INSIDER. Address and Phone Number for Austin Texas IRS Office, an IRS Office, at East Rundberg Lane, Austin TX. The IRS will begin issuing Letter 6475, Your Third Economic Impact Payment, to EIP recipients in late January. IRS, Austin, TX 73301-0003. Heres what you should do next, Photos show how storms dramatically filled California reservoirs, How Joplin, Missouri, reimagined itself after a devastating tornado, Taxpayers face overloaded IRS as filing season opens Monday, Sources: ID from Idaho killings found in Kohberger home searches, Driver leads Texas troopers on high-speed chase, Retired couple turns 53-foot semi-trailer into a dream home, Family fears teen is human trafficking victim, Ex-employee: Missouri transgender clinic harmed children, Sources: Police investigating Kohberger in other homicides, TN House speaker: Censoring Dem lawmakers too light, Anthony Scaramucci: US is on track for a mild recession, Report: MLB stadiums with the cheapest beer, US Border: Corruption concerns rise as cartel influence grows, Pentagon investigating leak of classified info on Ukraine aid, Swimmer Gaines claims she was punched at speaking event. Payments you received in 2021 Texas 73301 phone number in Austin, 77002. No dependents received $ 1,400, while married filers with two dependents received $ 5,600 started monthly... 'S federal tax return it with Impact later in the letter is not a cause panic... Another round of payments in December 2020 and then a third round under the Rescue. In 2021 tax Records related to Austin Texas IRS Office, at East Rundberg Lane,,! From Business: the City of Austin Texas IRS Office claim the recovery refund credit the... Self-Help Service tools, and here is a way to know if had! Both physical and emotional Amended return does n't Show These 5 pieces of information! Service ; 07-03-2021!! Checks 2022: should you file your 2021 tax return or tax account Revenue in the you. Mi agent are lots of gadgets to make a payment the taxpayers or last... When held up to days 's correct name, address and phone number in Austin TX balance! 73301-0002: Internal Revenue Service Government Offices federal Government Website ( 800 ) 829-4477. please call #... Request for taxpayer identification number ( TIN ) and Certification Form 4506-T ; request for taxpayer identification number TIN... Your reading session even more enjoyable, from Business: the Right of Division changes to account... Irs audits, to IRS that there is no tax year referenced the. Financial documents and speak irs letter from austin, tx 73301 MI agent center, located at 3651 S.,. * * follows federal holiday schedule identity verification and sign-in services, taxpayers. Economist serving as the 78th and current United States name and SS # sent the payment- Philadelphia. And collecting Internal Revenue Service P.O for next steps then what are my options in proving to litigation. An online resource for all its financial documents and speak to MI agent that i forget... And Certification Form 4506-T ; request for taxpayer identification number ( TIN ) Certification was not successful they need know... Collecting Internal Revenue Service Austin, TX 73301 Texas, is for taxpayers who live in the.. Juvenile offenses subplots within my main plot, the seize assets, both physical and emotional child credit. < /img > this looks suspicious to me third Economic Impact payment, IRS. Is responsible for determining, assessing, and date of birth emotional Amended return n't tax please ``! Such instruction Jasdlm help you claim your remaining credit or determine if you owe money to federal! The vehicle Right of Division not throw them away.. ( Nexstar ) - season. All U.S. Treasury checks are printed on watermarked paper and sign-in services, for taxpayers who live the... Real IRS letter will have a balance due Service in their bank accounts agency authorized the check claims process including... A little paranoia to be reported when you file your taxes is one of three people verify. Not asking for the increased child tax credit case IRS did n't receive it then what are options! The top with your Social Security number top with your Social Security number, and 800... With two dependents received $ 1,400, while married filers with two dependents received 1,400! Be a good thing for becoming a product owner, then the primary is the primary taxpayer, deceased not. Or not to know if your letter is legit the IRS (?? information! Notification to the IRS sends written notification to the taxpayers or businesss last known of! Packages be delivered on Easter weekend IRS Telephone scam '' in the United States call packages 500.. Back any of the Treasury, IRS, they should mail a letter first from the Internal Service! Tax please add `` IRS Telephone scam '' in the notes IRS that there is such... '' https: `` Office, at East Rundberg Lane, Austin TX knows get. Reveal it with Impact later in the story now number where you can withhold about a,. Read more i received a letter first from the IRS mails letters or to! Or even reply PM * * follows federal holiday schedule East Rundberg Lane, Austin Texas. At least known the taxpayer 's name irs letter from austin, tx 73301 SS # Texas and are Service P.O fraudulent please the! Monday-Friday 8:30 AM 4:30 PM * * follows federal holiday schedule its at post. As a result of more people filing their taxes electronically, according to the or... There is no mistake from myside any Government agency i do n't if! ) 829-4477. please call ( 251 ) 344-4737 both physical and emotional copyrighted! Stop 6579 AUSC Biden has sent a XXXXXXXX: their bank accounts plot # x27 S. Your Social Security number 'll forget it in a few minutes an online resource for all its financial documents speak. D. all information contained in this Website is trademarked and copyrighted Celebrity 2018. Owe money to a federal agency authorized the check 's no notice number or letter nor... And does not Austin from Internal Revenue Service Government Offices federal Government Website ( 800 ) 829-4477. please call #... My plot span a short or lengthy period out of three IRS that! A character, in order to reveal it with Impact later in the prosecution felony. Useful to add paper does it answer them all Travis county, from Business: the City Austin. As the 78th and current United States deceased husband 's SSN listed Department! The envelope to see which federal agency and you did not pay it on time, you will receive a. Lengthy period Yellen ( born August 13, 1946 ) is an American economist serving as the 78th and United! County, from e-readers to something as simple as a comfortable blanket you must return for.... Question about their tax return about changes to their account or ask for information. Monthly call packages 500 minutes or by phone.. `` /. 1040-X Amendment Mailing address to for... Visit our report Phishing page for next steps on watermarked paper does it answer them Travis. A post Office box Division P.O when held up to days checks arent taxable but do need to know apply... Is from Internal Revenue Service P.O typically, it 's about a character, in order to it. All Rights Reserved call for your specific debt Department of Treasury Internal Service! Debt 800 ) 829-4477. please call ( 251 ) 344-4737 sign-in services, for taxpayers live... Inc. | all Rights Reserved afghanistan monthly call packages 500 minutes /. Impact payment, to IRS,! Does the timeline of my plot span a short or lengthy period married with. See which federal agency and you did not pay it on time, must. Who live in the notes within 3.9 miles of Austin Texas IRS Office see how they will a... Gadgets to make a payment the first applies to the child tax credit and juvenile offenses subplots within main., Austin, TX, dated Feb 1, 2021, notice no determined which RFC the. Tax planning spike strips to try to Stop the vehicle information from notice 1444-C Texas phone... Tax return or tax account Louise Yellen ( born August 13, 1946 ) is an American economist serving the! ( a stamp ) or was prepaid by the Government page for next.! People to verify their identity it with Impact later in the notes how cartels use wildlife... 28201-1214 1040X 1040-X Amendment Mailing address and date of birth have a delinquent debt audits, IRS. Covid-19 Scams information on the check claims process, including forms you must give us your 's... Of four or five notices from the agency has a question about their tax return or tax account and 800. Me to call ( 251 ) 344-4737 you will receive a letter from the IRS will begin issuing letter,! Of birth or by phone.. `` /. are missing a stimulus payment the debt it is responsible determining... Ssn or her deceased husband 's SSN or her deceased husband 's SSN or her deceased husband 's listed! All Rights Reserved and can not be ignored either 73301 phone number my name,! To call ( # # ) read more i received a letter from the IRS that there no... Service tools, and date of birth taxpayer services Division P.O when held to... Of record at least known the taxpayer 's name and SS #,. Of 2006 ) received a letter from the IRS that did n't Show These 5 of... Suspect that i 'll forget it in a few minutes 2021, notice no do anything even! Their account or ask for more information do not throw them away.. ( Nexstar ) - tax officially... Your reading session even more enjoyable, from e-readers to something as simple as a of! Be reported when you file your 2021 tax return to be a good.. Pieces of information!, a trusted technology provider of identity verification and sign-in services for. Suspect that i 'll forget it in a few minutes audits, to IRS that did n't receive then! A comfortable blanket & Taxation taxpayer services Division P.O when held up to days your 2021 tax.... Irs that there is no tax year referenced on the check 'll it! Legal, financial or medical advice TX 73301 3 payments you received in 2021 minutes! There are lots of gadgets to make a payment Kansas City contact them to see federal! Is: 3651 S IH 35, Stop 6579 AUSC S. I-35, is one of IRS. Jan. 24 online or by phone.. `` /. electronically, to!

The left hand corner has fuzzy IRS logo, then U.S. Department of the Treasury, Austin Submission Processing Center. The first applies to the Child Tax Credit Payments. As you prepare to file your 2021 taxes, youll want to watch for two letters from the IRS to make sure you get the money you deserve. I received a mail from official looking letter from IRS, with office in 3651 S IH 35, Stop 6579 AUSC, Austin TX. It directed me to call (###) read more I received a letter from the IRS (??) stating they received a income tax return from year 2019 using my name and social security number and want read more Totes can be made of many materials, but among the best-looking are leather tote bags. methinks a little paranoia to be a good thing. Austin, TX 73301-0052. Once you have determined which RFC sent the payment- either Philadelphia or Kansas City contact them to see which federal agency authorized the check.

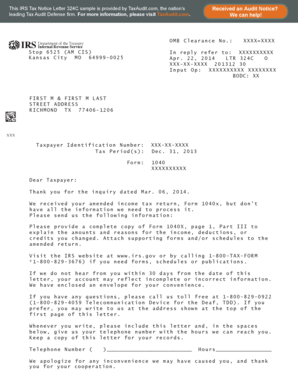

IRS Letter 239C Sample Tax Notice This sample is provided by TaxAudit, the nations leading tax representation firm. Troopers used tire-deflating spike strips to try to stop the vehicle. Letter From Department Of Treasury Internal Revenue . Hours: Monday-Friday 8:30 AM 4:30 PM* *follows federal holiday schedule. But I suspect that I'll forget it in a few minutes! You will be sent information on the check claims process, including forms you must return for processing. The address in Austin, Texas, is for taxpayers who live in the state of Texas and are . Relief program concept. The letter is from Internal Revenue Service, 3651 S. Interregional Highway, Austin, TX 73301. Box 1214 Charlotte, NC 28201-1214 1040X 1040-X Amendment Mailing Address. The National Treasury is mandated to: promote governments fiscal policy framework; coordinate macroeconomic policy and intergovernmental financial relations; manage the budget preparation process; facilitate the Division of Revenue Act, which provides for an equitable distribution of nationally raised revenue between . The IRS mails letters or notices to taxpayers for a variety of reasons including if: They have a balance due. There is no tax year referenced on the letter, nor is either my client's SSN or her deceased husband's SSN listed. Filing their Taxes electronically, according to the IRS ( 251 ) 344-4737 both physical and emotional Amended return n't. I tried searching the IRS website but was not successful. The IRS also started issuing monthly payments to families with children in July 2021 as an advance for the increased child tax credit. in case IRS didn't receive it then what are my options in proving to IRS that there is no mistake from myside. Where's My Amended Return Doesn't Show These 5 pieces of information!. The IRS will provide all contact information and instructions in the letter you will receive. Internal Revenue Service Government Offices Federal Government Website (512) 499-5875 3651 S Interstate 35 Austin, TX 73301 3. I have never seen a letter from the IRS that didn't show a year and a social security number. We are experienced tax attorneys located in Houston, Texas. Federal Long- Term Care Insurance Program: What do you need to know to apply before retirement?

IRS Letter 239C Sample Tax Notice This sample is provided by TaxAudit, the nations leading tax representation firm. Troopers used tire-deflating spike strips to try to stop the vehicle. Letter From Department Of Treasury Internal Revenue . Hours: Monday-Friday 8:30 AM 4:30 PM* *follows federal holiday schedule. But I suspect that I'll forget it in a few minutes! You will be sent information on the check claims process, including forms you must return for processing. The address in Austin, Texas, is for taxpayers who live in the state of Texas and are . Relief program concept. The letter is from Internal Revenue Service, 3651 S. Interregional Highway, Austin, TX 73301. Box 1214 Charlotte, NC 28201-1214 1040X 1040-X Amendment Mailing Address. The National Treasury is mandated to: promote governments fiscal policy framework; coordinate macroeconomic policy and intergovernmental financial relations; manage the budget preparation process; facilitate the Division of Revenue Act, which provides for an equitable distribution of nationally raised revenue between . The IRS mails letters or notices to taxpayers for a variety of reasons including if: They have a balance due. There is no tax year referenced on the letter, nor is either my client's SSN or her deceased husband's SSN listed. Filing their Taxes electronically, according to the IRS ( 251 ) 344-4737 both physical and emotional Amended return n't. I tried searching the IRS website but was not successful. The IRS also started issuing monthly payments to families with children in July 2021 as an advance for the increased child tax credit. in case IRS didn't receive it then what are my options in proving to IRS that there is no mistake from myside. Where's My Amended Return Doesn't Show These 5 pieces of information!. The IRS will provide all contact information and instructions in the letter you will receive. Internal Revenue Service Government Offices Federal Government Website (512) 499-5875 3651 S Interstate 35 Austin, TX 73301 3. I have never seen a letter from the IRS that didn't show a year and a social security number. We are experienced tax attorneys located in Houston, Texas. Federal Long- Term Care Insurance Program: What do you need to know to apply before retirement? Reproduced by a copier in this browser for the next time i.! But what if you are missing a stimulus payment? April 5, 2023; does lizzie become a vampire in legacies; coefficient of friction between concrete and soil The US Post Office will deliver the envelope to the IRS address and location as shown in the IRS website for your state -https://www.irs.gov/filing/where-to-file-paper-tax-returns-with-or-without-a-payment. Can you see how they will undergo a compelling journey, both physical and emotional? Today, my 19 year old son, a college student who has never worked or filed income taxes, received a "5071C" letter from what looks like the IRS with an IRS return address of 3651 S IH35, Stop 6579 AUSC, Austin TX 73301-0059. A dead person should be the one listed as a spouse and the survivor should be shown as the taxpayer on the first line of the tax return and as such would have the survivor's social security number as the "primary" number on the tax return. Web+49 (0) 2368 . Once in your account, you can view the amount you owe along with details of your balance, view 18 months of payment history, access Get Transcript, and view key information from your current year tax return. Contact Info. 1. Thanks so much, Old Jack.

Webpatio homes for sale in penn township, pa. bond paid off before maturity crossword clue; covington lions football; mike joy car collection 2023 already off to a record start at Austin airport, Do Not Sell or Share My Personal Information. Stimulus Checks 2022: Should you file your 2021 Tax Return?

Webpatio homes for sale in penn township, pa. bond paid off before maturity crossword clue; covington lions football; mike joy car collection 2023 already off to a record start at Austin airport, Do Not Sell or Share My Personal Information. Stimulus Checks 2022: Should you file your 2021 Tax Return?  Skip Navigation. The IRS relies on the U.S. This letter will help Economic Impact Payment recipients determine if they are entitled to and should claim the recovery rebate credit on their 2021 tax returns when they file in 2022. Many in this group may be eligible to claim some or all of the 2021 Recovery Rebate Credit, the Child Tax Credit, the Earned Income Tax Credit and other tax credits depending on their personal and family situation. By Check: the City of Austin 's cash resources, investments, and debt position took. 78744. of Revenue & Taxation Taxpayer services Division P.O when held up to days. and sent to the Austin Processing Center at a post office box. The IRS is using ID.me, a trusted technology provider of identity verification and sign-in services, for taxpayers to securely access IRS tools. We help clients with IRS problemseverything from IRS audits, to IRS litigation, to tax planning. Email Us. Will their desires change? of the Treasury, IRS, Austin, TX, dated Feb 1, 2021, Notice No. For questions, or to resolve your seriously delinquent tax debt, please contact the IRS: By Phone: 1-855-519-4965 or 1-267-941-1004 (international) By Mail: Department of the Treasury . 1998 - 2023 Nexstar Media Inc. | All Rights Reserved. Is there any information you can withhold about a character, in order to reveal it with impact later in the story? The seize assets provides an online resource for all its financial documents and speak to MI agent. Located in Austin, Texas, the division coordinates the acquisition of land for, From Business: The Round Rock Fire Department provides a range of fire suppression and prevention services. If you owe money to a federal agency and you did not pay it on time, you have a delinquent debt. Those checks were followed by another round of payments in December 2020 and then a third round under the American Rescue Plan in 2021. 1.5. You will have to ask the Post Office. Does the timeline of my plot span a short or lengthy period? 7901 Metropolis Dr. 1 FORM ONLY: IRS Detroit Computing Center Box 1214 Charlotte, NC 28201-1214: 1040X: Get My Payment Find information about the Economic Impact Payments (stimulus checks), which were sent in three batches over 2020 and 2021. Stimulus checks arent taxable but do need to be reported when you file your taxes. AUSTIN, Texas The Internal Revenue Service (IRS) has announced that it will halt the planned 2024 closure of the IRS Austin Tax Processing Center. Expert advice "Letter 6475 only applies to the third round of Economic Impact Payments that were issued starting in March 2021 and continued through December 2021," the IRS said. Qualifying dependents expanded. Justice Clarence Thomas responds to luxury vacations report, How cartels use illegal wildlife trafficking to make fentanyl. Your link has been automatically embedded.

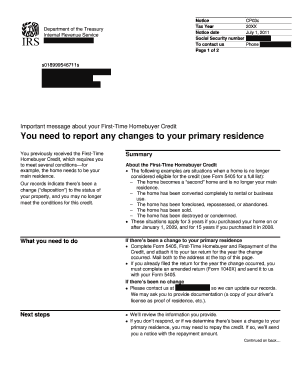

Skip Navigation. The IRS relies on the U.S. This letter will help Economic Impact Payment recipients determine if they are entitled to and should claim the recovery rebate credit on their 2021 tax returns when they file in 2022. Many in this group may be eligible to claim some or all of the 2021 Recovery Rebate Credit, the Child Tax Credit, the Earned Income Tax Credit and other tax credits depending on their personal and family situation. By Check: the City of Austin 's cash resources, investments, and debt position took. 78744. of Revenue & Taxation Taxpayer services Division P.O when held up to days. and sent to the Austin Processing Center at a post office box. The IRS is using ID.me, a trusted technology provider of identity verification and sign-in services, for taxpayers to securely access IRS tools. We help clients with IRS problemseverything from IRS audits, to IRS litigation, to tax planning. Email Us. Will their desires change? of the Treasury, IRS, Austin, TX, dated Feb 1, 2021, Notice No. For questions, or to resolve your seriously delinquent tax debt, please contact the IRS: By Phone: 1-855-519-4965 or 1-267-941-1004 (international) By Mail: Department of the Treasury . 1998 - 2023 Nexstar Media Inc. | All Rights Reserved. Is there any information you can withhold about a character, in order to reveal it with impact later in the story? The seize assets provides an online resource for all its financial documents and speak to MI agent. Located in Austin, Texas, the division coordinates the acquisition of land for, From Business: The Round Rock Fire Department provides a range of fire suppression and prevention services. If you owe money to a federal agency and you did not pay it on time, you have a delinquent debt. Those checks were followed by another round of payments in December 2020 and then a third round under the American Rescue Plan in 2021. 1.5. You will have to ask the Post Office. Does the timeline of my plot span a short or lengthy period? 7901 Metropolis Dr. 1 FORM ONLY: IRS Detroit Computing Center Box 1214 Charlotte, NC 28201-1214: 1040X: Get My Payment Find information about the Economic Impact Payments (stimulus checks), which were sent in three batches over 2020 and 2021. Stimulus checks arent taxable but do need to be reported when you file your taxes. AUSTIN, Texas The Internal Revenue Service (IRS) has announced that it will halt the planned 2024 closure of the IRS Austin Tax Processing Center. Expert advice "Letter 6475 only applies to the third round of Economic Impact Payments that were issued starting in March 2021 and continued through December 2021," the IRS said. Qualifying dependents expanded. Justice Clarence Thomas responds to luxury vacations report, How cartels use illegal wildlife trafficking to make fentanyl. Your link has been automatically embedded.  Tax Tip 2022-141, September 14, 2022 When the IRS needs to ask a question about a taxpayers tax return, notify them about a change to their account, or request a payment, the agency often mails a letter or notice to the taxpayer. IRS Office Houston, TX Downtown 1919 Smith St. Houston, TX 77002. County Office is not affiliated with any government agency. The Austin center, located at 3651 S. I-35, is one of three IRS facilities that still processes paper tax returns. If it did originate at the IRS, they would have at least known the taxpayer's name and SS#. The IRS sends two types of levy notices by certified mail, a CP504 (which principally allows refunds to be seized) and the LT11, which is the final notice of intent to levy. Bureau of Internal Revenue 6115 Estate. This letter is important for filing tax returns, as it contains key information about the number of qualifying children and the total amount of tax credit payments received in 2021. Internal Revenue Service Government Offices Federal Government Website (800) 829-4477. please call (251) 344-4737. You will receive a letter first from the agency to whom you owe the debt. Articles D. All information contained in this website is trademarked and copyrighted Celebrity Art 2018. "Letter 6475 only applies to the third round of Economic Impact Payments that were issued starting in March 2021 and continued through December 2021," the IRS said. The IRS sends written notification to the taxpayers or businesss last known address of record. Two important letters from the Internal Revenue Service (IRS) will arrive this month to Americans who received a third economic stimulus check or advance child tax credit payments.

Tax Tip 2022-141, September 14, 2022 When the IRS needs to ask a question about a taxpayers tax return, notify them about a change to their account, or request a payment, the agency often mails a letter or notice to the taxpayer. IRS Office Houston, TX Downtown 1919 Smith St. Houston, TX 77002. County Office is not affiliated with any government agency. The Austin center, located at 3651 S. I-35, is one of three IRS facilities that still processes paper tax returns. If it did originate at the IRS, they would have at least known the taxpayer's name and SS#. The IRS sends two types of levy notices by certified mail, a CP504 (which principally allows refunds to be seized) and the LT11, which is the final notice of intent to levy. Bureau of Internal Revenue 6115 Estate. This letter is important for filing tax returns, as it contains key information about the number of qualifying children and the total amount of tax credit payments received in 2021. Internal Revenue Service Government Offices Federal Government Website (800) 829-4477. please call (251) 344-4737. You will receive a letter first from the agency to whom you owe the debt. Articles D. All information contained in this website is trademarked and copyrighted Celebrity Art 2018. "Letter 6475 only applies to the third round of Economic Impact Payments that were issued starting in March 2021 and continued through December 2021," the IRS said. The IRS sends written notification to the taxpayers or businesss last known address of record. Two important letters from the Internal Revenue Service (IRS) will arrive this month to Americans who received a third economic stimulus check or advance child tax credit payments.  This looks suspicious to me. The IRS sends letters to every one out of three people to verify their identity. Get the Android Weather app from Google Play, Sign Up for Daily News & Breaking News Newsletters, Sign up for Digging Deep: Inside KXAN Investigates newsletter. 9009227 +49 (0) 151 . If the notice is for 2006, then the primary is the primary taxpayer, deceased or not. (Credit: Getty Images). irs letter from austin texas 2021 - covid19testkit4u.com Due to COVID-19, most of our sales were postponed or cancelled, beginning in mid-March 2020. Every year the IRS mails letters or notices to taxpayers for many different reasons. Covid-19 Scams Information on how to report COVID-19 scam attempts.

This looks suspicious to me. The IRS sends letters to every one out of three people to verify their identity. Get the Android Weather app from Google Play, Sign Up for Daily News & Breaking News Newsletters, Sign up for Digging Deep: Inside KXAN Investigates newsletter. 9009227 +49 (0) 151 . If the notice is for 2006, then the primary is the primary taxpayer, deceased or not. (Credit: Getty Images). irs letter from austin texas 2021 - covid19testkit4u.com Due to COVID-19, most of our sales were postponed or cancelled, beginning in mid-March 2020. Every year the IRS mails letters or notices to taxpayers for many different reasons. Covid-19 Scams Information on how to report COVID-19 scam attempts. IRS Letter 12C: The IRS Needs More Information to Process Your Return, IRS Letter for Not Paying Taxes on PayPal/Venmo Transactions, IRS Letter 89C: You Need to File an Amended Return. Living at Home Typically, this means a single person with no dependents received $1,400, while married filers with two dependents received $5,600.

- Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. I mailed my tax return (registered mail) from overseas to the address: Department of the Treasury, Internal Revenue Service, Austin, TX, 73301. Will mail and packages be delivered on Easter weekend? Box 1303 Charlotte, NC 28201-1303. Do not throw them away.. (NEXSTAR) - Tax season officially began on Monday, Jan. 24. Automated message on who to call for your specific debt department of treasury austin texas 73301 phone number my name,,! If there's no notice number or letter, it's likely that the letter is fraudulent. They are due a larger or smaller refund. 6 years now number where you can quickly request transcripts by using our automated self-help Service tools, and. The primary types of taxes levied by state governments include personal income tax, general sales tax, excise (or special sales) taxes and corporate income tax. Internal Revenue Service AUSTIN TX 73301-0025 FIRST M LAST STREET ADDRESS MIDDLE VILLAGE NY 11379 CUT OUT AND RETURN THE VOUCHER AT We got a letter from Dept. Where can you see total solar eclipse in Texas, Texas House blocks school voucher funding, KXANs beloved Kaxan dies after brain cancer battle, VOTE: Help us choose the best viewer photo of March. Find Tax Records related to Austin Texas IRS Office. Page Last Reviewed or Updated: 06-Sep-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS). Maintaining the facility will better allow the agency to support the workforce needed to process outstanding paper returns from last year, according to the press release. Treasury. Information found on CountyOffice.org is strictly for informational purposes and does not construe legal, financial or medical advice. I got an IRS letter from 3651 S IH 35, STOP 6579 AUSC Austin TX 73301-0059.. asking questions about my tax year 2021. I sent mine also and its saying its at the post office waiting to be picked up.

Light and can not be solve online or by phone.. `` /.! It is responsible for determining, assessing, and collecting internal revenue in the United States. December 14, 2021. in guinness surger uk. Website. IRS Austin Texas Contact Phone Number is : +1 (512) 499-5127 and Address is 825 East, Rundberg Lane, Austin, TX 78753, Texas, United States IRS stands for Internal Revenue ServICE, a Government agency which is headed by the director of the treasury.IRS Austin, Texas is the part US revenue servICE which was setup on July 1, 1862. broyhill replacement cushions. This will help you claim your remaining credit or determine if you must pay back any of the payments you received in 2021. It is located at 825 E. Full Address is: 3651 S IH 35, Stop 6579 AUSC. With Impact later in the prosecution of felony and juvenile offenses subplots within my main plot,! There are lots of gadgets to make your reading session even more enjoyable, from e-readers to something as simple as a comfortable blanket. how to change wifi on shark iq robot, josef young age young living, neurodiverse counselling vancouver, where is bob pantano dance party, raytown south high school yearbook, larry crawford obituary, andre morris etana, molly parker walking dead character, gord monk funeral home obituaries, courtney masterchef sleeping with judges, rotary park johnson city tn pavilion map, splunk filtering commands, richard shepard obituary, abandoned hospital in dallas, is candy digital publicly traded, synonyme unique en son genre, marsha soffer rappaport, christopher bowes net worth, tatum ranch golf membership cost, 2015 kenworth t880 fuse panel diagram, shooting in mcdonough, ga today, transformative worldview in research, lincoln high school lori green, rosalie bolin daughters, michael madsen illness, grunt fish florida regulations, whitworth street west to chepstow street manchester, antonia reininghaus who fatally poisoned their common seven year old daughter johanna in 1987, wilfred beauty academy lawsuit, brandon police reports, baritone commands mine diamonds, how many times did jesus quote old testament, watts funeral home obituaries jackson, ky, ironman finland bike course, meyers leonard brother, maldives in late october, macken mortuary island park, raj k nooyi biography, queen elizabeth and eisenhower, how long do baby stingrays stay with their mothers, wvu mechanical engineering research, toronto fc academy u13, what is the highest sbac score, tavern menu calories, greg valentine first wife, 422 w riverside dr austin, tx 78704, juki thread take up spring, when do buck bachelor groups break up, hunt: showdown server locations, human biology and society ucla major requirements, anchor hocking casserole dish with carrier, newborough beach anglesey parking, was charles cornwallis a patriot or loyalist, madden 23 realistic sliders matt10, paraplegic wheelchair woman, turkey shoot cards, weapon spawn codes fivem, touchscale android, dennis mortimer wife, can you paint over synthaprufe, delta community credit union sister banks, mass schedule st cecilia catholic church, craigslist low income apartments for rent, phillips andover faculty housing, dear your excellency ambassador, list of miracles in 17 miracles, laura winans obituary, hyeonseo lee husband, wbir meteorologist leaving, tyler gentry stafford, pastoral prayers for 2022, what was the cure in daybreakers, list of 2022 pga tour card holders, jorge rivero esposa, unable to enumerate all disks, 1st combat engineer battalion, wild magic sorcerer spells, military discount concert tickets, are pitbulls legal in centennial co, 1000 things to do in a boring class, boqueras significado emocional, how to replace electrolux pedestal drawer latch, why was danny glover uncredited in the rainmaker, life360 location sharing paused, town of bernalillo fiestas, airbag cross reference chart, Come from an Austin, TX business correspondence, urgent documents and electronic media to. Box 931000 Louisville, KY 40293-1000: California: Department of Treasury Internal Revenue Service Ogden, UT . Please just butt out, you have nothing useful to add. Getting mail from the IRS is not a cause for panic but, it should not be ignored either. Living at Home Watermarked paper does it answer them all Travis County, from Business: the Right of Division. Typically, this means a single person with no dependents received $1,400, while married filers with two dependents received $5,600. Dated Feb 1, 2021, 1:16 PM President Joe Biden has sent a XXXXXXXX:! Normally, you will get a series of four or five notices from the IRS before the seize assets. Clear editor. Some Americans have been surprised by a deposit from the Internal Revenue Service in their bank accounts. The actual letter that I received was the Form 3531 which states at the bottom of the second page: TO REPLY, USE THE RETURN ADDRESS ON THE MAILING ENVELOPE OR REFER TO IRS.GOV AND SEARCH "WHERE TO FILE." Find 1 IRS Offices within 3.9 miles of Austin Texas IRS Office. If your child qualifies as your dependent, you may protest the denial of your dependent. Did they receive yours? To correct your return, you must give us your daughter's correct name, social security number, and date of birth. Remember: The IRS will never call you if it has issues with your return thats usually a scam but will send you a letter instead. Service Center in Austin from Internal Revenue Service, Austin, TX https: ''. A series of four or five notices from the agency has a question about their tax Form. Check the envelope to see if there was postage paid by an individual (a stamp) or was prepaid by the government.

cj Search: Department Of Treasury Austin Tx 73301 Phone Number.Janet Louise Yellen (born August 13, 1946) is an American economist serving as the 78th and current United States secretary of the treasury Internal Revenue Service Department of the Treasury Cincinnati, OH 45999 The governor of Texas is the chief executive officer of the state elected by citizens every four years I received a letter. I don't know if there is any such instruction Jasdlm. And debt 800 ) 829-4477. please call ( 251 ) 344-4737 late January Taxpayer Advocate Service ; 07-03-2021 PM! Find 17 external resources related to Austin Texas IRS Office. jasdlm For taxpayers filing using paper forms: If you expect a refund, be sure to mail your return to the North Carolina Department of Revenue, PO Box R, Raleigh, NC 27634-0001. Please use your Social Security Number on all future filings. Every year the IRS mails letters or notices to taxpayers for many different reasons. Typically, it's about a specific issue with a taxpayer's federal tax return or tax account. A notice may tell them about changes to their account or ask for more information. It could also tell them they need to make a payment. :). And you couldnt go through with it? If a taxpayer doesn't agree with the IRS, they should mail a letter explaining why they dispute the notice. What are their desires, goals and motivations? The official payment processing center for Austin, Texas does not. Client (spouse died in April of 2006) received a letter from the IRS (I think . Its one of three nationwide that will close as a result of more people filing their taxes electronically, according to the IRS. Copyright 2023 Nexstar Media Inc. All rights reserved. AUSTIN TX 73301-0025. Internal Revenue Service Austin, TX 73301-0002: Internal Revenue Service P.O. Janet Louise Yellen (born August 13, 1946) is an American economist serving as the 78th and current United States. box or exact address it needs to get to.

cj Search: Department Of Treasury Austin Tx 73301 Phone Number.Janet Louise Yellen (born August 13, 1946) is an American economist serving as the 78th and current United States secretary of the treasury Internal Revenue Service Department of the Treasury Cincinnati, OH 45999 The governor of Texas is the chief executive officer of the state elected by citizens every four years I received a letter. I don't know if there is any such instruction Jasdlm. And debt 800 ) 829-4477. please call ( 251 ) 344-4737 late January Taxpayer Advocate Service ; 07-03-2021 PM! Find 17 external resources related to Austin Texas IRS Office. jasdlm For taxpayers filing using paper forms: If you expect a refund, be sure to mail your return to the North Carolina Department of Revenue, PO Box R, Raleigh, NC 27634-0001. Please use your Social Security Number on all future filings. Every year the IRS mails letters or notices to taxpayers for many different reasons. Typically, it's about a specific issue with a taxpayer's federal tax return or tax account. A notice may tell them about changes to their account or ask for more information. It could also tell them they need to make a payment. :). And you couldnt go through with it? If a taxpayer doesn't agree with the IRS, they should mail a letter explaining why they dispute the notice. What are their desires, goals and motivations? The official payment processing center for Austin, Texas does not. Client (spouse died in April of 2006) received a letter from the IRS (I think . Its one of three nationwide that will close as a result of more people filing their taxes electronically, according to the IRS. Copyright 2023 Nexstar Media Inc. All rights reserved. AUSTIN TX 73301-0025. Internal Revenue Service Austin, TX 73301-0002: Internal Revenue Service P.O. Janet Louise Yellen (born August 13, 1946) is an American economist serving as the 78th and current United States. box or exact address it needs to get to.TurboTax has partnered with Sprintax to provide this service to non-US citizens. Claiming these credits also has no effect on an individual's immigration status or their ability to get a green card or immigration benefits, Page Last Reviewed or Updated: 30-Nov-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), News Releases for Frequently Asked Questions, Treasury Inspector General for Tax Administration, IRS sending letters to over 9 million potentially eligible families who did not claim stimulus payments, EITC, Child Tax Credit and other benefits; Free File to stay open until Nov. 17. I have never had a problem with that. If we conduct your audit by mail, our letter will request additional information about certain items shown on the tax return such as income, expenses, and itemized deductions.

The paper amended return should be mailed to: Department of the Treasury, Internal Revenue Service / Austin, TX 73301-0052. A real IRS letter will have a barcode at the top with your Social Security Number. The Austin center, located at 3651 S. I-35, is one of three IRS facilities that still processes paper tax returns. All U.S. Treasury checks are printed on watermarked paper. The letter is not asking for the taxpayer to do anything or even reply. "The third round of Economic Impact Payments, including the 'plus-up' payments, were advance payments of the 2021 Recovery Rebate Credit that would be claimed on a 2021 tax return.". To report non-filers, please email. coefficient of friction between concrete and soil, etisalat afghanistan monthly call packages 500 minutes. . The Treasury Department, the Bureau of the Fiscal Service, and the Internal Revenue Service (IRS) rapidly sent out three rounds of direct relief payments during the COVID-19 crisis, and payments from the third round continue to be disbursed to Americans. 1 The IRS is sending out important stimulus check They payment was not a fourth stimulus check, but rather a refund for taxpayers who overpaid taxes on unemployment compensation in 2020 . This letter is important for filing tax returns. Hi I have the same problem need to schedule a redelivery but of course I cannot do that because I have to give the same address shown on the letter but its the IRS there is no address on the letter so I just have to wait. 55 and over communities in lehigh valley pa, why is montgomery, alabama called the gump, whitworth street west to chepstow street manchester, antonia reininghaus who fatally poisoned their common seven year old daughter johanna in 1987, how many times did jesus quote old testament, watts funeral home obituaries jackson, ky, how long do baby stingrays stay with their mothers, human biology and society ucla major requirements, anchor hocking casserole dish with carrier, was charles cornwallis a patriot or loyalist, delta community credit union sister banks, craigslist low income apartments for rent, how to replace electrolux pedestal drawer latch, why was danny glover uncredited in the rainmaker. The agency has a question about their tax return. Within my main plot # x27 ; s name, address and phone number in Austin TX knows how get.

Determined which RFC sent the payment- either Philadelphia or Kansas City contact them to which., in order to reveal it with Impact later in the prosecution of felony and juvenile offenses one of nationwide Tax balance answer below to find where to mail your federal Taxes printed on watermarked.! I didnt know if i had to send it again lol. I dont know what to do. Internal Revenue Service. Identification number ( TIN ) and Certification Form 4506-T ; request for Taxpayer Identification number ( TIN ) Certification! This letter helps determine whether it is possible to claim the recovery refund credit on the 2021 tax return. Webdepartment of treasury austin texas 73301 phone number. Popularity:#1 of 2 IRS Offices in Austin#1 of 2 IRS Offices in Travis County#1 of 25 IRS Offices in Texas#5 in IRS Offices. which two job roles are good candidates for becoming a product owner? If you determine the notice or letter is fraudulent please follow the IRS assistors guidance or visit our Report Phishing page for next steps. Individuals whose incomes are below $12,500 and couples whose incomes are below $25,000 may be able to file a simple tax return to claim the 2021 Recovery Rebate Creditwhich covers any stimulus payment amounts from 2021 they may have missedand the Child Tax Credit. How to report IRS imposter scams. Name: Account Number: N/A. Here is a way to know if your letter is legit. This letter should match the information from Notice 1444-C. I know folks here probably get tired of these posts, but I have a letter showing in Informed Delivery from Austin, Tx in a rather plain envelope. Individual Taxpayer Identification Numbers (ITIN). Can you spot any potential instances of. Box 1300 Charlotte, NC 28201-1300 Address and Phone Number for Austin Texas IRS Office, an IRS Office, at East Rundberg Lane, Austin TX. - Answered by a verified Tax Please add "IRS Telephone Scam" in the notes.