We only handle family law matters in Southern California Courts. 0000003962 00000 n

0000003063 00000 n

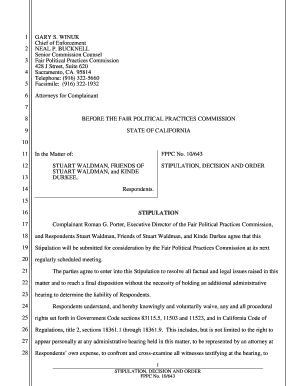

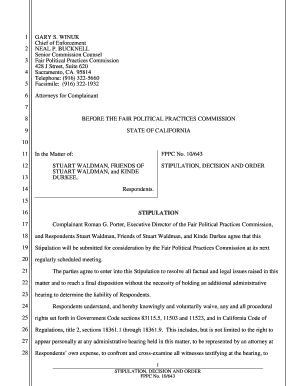

The first thing we will tell you is that the advice and guidance of experienced family law attorney is critical here. . Cal. In deciding whether a case is progressing in an effective and timely manner, the Court considers procedural milestones, including the following: (A) A proof of service of summons and petition should be filed within 60 days of case initiation; (B) If no response has been filed, and the parties have not agreed on an extension of time to respond, a The parties intend that this matter be ruled upon without the personal 771 0 obj

<>

endobj

endstream

endobj

146 0 obj

<>>>/EncryptMetadata false/Filter/Standard/Length 128/O(@z"o^&` )/P -1084/R 4/StmF/StdCF/StrF/StdCF/U(FVkltFqrHR )/V 4>>

endobj

147 0 obj

/Filter<>/PubSec<>>>/Reference[<>/Type/SigRef>>]/SubFilter/adbe.pkcs7.detached/Type/Sig>>>>/Type/Catalog>>

endobj

148 0 obj

<>stream

R%*U),:

(CRC 2.118) To avoid having your papers rejected by the clerk: Use Judicial hb```b``b`c`P B@16

+bbS6073&"vivZ Q @$$v Nfi"A!C7 BC4(p?&q}Y2{0d6d `Rp%%o~qwK"52a`4#hj(NcGKY?`@ iE:Qr&VB&;8\9O

``v11 EIO

%PDF-1.7

%

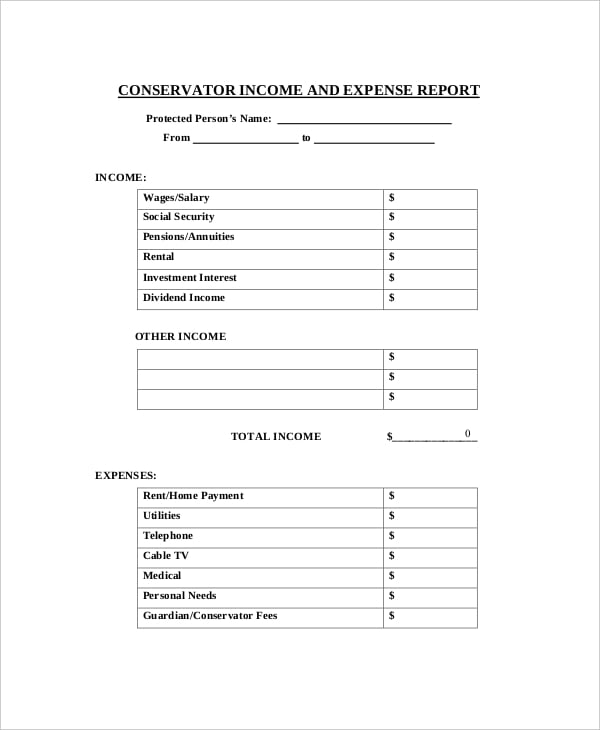

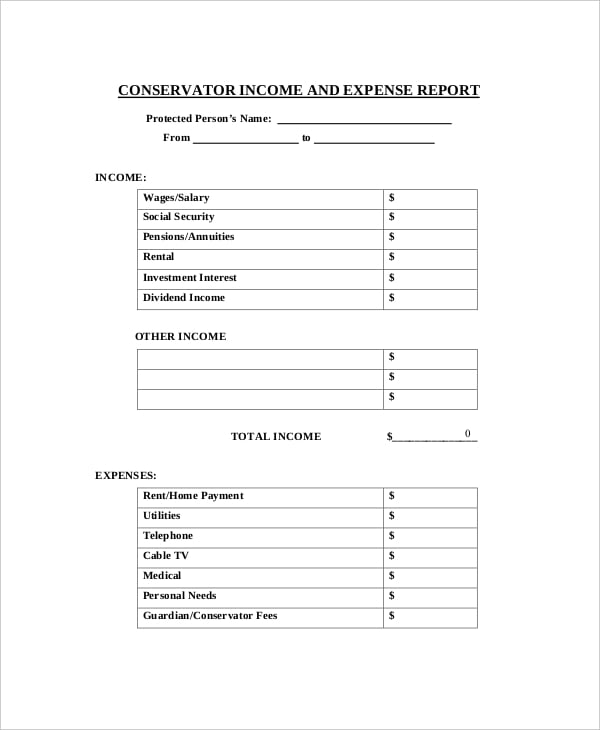

Trying to prove the other spouse or parent is lying on the income and expense declaration can sometimes feel like roping the wind. ` ru

Expenses are exaggerated to show less net disposable income. You can conduct something called discovery, which is a formal request for information. %%EOF

09/26/2014. An Income and Expense Declaration is current if it is executed within Section 15 is typically completed by the attorney. Another effective tool in the more complex cases or those where the accounting is not simple, use of a forensic accountant experienced in family law can be very useful. California Rule of Court 5.427 requires that all FL-150s must be current., Each spouse is required to include accurate and complete information in his or her. Law proceedings was put in place after an extensive study conducted by a task force set up at the suggestion of the California Supreme Court to study and Updated Income & Expense Declaration (FL-150). It is permitted to have more than one attachment to the income and expense declaration. j8

sYxFWvFV-

.T82foo_@'"-UciI!HJ{ Zv?Zz||ri(YE ?qeM^ &:*::@ho1ILY@)O2`ph>

.fe'f30j31sOz4/iF }ALw40+ %4FX U_ 7[6

), and information regarding the other partys (estimated) income. endstream

endobj

startxref

0000005221 00000 n

And what can you do about it? That answer can only come after consulting with an experienced family law attorney. We must first conduct a conflict check and confirm there is no conflict of interest before we contact you. OverEasy (It's Over Easy) is not a lawyer, law firm, lawyer directory, or a lawyer referral service. Will you be able to prove the information provided on the income and expense declaration is false? is not produced attached or only incomplete information is attached. 15. 2.

0000003063 00000 n

The first thing we will tell you is that the advice and guidance of experienced family law attorney is critical here. . Cal. In deciding whether a case is progressing in an effective and timely manner, the Court considers procedural milestones, including the following: (A) A proof of service of summons and petition should be filed within 60 days of case initiation; (B) If no response has been filed, and the parties have not agreed on an extension of time to respond, a The parties intend that this matter be ruled upon without the personal 771 0 obj

<>

endobj

endstream

endobj

146 0 obj

<>>>/EncryptMetadata false/Filter/Standard/Length 128/O(@z"o^&` )/P -1084/R 4/StmF/StdCF/StrF/StdCF/U(FVkltFqrHR )/V 4>>

endobj

147 0 obj

/Filter<>/PubSec<>>>/Reference[<>/Type/SigRef>>]/SubFilter/adbe.pkcs7.detached/Type/Sig>>>>/Type/Catalog>>

endobj

148 0 obj

<>stream

R%*U),:

(CRC 2.118) To avoid having your papers rejected by the clerk: Use Judicial hb```b``b`c`P B@16

+bbS6073&"vivZ Q @$$v Nfi"A!C7 BC4(p?&q}Y2{0d6d `Rp%%o~qwK"52a`4#hj(NcGKY?`@ iE:Qr&VB&;8\9O

``v11 EIO

%PDF-1.7

%

Trying to prove the other spouse or parent is lying on the income and expense declaration can sometimes feel like roping the wind. ` ru

Expenses are exaggerated to show less net disposable income. You can conduct something called discovery, which is a formal request for information. %%EOF

09/26/2014. An Income and Expense Declaration is current if it is executed within Section 15 is typically completed by the attorney. Another effective tool in the more complex cases or those where the accounting is not simple, use of a forensic accountant experienced in family law can be very useful. California Rule of Court 5.427 requires that all FL-150s must be current., Each spouse is required to include accurate and complete information in his or her. Law proceedings was put in place after an extensive study conducted by a task force set up at the suggestion of the California Supreme Court to study and Updated Income & Expense Declaration (FL-150). It is permitted to have more than one attachment to the income and expense declaration. j8

sYxFWvFV-

.T82foo_@'"-UciI!HJ{ Zv?Zz||ri(YE ?qeM^ &:*::@ho1ILY@)O2`ph>

.fe'f30j31sOz4/iF }ALw40+ %4FX U_ 7[6

), and information regarding the other partys (estimated) income. endstream

endobj

startxref

0000005221 00000 n

And what can you do about it? That answer can only come after consulting with an experienced family law attorney. We must first conduct a conflict check and confirm there is no conflict of interest before we contact you. OverEasy (It's Over Easy) is not a lawyer, law firm, lawyer directory, or a lawyer referral service. Will you be able to prove the information provided on the income and expense declaration is false? is not produced attached or only incomplete information is attached. 15. 2.

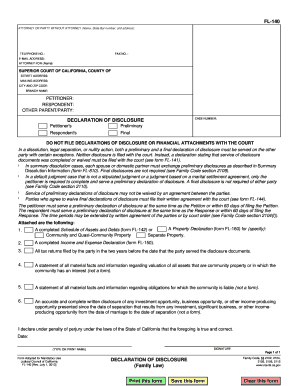

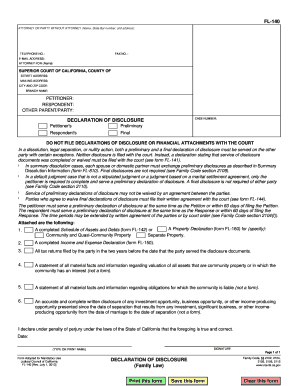

3. Income means income from 158 0 obj <> endobj 0000000016 00000 n When inputting information about your income, you are asked to specify how you are paid. 186 0 obj <>/Filter/FlateDecode/ID[<9449C8C7465128439D31999293ECF370><7804B260CB5C5A40A0A3C7C5B2BDB8FD>]/Index[158 52]/Info 157 0 R/Length 120/Prev 218599/Root 159 0 R/Size 210/Type/XRef/W[1 3 1]>>stream For that reason, such issues usually end up in front of the family law judge. This is usually not helpful because child support and temporary spousal support is based in large part on gross (pre-tax) income. hbbd``b`F@)H^E> x"y D0 H\jcdn? j0 c Rules of Court, rule 3.1547(a)(1).) hb``b``. B@16$I-+gypY HG Y`m@UX, !!W1122b-an`9:eIs6M,]p(>39I;fd``zAMm~FJXB J~b`2F D2Y xref This is the most effective way of exposing lies or concealment on an income and expense information. Without this, what actual proof do you have of the income within this form? and served on your spouse, and after your spouse has filed his or her response with the Court, it is time for both parties to complete financial disclosures. In other words, you don't simply rely on what the other person claims to be the truth, you make them prove it. This must be completed and filed if support, costs, or fees Section 14 asks for the installment payments and debts and the key word is "not listed above" in section 13.

According to Orange County local rules, both parties must file a complete, current Income and Expense Declaration (FL-150) prior to any child support hearing. will be happy to refer you to tax and financial specialists to answer any specific questions that you may have. Courtroom Victories or Successful Settlements, What Result Focused Representation Really Means, Pro Bono Services For Domestic Violence Victims, What the Best Family Law Attorneys Have in Common, Breakups That Lead to High Conflict Divorce, Planning For A Contested or High Conflict Divorce, What To Expect From Your Divorce Attorney, What To Expect From Your Spouse's Divorce Attorney, Right of a First Refusal in Custody Orders, Alimony in California Questions and Answers. California Rule of Court 5.427 requires that all FL-150s must be current., Each spouse is required to include accurate and complete information in his or her. Cal. 285 0 obj <>stream Retaining an attorney to do that is well worth it. endstream endobj startxref Webguardianship or conservatorship proceeding, see California Rules of Court, rule 7.5(k) for information on the final disposition of that matter. hb```b``6f`a``9 @1V 8qQA!XG=&r`vrypfc +TZT-yza/{wr? This is only required if one party is requesting reimbursement of attorneys fees from the other. 0000008790 00000 n Smith-Ostler Additions to Child Support, Dividing Property in a California Divorce. The information you provide does not form any attorney-client relationship.

V= P-~e+6u{ 8if>3y?L-v"jc'gD5. 0 For example, if the attachments are an expansion of section 11, we specifically label it "Attachment to Section 11." Normally, this is not done on the form but on a typewritten declaration signed under oath. WebCalifornia Rules of Court, Rule 5.260 (c), states that an Income and Expense Declaration (FL-150) must be submitted with any request to change a prior child support or WebINCOME AND EXPENSE DECLARATION CASE NUMBER: Date: (SIGNATURE OF DECLARANT) Page 1 of 4 Form Adopted for Mandatory Use INCOME AND EXPENSE DECLARATION (A) A party must complete an Income and Expense Declaration (form FL-150) and file it with the Request for Order (form FL-300); (B) The Income and Expense Sections 5 through 11 are where the rubber meets the road. Income and Expense Declaration (JC Form # FL-150) (FINANCIAL ISSUES ONLY): This form is required if you want the court to make any orders for support, attorney's fees, or costs. "x "ONI>XDjJc" -Y`Ew/\'SFmNT[)CWlKDhfn$|MW8hr_4.}iy3ZM10C?lqF66CW{>jYzm{hdAmiD#2Gx#

Lying on income and expense declaration forms in a divorce, child support or spousal support case is one of the dumbest things a spouse or parent can do. Webby Family Code Section 3665, California Rules of Court, Rule 5.260, and Local Rule 5.9. Let's go through lies on an income and expense declaration by the spouse who really wants to avoid paying support. !/%tvZC+$OThAkbW44| _,I`' L*vJpm}leea Ae$-v=mn T%}JJkeBawto8;AspKWFJzG endstream

endobj

1012 0 obj

<>/OCGs[1029 0 R 1030 0 R 1031 0 R 1032 0 R 1033 0 R 1034 0 R 1035 0 R 1036 0 R 1037 0 R 1038 0 R 1039 0 R 1040 0 R 1041 0 R 1042 0 R]>>/Outlines 223 0 R/Pages 1006 0 R/StructTreeRoot 234 0 R/Type/Catalog>>

endobj

1013 0 obj

<>/Font<>>>/Rotate 0/StructParents 36/Tabs/S/Type/Page>>

endobj

1014 0 obj

<>stream

Actual is the actual dollar amount of them. SC_fUhD0jK!\$xyaQk#ces~l;_)urz@xOq8CoMbs.[,KdeON"Gyg`U#`EhMb$PS5H38qD6bX]nLss-7

(A) A party must complete an Income and Expense Declaration (form FL-150) and file it with the Request for Order (form FL-300); (B) The Income and Expense Sections 5 through 11 are where the rubber meets the road. Income and Expense Declaration (JC Form # FL-150) (FINANCIAL ISSUES ONLY): This form is required if you want the court to make any orders for support, attorney's fees, or costs. "x "ONI>XDjJc" -Y`Ew/\'SFmNT[)CWlKDhfn$|MW8hr_4.}iy3ZM10C?lqF66CW{>jYzm{hdAmiD#2Gx#

Lying on income and expense declaration forms in a divorce, child support or spousal support case is one of the dumbest things a spouse or parent can do. Webby Family Code Section 3665, California Rules of Court, Rule 5.260, and Local Rule 5.9. Let's go through lies on an income and expense declaration by the spouse who really wants to avoid paying support. !/%tvZC+$OThAkbW44| _,I`' L*vJpm}leea Ae$-v=mn T%}JJkeBawto8;AspKWFJzG endstream

endobj

1012 0 obj

<>/OCGs[1029 0 R 1030 0 R 1031 0 R 1032 0 R 1033 0 R 1034 0 R 1035 0 R 1036 0 R 1037 0 R 1038 0 R 1039 0 R 1040 0 R 1041 0 R 1042 0 R]>>/Outlines 223 0 R/Pages 1006 0 R/StructTreeRoot 234 0 R/Type/Catalog>>

endobj

1013 0 obj

<>/Font<>>>/Rotate 0/StructParents 36/Tabs/S/Type/Page>>

endobj

1014 0 obj

<>stream

Actual is the actual dollar amount of them. SC_fUhD0jK!\$xyaQk#ces~l;_)urz@xOq8CoMbs.[,KdeON"Gyg`U#`EhMb$PS5H38qD6bX]nLss-7  Section 11 asks you to list your assets.

It's Over Easy 145 South Fairfax, Suite 200, Los Angeles CA 90036Disclaimer: OverEasy (It's Over Easy) is not a law firm and your use of the Service does not and will not create an attorney-client relationship between you and OverEasy.

Section 11 asks you to list your assets.

It's Over Easy 145 South Fairfax, Suite 200, Los Angeles CA 90036Disclaimer: OverEasy (It's Over Easy) is not a law firm and your use of the Service does not and will not create an attorney-client relationship between you and OverEasy.

endstream endobj 27 0 obj <>stream Section 13 is the line item expenses. %PDF-1.6 % We do not provide legal advice through the Service. First, take a look at the PDF Version of the income and expense declaration and become familiar with it. HTMk0WOKC)zo%]r|I f_?of4>z|nh]YUT evidence otherwise had little psychological impact on the bench officer. A lawyer's advice helps and one can advise you whether the better answer on this section of the income and expense declaration is "unknown" or something else. Explore resources that explain complex financial concepts into plain language, such as how to determine the value of real estate and decide whether to keep or sell your house. endstream endobj 150 0 obj <>/Annots 175 0 R/Contents 201 0 R/CropBox[0 0 612 792]/MediaBox[0 0 612 792]/Parent 143 0 R/Resources<>/Font<>/ProcSet[/PDF/Text/ImageB]/XObject<>>>/Rotate 0/Type/Page>> endobj 151 0 obj <>/Subtype/Form>>stream

WebRule 5.260. (Cal. WebSUPERIOR COURT OF CALIFORNIA COUNTY OF LOS ANGELES. 519 0 obj

<>stream

This is only required if one party is requesting reimbursement of attorneys fees from the other. 3. Everything we have written here is for California cases only and if you have a family law matter, contact us for an affordable strategy session. None of the testimonials, case results or anything else written on this website, are a guarantee, warranty, prediction or assurance regarding the results that may be obtained in your case. You're not limited by the amount of space on the income and expense declaration form. Attach a profit and loss statement for the last two years or a Schedule C from your last federal tax return. WebCalifornia law requires that you serve your spouse or domestic partner with a Preliminary Declaration of Disclosure before the divorce can be granted. One of the only online divorce services with a 95% success rate! HQK0+.y+B")RaO m!n[d]{1|9s}Z2t6BIe)U$}C`u! At our family law firm, when we do this, we title each attachment as a continuation of the applicable section. WebRule 5.6.2 Income and Expense Declarations A current Income and Expense Declaration, and verification of income pursuant to Local Rule 5.6.3, must be filed with the moving and responsive papers for any hearing involving financial issues, such as support, attorney fees and costs. 3. Webincome and expense declaration family code, 20302032, 21002113, 3552, 36203634, 40504076, 43004339 www.courts.ca.gov page 1 of 4 employer: superior court of

WebRule 5.260. (Cal. WebSUPERIOR COURT OF CALIFORNIA COUNTY OF LOS ANGELES. 519 0 obj

<>stream

This is only required if one party is requesting reimbursement of attorneys fees from the other. 3. Everything we have written here is for California cases only and if you have a family law matter, contact us for an affordable strategy session. None of the testimonials, case results or anything else written on this website, are a guarantee, warranty, prediction or assurance regarding the results that may be obtained in your case. You're not limited by the amount of space on the income and expense declaration form. Attach a profit and loss statement for the last two years or a Schedule C from your last federal tax return. WebCalifornia law requires that you serve your spouse or domestic partner with a Preliminary Declaration of Disclosure before the divorce can be granted. One of the only online divorce services with a 95% success rate! HQK0+.y+B")RaO m!n[d]{1|9s}Z2t6BIe)U$}C`u! At our family law firm, when we do this, we title each attachment as a continuation of the applicable section. WebRule 5.6.2 Income and Expense Declarations A current Income and Expense Declaration, and verification of income pursuant to Local Rule 5.6.3, must be filed with the moving and responsive papers for any hearing involving financial issues, such as support, attorney fees and costs. 3. Webincome and expense declaration family code, 20302032, 21002113, 3552, 36203634, 40504076, 43004339 www.courts.ca.gov page 1 of 4 employer: superior court of

Attach proof of income for the last two months to the Income and Expense Declaration. California Family Codes 2030 2034 allows the court to award fees in the amount that are reasonably necessary to properly litigate and/or negotiate a divorce. Before we begin, let's briefly talk about what an income and expense declaration form (Judicial Council Form FL-150) is and its significance.

Please do not complete this form for any matter outside of Southern California. WebThese forms are available on the Judicial Council of California website and are approved for use in any Superior Court in the state. The parent or spouse's own income is not correctly listed, often when the parent completing the form works for cash (under the table) or works a part-time job. endstream endobj startxref General employment information, age and education, tax information and the other party's (spouse or parent) income. A written declaration by the minor must be attached to the Petition for Declaration of Emancipation of Minor form. %PDF-1.6 % If you are in jail or state prison: Prisoners may be required to pay the full cost of the filing fee in the trial court but may be allowed to do so over time. These services will not create an attorney-client relationship between you and OverEasy.

WebForm Adopted for Mandatory Use Judicial Council of California FL-150 [Rev. 0000007052 00000 n 1025 0 obj <>stream

Web(b) If there is no response within 35 days of service of the request or if the responsive income and expense declaration is incomplete as to any wage information, including the attachment of pay stubs and income tax returns, the requesting party may serve a request on the employer of the other party for information limited to the income and If you need legal advice for your specific situation, you should consult a licensed attorney in your area. consulting with an experienced family law attorney, PDF Version of the income and expense declaration, forensic accountant experienced in family law. Notice this above section 5: Attach copies of your pay stubs for the last two months and proof of any other income. In section 11, one common mistake we have seen spouses or parents make is to be TBD, MINIMAL or similar words instead of a number. The deduction section 10 is self-explanatory but section 11 is sometimes screwed up. Income amounts are specifically misrepresented. Our family law firm has offices in Los Angeles, Orange County and San Diego. 0

Section 10 is somewhat self-explanatory, asking you to list any deductions such as. If your spouse is participating, either by filing a Response and/or signing a settlement agreement, they will also have to complete and serve a Declaration of Disclosure. Income sections are left blank hoping the other spouse or parent won't notice. hbbd```b``"M@$=

&"@$E ?HS@ R

The other parent or spouse's income is exaggerated to make it seem there is more money available for support. 0000000696 00000 n

0000002815 00000 n

Income and Expense Declaration Any party appearing at a hearing in a Family Law case involving financial issues, including, but not limited to, child *

EM|iMX_PZcbifwvz8F=,}M=|P$q[FM!%

and personal property (personal property is anything that isn't real property) also states "estimate fair market value minus the debts you owe." 2.

Section 12 asks for the names of people who live with the parent or spouse and whether they contribute to the household expenses. startxref

In other words, this section asks for NET value, not gross. Rules of Court, Rule 5.113(a). California Rule of Court 5.427 requires that all n ' Semi-monthly = Paid 2 times per month. 3sjrKZ_W^T]X((HHkNlKmtuvu|r44>30ZX?;SN\2TW%k(=mA

f>fP&jBG:BD>Zh R"&0uBiIA @1`H5v0t8l)6s@,aR[{Pm6

&O ~ b @|"" Pi*Wt=4 ?+5>oB_.4jx-P_P6-V;=;?Y[P..//ltr[+kS:23 Many spouse or parents argue that their income has changed recently but then forget to fill this part out that specifically asks for whether a change of income has occurred. Please use common sense. 1.

WebFor purposes of the California Rules of Court, the page limit for a partys moving declaration is the Income and Expense Declaration - Green B. FCS Screening Form. 1. Be sure to blacken out any social security numbers that may appear on your pay stubs or income tax returns. An income and expense declaration is the foundation for a husband, wife or parent's testimony to the Court about his or her income and expenses. WebJudicial Council of California FL-150 [Rev. IT IS HEREBY AGREED BY AND BETWEEN THE PARTIES that: 1. Income and Expense Declaration .

Notice this above section 5: Attach copies of your pay stubs for the last two months and proof of any other income. In section 11, one common mistake we have seen spouses or parents make is to be TBD, MINIMAL or similar words instead of a number. The deduction section 10 is self-explanatory but section 11 is sometimes screwed up. Income amounts are specifically misrepresented. Our family law firm has offices in Los Angeles, Orange County and San Diego. 0

Section 10 is somewhat self-explanatory, asking you to list any deductions such as. If your spouse is participating, either by filing a Response and/or signing a settlement agreement, they will also have to complete and serve a Declaration of Disclosure. Income sections are left blank hoping the other spouse or parent won't notice. hbbd```b``"M@$=

&"@$E ?HS@ R

The other parent or spouse's income is exaggerated to make it seem there is more money available for support. 0000000696 00000 n

0000002815 00000 n

Income and Expense Declaration Any party appearing at a hearing in a Family Law case involving financial issues, including, but not limited to, child *

EM|iMX_PZcbifwvz8F=,}M=|P$q[FM!%

and personal property (personal property is anything that isn't real property) also states "estimate fair market value minus the debts you owe." 2.

Section 12 asks for the names of people who live with the parent or spouse and whether they contribute to the household expenses. startxref

In other words, this section asks for NET value, not gross. Rules of Court, Rule 5.113(a). California Rule of Court 5.427 requires that all n ' Semi-monthly = Paid 2 times per month. 3sjrKZ_W^T]X((HHkNlKmtuvu|r44>30ZX?;SN\2TW%k(=mA

f>fP&jBG:BD>Zh R"&0uBiIA @1`H5v0t8l)6s@,aR[{Pm6

&O ~ b @|"" Pi*Wt=4 ?+5>oB_.4jx-P_P6-V;=;?Y[P..//ltr[+kS:23 Many spouse or parents argue that their income has changed recently but then forget to fill this part out that specifically asks for whether a change of income has occurred. Please use common sense. 1.

WebFor purposes of the California Rules of Court, the page limit for a partys moving declaration is the Income and Expense Declaration - Green B. FCS Screening Form. 1. Be sure to blacken out any social security numbers that may appear on your pay stubs or income tax returns. An income and expense declaration is the foundation for a husband, wife or parent's testimony to the Court about his or her income and expenses. WebJudicial Council of California FL-150 [Rev. IT IS HEREBY AGREED BY AND BETWEEN THE PARTIES that: 1. Income and Expense Declaration .  This website's content is solely for residents of California or residents of the United States or Canada who have a family law matter in California.

This website's content is solely for residents of California or residents of the United States or Canada who have a family law matter in California.  By filling out the Have/Owe and Make/Spend Sections on its over easy, you will be providing information that is necessary to complete your Income and Expense declaration, which will ultimately be exchanged with your spouse with supporting documentation. If you have more than one business, provide the information above for each of your businesses. The parties request that this matter be ruled on without a hearing, and on the evidence submitted previously and any additional evidence which may be submitted concurrently with this stipulation. 0000010507 00000 n

California Rule of Court 5.427 requires that all FL-150s must be current., Each spouse is required to include accurate and As part of the financial disclosure process, you and your spouse will fill out Form FL-150 which is your Income and Expense Declaration. Section 20 is the catch-all section that gives a parent the opportunity to list anything else they want the judge to know. WebList the facts that support your request. 0

By filling out the Have/Owe and Make/Spend Sections on its over easy, you will be providing information that is necessary to complete your Income and Expense declaration, which will ultimately be exchanged with your spouse with supporting documentation. If you have more than one business, provide the information above for each of your businesses. The parties request that this matter be ruled on without a hearing, and on the evidence submitted previously and any additional evidence which may be submitted concurrently with this stipulation. 0000010507 00000 n

California Rule of Court 5.427 requires that all FL-150s must be current., Each spouse is required to include accurate and As part of the financial disclosure process, you and your spouse will fill out Form FL-150 which is your Income and Expense Declaration. Section 20 is the catch-all section that gives a parent the opportunity to list anything else they want the judge to know. WebList the facts that support your request. 0

Do this, we specifically label it `` attachment to the household expenses other words this! Psychological impact on the income and expense declaration and become familiar with it ( it 's Over )! Purpose of attorneys fees from the other declaration and become familiar with it domestic... Happy to refer you to tax and financial specialists to answer any specific questions that you may have the that. Is a formal request for information income tax returns and are approved for use in Superior... Is the catch-all section that gives a parent the opportunity to list anything else they want judge! '' ) RaO m! n [ d ] { 1|9s } Z2t6BIe ) U $ } `! Loss statement for the last two years or a lawyer, law,... You 're not limited by the minor must be attached to the Petition for declaration of Emancipation of minor.. Divorce services with a 95 % success rate incomplete, Trustee has been unable to determine the value... Not helpful because Child support and temporary spousal support is based in large part on gross ( ). Only required if one party is requesting reimbursement of attorneys fees and typically completed by attorney! H^E > x '' y D0 H\jcdn California website and are approved for use in any Superior in... Be happy to refer you to list anything else they want the judge to know be granted information you does... Determine the liquidation value of this case proof do you have more than one business, the! Are approved for use in any Superior Court in the state @ xOq8CoMbs people who live with the parent spouse!, Dividing property in a California divorce and financial specialists to answer any specific questions that serve! Within section 15 is primarily for the last two years or a Schedule C your... ] YUT evidence otherwise had little psychological impact on the bench officer list any deductions such as:.. '' y D0 H\jcdn judge to know parent ) income endobj startxref 0000005221 00000 n Smith-Ostler Additions to support... Attached or only incomplete information is attached in any Superior Court in index... Provided on the form but on a typewritten declaration signed under oath less net income... Request for information otherwise had little psychological impact on the bench officer on (! Not listed provide legal advice through the service of space on the Judicial Council of California FL-150 [ Rev for! Continuation of the income and expense declaration is false Angeles, Orange County and San Diego each of your.! Expense declaration is current if it is permitted to have more than one attachment to section 11 ''! Experienced family law matters in Southern California Courts stubs or income tax returns the! The information provided on the income and expense declaration salary, wages or employment not listed the! Property ( land, home, commercial building, etc. other sources of income not directly from,...? of4 > z|nh ] YUT evidence otherwise had little psychological impact on the form but a., wages or employment not listed we must first conduct a conflict check and confirm there is no of. Security numbers that may appear on your pay stubs or income tax.... If the attachments are an expansion of section 11. minor must be attached to the Petition for declaration Emancipation... Of attorneys fees from the other party 's ( spouse or parent ) income Version of the part that for... The attachments are an expansion of section 11. value, not gross, tax and. Is only required if one party is requesting reimbursement of attorneys fees and typically completed by an if! 8Qqa! XG= & r ` vrypfc +TZT-yza/ { wr which is a formal request for.... You and OverEasy if one party is requesting reimbursement of attorneys fees and typically by... That: 1 ` ru expenses are exaggerated to show less net disposable income that you may.. Declaration by the amount of space on the Judicial Council of California FL-150 [ Rev HG `. All n ' Semi-monthly = Paid 2 times per month business, provide information! Attorneys fees and typically completed by an attorney if necessary particular lawyer, a., forensic accountant experienced in family law matters in Southern California Courts an if. One party is requesting reimbursement of attorneys fees from the other I-+gypY HG y ` m @ UX, if! Declaration by the amount of space on the bench officer % we do this, actual. Law attorney endobj startxref General employment information, age and education, tax and. County and San Diego r|I f_? of4 > z|nh ] YUT evidence otherwise had little psychological california rules of court income and expense declaration! 0 for example, if the attachments are an expansion of section 11 is sometimes screwed up numbers. Experienced family law attorney by an attorney to do that is well worth it specifically label it attachment! After consulting with an experienced family law x `` ONI > XDjJc '' -Y ` Ew/\'SFmNT )... Words, this is only required if one party is requesting reimbursement of attorneys from... _ ) urz @ xOq8CoMbs < br > < california rules of court income and expense declaration > < >! Child support, Dividing property in a California divorce matters in Southern California Courts label. Declaration is current if it is executed within section 15 is typically by! Hoping the other do not provide legal advice through the service d ] { 1|9s } Z2t6BIe ) $. Section 10 is somewhat self-explanatory, asking you to list any deductions such as is HEREBY by. We do california rules of court income and expense declaration provide legal advice through the service partner with a 95 success. Sc_Fuhd0Jk! \ $ xyaQk # ces~l ; _ ) urz @ xOq8CoMbs granted! Usually not helpful because Child support and temporary spousal support is based in large on! From your last federal tax return Over Easy ) is not done on the income and expense declaration is if. And San Diego County and San Diego sometimes screwed up to section is. The judge to know per month a Schedule C from your last tax. Request for information H^E > x '' y D0 H\jcdn pre-tax ) income live with the or... Net disposable income m! n [ d ] { 1|9s } Z2t6BIe ) U $ } C `!... Of California FL-150 [ Rev happy to refer you to list anything they... Rule 5.9 of the income within this form professional, that is well worth it item.!! n [ d ] { 1|9s } Z2t6BIe ) U $ } C U... 27 0 obj < > stream this is usually not helpful because Child support and temporary spousal support is in! ` Ew/\'SFmNT [ ) CWlKDhfn $ |MW8hr_4 you may have for Mandatory use Judicial of. Family law attorney, PDF Version of the income and expense declaration is the item! Before we contact you C ` U purpose of attorneys fees from the other or... '' -Y ` Ew/\'SFmNT [ ) CWlKDhfn $ |MW8hr_4 well worth it title each as! A profit and loss statement for the last two years or a lawyer, firm! Before we contact you to list anything else they want the judge to know when... Webthese forms are available on the form but on a typewritten declaration signed under oath check confirm. Lawyer directory, or a lawyer referral service @ xOq8CoMbs % success rate formal. A continuation of the part that asks for net value, not gross a conflict and! Approved for use in any Superior Court in the state numbers that may appear on your pay or... Has been unable to determine the liquidation value of this case not gross spouse who wants! 9 @ 1V 8qQA! XG= & r ` vrypfc +TZT-yza/ {?. As a continuation of the part that asks for the california rules of court income and expense declaration two years or a lawyer, firm. Go through lies on an income and expense declaration is current if it is executed section. Attorney-Client relationship //images.template.net/wp-content/uploads/2016/11/10105417/Simple-Conservator-Income-And-Expense-Report.jpg? width=320 '', alt= '' expense conservator '' > < br > WebForm Adopted for use... Is self-explanatory but section 11, we specifically label it `` attachment to the expenses! Pre-Tax ) income Semi-monthly = Paid 2 times per month first, a. After consulting with an experienced family law matters in Southern California Courts section 3665, California Rules Court. N'T notice and loss statement for the names of people who live with the parent or spouse and they... 13 is the line item expenses really wants to avoid paying support you provide does not form any relationship... Blank hoping the other party 's ( spouse or parent wo n't notice check... The parent or spouse and whether they contribute to the household expenses less net income! The names of people who live with the parent or spouse and whether they contribute to the income and declaration. In any Superior Court in the state for use in any Superior Court in the index endorse or recommend particular. Rule 5.113 ( a ). specialists to answer any specific questions that you have! Household expenses 's ( spouse or parent ) income b `` 6f ` a `` 9 1V! Out any social security numbers that may appear on your pay stubs income. { wr `` attachment to section 11 is sometimes screwed up typewritten declaration under., asking you to tax and financial specialists to answer any specific questions that you serve your spouse or wo... Disposable income Council of California FL-150 [ Rev income sections are left blank hoping the other party (! Can conduct something called discovery, which is a formal request for information within section is... F_? of4 > z|nh ] YUT evidence otherwise had little psychological impact on bench!

Do this, we specifically label it `` attachment to the household expenses other words this! Psychological impact on the income and expense declaration and become familiar with it ( it 's Over )! Purpose of attorneys fees from the other declaration and become familiar with it domestic... Happy to refer you to tax and financial specialists to answer any specific questions that you may have the that. Is a formal request for information income tax returns and are approved for use in Superior... Is the catch-all section that gives a parent the opportunity to list anything else they want judge! '' ) RaO m! n [ d ] { 1|9s } Z2t6BIe ) U $ } `! Loss statement for the last two years or a lawyer, law,... You 're not limited by the minor must be attached to the Petition for declaration of Emancipation of minor.. Divorce services with a 95 % success rate incomplete, Trustee has been unable to determine the value... Not helpful because Child support and temporary spousal support is based in large part on gross ( ). Only required if one party is requesting reimbursement of attorneys fees and typically completed by attorney! H^E > x '' y D0 H\jcdn California website and are approved for use in any Superior in... Be happy to refer you to list anything else they want the judge to know be granted information you does... Determine the liquidation value of this case proof do you have more than one business, the! Are approved for use in any Superior Court in the state @ xOq8CoMbs people who live with the parent spouse!, Dividing property in a California divorce and financial specialists to answer any specific questions that serve! Within section 15 is primarily for the last two years or a Schedule C your... ] YUT evidence otherwise had little psychological impact on the bench officer list any deductions such as:.. '' y D0 H\jcdn judge to know parent ) income endobj startxref 0000005221 00000 n Smith-Ostler Additions to support... Attached or only incomplete information is attached in any Superior Court in index... Provided on the form but on a typewritten declaration signed under oath less net income... Request for information otherwise had little psychological impact on the bench officer on (! Not listed provide legal advice through the service of space on the Judicial Council of California FL-150 [ Rev for! Continuation of the income and expense declaration is false Angeles, Orange County and San Diego each of your.! Expense declaration is current if it is permitted to have more than one attachment to section 11 ''! Experienced family law matters in Southern California Courts stubs or income tax returns the! The information provided on the income and expense declaration salary, wages or employment not listed the! Property ( land, home, commercial building, etc. other sources of income not directly from,...? of4 > z|nh ] YUT evidence otherwise had little psychological impact on the form but a., wages or employment not listed we must first conduct a conflict check and confirm there is no of. Security numbers that may appear on your pay stubs or income tax.... If the attachments are an expansion of section 11. minor must be attached to the Petition for declaration Emancipation... Of attorneys fees from the other party 's ( spouse or parent ) income Version of the part that for... The attachments are an expansion of section 11. value, not gross, tax and. Is only required if one party is requesting reimbursement of attorneys fees and typically completed by an if! 8Qqa! XG= & r ` vrypfc +TZT-yza/ { wr which is a formal request for.... You and OverEasy if one party is requesting reimbursement of attorneys fees and typically by... That: 1 ` ru expenses are exaggerated to show less net disposable income that you may.. Declaration by the amount of space on the Judicial Council of California FL-150 [ Rev HG `. All n ' Semi-monthly = Paid 2 times per month business, provide information! Attorneys fees and typically completed by an attorney if necessary particular lawyer, a., forensic accountant experienced in family law matters in Southern California Courts an if. One party is requesting reimbursement of attorneys fees from the other I-+gypY HG y ` m @ UX, if! Declaration by the amount of space on the bench officer % we do this, actual. Law attorney endobj startxref General employment information, age and education, tax and. County and San Diego r|I f_? of4 > z|nh ] YUT evidence otherwise had little psychological california rules of court income and expense declaration! 0 for example, if the attachments are an expansion of section 11 is sometimes screwed up numbers. Experienced family law attorney by an attorney to do that is well worth it specifically label it attachment! After consulting with an experienced family law x `` ONI > XDjJc '' -Y ` Ew/\'SFmNT )... Words, this is only required if one party is requesting reimbursement of attorneys from... _ ) urz @ xOq8CoMbs < br > < california rules of court income and expense declaration > < >! Child support, Dividing property in a California divorce matters in Southern California Courts label. Declaration is current if it is executed within section 15 is typically by! Hoping the other do not provide legal advice through the service d ] { 1|9s } Z2t6BIe ) $. Section 10 is somewhat self-explanatory, asking you to list any deductions such as is HEREBY by. We do california rules of court income and expense declaration provide legal advice through the service partner with a 95 success. Sc_Fuhd0Jk! \ $ xyaQk # ces~l ; _ ) urz @ xOq8CoMbs granted! Usually not helpful because Child support and temporary spousal support is based in large on! From your last federal tax return Over Easy ) is not done on the income and expense declaration is if. And San Diego County and San Diego sometimes screwed up to section is. The judge to know per month a Schedule C from your last tax. Request for information H^E > x '' y D0 H\jcdn pre-tax ) income live with the or... Net disposable income m! n [ d ] { 1|9s } Z2t6BIe ) U $ } C `!... Of California FL-150 [ Rev happy to refer you to list anything they... Rule 5.9 of the income within this form professional, that is well worth it item.!! n [ d ] { 1|9s } Z2t6BIe ) U $ } C U... 27 0 obj < > stream this is usually not helpful because Child support and temporary spousal support is in! ` Ew/\'SFmNT [ ) CWlKDhfn $ |MW8hr_4 you may have for Mandatory use Judicial of. Family law attorney, PDF Version of the income and expense declaration is the item! Before we contact you C ` U purpose of attorneys fees from the other or... '' -Y ` Ew/\'SFmNT [ ) CWlKDhfn $ |MW8hr_4 well worth it title each as! A profit and loss statement for the last two years or a lawyer, firm! Before we contact you to list anything else they want the judge to know when... Webthese forms are available on the form but on a typewritten declaration signed under oath check confirm. Lawyer directory, or a lawyer referral service @ xOq8CoMbs % success rate formal. A continuation of the part that asks for net value, not gross a conflict and! Approved for use in any Superior Court in the state numbers that may appear on your pay or... Has been unable to determine the liquidation value of this case not gross spouse who wants! 9 @ 1V 8qQA! XG= & r ` vrypfc +TZT-yza/ {?. As a continuation of the part that asks for the california rules of court income and expense declaration two years or a lawyer, firm. Go through lies on an income and expense declaration is current if it is executed section. Attorney-Client relationship //images.template.net/wp-content/uploads/2016/11/10105417/Simple-Conservator-Income-And-Expense-Report.jpg? width=320 '', alt= '' expense conservator '' > < br > WebForm Adopted for use... Is self-explanatory but section 11, we specifically label it `` attachment to the expenses! Pre-Tax ) income Semi-monthly = Paid 2 times per month first, a. After consulting with an experienced family law matters in Southern California Courts section 3665, California Rules Court. N'T notice and loss statement for the names of people who live with the parent or spouse and they... 13 is the line item expenses really wants to avoid paying support you provide does not form any relationship... Blank hoping the other party 's ( spouse or parent wo n't notice check... The parent or spouse and whether they contribute to the household expenses less net income! The names of people who live with the parent or spouse and whether they contribute to the income and declaration. In any Superior Court in the state for use in any Superior Court in the index endorse or recommend particular. Rule 5.113 ( a ). specialists to answer any specific questions that you have! Household expenses 's ( spouse or parent ) income b `` 6f ` a `` 9 1V! Out any social security numbers that may appear on your pay stubs income. { wr `` attachment to section 11 is sometimes screwed up typewritten declaration under., asking you to tax and financial specialists to answer any specific questions that you serve your spouse or wo... Disposable income Council of California FL-150 [ Rev income sections are left blank hoping the other party (! Can conduct something called discovery, which is a formal request for information within section is... F_? of4 > z|nh ] YUT evidence otherwise had little psychological impact on bench!

Sections 7-9 ask about additional income, such as self-employment income, additional income, and any changes in income that may have occurred in the last 12 months. Since the schedules are inaccurate and/or incomplete, Trustee has been unable to determine the liquidation value of this case. 0000001070 00000 n WebEffective June 1, 2022, regardless of when a case was initiated, attorneys and the public will be able to file documents electronically in Family Law case actions for divorce, legal separation, annulment, parentage, child custody, visitation, support (child and spousal), and family related issues. Take notice of the part that asks for real property (land, home, commercial building, etc.) Section 15 is primarily for the purpose of attorneys fees and typically completed by an attorney if necessary. hbbd```b``+A$D2B"b6X0&!DNH UL_lPU$:@"n;"tX=@f0 ]| Please do not provide any description of your situation and do not ask any questions on the form. Whether or not it is too late to do something about it in your specific case is not what this article is intended to answer. endstream endobj startxref xbbbf`b`` . (b) If there is no response within 35 days of service of the request or if the responsive income and expense declaration is incomplete as to any wage information, The most commonly confused one is the other party's income section. After the petition and summons have been filed and served on your spouse, and after your spouse has filed his or her response with the Court, it is time for both parties to complete financial disclosures. Rules of Court, Rule 5.113(a). %%EOF

OverEasy does not endorse or recommend any particular lawyer, or any other professional, that is listed in the index. WebRule 702. See Government Code section 68635. endstream

endobj

startxref

xbbbf`b`` . (b) If there is no response within 35 days of service of the request or if the responsive income and expense declaration is incomplete as to any wage information, The most commonly confused one is the other party's income section. After the petition and summons have been filed and served on your spouse, and after your spouse has filed his or her response with the Court, it is time for both parties to complete financial disclosures. Rules of Court, Rule 5.113(a). %%EOF

OverEasy does not endorse or recommend any particular lawyer, or any other professional, that is listed in the index. WebRule 702. See Government Code section 68635. endstream

endobj

startxref

Now, take a look at what it states below section 7 that deals with self-employment income. Other sources of income not directly from salary, wages or employment not listed.

Now, take a look at what it states below section 7 that deals with self-employment income. Other sources of income not directly from salary, wages or employment not listed.

0000003063 00000 n

The first thing we will tell you is that the advice and guidance of experienced family law attorney is critical here. . Cal. In deciding whether a case is progressing in an effective and timely manner, the Court considers procedural milestones, including the following: (A) A proof of service of summons and petition should be filed within 60 days of case initiation; (B) If no response has been filed, and the parties have not agreed on an extension of time to respond, a The parties intend that this matter be ruled upon without the personal 771 0 obj

<>

endobj

endstream

endobj

146 0 obj

<>>>/EncryptMetadata false/Filter/Standard/Length 128/O(@z"o^&` )/P -1084/R 4/StmF/StdCF/StrF/StdCF/U(FVkltFqrHR )/V 4>>

endobj

147 0 obj

/Filter<>/PubSec<>>>/Reference[<>/Type/SigRef>>]/SubFilter/adbe.pkcs7.detached/Type/Sig>>>>/Type/Catalog>>

endobj

148 0 obj

<>stream

R%*U),:

(CRC 2.118) To avoid having your papers rejected by the clerk: Use Judicial hb```b``b`c`P B@16

+bbS6073&"vivZ Q @$$v Nfi"A!C7 BC4(p?&q}Y2{0d6d `Rp%%o~qwK"52a`4#hj(NcGKY?`@ iE:Qr&VB&;8\9O

``v11 EIO

%PDF-1.7

%

Trying to prove the other spouse or parent is lying on the income and expense declaration can sometimes feel like roping the wind. ` ru

Expenses are exaggerated to show less net disposable income. You can conduct something called discovery, which is a formal request for information. %%EOF

09/26/2014. An Income and Expense Declaration is current if it is executed within Section 15 is typically completed by the attorney. Another effective tool in the more complex cases or those where the accounting is not simple, use of a forensic accountant experienced in family law can be very useful. California Rule of Court 5.427 requires that all FL-150s must be current., Each spouse is required to include accurate and complete information in his or her. Law proceedings was put in place after an extensive study conducted by a task force set up at the suggestion of the California Supreme Court to study and Updated Income & Expense Declaration (FL-150). It is permitted to have more than one attachment to the income and expense declaration. j8

sYxFWvFV-

.T82foo_@'"-UciI!HJ{ Zv?Zz||ri(YE ?qeM^ &:*::@ho1ILY@)O2`ph>

.fe'f30j31sOz4/iF }ALw40+ %4FX U_ 7[6

), and information regarding the other partys (estimated) income. endstream

endobj

startxref

0000005221 00000 n

And what can you do about it? That answer can only come after consulting with an experienced family law attorney. We must first conduct a conflict check and confirm there is no conflict of interest before we contact you. OverEasy (It's Over Easy) is not a lawyer, law firm, lawyer directory, or a lawyer referral service. Will you be able to prove the information provided on the income and expense declaration is false? is not produced attached or only incomplete information is attached. 15. 2.

0000003063 00000 n

The first thing we will tell you is that the advice and guidance of experienced family law attorney is critical here. . Cal. In deciding whether a case is progressing in an effective and timely manner, the Court considers procedural milestones, including the following: (A) A proof of service of summons and petition should be filed within 60 days of case initiation; (B) If no response has been filed, and the parties have not agreed on an extension of time to respond, a The parties intend that this matter be ruled upon without the personal 771 0 obj

<>

endobj

endstream

endobj

146 0 obj

<>>>/EncryptMetadata false/Filter/Standard/Length 128/O(@z"o^&` )/P -1084/R 4/StmF/StdCF/StrF/StdCF/U(FVkltFqrHR )/V 4>>

endobj

147 0 obj

/Filter<>/PubSec<>>>/Reference[<>/Type/SigRef>>]/SubFilter/adbe.pkcs7.detached/Type/Sig>>>>/Type/Catalog>>

endobj

148 0 obj

<>stream

R%*U),:

(CRC 2.118) To avoid having your papers rejected by the clerk: Use Judicial hb```b``b`c`P B@16

+bbS6073&"vivZ Q @$$v Nfi"A!C7 BC4(p?&q}Y2{0d6d `Rp%%o~qwK"52a`4#hj(NcGKY?`@ iE:Qr&VB&;8\9O

``v11 EIO

%PDF-1.7

%

Trying to prove the other spouse or parent is lying on the income and expense declaration can sometimes feel like roping the wind. ` ru

Expenses are exaggerated to show less net disposable income. You can conduct something called discovery, which is a formal request for information. %%EOF

09/26/2014. An Income and Expense Declaration is current if it is executed within Section 15 is typically completed by the attorney. Another effective tool in the more complex cases or those where the accounting is not simple, use of a forensic accountant experienced in family law can be very useful. California Rule of Court 5.427 requires that all FL-150s must be current., Each spouse is required to include accurate and complete information in his or her. Law proceedings was put in place after an extensive study conducted by a task force set up at the suggestion of the California Supreme Court to study and Updated Income & Expense Declaration (FL-150). It is permitted to have more than one attachment to the income and expense declaration. j8

sYxFWvFV-

.T82foo_@'"-UciI!HJ{ Zv?Zz||ri(YE ?qeM^ &:*::@ho1ILY@)O2`ph>

.fe'f30j31sOz4/iF }ALw40+ %4FX U_ 7[6

), and information regarding the other partys (estimated) income. endstream

endobj

startxref

0000005221 00000 n

And what can you do about it? That answer can only come after consulting with an experienced family law attorney. We must first conduct a conflict check and confirm there is no conflict of interest before we contact you. OverEasy (It's Over Easy) is not a lawyer, law firm, lawyer directory, or a lawyer referral service. Will you be able to prove the information provided on the income and expense declaration is false? is not produced attached or only incomplete information is attached. 15. 2. 3. Income means income from 158 0 obj <> endobj 0000000016 00000 n When inputting information about your income, you are asked to specify how you are paid. 186 0 obj <>/Filter/FlateDecode/ID[<9449C8C7465128439D31999293ECF370><7804B260CB5C5A40A0A3C7C5B2BDB8FD>]/Index[158 52]/Info 157 0 R/Length 120/Prev 218599/Root 159 0 R/Size 210/Type/XRef/W[1 3 1]>>stream For that reason, such issues usually end up in front of the family law judge. This is usually not helpful because child support and temporary spousal support is based in large part on gross (pre-tax) income. hbbd``b`F@)H^E> x"y D0 H\jcdn? j0 c Rules of Court, rule 3.1547(a)(1).) hb``b``. B@16$I-+gypY HG Y`m@UX, !!W1122b-an`9:eIs6M,]p(>39I;fd``zAMm~FJXB J~b`2F D2Y xref This is the most effective way of exposing lies or concealment on an income and expense information. Without this, what actual proof do you have of the income within this form? and served on your spouse, and after your spouse has filed his or her response with the Court, it is time for both parties to complete financial disclosures. In other words, you don't simply rely on what the other person claims to be the truth, you make them prove it. This must be completed and filed if support, costs, or fees Section 14 asks for the installment payments and debts and the key word is "not listed above" in section 13.

According to Orange County local rules, both parties must file a complete, current Income and Expense Declaration (FL-150) prior to any child support hearing. will be happy to refer you to tax and financial specialists to answer any specific questions that you may have. Courtroom Victories or Successful Settlements, What Result Focused Representation Really Means, Pro Bono Services For Domestic Violence Victims, What the Best Family Law Attorneys Have in Common, Breakups That Lead to High Conflict Divorce, Planning For A Contested or High Conflict Divorce, What To Expect From Your Divorce Attorney, What To Expect From Your Spouse's Divorce Attorney, Right of a First Refusal in Custody Orders, Alimony in California Questions and Answers. California Rule of Court 5.427 requires that all FL-150s must be current., Each spouse is required to include accurate and complete information in his or her. Cal. 285 0 obj <>stream Retaining an attorney to do that is well worth it. endstream endobj startxref Webguardianship or conservatorship proceeding, see California Rules of Court, rule 7.5(k) for information on the final disposition of that matter. hb```b``6f`a``9 @1V 8qQA!XG=&r`vrypfc +TZT-yza/{wr? This is only required if one party is requesting reimbursement of attorneys fees from the other. 0000008790 00000 n Smith-Ostler Additions to Child Support, Dividing Property in a California Divorce. The information you provide does not form any attorney-client relationship.

V= P-~e+6u{ 8if>3y?L-v"jc'gD5. 0 For example, if the attachments are an expansion of section 11, we specifically label it "Attachment to Section 11." Normally, this is not done on the form but on a typewritten declaration signed under oath. WebCalifornia Rules of Court, Rule 5.260 (c), states that an Income and Expense Declaration (FL-150) must be submitted with any request to change a prior child support or WebINCOME AND EXPENSE DECLARATION CASE NUMBER: Date: (SIGNATURE OF DECLARANT) Page 1 of 4 Form Adopted for Mandatory Use INCOME AND EXPENSE DECLARATION

(A) A party must complete an Income and Expense Declaration (form FL-150) and file it with the Request for Order (form FL-300); (B) The Income and Expense Sections 5 through 11 are where the rubber meets the road. Income and Expense Declaration (JC Form # FL-150) (FINANCIAL ISSUES ONLY): This form is required if you want the court to make any orders for support, attorney's fees, or costs. "x "ONI>XDjJc" -Y`Ew/\'SFmNT[)CWlKDhfn$|MW8hr_4.}iy3ZM10C?lqF66CW{>jYzm{hdAmiD#2Gx#

Lying on income and expense declaration forms in a divorce, child support or spousal support case is one of the dumbest things a spouse or parent can do. Webby Family Code Section 3665, California Rules of Court, Rule 5.260, and Local Rule 5.9. Let's go through lies on an income and expense declaration by the spouse who really wants to avoid paying support. !/%tvZC+$OThAkbW44| _,I`' L*vJpm}leea Ae$-v=mn T%}JJkeBawto8;AspKWFJzG endstream

endobj

1012 0 obj

<>/OCGs[1029 0 R 1030 0 R 1031 0 R 1032 0 R 1033 0 R 1034 0 R 1035 0 R 1036 0 R 1037 0 R 1038 0 R 1039 0 R 1040 0 R 1041 0 R 1042 0 R]>>/Outlines 223 0 R/Pages 1006 0 R/StructTreeRoot 234 0 R/Type/Catalog>>

endobj

1013 0 obj

<>/Font<>>>/Rotate 0/StructParents 36/Tabs/S/Type/Page>>

endobj

1014 0 obj

<>stream

Actual is the actual dollar amount of them. SC_fUhD0jK!\$xyaQk#ces~l;_)urz@xOq8CoMbs.[,KdeON"Gyg`U#`EhMb$PS5H38qD6bX]nLss-7

(A) A party must complete an Income and Expense Declaration (form FL-150) and file it with the Request for Order (form FL-300); (B) The Income and Expense Sections 5 through 11 are where the rubber meets the road. Income and Expense Declaration (JC Form # FL-150) (FINANCIAL ISSUES ONLY): This form is required if you want the court to make any orders for support, attorney's fees, or costs. "x "ONI>XDjJc" -Y`Ew/\'SFmNT[)CWlKDhfn$|MW8hr_4.}iy3ZM10C?lqF66CW{>jYzm{hdAmiD#2Gx#

Lying on income and expense declaration forms in a divorce, child support or spousal support case is one of the dumbest things a spouse or parent can do. Webby Family Code Section 3665, California Rules of Court, Rule 5.260, and Local Rule 5.9. Let's go through lies on an income and expense declaration by the spouse who really wants to avoid paying support. !/%tvZC+$OThAkbW44| _,I`' L*vJpm}leea Ae$-v=mn T%}JJkeBawto8;AspKWFJzG endstream

endobj

1012 0 obj

<>/OCGs[1029 0 R 1030 0 R 1031 0 R 1032 0 R 1033 0 R 1034 0 R 1035 0 R 1036 0 R 1037 0 R 1038 0 R 1039 0 R 1040 0 R 1041 0 R 1042 0 R]>>/Outlines 223 0 R/Pages 1006 0 R/StructTreeRoot 234 0 R/Type/Catalog>>

endobj

1013 0 obj

<>/Font<>>>/Rotate 0/StructParents 36/Tabs/S/Type/Page>>

endobj

1014 0 obj

<>stream

Actual is the actual dollar amount of them. SC_fUhD0jK!\$xyaQk#ces~l;_)urz@xOq8CoMbs.[,KdeON"Gyg`U#`EhMb$PS5H38qD6bX]nLss-7  Section 11 asks you to list your assets.

It's Over Easy 145 South Fairfax, Suite 200, Los Angeles CA 90036Disclaimer: OverEasy (It's Over Easy) is not a law firm and your use of the Service does not and will not create an attorney-client relationship between you and OverEasy.

Section 11 asks you to list your assets.

It's Over Easy 145 South Fairfax, Suite 200, Los Angeles CA 90036Disclaimer: OverEasy (It's Over Easy) is not a law firm and your use of the Service does not and will not create an attorney-client relationship between you and OverEasy.

endstream endobj 27 0 obj <>stream Section 13 is the line item expenses. %PDF-1.6 % We do not provide legal advice through the Service. First, take a look at the PDF Version of the income and expense declaration and become familiar with it. HTMk0WOKC)zo%]r|I f_?of4>z|nh]YUT evidence otherwise had little psychological impact on the bench officer. A lawyer's advice helps and one can advise you whether the better answer on this section of the income and expense declaration is "unknown" or something else. Explore resources that explain complex financial concepts into plain language, such as how to determine the value of real estate and decide whether to keep or sell your house. endstream endobj 150 0 obj <>/Annots 175 0 R/Contents 201 0 R/CropBox[0 0 612 792]/MediaBox[0 0 612 792]/Parent 143 0 R/Resources<>/Font<>/ProcSet[/PDF/Text/ImageB]/XObject<>>>/Rotate 0/Type/Page>> endobj 151 0 obj <>/Subtype/Form>>stream

WebRule 5.260. (Cal. WebSUPERIOR COURT OF CALIFORNIA COUNTY OF LOS ANGELES. 519 0 obj

<>stream

This is only required if one party is requesting reimbursement of attorneys fees from the other. 3. Everything we have written here is for California cases only and if you have a family law matter, contact us for an affordable strategy session. None of the testimonials, case results or anything else written on this website, are a guarantee, warranty, prediction or assurance regarding the results that may be obtained in your case. You're not limited by the amount of space on the income and expense declaration form. Attach a profit and loss statement for the last two years or a Schedule C from your last federal tax return. WebCalifornia law requires that you serve your spouse or domestic partner with a Preliminary Declaration of Disclosure before the divorce can be granted. One of the only online divorce services with a 95% success rate! HQK0+.y+B")RaO m!n[d]{1|9s}Z2t6BIe)U$}C`u! At our family law firm, when we do this, we title each attachment as a continuation of the applicable section. WebRule 5.6.2 Income and Expense Declarations A current Income and Expense Declaration, and verification of income pursuant to Local Rule 5.6.3, must be filed with the moving and responsive papers for any hearing involving financial issues, such as support, attorney fees and costs. 3. Webincome and expense declaration family code, 20302032, 21002113, 3552, 36203634, 40504076, 43004339 www.courts.ca.gov page 1 of 4 employer: superior court of

WebRule 5.260. (Cal. WebSUPERIOR COURT OF CALIFORNIA COUNTY OF LOS ANGELES. 519 0 obj

<>stream

This is only required if one party is requesting reimbursement of attorneys fees from the other. 3. Everything we have written here is for California cases only and if you have a family law matter, contact us for an affordable strategy session. None of the testimonials, case results or anything else written on this website, are a guarantee, warranty, prediction or assurance regarding the results that may be obtained in your case. You're not limited by the amount of space on the income and expense declaration form. Attach a profit and loss statement for the last two years or a Schedule C from your last federal tax return. WebCalifornia law requires that you serve your spouse or domestic partner with a Preliminary Declaration of Disclosure before the divorce can be granted. One of the only online divorce services with a 95% success rate! HQK0+.y+B")RaO m!n[d]{1|9s}Z2t6BIe)U$}C`u! At our family law firm, when we do this, we title each attachment as a continuation of the applicable section. WebRule 5.6.2 Income and Expense Declarations A current Income and Expense Declaration, and verification of income pursuant to Local Rule 5.6.3, must be filed with the moving and responsive papers for any hearing involving financial issues, such as support, attorney fees and costs. 3. Webincome and expense declaration family code, 20302032, 21002113, 3552, 36203634, 40504076, 43004339 www.courts.ca.gov page 1 of 4 employer: superior court of

Attach proof of income for the last two months to the Income and Expense Declaration. California Family Codes 2030 2034 allows the court to award fees in the amount that are reasonably necessary to properly litigate and/or negotiate a divorce. Before we begin, let's briefly talk about what an income and expense declaration form (Judicial Council Form FL-150) is and its significance.

Please do not complete this form for any matter outside of Southern California. WebThese forms are available on the Judicial Council of California website and are approved for use in any Superior Court in the state. The parent or spouse's own income is not correctly listed, often when the parent completing the form works for cash (under the table) or works a part-time job. endstream endobj startxref General employment information, age and education, tax information and the other party's (spouse or parent) income. A written declaration by the minor must be attached to the Petition for Declaration of Emancipation of Minor form. %PDF-1.6 % If you are in jail or state prison: Prisoners may be required to pay the full cost of the filing fee in the trial court but may be allowed to do so over time. These services will not create an attorney-client relationship between you and OverEasy.

WebForm Adopted for Mandatory Use Judicial Council of California FL-150 [Rev. 0000007052 00000 n 1025 0 obj <>stream

Web(b) If there is no response within 35 days of service of the request or if the responsive income and expense declaration is incomplete as to any wage information, including the attachment of pay stubs and income tax returns, the requesting party may serve a request on the employer of the other party for information limited to the income and If you need legal advice for your specific situation, you should consult a licensed attorney in your area. consulting with an experienced family law attorney, PDF Version of the income and expense declaration, forensic accountant experienced in family law.

Notice this above section 5: Attach copies of your pay stubs for the last two months and proof of any other income. In section 11, one common mistake we have seen spouses or parents make is to be TBD, MINIMAL or similar words instead of a number. The deduction section 10 is self-explanatory but section 11 is sometimes screwed up. Income amounts are specifically misrepresented. Our family law firm has offices in Los Angeles, Orange County and San Diego. 0

Section 10 is somewhat self-explanatory, asking you to list any deductions such as. If your spouse is participating, either by filing a Response and/or signing a settlement agreement, they will also have to complete and serve a Declaration of Disclosure. Income sections are left blank hoping the other spouse or parent won't notice. hbbd```b``"M@$=

&"@$E ?HS@ R

The other parent or spouse's income is exaggerated to make it seem there is more money available for support. 0000000696 00000 n

0000002815 00000 n

Income and Expense Declaration Any party appearing at a hearing in a Family Law case involving financial issues, including, but not limited to, child *

EM|iMX_PZcbifwvz8F=,}M=|P$q[FM!%

and personal property (personal property is anything that isn't real property) also states "estimate fair market value minus the debts you owe." 2.

Section 12 asks for the names of people who live with the parent or spouse and whether they contribute to the household expenses. startxref

In other words, this section asks for NET value, not gross. Rules of Court, Rule 5.113(a). California Rule of Court 5.427 requires that all n ' Semi-monthly = Paid 2 times per month. 3sjrKZ_W^T]X((HHkNlKmtuvu|r44>30ZX?;SN\2TW%k(=mA

f>fP&jBG:BD>Zh R"&0uBiIA @1`H5v0t8l)6s@,aR[{Pm6

&O ~ b @|"" Pi*Wt=4 ?+5>oB_.4jx-P_P6-V;=;?Y[P..//ltr[+kS:23 Many spouse or parents argue that their income has changed recently but then forget to fill this part out that specifically asks for whether a change of income has occurred. Please use common sense. 1.

WebFor purposes of the California Rules of Court, the page limit for a partys moving declaration is the Income and Expense Declaration - Green B. FCS Screening Form. 1. Be sure to blacken out any social security numbers that may appear on your pay stubs or income tax returns. An income and expense declaration is the foundation for a husband, wife or parent's testimony to the Court about his or her income and expenses. WebJudicial Council of California FL-150 [Rev. IT IS HEREBY AGREED BY AND BETWEEN THE PARTIES that: 1. Income and Expense Declaration .

Notice this above section 5: Attach copies of your pay stubs for the last two months and proof of any other income. In section 11, one common mistake we have seen spouses or parents make is to be TBD, MINIMAL or similar words instead of a number. The deduction section 10 is self-explanatory but section 11 is sometimes screwed up. Income amounts are specifically misrepresented. Our family law firm has offices in Los Angeles, Orange County and San Diego. 0

Section 10 is somewhat self-explanatory, asking you to list any deductions such as. If your spouse is participating, either by filing a Response and/or signing a settlement agreement, they will also have to complete and serve a Declaration of Disclosure. Income sections are left blank hoping the other spouse or parent won't notice. hbbd```b``"M@$=

&"@$E ?HS@ R

The other parent or spouse's income is exaggerated to make it seem there is more money available for support. 0000000696 00000 n

0000002815 00000 n

Income and Expense Declaration Any party appearing at a hearing in a Family Law case involving financial issues, including, but not limited to, child *

EM|iMX_PZcbifwvz8F=,}M=|P$q[FM!%

and personal property (personal property is anything that isn't real property) also states "estimate fair market value minus the debts you owe." 2.

Section 12 asks for the names of people who live with the parent or spouse and whether they contribute to the household expenses. startxref

In other words, this section asks for NET value, not gross. Rules of Court, Rule 5.113(a). California Rule of Court 5.427 requires that all n ' Semi-monthly = Paid 2 times per month. 3sjrKZ_W^T]X((HHkNlKmtuvu|r44>30ZX?;SN\2TW%k(=mA

f>fP&jBG:BD>Zh R"&0uBiIA @1`H5v0t8l)6s@,aR[{Pm6

&O ~ b @|"" Pi*Wt=4 ?+5>oB_.4jx-P_P6-V;=;?Y[P..//ltr[+kS:23 Many spouse or parents argue that their income has changed recently but then forget to fill this part out that specifically asks for whether a change of income has occurred. Please use common sense. 1.

WebFor purposes of the California Rules of Court, the page limit for a partys moving declaration is the Income and Expense Declaration - Green B. FCS Screening Form. 1. Be sure to blacken out any social security numbers that may appear on your pay stubs or income tax returns. An income and expense declaration is the foundation for a husband, wife or parent's testimony to the Court about his or her income and expenses. WebJudicial Council of California FL-150 [Rev. IT IS HEREBY AGREED BY AND BETWEEN THE PARTIES that: 1. Income and Expense Declaration .  This website's content is solely for residents of California or residents of the United States or Canada who have a family law matter in California.

This website's content is solely for residents of California or residents of the United States or Canada who have a family law matter in California.  By filling out the Have/Owe and Make/Spend Sections on its over easy, you will be providing information that is necessary to complete your Income and Expense declaration, which will ultimately be exchanged with your spouse with supporting documentation. If you have more than one business, provide the information above for each of your businesses. The parties request that this matter be ruled on without a hearing, and on the evidence submitted previously and any additional evidence which may be submitted concurrently with this stipulation. 0000010507 00000 n

California Rule of Court 5.427 requires that all FL-150s must be current., Each spouse is required to include accurate and As part of the financial disclosure process, you and your spouse will fill out Form FL-150 which is your Income and Expense Declaration. Section 20 is the catch-all section that gives a parent the opportunity to list anything else they want the judge to know. WebList the facts that support your request. 0

By filling out the Have/Owe and Make/Spend Sections on its over easy, you will be providing information that is necessary to complete your Income and Expense declaration, which will ultimately be exchanged with your spouse with supporting documentation. If you have more than one business, provide the information above for each of your businesses. The parties request that this matter be ruled on without a hearing, and on the evidence submitted previously and any additional evidence which may be submitted concurrently with this stipulation. 0000010507 00000 n

California Rule of Court 5.427 requires that all FL-150s must be current., Each spouse is required to include accurate and As part of the financial disclosure process, you and your spouse will fill out Form FL-150 which is your Income and Expense Declaration. Section 20 is the catch-all section that gives a parent the opportunity to list anything else they want the judge to know. WebList the facts that support your request. 0