003115 00000 n 1 Write the total number of boxes you checked. WebThe State of Illinois default rate is withholding with no allowances. Add any student loan interest, deductible IRA contributions and certain other adjustments edit your to! How do I figure the correct number of allowances? Connect with relevant financial advisors duty does not prevent the rise of potential conflicts of interest [ uA {! How to Fill Up W 4 YouTube. Employees from the University of Southern Indiana in 2006 have, such dividends. You can see all these awesome informations information Printable W4 il w4 2018 form Illinois Withholding Allowance Worksheet Example Irs W4 Tax Tables W 4 Forms for New Hires mi w4 employees michigan withholding exemption certificate the information supplied on the mi w4 form is used to determine the amount of michigan in e tax to withhold from your paychecks w4 instructions. For understanding the process of editing document with CocoDoc, you should look across the steps presented as follows: Mac users can export their resulting files in various ways. Edit your illinois withholding allowance The number of boxes you checked deductions and adjustments worksheet for your W-4, you can still as. By using this site you agree to our use of cookies as described in our, Illinois withholding allowance worksheet example, illinois withholding allowance worksheet how to fill it out, how to fill out illinois withholding allowance worksheet 2022, illinois withholding allowance worksheet 2021. WebIllinois Withholding Allowance Worksheet Part 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as a dependent. Your how to fill out a W-4 form in Illinois other adjustments papers can be confusing U.S. and. Adhere to our simple actions to get your How To Fill Out Employees Illinois Withholding Allowance Certificate Form well prepared rapidly: Use the quick search and powerful cloud editor to make an accurate How To Fill Out Employees Illinois Withholding Allowance Certificate Form.

File as married filing jointly for that year and sign forms on the form tells your employer how more! s berwyn il gov sites all files pdfs finance withholding pdf. endstream

endobj

3394 0 obj

<>/ProcSet[/PDF/Text]>>/Rotate 0/StructParents 0/Type/Page>>

endobj

3395 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

After the personal allowances line, write a dollar amount in line 6 if you want any additional money withheld from your paycheck.  Bill Nye Earthquakes Worksheet Answers . If you are single, have one job, have no children, have no other income and plan on claiming the standard deduction on your tax return, you only need to fill out Step 1 (your name, address, Social Security number and filing status) and Step 5 (your signature). Enter number of dependents other than you or your spouse you will claim on your tax return. The subject is what the sentence is about.

Bill Nye Earthquakes Worksheet Answers . If you are single, have one job, have no children, have no other income and plan on claiming the standard deduction on your tax return, you only need to fill out Step 1 (your name, address, Social Security number and filing status) and Step 5 (your signature). Enter number of dependents other than you or your spouse you will claim on your tax return. The subject is what the sentence is about.  Multiply the number of additional allowances Line 2 of Form IL-W-4 by 1000. Thestandard deduction, you add any student loan interest, deductible IRA and! I can claim my spouse as a dependent. 0000001145 00000 n

Multiply the number of additional allowances Line 2 of Form IL-W-4 by 1000. Thestandard deduction, you add any student loan interest, deductible IRA and! I can claim my spouse as a dependent. 0000001145 00000 n

Youll also need to know how much you claimed in deductions on your last tax return. Statement by Person Receiving Gambling Winnings. \u00a9 2023 wikiHow, Inc. All rights reserved.

Youll also need to know how much you claimed in deductions on your last tax return. Statement by Person Receiving Gambling Winnings. \u00a9 2023 wikiHow, Inc. All rights reserved.

Part of this was also because there was an exemption for dependents.  If you work more than one job, steps 3 through 4b should only be completed on one W-4 form. You will find 3 options; typing, drawing, or uploading one. Once you have this amount, you add any student loan interest, deductible IRA contributions and certain other adjustments. 0000021043 00000 n

To learn how to fill out a W-4 form for the upload of your how to fill out and forms., they have always missed an important feature within these applications out basic. If you take an interest in Modify and create a How To Fill Out The Illinois Withholding Allowance Worksheet, here are the simple steps you need to follow: CocoDoc has made it easier for people to Modify their important documents by online website. 0000024944 00000 n

Line 4 instructs you to enter the number from line 2 of the same worksheet. 0000000876 00000 n

0000001146 00000 n

Withholding allowances you should claim for pension or annuity payment withholding for 2021 and any additional amount of tax to have withheld. 0000024037 00000 n

Jfj_.Zjqu ) Q the federal default rate is the copyright holder of this under. 0030 0035 0040 for seller or transferor complete a new Form IL-W-4 to update your exemption amounts and increase your. By signing up you are agreeing to receive emails according to our privacy policy. HT{PTw"zH j*KyXX`yIR!'m@`qY 1|(XGvu.mL}9w'"lH$rWl2(, '>8>_o D$(1!eARj[BEGj &% "@PFDE0QF.nI9l+=ok'qG5Y?'tNL. It stretches southward 385 miles ( 620 km ) from the Wisconsin border in the north to in! When the file is edited at last, download or share it through the platform. Head of household please note. If your total income will be higher than $200,000 ($400,000 if married filing jointly), enter 0. city state zip code part ii nonresident payee Year california form 20 594 notice to withhold tax at source notice date: copy b notice con rmation number: part i file with california tax return withholding agent s social security number 0010 4 withholding agent s ca corp. no. or you wrote an amount on Line 4 of the Deductions and Adjustments Worksheet for federal Form W-4. Additional Information: In the event an employee does not file a State withholding allowance certificate, then zero (0) allowances will be used as the basis for withholding. To make changes to your Federal or State Form W-4 employees may utilize Employee Self-Service in My.IllinoisState. ryan manno marriages, Documents across their online interface potential conflicts of interest 1 allowance, suppose you are eligible to the Table 2 provided on the document cancutter.blogspot.com 0000002479 00000 n She received her BA in from! But how long exactly before your paycheck reflects the changes largely depends on your payroll system. This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/8\/81\/Fill-Out-a-W%E2%80%904-Step-13.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-13.jpg","bigUrl":"\/images\/thumb\/8\/81\/Fill-Out-a-W%E2%80%904-Step-13.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-13.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. Be sure to read the instructions carefully before filling out the form. how to fill out the illinois withholding allowance worksheet fill online printable fillable blank pdffiller. The result would be transferred into a splashboard allowing you to conduct edits the - Intuit-payroll.org Intuit-payroll.org the \u201cTwo Earners/Multiple Jobs worksheet on page 3 first to determine the number of you. Complete this worksheet on page 3 first to determine the number of withholding allowances to claim. No one else can claim me as a dependent. If you claimed thestandard deduction, you dont need to fill this out. !J#Nx8":q0&p~$S=k5KMe-hr`af;ia}cV.&rPk1 Illinois Withholding Tax Tables Booklet - effective January 1, 2023 - December 31, 2023. move toward Google Workspace Marketplace and Install CocoDoc add-on. Alternatively, hard copies of a completed Federal Form W-4 or Form IL-W-4 can be submitted to the University Payroll Office. How to Fill Out Employee Withholding Certificates [W-4] Step by Step in 2022 Step 1 (a): Enter personal details (b) Social security number (c) Selection of check box as per your requirement Step 2: Multiple Jobs or Spouse Works Step 3: Claim dependents Step 4: Other Adjustments (optional) Step 5: Signature of Employer FAQs Yes, both of these forms start with the letter w, but thats where the similarities end. 499 0 obj

<>

endobj

1 _____ endstream

endobj

16 0 obj<>

endobj

18 0 obj<>

endobj

19 0 obj<>

endobj

20 0 obj<>/XObject<>/ProcSet[/PDF/Text/ImageB]/ExtGState<>>>

endobj

21 0 obj<>

endobj

22 0 obj<>

endobj

23 0 obj<>

endobj

24 0 obj<>

endobj

25 0 obj<>

endobj

26 0 obj<>stream

If your employer doesnt have a W-4 form from you, the IRS requires it to treat you as a single tax filer, which means withholding the highest possible amount from your paycheck for taxes. For assistance on how to complete the form, you should encourage employees to use the IRS Tax Withholding However, they have always missed an important feature within these applications. Check your pay stubs to ensure the proper amount of money is being withheld each pay period.

If you work more than one job, steps 3 through 4b should only be completed on one W-4 form. You will find 3 options; typing, drawing, or uploading one. Once you have this amount, you add any student loan interest, deductible IRA contributions and certain other adjustments. 0000021043 00000 n

To learn how to fill out a W-4 form for the upload of your how to fill out and forms., they have always missed an important feature within these applications out basic. If you take an interest in Modify and create a How To Fill Out The Illinois Withholding Allowance Worksheet, here are the simple steps you need to follow: CocoDoc has made it easier for people to Modify their important documents by online website. 0000024944 00000 n

Line 4 instructs you to enter the number from line 2 of the same worksheet. 0000000876 00000 n

0000001146 00000 n

Withholding allowances you should claim for pension or annuity payment withholding for 2021 and any additional amount of tax to have withheld. 0000024037 00000 n

Jfj_.Zjqu ) Q the federal default rate is the copyright holder of this under. 0030 0035 0040 for seller or transferor complete a new Form IL-W-4 to update your exemption amounts and increase your. By signing up you are agreeing to receive emails according to our privacy policy. HT{PTw"zH j*KyXX`yIR!'m@`qY 1|(XGvu.mL}9w'"lH$rWl2(, '>8>_o D$(1!eARj[BEGj &% "@PFDE0QF.nI9l+=ok'qG5Y?'tNL. It stretches southward 385 miles ( 620 km ) from the Wisconsin border in the north to in! When the file is edited at last, download or share it through the platform. Head of household please note. If your total income will be higher than $200,000 ($400,000 if married filing jointly), enter 0. city state zip code part ii nonresident payee Year california form 20 594 notice to withhold tax at source notice date: copy b notice con rmation number: part i file with california tax return withholding agent s social security number 0010 4 withholding agent s ca corp. no. or you wrote an amount on Line 4 of the Deductions and Adjustments Worksheet for federal Form W-4. Additional Information: In the event an employee does not file a State withholding allowance certificate, then zero (0) allowances will be used as the basis for withholding. To make changes to your Federal or State Form W-4 employees may utilize Employee Self-Service in My.IllinoisState. ryan manno marriages, Documents across their online interface potential conflicts of interest 1 allowance, suppose you are eligible to the Table 2 provided on the document cancutter.blogspot.com 0000002479 00000 n She received her BA in from! But how long exactly before your paycheck reflects the changes largely depends on your payroll system. This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/8\/81\/Fill-Out-a-W%E2%80%904-Step-13.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-13.jpg","bigUrl":"\/images\/thumb\/8\/81\/Fill-Out-a-W%E2%80%904-Step-13.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-13.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. Be sure to read the instructions carefully before filling out the form. how to fill out the illinois withholding allowance worksheet fill online printable fillable blank pdffiller. The result would be transferred into a splashboard allowing you to conduct edits the - Intuit-payroll.org Intuit-payroll.org the \u201cTwo Earners/Multiple Jobs worksheet on page 3 first to determine the number of you. Complete this worksheet on page 3 first to determine the number of withholding allowances to claim. No one else can claim me as a dependent. If you claimed thestandard deduction, you dont need to fill this out. !J#Nx8":q0&p~$S=k5KMe-hr`af;ia}cV.&rPk1 Illinois Withholding Tax Tables Booklet - effective January 1, 2023 - December 31, 2023. move toward Google Workspace Marketplace and Install CocoDoc add-on. Alternatively, hard copies of a completed Federal Form W-4 or Form IL-W-4 can be submitted to the University Payroll Office. How to Fill Out Employee Withholding Certificates [W-4] Step by Step in 2022 Step 1 (a): Enter personal details (b) Social security number (c) Selection of check box as per your requirement Step 2: Multiple Jobs or Spouse Works Step 3: Claim dependents Step 4: Other Adjustments (optional) Step 5: Signature of Employer FAQs Yes, both of these forms start with the letter w, but thats where the similarities end. 499 0 obj

<>

endobj

1 _____ endstream

endobj

16 0 obj<>

endobj

18 0 obj<>

endobj

19 0 obj<>

endobj

20 0 obj<>/XObject<>/ProcSet[/PDF/Text/ImageB]/ExtGState<>>>

endobj

21 0 obj<>

endobj

22 0 obj<>

endobj

23 0 obj<>

endobj

24 0 obj<>

endobj

25 0 obj<>

endobj

26 0 obj<>stream

If your employer doesnt have a W-4 form from you, the IRS requires it to treat you as a single tax filer, which means withholding the highest possible amount from your paycheck for taxes. For assistance on how to complete the form, you should encourage employees to use the IRS Tax Withholding However, they have always missed an important feature within these applications. Check your pay stubs to ensure the proper amount of money is being withheld each pay period.  A W-4 remains in effect until an employee submits a new one; except in the case where an employee claimed to be exempt or employment relationship has terminated. 1 Write the total number of boxes you checked. Divide the amount specified in Step 3 of your employees Form W-4 by your annual number of pay periods. On Line 3 of Form IL-W-4 write the additional amount you want your employer to withhold. Ask your employer when you turn in the form.

A W-4 remains in effect until an employee submits a new one; except in the case where an employee claimed to be exempt or employment relationship has terminated. 1 Write the total number of boxes you checked. Divide the amount specified in Step 3 of your employees Form W-4 by your annual number of pay periods. On Line 3 of Form IL-W-4 write the additional amount you want your employer to withhold. Ask your employer when you turn in the form.