In 2021, each individual allowance a tax payer claims will reduce their taxable income by $4,300. You must find the correct number of allowances to claim. This is when the actual amount of tax you owe will be compared with how much tax youve paid throughout the year. It is important to keep in mind that a majority of employees will not qualify for an exemption from withholding, as this is considered a unique situation. State restrictions may apply. But heres the truth: a tax refund might not be the best thing for you, no matter how big your refund is. The IRS provides a rough formula for how many allowances taxpayers should claim to have the correct amount withheld from each paycheck. Sign up for our newsletter for tax tips & tricks! Participating locations only. We think it's important for you to understand how we make money. In some cases, an employee may also face a penalty. You should also claim 0 if your parents still claim you as a dependent. First, its important to fill out the multiple jobs or working spouse section using the worksheet on the third page of the W-4 so that the IRS has a proper record of how much money total you bring in. The Equifax logo is a registered trademark owned by Equifax in the United States and other countries. Claiming too many allowances can lead to you owing the IRS at the end of the year, while claiming too few allowances can reduce your weekly or monthly paychecks. In 2023, the amount is $13,850. WebIn order to decide how many allowances you can claim, you need to consider your situation. When receiving this money as a check or paid to your bankeven if you later plan to add it back to another retirement plan (known as an indirect rollover), the plan administrator must withhold 20% for federal income taxes. Here are the general guidelines: You can claim fewer allowances than youre entitled to, but not more. The fewer allowances claimed, the larger withholding amount, which may result in a refund. Find your federal tax withheld and divide it by income. While you used to be able to claim allowances, your withholding is now affected by your claimed dependents, if your spouse works or if you have multiple jobs. ; it is not your tax refund. Back Taxes Help: Get Help Filing IRS Back Taxes. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Securities and Exchange Commission as an investment adviser. Even better, when youre done, youll have a completed form to take to your employer. Additional training or testing may be required in CA, OR, and other states. Usually, its because youre not making high-enough income. The IRS has introduced a draft of a new W-4 form that plans to eliminate allowances and changes are planned to take effect in 2020. Tax Audit & Notice Services include tax advice only. If you claimed too many allowances, you probably ended up owing the IRS money. Read on to understand the current world of withholding tax. When you are filling out your W-4 form, you will need to know the number of allowances to claim. The number of allowances you can claim depends on your filing status, the number of jobs you have, and if you have any dependents. But you can and should update your W-4 throughout the year if your financial or life situation changes significantly.

IRS: About Form W-2, Wage and Tax Statement, IRS: Publication 505 (2019), Tax Withholding and Estimated Tax, Image: Woman sitting at home looking at documents she needs for filing back taxes, Image: Self-employed female fashion designer in her shop, looking up form 1099 nec on her laptop, Image: Woman at home drinking cup of coffee and looking up the 2020 standard deduction on her cellphone, Image: Two women sitting together on their couch, discussing whether life insurance is taxable, Image: Woman on laptop, looking up the 2020 federal tax brackets, Image: Couple sitting at home on sofa, discussing if political donations are tax deductible. Most people love tax refunds. WebIn order to decide how many allowances you can claim, you need to consider your situation. If you are filing as the head of the household and you have one child, you should claim 2 allowances. It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. The number of allowances you can claim depends on your filing status, the number of jobs you have, and if you have any dependents. Instead of paying $11,000 at tax time, youll pay about $450 every month. Fees apply to Emerald Card bill pay service. Only then can you claim exemption for the following year, so long as your financial situation hasnt changed. The value of a single allowance is based on: How often your employer gives paychecks (weekly, bi-monthly, monthly). In the past, employees could claim allowances on their W-4 to lower the amount of federal income tax withheld from their wages. Choosing the right number of allowances is an important part of ensuring your taxes are withheld properly. If you claim too many allowances, youll owe the IRS money when you file your taxes. If your situation changes, you can update your W-4 and submit it to your employer. This is where youll need to determine what suits your financial situation best: having fewer taxes taken out now and paying them later, or having more taxes taken out now, owing less later on. info@communitytax.com. Any Retail Reload Fee is an independent fee assessed by the individual retailer only and is not assessed by H&R Block or Pathward.

There is theoretically no maximum number of allowances employees can claim. You will be able to request an allowance for each child that you have. A 0% interest loan of up to $3,500 received within minutes of filing, if approved.

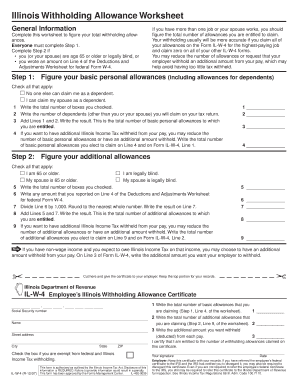

But do you qualify for any? The loss of allowances on the form might seem especially irksome, but not to worry. This withholding covers your taxes so that instead of paying your taxes with one lump sum during tax season, you pay them gradually throughout the year. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials, which may be non-refundable. Employers in every state must withhold money for federal income taxes. Ex. Copyright 2021-2023 HRB Digital LLC. Typically, you can either claim more allowances and get higher paychecks, or claim less allowances and get a larger tax refund. If an employer doesnt withhold taxes from your paycheck, its probably because: Theyve classified you as an independent contractor, You have no federal tax obligation (well discuss this later). Message and data rates may apply. You can technically claim as many allowances as you want, but if you withhold too much money then you could be penalized by the IRS. You use the W-4 form to tell your employer how much federal income tax to withhold from your paycheck. 2 or More Allowances Youll have 2 allowances if you have a spouse and file jointly. How many allowances should I claim married with 2 kid? WebInstead, the form uses a 5-step process and new Federal Income Tax Withholding Methods to determine actual withholdings. Learn moreabout Security. 2023 Bankrate, LLC. How much in taxes you withhold depends on your sources of income. With multiple jobs, this can sometimes be tricky. You should claim 1 allowance if you are married and filing jointly. and Ingo Money, Inc., subject to the Sunrise Banks and Ingo Money Service. The money is deducted from your gross wages and is sent directly to the government. If you intentionally falsify how many allowances you claim, you could be subject to a hefty fine and criminal penalty. Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can. This form can guide you through a basic rundown of how many allowances youre eligible to claim, and whether youll need to fill out the more-complicated worksheets that follow. Read: How to Properly Claim Dependents on a W-4 Form. Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld. If its been several years since youve completed a W-4, you may remember trying to figure out your withholding allowances. This depends on how many dependents you have. Well, in 2020, the IRS launched a new form that did away with the method of withholding allowances. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. Youll find the Personal Allowances Worksheet on the third page of Form W-4. Otherwise, you could possibly owe the IRS more money at the end of the year or face penalties for your mistake. When this was the tax law, if you didnt file a W-4, your employer accounted for withholding tax from your wages at the highest rateas though youre single with zero allowances on taxes. However, now that the allowances section of the W-4 has been eliminated, filling out the form has become somewhat streamlined. Read: How to Fill Out W-4 if Head of Household. You may be able to claim exemption from withholding if you had the right to a refund of all your income tax due to no tax liability the previous year. Page Last Reviewed or Updated: 09-Mar-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Publication 505, Tax Withholding and Estimated Tax, Form W-4 Employee Withholding Certificate, Form W-4P, Withholding Certificate for Pension or Annuity Payments, Notice 1392, Supplement Form W-4 Instructions for Nonresident Aliens, Form W-4, Employee's Withholding Certificate, Treasury Inspector General for Tax Administration, Estimate your federal income tax withholding, See how your refund, take-home pay or tax due are affected by withholding amount, Choose an estimated withholding amount that works for you, Other income info (side jobs, self-employment, investments, etc. You may find that you are taking a hit due to how much is coming out of your paycheck or you might get surprised by how little your return is at the end of the year. In the past, employees could claim allowances on their W-4 to lower the amount of federal income tax withheld from their wages. This depends on how many dependents you have. Federal pricing will vary based upon individual taxpayer circumstances and is finalized at the time of filing. Credit Karma Mortgage, Inc. NMLS ID# 1588622|, Credit Karma Offers, Inc. NMLS ID# 1628077|, Credit Karma Credit Builder (McBurberod Financial, Inc.) NMLS 2057952 |. While they dont exist on the W-4 anymore, its still very possible to effect the size of your paychecks by claiming additional withholding or deductions. Essentially, this is accounting for potential credits that you may be able to claim. Update your Form W-4 for all major financial changes in your life, such as: Theres one more important aspect of Form W-4 that we havent discussed yet. The fewer allowances claimed, the larger withholding amount, which may result in a refund. All you really have to do is compare your income with the given tables and do some simple maththe instructions will walk you through it. How do I know how many tax allowances I should claim? After youve earned your last paycheck, you may still have income coming your way. This is true as long as the child is under 19 years of age. In the past, employees could claim allowances on their W-4 to lower the amount of federal income tax withheld from their wages. is used by an employer to determine how much of each of your paychecks will be withheld for the federal income tax. Year-round access may require an Emerald Savingsaccount. The Income Tax Course consists of 62 hours of instruction at the federal level, 68 hours of instruction in Maryland, 80 hours of instruction in California, and 81 hours of instruction in Oregon. Married taxpayers are usually given an extra allowance per dependent. If you receive $20 or more monthly in tips, report that income to your employer. This all plays into how well you claim the allowances you are entitled to. Calculating how many W-4 allowances you should take is a bit of a balancing act though you might not have to manage it in the future if the new allowances-free W-4 takes effect. See your. Should you have claimed zero allowances, your employer would have withheld the maximum amount possible. If you are filling out more than one W-4 form, then you will not want to claim the maximum number of allowances you are entitled to on each form. If you dont pay enough tax throughout the year, youll owe the IRS come tax time and could be subject to penalties. Let's pretend it's $1,000. Note: Employees must specify a filing status and their number of withholding allowances on Form W4. If you withhold too little, you can create a balance due and potentially an underpayment penalty. Youre Single and you work 2 or more jobs, and your annual earnings exceed $20,000, Youre married and your total earnings exceed $50,000. Well help you find the answers you need. Some people are exempt from withholding. All Rights Reserved. In some cases, an employee may also face a penalty. All deposit accounts through Pathward are FDIC insured.

As a single parent with just two children, you qualify for more than one allowance per job. A child is a significant financial responsibility, so youre able to claim an extra allowance on your Form W-4. Refund claims must be made during the calendar year in which the return was prepared. Getting too much withheld from your paycheck or even facing a penalty for underpayment are possibilities if you are not regularly updating your W-4. Additional fees, terms and conditions apply; consult your, For a full schedule of Emerald Card fees, see your. Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit. If you claim 0 allowances or 1 allowance, youll most likely have a very high tax refund. What is the best number of tax allowances for a single person? Generally, the number of allowances you should claim is dependent on your filing status, income, and whether or not you claim someone as a dependent. Refund Transfer is a bank deposit product, not a loan. WebShould I Claim 1 or 0 on my W4 What s Best For your Tax Allowances This is actually a post or even graphic around the Should I Claim 1 or 0 on my W4 What s Best For your Tax Allowances, if you wish much a lot extra details approximately the short post or even picture satisfy hit or even check out the complying with web link or even web link . For details on how to protect yourself from scams, see Tax Scams/Consumer Alerts. Youre able to withhold any extra amount you wish. Consent is not required as a condition of purchase. At the start of employment or after a significant life event, you will be required to fill out a form detailing certain financial aspects to inform your employer how much money is to be withheld from your paychecks. This is a personal choice that helps you plan your budget throughout the year. But then you get to line 5. Additional fees apply for tax expert support. If the IRS refunded you last year for all of the federal income tax that was withheld, and if you expect that to happen again this year, you can claim exemption from withholding. As a single parent with just two children, you qualify for more than one allowance per job. It depends. Minimum monthly payments apply. If the online tax preparation or tax software makes an arithmetic error that results in your payment of a penalty and/or interest to the IRS that you would otherwise not have been required to pay, H&R Block will reimburse you up to a maximum of $10,000. The money, which is rightfully yours, sits in the governments pocket all year and you get nothing for it. If you have more than one job, or are married, youll need to consider all your incomeand if some jobs bring in more money than others. Another person can claim you as a dependent, Your income exceeds $1,100 and includes more than $350 of unearned income, such as interest or dividends, Youll save time if you gather and organize all the supporting. To change your tax withholding you should: Complete a new Form W-4, Employees Withholding Allowance Certificate, and submit it to your employer. If there has not been enough money withheld from their paycheck, then more taxes will be due.

If you discover an error in the H&R Block tax preparation software that entitles you to a larger refund (or smaller liability), we will refund the software fees you paid to prepare that return and you may use our software to amend your return at no additional charge.

Insurance related services offered through Credit Karma Insurance Services, LLC, which does business in some states as Karma Insurance Services, LLC.

Find your federal tax withheld and divide it by income.

Find your federal tax withheld and divide it by income. If you have children, you will be able to claim them as dependents and claim more allowances. If there has not been enough money withheld from their paycheck, then more taxes will be due. All tax situations are different. Find out what adjustments and deductions are available and whether you qualify. All tax situations are different. How many allowances should I claim if Im single? In 2023, the amount is $13,850. It starts off easy enough - name, address, Social Security number, filing status. This can help with getting closer to a break-even point, but could also result in taxes being due. Why would the IRS refund all your withheld tax? 2022 HRB Tax Group, Inc. H&R Block Emerald Prepaid Mastercard is issued by Pathward, N.A., Member FDIC, pursuant to license by Mastercard. However, you might still have to fill out a W-4 form for your other jobs. Terms and conditions apply; see. And if on Tax Day you still owe more than 10% of your total tax obligation for the year, you could face a penalty. If youre concerned about the amount your employer withholds, you can also refer tothe withholding calculatorprovided by the IRS.

Choosing not to adjust your W-4 allowances or doing so incorrectly could lead to unwanted consequences. Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesnt affect. Keep in mind that you still need to settle up your tax liability at the end of the year by filing your tax return. To be a little more specific, life changes that might impact your withholdings include: When you complete the form, there are three main elements that impact how much tax will be withheld from your pay and will ultimately factor into your tax return: Completing a new W-4 can get complicated, but its important to get your withholding right. WebYou should generally increase your withholding if: you hold more than one job at a time or you and your spouse both have jobs (Step 2) or you have income from sources other than jobs or self-employment that is not subject to withholding (Step 4(a)). Your information isn't saved. WebInstead, the form uses a 5-step process and new Federal Income Tax Withholding Methods to determine actual withholdings. If your situation has changed, you can request a new W-4 from your employer. We have the answers. Enrolled Agents do not provide legal representation; signed Power of Attorney required. On the form, youll be instructed to choose one of these rates: If youre closing out your retirement account, youll receive whats called a lump-sum payment from your retirement plan. Wouldnt it be better to put that money back into your paychecks?

In fact, you can have federal income taxes withheld from your: Youll fill out Form W-4P if you have a pension, individual retirement accounts, or annuity payments. Your first instinct might be that its better to overpay and receive a tax refund.

A Red Ventures company. Consult your own attorney for legal advice. How Much Do I Need to Save for Retirement? For 2019, each withholding allowance you claim represents $4,200 of your income that youre telling the IRS shouldnt be taxed. Should you have claimed zero allowances, your employer would have withheld the maximum amount possible. One-Time Checkup with a Financial Advisor. If youre stumped about the meaning of tax withholding, youre not alone. By entering your phone number and clicking the Get Started button, you provide your electronic signature and consent for Community Tax LLC or its service providers to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. If you claimed too many allowances, you probably ended up owing the IRS money. Instead, you will want to claim your allowances for one job. Or keep the same amount. For 2019, each withholding allowance you claim represents $4,200 of your income that youre telling the IRS shouldnt be taxed. TurboTax is a registered trademark of Intuit, Inc. All tax situations are different. A withholding allowance was like an exemption from paying a certain amount of income tax. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. You can do this bypaying estimated taxes. But you may have encountered it when starting a job. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. Thats not good for the government; the government needs to collect some taxes during the year for budgeting purposes, and theyre also afraid that people wont pay their tax bill on time if its too large. Thats why you need to fill out a new W-4 anytime you start a new job or experience a big life change like a marriage or the adoption of a child. But if you need help figuring out your taxes, a financial advisor could help you optimize a strategy for your finances. $500/10,000 = 5% is less than 10% so you will owe money. Check your tax withholding every year, especially: If you have more questions about your withholding, ask your employer or tax advisor. The money is deducted from your gross wages and is sent directly to the government. $500/ $5000 = 10% on track to zero out. If youd rather get more money with each paycheck instead of having to wait for your refund, claiming 1 on your taxes is typically a better option. Supporting Identification Documents must be original or copies certified by the issuing agency. Ding! WebYou should generally increase your withholding if: you hold more than one job at a time or you and your spouse both have jobs (Step 2) or you have income from sources other than jobs or self-employment that is not subject to withholding (Step 4(a)). For 2022, a single person who isnt a dependent can have as much as $12,950 in gross income before any tax is due. Once you start to look at a recent W-4, youll see that withholding allowances and allowances on taxes arent even mentioned on the form.

Credit Karma is committed to ensuring digital accessibility for people with disabilities. $500/10,000 = 5% is less than 10% so you will owe money. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. For tax years 2020 or later, withholding allowances are no longer reported on federal Form W-4. A Power of Attorney may be required for some Tax Audit & Notice Services. This could be for any side income or additional income (ex. If you have the same number of children with each parental caregiver and has only one job, then you can request an allowance for each child. Obviously, thats mostly for anyone who expects to pay some taxes at the end of the year. By the time Tax Day rolls around, the IRS typically expects you to have paid at least 90% of all the tax youll owe for a tax year. Now you know what W-4 allowances are. Check your tax withholding at year-end, and adjust as needed with a new W-4. In the past, the value of withholding allowances was also tied to personal and dependent exemptions, but those exemptions were eliminated under The Tax Cuts and Jobs Act signed in 2017. Understanding how W-4 allowances affect your federal income tax withholding can help you take control of exactly when you pay your tax obligation to the federal government. You will also need to be expecting a refund of all your federal income tax that has been withheld due to no tax liability for the current year. But be careful. A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. Amended tax returns not included in flat fees. Allowances are no longer in effect on the current W-4 form, but when they were the allowances were completely subjective to you and your tax professional. You will likely be getting a refund back come tax time. You will typically want to pick the highest-paying job to do this. H&R Block Free Online, NerdWallets 2023 winner for Best Online Tax Software for Simple Returns. Do you want a higher tax refund? See. Fees apply. If there is too much money withheld from an employees paycheck, then that employee will receive a refund at the end of the year. Each of your children adds another allowance, so a family of four could claim 4 allowances. Claiming 2 allowances will most likely result in a moderate tax refund. Most of the time, youll submit Form W-4 to your employer when you begin a new job. Exactly how much your employer withholds will depend largely on how much money you make and how you fill out your W-4. Description of benefits and details at. 2 or More Allowances Youll have 2 allowances if you have a spouse and file jointly. Read: How to Fill Out W-4 with 1, 2, 3, or 4+ Dependents. Prior to 2020, one of the biggest things you could do to affect the size of your paycheck was to adjust the number of allowances claimed on your W-4. Ex. Technically, you can claim as many allowances as you wantyou could even claim 100.

7775 Baymeadows Way Suite 205 Credit Karma is a registered trademark of Credit Karma, LLC. Check your tax withholding every year, especially: When you have a major life change New job or other paid work Major income change Marriage Child birth or adoption Home purchase If you changed your tax withholding mid-year Check your tax withholding at year-end, and adjust as needed with a new W-4 document.getElementById( "ak_js_3" ).setAttribute( "value", ( new Date() ).getTime() ); document.getElementById( "ak_js_4" ).setAttribute( "value", ( new Date() ).getTime() ); Community Tax, LLC Product name, logo, brands, and other trademarks featured or referred to within Credit Karma are the property of their respective trademark holders. In fact, concepts and questions such as dependency allowances, number of exemptions and how many exemptions should I claim? have all gone by the wayside. For two earners and multiple jobs, you will want to make sure that you are calculating the total number of allowances you are entitled to correctly. How many allowances you are eligible for can also change over time. To change your tax withholding you should: Complete a new Form W-4, Employees Withholding Allowance Certificate, and submit it to your employer. Most state programs available in January; software release dates vary by state. Photo credit: iStock.com/vgajic, iStock.com/nandyphotos, CoinMarketCap via Yahoo Finance iStock.com/Steve Debenport. It is time to reassess when personal life changes occur that could result in you facing more taxes or present you with opportunities for credits, as well as deductions.

To understand how allowances worked, it helps first to understand how tax withholding works. You can also do both make estimated payments and withhold money from your checks. $500/ $5000 = 10% on track to zero out. Claiming the right number of allowances on your yearly tax return is an important part of making sure your taxes are withheld properly. Update Form W-4 after any major life events that affect your filing status or financial situation. Tax returns may be e-filed without applying for this loan.