Previous appraisals, expert opinions, and appraisals for similar properties may be attached to the appeal as supporting documentation. The second public meeting to seek input on the county's biennial budget will be held in Kent. Story. As to how a higher assessment will affect your taxes, jurisdictions are only allowed to increase their levy (the overall amount of tax they collect) by 1% each year without a vote of the people. In cases of extreme property tax delinquency, the King And Queen County Tax Board may seize the delinquent property and offer it for sale at a public tax foreclosure auction, often at a price well under market value. Weve made critical investments in community safety, equitable recovery from the pandemic, and enhanced the Office of Law Enforcement Oversight as the Sheriffs Department moves to using body-worn cameras. The King County Assessor is sending out 2023 bills starting today, but you dont have to wait for yours to arrive in the mail you can look it up right now online via kingcounty.gov/propertytax. We have a party night nearly every month Halloween, Christmas, Valentines Day, etc. a per capita property tax collected for each county. Cry me a river. The budget accelerates our work of.

2023 Property Taxes. Many of these numbers have increased since 2019. The lack of common sense around here is appalling when people want so much new housing in a already built up city not caring it is all going in someone elses pockets in rent. It is absolute usury. The link to file an appeal on the back of the card. Getting a Homestead Exemption may also help protect your home from being repossessed in the case of a property tax lien due to unpaid King County property taxes or other types of other debt. For properties considered the primary residence of the taxpayer, a homestead exemption may exist. The meetings will be held on Novemer 8 and 10, beginning at 9:30 am. spent most effectively. I understand not enjoying taxes going up. The Vice President is Jeannie Mastine and the Treasurer/Secretary is Wendy Shields; the Social Convener is Mary Dament. The statutory due date for the first half falls on a Sunday in 2023, so payments will not be due until Monday, May 1. Assessments take a sample of 24 months. A homeowner has a tax bill for the year 2023, totaling $5,000. Distinguished Service Awards Winners, Attachment A: Capital Improvement Program, https://kingcounty.gov/council/committees/budget.aspx, Watch a recording of the budget address to the Council, $220 million to convert Metro to all-electric buses by 2035, $166 million to fund affordable housing near transit centers, supportive housing operations and coordinated crisis response efforts to homelessness, More than $50 million to fund environmental improvements and protections, including restoring fish passage habitat, removing nitrogen and chemicals from wastewater, and expanding access to heat pumps and solar panels for homeowners in unincorporate King County.

2023 Property Taxes. Many of these numbers have increased since 2019. The lack of common sense around here is appalling when people want so much new housing in a already built up city not caring it is all going in someone elses pockets in rent. It is absolute usury. The link to file an appeal on the back of the card. Getting a Homestead Exemption may also help protect your home from being repossessed in the case of a property tax lien due to unpaid King County property taxes or other types of other debt. For properties considered the primary residence of the taxpayer, a homestead exemption may exist. The meetings will be held on Novemer 8 and 10, beginning at 9:30 am. spent most effectively. I understand not enjoying taxes going up. The Vice President is Jeannie Mastine and the Treasurer/Secretary is Wendy Shields; the Social Convener is Mary Dament. The statutory due date for the first half falls on a Sunday in 2023, so payments will not be due until Monday, May 1. Assessments take a sample of 24 months. A homeowner has a tax bill for the year 2023, totaling $5,000. Distinguished Service Awards Winners, Attachment A: Capital Improvement Program, https://kingcounty.gov/council/committees/budget.aspx, Watch a recording of the budget address to the Council, $220 million to convert Metro to all-electric buses by 2035, $166 million to fund affordable housing near transit centers, supportive housing operations and coordinated crisis response efforts to homelessness, More than $50 million to fund environmental improvements and protections, including restoring fish passage habitat, removing nitrogen and chemicals from wastewater, and expanding access to heat pumps and solar panels for homeowners in unincorporate King County.  WebCheck your tax statement or property value notice. Our membership is quite varied in ages and abilities with everyone enjoying the fun and friendships that are offered. for every school district in the country. The King County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed, resulting in a lower annual property tax rate for owner-occupied homes. I have such an issue with the property tax situation. King County collects, on average, 0.88% of a property's assessed fair market value as property tax. Please enter your username or e-mail address. And I just shake my head thinking about all of the excessive taxes paid in Seattle and King County. King County, Washingtons average effective property tax rate is 1.05%. Our property tax estimates are based on the median property tax levied on similar houses in the King County area. You can also ask about other exemptions that may exist for veterans, seniors, low-income families, or property used for certain purposes such as farmland or open space. With the housing market starting to go sideways and this is already making my valuation signifigantly higher than what comperable homes are listed at.

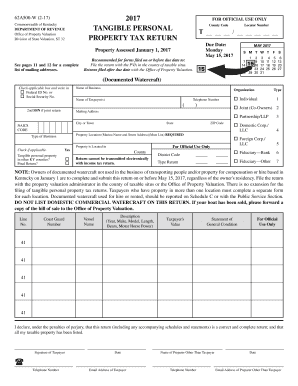

WebCheck your tax statement or property value notice. Our membership is quite varied in ages and abilities with everyone enjoying the fun and friendships that are offered. for every school district in the country. The King County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed, resulting in a lower annual property tax rate for owner-occupied homes. I have such an issue with the property tax situation. King County collects, on average, 0.88% of a property's assessed fair market value as property tax. Please enter your username or e-mail address. And I just shake my head thinking about all of the excessive taxes paid in Seattle and King County. King County, Washingtons average effective property tax rate is 1.05%. Our property tax estimates are based on the median property tax levied on similar houses in the King County area. You can also ask about other exemptions that may exist for veterans, seniors, low-income families, or property used for certain purposes such as farmland or open space. With the housing market starting to go sideways and this is already making my valuation signifigantly higher than what comperable homes are listed at.  As a retiree, I cannot write off any of the things you mention as I only qualify for the standard deduction itemizing would cost me money in the long run. How much your taxes change is a much more important factor than how much your valuation changed since the two are not directly related. Thank you for your answer! Per state law the property is supposed to be assessed at its actual fair market value on whatever date the assessor uses. County assessors value (assess) your property, and county treasurers collect property tax. Most county assessors' offices are located in or near the county courthouse or the local county administration building. My property taxes have increased $900.00 since 2020. A lot of houses did actually increase in value by that much last year. positive return on investment for homeowners in the community. There isnt a direct correlation between the change in assessed value and the change in your property tax liability. If you need to find out the exact amount of your property tax bill or find other specific information, you can contact the EVERYONE that owns a home is rich and entitled? Look up the tax revenue Seattle has brought in. assessments/basis were set in the past, not as of today. When youre ready to pay your property tax bill, you can do so online with a check or credit card. You (or your mortgage lender) should receive a bill in the mail in February. Over 30% more in 2022 than 6 years ago. When prices start to drop, you are paying more than you think you should. Sources: US Census Bureau 2018 American Community Survey, We created an average score for each district by looking at You have permission to edit this article. In fact, the performance of what the majority of the taxes go toward, have seen a markedly decline!!! Aggregate King County property values increased by 21.8% in 2022, rising from $722.5 billion to $879.9 billion, but since we operate under a "budget based" property tax revenue system here in Washington State, property taxes were up, but nowhere near 21.8 percent. Within each state, we assigned every county a score between 1 and 10 (with 10 being the best) I sure dont miss light rail taxes either.But all of these commentators supporting a state income tax thinking any of the other taxes would be reduced as a result are just dreaming. The striking amendment, created by Budget Chair Joe McDermott and Councilmembers Rod Dembowski, Dave Upthegrove, and Girmay Zahilay, is the BLTs recommended changes to the Executive Proposed Budget. Payments are accepted online, by mail, and by drop box. There is a publication called Square Time that dancers can subscribe to. I only see 2022 rates on the assessors site, am I missing something? And if it keeps going down the the rest of this year it will only get worse. Property Tax Information and Customer Service 206-263-2890 or PropertyTax.CustomerService@kingcounty.gov. Council changes added roughly $76 million to the original proposal of $16.14 billion. The King County Council on September 27 kicked off the process of reviewing and approving the Countys 2023-2024 biennial budget. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. King County Tax Assessor . If not, its just a residable credit card. I dont understand the complaining about increases in tax while we own our ever-increasingly valuable homes. Thanks for your careless comment. Sure, homeowners wish they can write off the entire amount of property tax and general sales tax for deduction in Sch. King County residents pay two different types of property taxes: real property taxes (for homes, buildings and land) and personal property taxes (for equipment, machinery and mobile homes located in mobile home parks). 2017 Swinging Swallows Modern Square Dance Club.

As a retiree, I cannot write off any of the things you mention as I only qualify for the standard deduction itemizing would cost me money in the long run. How much your taxes change is a much more important factor than how much your valuation changed since the two are not directly related. Thank you for your answer! Per state law the property is supposed to be assessed at its actual fair market value on whatever date the assessor uses. County assessors value (assess) your property, and county treasurers collect property tax. Most county assessors' offices are located in or near the county courthouse or the local county administration building. My property taxes have increased $900.00 since 2020. A lot of houses did actually increase in value by that much last year. positive return on investment for homeowners in the community. There isnt a direct correlation between the change in assessed value and the change in your property tax liability. If you need to find out the exact amount of your property tax bill or find other specific information, you can contact the EVERYONE that owns a home is rich and entitled? Look up the tax revenue Seattle has brought in. assessments/basis were set in the past, not as of today. When youre ready to pay your property tax bill, you can do so online with a check or credit card. You (or your mortgage lender) should receive a bill in the mail in February. Over 30% more in 2022 than 6 years ago. When prices start to drop, you are paying more than you think you should. Sources: US Census Bureau 2018 American Community Survey, We created an average score for each district by looking at You have permission to edit this article. In fact, the performance of what the majority of the taxes go toward, have seen a markedly decline!!! Aggregate King County property values increased by 21.8% in 2022, rising from $722.5 billion to $879.9 billion, but since we operate under a "budget based" property tax revenue system here in Washington State, property taxes were up, but nowhere near 21.8 percent. Within each state, we assigned every county a score between 1 and 10 (with 10 being the best) I sure dont miss light rail taxes either.But all of these commentators supporting a state income tax thinking any of the other taxes would be reduced as a result are just dreaming. The striking amendment, created by Budget Chair Joe McDermott and Councilmembers Rod Dembowski, Dave Upthegrove, and Girmay Zahilay, is the BLTs recommended changes to the Executive Proposed Budget. Payments are accepted online, by mail, and by drop box. There is a publication called Square Time that dancers can subscribe to. I only see 2022 rates on the assessors site, am I missing something? And if it keeps going down the the rest of this year it will only get worse. Property Tax Information and Customer Service 206-263-2890 or PropertyTax.CustomerService@kingcounty.gov. Council changes added roughly $76 million to the original proposal of $16.14 billion. The King County Council on September 27 kicked off the process of reviewing and approving the Countys 2023-2024 biennial budget. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. King County Tax Assessor . If not, its just a residable credit card. I dont understand the complaining about increases in tax while we own our ever-increasingly valuable homes. Thanks for your careless comment. Sure, homeowners wish they can write off the entire amount of property tax and general sales tax for deduction in Sch. King County residents pay two different types of property taxes: real property taxes (for homes, buildings and land) and personal property taxes (for equipment, machinery and mobile homes located in mobile home parks). 2017 Swinging Swallows Modern Square Dance Club. To compare King County with property tax rates in other states, see our map of property taxes by state. Even a small property tax bill can be burdensome for certain King County residents. Karl S. Park III and Shelley S. Park to Jared M. Smith, Tract Madison Co., $219,500. My property tax increase by $4,200 from last year! Lowest rate: Highest rate: No. In the meantime, you can view your property tax bill online by visiting kingcounty.gov and entering your tax account number for your real or personal property (you can find this number on your Assessor's Valuation Change Notice or an older property tax statement). Note: This page provides general information about property taxes in King County. Some low-income homeowners may be able to defer the payment of their property taxes, too. If you have been overassessed, we can help you submit a tax appeal. WebAggregate property taxes in King County for 2023 rose by 6.4% or nearly $436 million, going from $6.6 billion to $7.2 billion largely due to voted measures. There is ample parking in the rear of the Church. does not review the ongoing performance of any Adviser, participate in the management of any users Did the tax rate increase or just the assessment of your property? The King County Tax Assessor is responsible for assessing the fair market value of properties within King County and determining the property tax rate that will apply. Every locality uses a unique property tax assessment method. Average Retirement Savings: How Do You Compare? Full-time Apartment Groundskeeper in West Seattle, REMOVE DAYSTAR JOB POSING POSITION FILLED -THANK YOU, After School Program Teacher ($750 Sign On Bonus!) All investing involves risk, including King And Queen County collects, on average, 0.46% of a property's assessed fair market value as property tax. If you live in the area, your property tax bill is calculated by multiplying the effective property tax rate by the estimated value of your property. King Street Center 201 South Jackson Street #710 Seattle, WA 98104. In King County, property taxes are usually paid in two installments. WebKing County, WA Property Tax Calculator - SmartAsset Calculate how much you can expect to pay in property taxes on your home in King County, Washington. What are they doing in Scottsdale? To get a copy of the King And Queen County Homestead Exemption Application, call the King And Queen County Assessor's Office and ask for details on the homestead exemption program. If your appeal is denied, you still have the option to re-appeal the decision. This

King county releases the tax info in February of the year it's due. of rates No. The Swallows dance most Thursday evenings, from 7:00 to about 9:30. Rainfall around a quarter of an inch.. Overcast. Highland Park, Launch, Southwest Precinct Crime Prevention Council, West Seattle Community Recognition Awards, WS Health Club/ex-Athletic Club/ex-Allstar Fitness, PROPERTY TAX: King County Assessor says this years bills are ready. You will receive a new password via e-mail. :(. My social security increase doesnt come close to covering the increase in my property taxes this year, let alone increases in costs of groceries and other everyday necessities. (For more information on how the dancing is different, visit theModern Squares?in the main menu.). It's not long before the new dancer is feeling like an old pro! It doesnt make property taxes any easier to swallow though, especially when still paying mortgages. (optional). Scarlett. 2023 Taxes - King County Skip to main content Our website is changing!

King county releases the tax info in February of the year it's due. of rates No. The Swallows dance most Thursday evenings, from 7:00 to about 9:30. Rainfall around a quarter of an inch.. Overcast. Highland Park, Launch, Southwest Precinct Crime Prevention Council, West Seattle Community Recognition Awards, WS Health Club/ex-Athletic Club/ex-Allstar Fitness, PROPERTY TAX: King County Assessor says this years bills are ready. You will receive a new password via e-mail. :(. My social security increase doesnt come close to covering the increase in my property taxes this year, let alone increases in costs of groceries and other everyday necessities. (For more information on how the dancing is different, visit theModern Squares?in the main menu.). It's not long before the new dancer is feeling like an old pro! It doesnt make property taxes any easier to swallow though, especially when still paying mortgages. (optional). Scarlett. 2023 Taxes - King County Skip to main content Our website is changing!  Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. There is no way we could afford to buy here today. Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. So as the price goes up, you usually get a good rate. Fixing the problem is a matter of political will. Scottsdale Councilmember Tammy Caputi. In 2015 we began a new annual tradition by hosting the Boys and Girls Club for a dinner and some dancing after. Jordan Still and Brittany Still to Charles OConnell, Breezy Point Estate, $280,000, Peyton Homes, LLC to Ashley Nicole Russo and Pablo Russo, Ash Park Subdivision, $218,500, D-PRO, LLC and Eric Len Ogden and Rose Ella Ogden to Erica L. Sellers and Levi T. Dunn, Lot 11 Plat 7/284, $133,000, Michael Fitzgerald and Melanie Fitzgerald to Johnathan McQuarter and Rachael McQuarter, Pond Meadow Subdivision, $283,200, Short Carpentry and Construction, Inc. to Grover Cleveland Harrison and Pamela Sue Harrison, Prairie View @ Twin Lakes, $284,200, Estate of Homer Renfro, by and through Michael D. Renfro, Executor to Daniel Reyna, Lot 1 Plat 30/226, $60,000, Joshua Dale Robinson and Summer Robinson to Jason Snapp, Burnamwood Addition, $234,000, Aaron Gregory Hubbs and Daniel Joseph Hubbs to Daniel Joseph Hubbs andEmmal Mildred Steeves, Beginnings, $45,000, Travis Still and Morgan Brittany Perri Still to Laurel Amanda Rutherford and Jason Brian Rutherford, Fairfield Subdivision, $239,900, Karl S. Park III and Shelley S. Park to Jared M. Smith, Tract Madison Co., $219,500, Robert C. Sword and Lanesha G. Sword to Charles Sallee and Diana Sallee, Hartland Subdivision, $201,000, Dearl Turner and Janet Turner to Cody Shepherd and Hillary Shepherd, Tract Madison Co., $160,000, Meghan Brown and Justin Price to Cecile Nora Walker, Lot 28 Plat 21/135, $360,000, Harvey R. Little, Jr. Disclaimer: Please note that we can only estimate your King And Queen County property tax based on average property taxes in your area. If that is the case, I understand. Please tell us where you live. First Amendment: Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof; or abridging the freedom of speech, or of the press; or the right of the people peaceably to assemble, and to petition the Government for a redress of grievances. Property tax increases are a pittance compared to the appreciation homeowners have enjoyed over the years. Create an account to follow your favorite communities and start taking part in conversations. Customer service representatives are also available to assist Monday through Friday, 8:30 a.m. to 4:30 p.m.

Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. There is no way we could afford to buy here today. Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. So as the price goes up, you usually get a good rate. Fixing the problem is a matter of political will. Scottsdale Councilmember Tammy Caputi. In 2015 we began a new annual tradition by hosting the Boys and Girls Club for a dinner and some dancing after. Jordan Still and Brittany Still to Charles OConnell, Breezy Point Estate, $280,000, Peyton Homes, LLC to Ashley Nicole Russo and Pablo Russo, Ash Park Subdivision, $218,500, D-PRO, LLC and Eric Len Ogden and Rose Ella Ogden to Erica L. Sellers and Levi T. Dunn, Lot 11 Plat 7/284, $133,000, Michael Fitzgerald and Melanie Fitzgerald to Johnathan McQuarter and Rachael McQuarter, Pond Meadow Subdivision, $283,200, Short Carpentry and Construction, Inc. to Grover Cleveland Harrison and Pamela Sue Harrison, Prairie View @ Twin Lakes, $284,200, Estate of Homer Renfro, by and through Michael D. Renfro, Executor to Daniel Reyna, Lot 1 Plat 30/226, $60,000, Joshua Dale Robinson and Summer Robinson to Jason Snapp, Burnamwood Addition, $234,000, Aaron Gregory Hubbs and Daniel Joseph Hubbs to Daniel Joseph Hubbs andEmmal Mildred Steeves, Beginnings, $45,000, Travis Still and Morgan Brittany Perri Still to Laurel Amanda Rutherford and Jason Brian Rutherford, Fairfield Subdivision, $239,900, Karl S. Park III and Shelley S. Park to Jared M. Smith, Tract Madison Co., $219,500, Robert C. Sword and Lanesha G. Sword to Charles Sallee and Diana Sallee, Hartland Subdivision, $201,000, Dearl Turner and Janet Turner to Cody Shepherd and Hillary Shepherd, Tract Madison Co., $160,000, Meghan Brown and Justin Price to Cecile Nora Walker, Lot 28 Plat 21/135, $360,000, Harvey R. Little, Jr. Disclaimer: Please note that we can only estimate your King And Queen County property tax based on average property taxes in your area. If that is the case, I understand. Please tell us where you live. First Amendment: Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof; or abridging the freedom of speech, or of the press; or the right of the people peaceably to assemble, and to petition the Government for a redress of grievances. Property tax increases are a pittance compared to the appreciation homeowners have enjoyed over the years. Create an account to follow your favorite communities and start taking part in conversations. Customer service representatives are also available to assist Monday through Friday, 8:30 a.m. to 4:30 p.m.  We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. Our data allows you to compare King And Queen County's property taxes by median property tax in dollars, median property tax as a percentage of home value, and median property tax as a percentage of the King And Queen County median household income. Unpaid property tax can lead to a property tax lien, which remains attached to the property's title and is the responsibility of the current owner of the property. We dance for fun not for perfection!

We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. Our data allows you to compare King And Queen County's property taxes by median property tax in dollars, median property tax as a percentage of home value, and median property tax as a percentage of the King And Queen County median household income. Unpaid property tax can lead to a property tax lien, which remains attached to the property's title and is the responsibility of the current owner of the property. We dance for fun not for perfection!  I have moved. If you have questions about how property taxes can affect your overall financial plans, a financial advisor in Bellevue can help you out. I bought a home years ago at a price I could (barely) afford. Your house, you mention is what 1.6m? Events are listed with the most recent first. Its why your assessed value is usually about 80% of its market value (since about 2012) instead of the actual value - there are lots of homes from 24 months ago that are dragging down your value. Disabled taxpayers and seniors who were born in 1958 or before may be able to lower their property tax bills if their annual income is under $58,423. However, the homeowner does not expect to have funds to pay the first half taxes of $2,500, which are There are no guarantees that working with an adviser will yield positive returns. matching platform based on information gathered from users through our online questionnaire. Unpaid property tax can lead to a property tax lien, which remains attached to the property's title and is the responsibility of the current owner of the property. We oversee the administration of property taxes at state and local levels. At some point, when services decline and taxes must go up to pay for higher salaries, Scottsdale will have to re-examine our housing priorities. Assessed value of land and improvements went from 1.3m to 1.8m in last year it increased 25%. A financial advisor can help you understand how homeownership fits into your overall financial goals. Exemptions are available for different groups of people, including farmers with certain machinery or equipment and homeowners whove renovated their single-family homes or historic properties. I thought about appealing but the documentation for doing so stated I needed to provide actual evidence of the property being worth less than what the county assessment states- and I can't do that as almost identical homes in my development and nearby have indeed sold for around that much in the last year. If you need specific tax information or property records about a property in King County, contact the King County Tax Assessor's Office. Your actual property tax burden will depend on the details and features of each individual property. Instead, we provide property tax information based on the statistical median of all taxable properties in King And Queen County. If your appeal is successful, your property will be reassessed at a lower valuation and your King County property taxes will be lowered accordingly. King County Treasury Operations, King Street Center, 201 S. Jackson St, Suite 710, Seattle, WA 98104. And as for the increased value of my home, the only way for me to take advantage of that would be to sell it. Updated advisories will be sent weekly on Fridays, and additional information and budget documents will be posted on this page. Information on tax exemption and deferral programs for seniors, people with disabilities, or other qualifying conditions can be obtained from the King County Assessors Office at TaxRelief.kingcounty.gov, by emailing exemptions.assessments@kingcounty.gov, or calling 206-296-3920. The median property tax amount is based on the median King County property value of $407,700. loss of principal. Property taxes are managed on a county level by the local tax assessor's office. wa state has no income tax.

I have moved. If you have questions about how property taxes can affect your overall financial plans, a financial advisor in Bellevue can help you out. I bought a home years ago at a price I could (barely) afford. Your house, you mention is what 1.6m? Events are listed with the most recent first. Its why your assessed value is usually about 80% of its market value (since about 2012) instead of the actual value - there are lots of homes from 24 months ago that are dragging down your value. Disabled taxpayers and seniors who were born in 1958 or before may be able to lower their property tax bills if their annual income is under $58,423. However, the homeowner does not expect to have funds to pay the first half taxes of $2,500, which are There are no guarantees that working with an adviser will yield positive returns. matching platform based on information gathered from users through our online questionnaire. Unpaid property tax can lead to a property tax lien, which remains attached to the property's title and is the responsibility of the current owner of the property. We oversee the administration of property taxes at state and local levels. At some point, when services decline and taxes must go up to pay for higher salaries, Scottsdale will have to re-examine our housing priorities. Assessed value of land and improvements went from 1.3m to 1.8m in last year it increased 25%. A financial advisor can help you understand how homeownership fits into your overall financial goals. Exemptions are available for different groups of people, including farmers with certain machinery or equipment and homeowners whove renovated their single-family homes or historic properties. I thought about appealing but the documentation for doing so stated I needed to provide actual evidence of the property being worth less than what the county assessment states- and I can't do that as almost identical homes in my development and nearby have indeed sold for around that much in the last year. If you need specific tax information or property records about a property in King County, contact the King County Tax Assessor's Office. Your actual property tax burden will depend on the details and features of each individual property. Instead, we provide property tax information based on the statistical median of all taxable properties in King And Queen County. If your appeal is successful, your property will be reassessed at a lower valuation and your King County property taxes will be lowered accordingly. King County Treasury Operations, King Street Center, 201 S. Jackson St, Suite 710, Seattle, WA 98104. And as for the increased value of my home, the only way for me to take advantage of that would be to sell it. Updated advisories will be sent weekly on Fridays, and additional information and budget documents will be posted on this page. Information on tax exemption and deferral programs for seniors, people with disabilities, or other qualifying conditions can be obtained from the King County Assessors Office at TaxRelief.kingcounty.gov, by emailing exemptions.assessments@kingcounty.gov, or calling 206-296-3920. The median property tax amount is based on the median King County property value of $407,700. loss of principal. Property taxes are managed on a county level by the local tax assessor's office. wa state has no income tax.  Overall, countywide property tax collections for the 2022 tax year are $6.79 billion, an increase of $190 million --3% -- over last years total of $6.6 billion. Nonprofit exemptions Renew your property tax exemption. Sell your house and move somewhere that does not rely on property and sales tax to provide government services. Also sunset pics. Tax Foreclosures Seriously, how much more do you entitled homeowners think you deserve?

Overall, countywide property tax collections for the 2022 tax year are $6.79 billion, an increase of $190 million --3% -- over last years total of $6.6 billion. Nonprofit exemptions Renew your property tax exemption. Sell your house and move somewhere that does not rely on property and sales tax to provide government services. Also sunset pics. Tax Foreclosures Seriously, how much more do you entitled homeowners think you deserve?  You will be provided with a property tax appeal form, on which you will provide the tax assessor's current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate. Counties with the highest scores Property tax income is almost always used for local projects and services, and does not go to the federal or state budget. Please note that we can only estimate your property tax based on median Some of councils added provisions include: On November 7, the County Councils Budget and Fiscal Management Committeewhich is all nine members of the Council during the review and deliberations on the County's 2023-2024 biennial budgetreceived the Budget Leadership Teams (BLT) Budget striking amendment. It seems unlikely that your property was assessed at 40% higher for a single year.

You will be provided with a property tax appeal form, on which you will provide the tax assessor's current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate. Counties with the highest scores Property tax income is almost always used for local projects and services, and does not go to the federal or state budget. Please note that we can only estimate your property tax based on median Some of councils added provisions include: On November 7, the County Councils Budget and Fiscal Management Committeewhich is all nine members of the Council during the review and deliberations on the County's 2023-2024 biennial budgetreceived the Budget Leadership Teams (BLT) Budget striking amendment. It seems unlikely that your property was assessed at 40% higher for a single year. Both proposals are still in committee. King And Queen County collects, on average, 0.46% of a property's assessed fair market value as property tax. In most counties, you must specifically submit a homestead exemption application to your county tax assessor in order to enjoy the tax reduction and other benefits available.

WebThe majority of property tax revenue nearly 53 percent will pay for schools. King County has one of the highest median property taxes in the United States, and is ranked 102nd of the 3143 counties in order of median property taxes. WebKing County Treasury Operations, King Street Center, 201 S. Jackson St, Suite 710, Seattle, WA 98104.

WebThe majority of property tax revenue nearly 53 percent will pay for schools. King County has one of the highest median property taxes in the United States, and is ranked 102nd of the 3143 counties in order of median property taxes. WebKing County Treasury Operations, King Street Center, 201 S. Jackson St, Suite 710, Seattle, WA 98104. Sign up now to get our FREE breaking news coverage delivered right to your inbox. In our calculator, we take your home value and multiply that by your county's effective property tax rate.

If your appeal is denied, you still have the option to re-appeal the decision.

If your appeal is denied, you still have the option to re-appeal the decision.  SmartAssets interactive map highlights the places across the country where property tax dollars are being WebKing Street Center 201 South Jackson Street #710 Seattle, WA 98104 Hours: Monday-Friday, 8:30 a.m. to 4:30 p.m. PST TTY Relay: 711 Customer Service Property Tax Information of levy codes Hi-Lo % Diff: Jurisdiction Lowest rate: Highest rate No. We bought our house in 2013 and it was a real stretch and sacrifice then. I just want to be able to afford to continue to live in the home that I worked hard for. In most counties, you must specifically submit a homestead exemption application to your county tax assessor in order to enjoy the tax reduction and other benefits available. I freaked out reading comments so checked mine. The state median is $485,700, and the nation's median is almost half less than King County at $281,400. King And Queen County is ranked 1852nd of the 3143 counties for property taxes as a percentage of median income. Application details What that means is that if everyone's property value increases by 40%, everyone's tax will increase by 1%. Effects statement Sticker shock, Sure glad the voters keep saying YES on these ballots.

SmartAssets interactive map highlights the places across the country where property tax dollars are being WebKing Street Center 201 South Jackson Street #710 Seattle, WA 98104 Hours: Monday-Friday, 8:30 a.m. to 4:30 p.m. PST TTY Relay: 711 Customer Service Property Tax Information of levy codes Hi-Lo % Diff: Jurisdiction Lowest rate: Highest rate No. We bought our house in 2013 and it was a real stretch and sacrifice then. I just want to be able to afford to continue to live in the home that I worked hard for. In most counties, you must specifically submit a homestead exemption application to your county tax assessor in order to enjoy the tax reduction and other benefits available. I freaked out reading comments so checked mine. The state median is $485,700, and the nation's median is almost half less than King County at $281,400. King And Queen County is ranked 1852nd of the 3143 counties for property taxes as a percentage of median income. Application details What that means is that if everyone's property value increases by 40%, everyone's tax will increase by 1%. Effects statement Sticker shock, Sure glad the voters keep saying YES on these ballots.  You will be provided with a property tax appeal form, on which you will provide the tax assessor's current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate. To appeal the King And Queen County property tax, you must contact the King And Queen County Tax Assessor's Office.

You will be provided with a property tax appeal form, on which you will provide the tax assessor's current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate. To appeal the King And Queen County property tax, you must contact the King And Queen County Tax Assessor's Office.