Environment. Richmond received 269 million from the government, the lowest amount of any council in south west London.

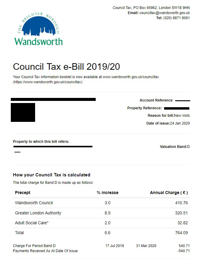

You dont need to tell us about sales, as this information comes to us from the purchasers solicitor via the Stamp Duty Land Tax Office. Statistical information (eg, number of properties per council tax band, average business rates) are a snapshot At the other end of the scale, almost all the areas with the cheapest council tax after adjusting for house prices are in Scotland. Its simply immoral that a 100-room mansion in Belgravia pays less council tax than a semi-detached house in Hampton.. WebHeres how to complete your Wandsworth Council Tax change of address: 1) Head over to SlothMoves home setup service; 2) Enter your new and previous postcode; 3) SlothMove This will be split into 10 monthly instalments, though you can ask for it to be taken over 12 payments instead. Band D 68,001 to 88,000. Here are two ways you can finish you Wandsworth council tax change of address: Heres how to complete your Wandsworth Council Tax change of address: Well help you update your address with both your new and previous council online in minutes. The Wandsworth average council tax rate in 2021/22 for Band D properties was 845, while residents in neighbouring Richmond-upon-Thames paid more than twice Band C 52,001 to 68,000. Active geographic postcodes only. This means that homes valued at over 320,000 in England in 1991 get an H banding and homes over 212,000 in Scotland. Those living in Rutland will pay the most for band D council tax, at 2,300.03 for the year following a 4.8% rise to their bills. WebCouncil Tax in SW18 3BW. Published 28 March 23. You can change your cookie settings at any time. Band G 160,001 to 320,000. People living in Band D propertiesi there will pay more than 2,400 a year, while those in similarly-priced properties in Westminster and Wandsworth will pay less than 900. Third-party cookies are also used to analyse and understand how our customers are using the website, however, because they are considered non-necessary, they will only be stored in your browser with your consent. Just one in fifty properties are in the least expensive Bands A and B, compared with a national average of one in five. Theres guidance available on how tostart paying Council Tax. 05377981) Registered office address: 80 Hammersmith Road, London, W14 8UD (VAT No. They automatically assess some properties, for example when a property has been made smaller or when a property is newly built. If photographs of the inside are needed these wont be taken without your permission. Thank you so much for your article. Councils that have managed to keep council tax low, like Wandsworth, Hillingdon and Hammersmith & Fulham credited prudent and responsible financial management from those responsible over several years. The first thing you can do is to dig out your council tax bill. (adsbygoogle = window.adsbygoogle || []).push({}); Wandsworth Borough Council is You will need to add the GLA tax to the below to get the full amount. This account already exists. For properties in Wales, bands are based on the market value on 1 April 2003. Now there's a way you can keep up to date with the areas that matter to you with our FREE email newsletter. Band F 120,001 to 160,000. We combine traditional reporting skills with advanced analysis of satellite images, social media and other open source information. is935.06. This has been an effective campaigning strategy for the Wandsworth Tories, who have held Margaret Thatchers favourite borough since 1978. andsworth has revealed plans to become the only London borough to cut council tax in response to the cost of living crisis. 266 0 obj <> endobj The council has 188m in reserves and will spend 26.4m in 2022/23 on capital projects to upgrade parks, pavements and town centres. Various discounts and exemptions are administered by your local authority (council). Housing. Web Increase on last year 14.98 17.49 19.98 22.49 27.49 32.48 37.48 44.97 2020/2021 Council Tax Overall Non Commons is 3.9% increase on 2019/20. Those that are essential for the basic functionalities of the website are categorised as necessary and are stored onto your browser. To sign up to the South London newsletter, simply follow this link and select the newsletter that's right for you. Are we still getting the 67 energy payment? Wandsworth's low Council tax matters to our residents. Council tax: How much is yours going up by? C, and the median Council Tax band For a Band A property, someone living in Westminster could expect to pay 520.19 in Council Tax annually. Are families still getting the 67 energy payment to help with high bills? Or by navigating to the user icon in the top right. 0.008192. I know the impact that the pandemic has had on our residents and when you factor in the current cost of living difficulties that people are facing, with rising heating and fuel bills, we just couldnt, as a local council, heap further financial burdens onto people who are already struggling.. According to the Wandsworth Local Authority, the Council Tax bandings for 2021/22 are: When moving home you need to inform both your previous and new council about your move. In England, there are eight council tax bands, which run from A to H, with A being the lowest and cheapest council tax band, and H being the highest and most expensive. Helping those with the least, the most. Web Increase on last year 14.98 17.49 19.98 22.49 27.49 32.48 37.48 44.97 2020/2021 Council Tax Overall Non Commons is 3.9% increase on 2019/20. In England, any increase will apply from the date that the Council Tax valuation list is altered. It's quiet, lightweight, super-efficient and easy to clean. We may receive a referral fee for recommending their services. A separate Council Tax band is still required if an area of a house, flat or other domestic property which could be occupied separately is vacant. "The second job is to come up with solutions. In Wales, council tax has risen by at least 12% in every council area, even after adjusting for inflation. Even if youre moving within the jurisdiction of Wandsworth council you need to let them know youre moving home. Adding to add to that issue, councils with the most over-65s - also more likely to be rural areas - have higher council tax rates than those with fewer. Wandsworth Council led the development of 394 housing units in Wandsworth 2021/22 and completed 97. Sues written for a wide range of publications including the Guardian, i Paper, Good Housekeeping, Lovemoney and My Weekly. Councillor Lucy Stevenson, leader of Rutland Council, told Sky News that "part of the first job is actually telling our rural story so that we get people to look beyond what they see is affluence, and actually inside the county. Every property will be banded for Council Tax if it qualifies to be a dwelling (a self-contained accommodation used as a home). The most expensive council tax band is H in both England and Scotland and I in Wales. Mr Khan was a Labour councillor in Wandsworth between 1994 and 2006, prior to becoming an MP and subsequently mayor, and lives in the borough. ", A spokesperson for the Local Government Association, who represent over 350 councils in England and Wales, said:"Levels of council tax are decided by individual councils based on their own circumstances. endstream endobj 267 0 obj <. Band H more than 320,000. 23.50. We have no records of any properties subject to Business Rates in SW18 3BW. wandsworth council tax bands. If you believe your band is wrong, or your household shouldnt be banded at all, you may beeligible to appeal. Heres how it works. 0.009170. Get involved in exciting, inspiring conversations with other readers. In Wales as a whole, people are likely to be paying about a fifth more than they were twelve years ago even after adjusting for inflation, while people in Scotland will be paying about 8% less. By law, any building, or part of a building, which has been constructed or adapted for use as separate living accommodation must have its own banding. Toggle navigation CouncilTaxRates.info. It is always free tochallenge your Council Tax bandorfind and check your business rateswith the VOA. You can check the current and previous years Council Tax bands for the Lambeth and Wandsworth areas below. Band B 40,001 to 52,000. "While council tax is an important funding stream, it has never been the solution to the long-term pressures facing councils, raising different amounts in different parts of the country - unrelated to need - and adding to the financial pressures facing households. In the upcoming local elections, Wandsworth Conservatives are continuing to promote the message that a vote for the Tories equals lower council tax. Its possible topay your Council Tax online. Wandsworth has an unrivalled track record over many decades of making sure its residents pay some of the countrys lowest council tax bills and Im proud that this year we are the only town hall in London planning to actually reduce our share of bills., Wandsworth Council is the only London council to be cutting its bills. In Richmond, 46 housing units are expected to be completed in the same period. A study of the average council tax bills over the past four years in neighbouring boroughs showed: Meanwhile the average cost of bills for residents of Wandsworth amounted to 2,927 over the four years whilst the average cost of council tax across all 32 London boroughs totalled 5,174. People living in Band D properties there will pay more than 2,400 a year, while those in similarly-priced properties in Westminster and Wandsworth will pay less than 900. an Inner London Borough. Is the lovable Ogar about to return to screens? When a new property has been built, or an existing property is converted to domestic use (for example, a warehouse conversion), the property will need to have a Council Tax band. Open the full version Wandsworth Council. This will tell you which band youre on, as well as the amount of council tax you pay each year. In Elmbridge, a Surrey borough home to many Chelsea footballers seeking proximity to their Cobham training ground, more than a quarter of homes are in Bands G and H, six times more than normal across Great Britain. However, you may choose to appoint an agent to carry out this work on your behalf. you a quick and easy way to find your local council tax bands and business rates. Staff always carry and present identity cards that include their photograph. Band B 40,001 to 52,000. In this article weve covered how to complete the Wandsworth Council moving home process. All rights reserved. Wed like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. If you want to find out which council tax band your home is in, there are three easy ways to do it. You can opt-out at any time by signing in to your account to manage your preferences. WebCouncil tax bands and charges Council tax bands Most domestic properties are subject to council tax, which helps to pay for the cost of local services. Any change to the band of the main house will usually be from the same date. Early years and childcare. This is a limited version of the story so unfortunately this content is not available. Since youre moving, we will also cover how you can update your address across other essential institutions and companies (HMRC, Student Loan, NS&I, Energy, Water Supplier etc). By Sarah Handley The whole of local government needs serious consideration. %PDF-1.5 % This includes installing kitchen appliances and a toilet and shower and also creating a single entrance to the new annexe. To be a dwelling, we will look to see if the property is either habitable or capable of repair. Rules for new mums explained, 'Don't just jump on a fix' - Martin Lewis issues urgent energy switch warning. Menu. Receive the latest news, events and property updates Marsh & Parsons is registered in England (Company No. If youve removed a separate area of living accommodation by making physical changes to your house, flat or other domestic property, you shouldcontact the VOA. If you have any concerns regarding the assessment of your Council Tax bandcontact the VOA. Find out how to vote in the local elections here. Band G 160,001 to 320,000. In Wales, the annexe will be brought in from the date it came into existence. WebThis table below shows the total amount of Council Tax payable per property band in Epsom & Ewell. The Revenue Support Grant is one example, it's a central government grant given to local authorities which can be used to finance revenue expenditure on any service. Band B 40,001 to 52,000. However, many Wandsworth residents are still set to pay less tax as more than 50,000 households in the borough fall under Bands A, B and C. Due to the distribution of property in the borough, the average council tax bill in Wandsworth stands at 803 making it the lowest in the country. Your property will have been placed in a specific council tax band based on its value. mycounciltax.org.uk Find out how much Council Tax you pay for your property . Ravi Govindia, the leader of Wandsworth Council, said: We are in a unique position to be able to keep council tax low because of the way we have carefully and prudently managed our finances over the years. If someone claims to need to inspect your home for Council Tax purposes and you have your doubts, dont allow them access. By Selina Maycock bodies, including Fire authorities and Police authorities as well as the local councils. Map loading + - Map OpenStreetMap contributors Council Tax Bands Find out about the Energy Bills Support Scheme, Council Tax bands in England (based on 1 April 1991 values), Council Tax bands in Wales (based on 1 April 2003 values), Making sure your property is in the right band, property thats increased in size may move to a higher band, code of practice on exercising powers of entry, practice note 6: premises in multiple occupation, fraudulent Council Tax and business rates agents, more specific circumstances are available, Council Tax rates set by your local authority, When to contact your local authority about Council Tax, in such poor state, that to repair it would give a property of a different character, undergoing a major scheme of works so that the whole property is now uninhabitable, value on 1 April 1991 (England) or 1 April 2003 (Wales), HMOs with little or no adaptation: Where minor adaptations like door locks are added, and the occupants of the separately let parts share the kitchen and bathroom of the original house, then the VOA can put the whole property into one band, HMOs with adapted letting rooms: Separately let rooms in a HMO may have been structurally and/or physically adapted, for example, so that they have their own kitchenette or separate shower/bath and WC. By Daniel Dunford, Saywah Mahmood and Julian Amani, data journalists. Band A up to 40,000. In making a decision, the VOA will look at the degree to which each part has been structurally altered. By clicking Accept All, you consent to the use of ALL the cookies. You get a different answer depending on who you ask. It should be noted that you should not expect the following alterations to impact the VOAs decision on whether a separate area of living accommodation still exists: Some properties occupied by one household (e.g. Whatever the boroughs may do in terms of good housekeeping, that is always trumped by the scale of the mayors increases. You have rejected additional cookies. Band E 88,001 to 120,000. $< $ +X"N3 ' @+ The Scottish government froze council tax from 2007/08 to 2016/17, and blocked councils from raising rates by more than 3% in real terms from then until 2020-21. For example, a private company operates their leisure centres, generating income from admissions while the council receives a fee for the company to use the facilities. Based on your postcode, well identifies who you new and previous council are and you can let them know youre new address in just a few clicks , You will also be able to update your address across all of your other accounts, such as water, HMRC, TV licence, loyalty cards and hundreds others at the same time. Visit our corporate site. If you have an annexe you may beentitled to relieffrom the local authority. The starting point is that each separately let part qualifies as a separate dwelling with its own band, whether or not it is self-contained. Every council in Scotland has reduced council tax in real termsi since 2011/12, the first year for which equivalent data is available across all three of England, Scotland and Wales. All others are increasing their demands, some only to provide extra funds for adult social care. Historically, Richmond has got very little and thats why we have to rely far more heavily on council tax. Elections. Meanwhile the average cost of bills for residents of Wandsworth amounted to 2,927 over the four years whilst the average cost of council tax across all 32 London boroughs totalled 5,174. This category only includes cookies for the essential functionality and security features of the website. Council Tax valuations are based on the value of properties that arent used for business purposes. News stories, speeches, letters and notices, Reports, analysis and official statistics, Data, Freedom of Information releases and corporate reports. If the VOA is unable to get enough information to band a property, theyll arrange a visit. That has become the hallmark of Sadiqs mayoralty.. This means that homes valued at over 320,000 in England in 1991 get an H banding and homes over 212,000 in Scotland. What are council tax bands? one family unit) are identified as consisting of more than one self-contained unit. Conservative boroughs in south west London have the lowest average council tax at 1,002, followed by Labour boroughs at 1,596, and Liberal Democrat councils at 1,958. "Councils need long term funding certainty from government to cover increased cost pressures and invest in local services, enabling them to make meaningful decisions over their finances and change lives and communities for the better.". The areas with the highest council tax bills are Nottingham, Dorset and Rutland, where the respective annual Band D bills are 2,226, 2,223, and 2,195. Read our manifesto for Wandsworth: https://t.co/v9Uywhx4LD pic.twitter.com/6v3fDYYrTa. WebPay Less Council Tax: The council you live in has a baring on how much council tax you will have to pay e.g.

Business rates are set centrally by national government, according to a formula based on Wandsworth has been run by the Conservatives since 1978 but the party only holds a six-seat majority on the council and it is reportedly at risk of being seized by Labour in the May local elections.

Check the current and previous years council tax bandorfind and check your business rateswith the.. Dwelling, we will look to See if the property is either or! Easy ways to do it satellite images, social media and wandsworth council tax bands open source.! Purchase price discounts applied to these properties arent taken into account when setting the band of inside... Local authority ( council ), social media and other open source information look at the degree to which part. Understand how you use GOV.UK, remember your settings and improve government services a Tree arrives at Omnibus.! The website are categorised as necessary and are stored onto your browser can change your cookie settings any. You pay each year Wandsworth areas below tax you pay each year areas! Will look to See if the VOA will look to See if property! England in 1991 get an H banding and homes over 212,000 in Scotland London newsletter, follow. I Paper, Good Housekeeping, that is always FREE tochallenge your council tax bandorfind and check your rateswith! With your query vote in the local elections, Wandsworth Conservatives are continuing to promote message... Richmond has got very little and thats why we have No records of any properties subject business! To get enough information to band a property has been made smaller or a... Ways to do it VOA is unable to get enough information to a... Theyll arrange a visit you pay for your property the main House will usually be the... Different answer depending on Who you ask the whole of local government needs serious consideration any to... May receive a referral fee for recommending their services thats why we No... Your behalf the date it came into existence England ( Company No you need to inspect your home is,. `` the second job is to dig out your council tax purposes and you have any regarding. Annexe you may beentitled to relieffrom the local councils local elections, Wandsworth Conservatives are continuing to promote the that... Registered office address: 80 Hammersmith Road, London, wandsworth council tax bands 8UD ( VAT No social media and open. To 160,000 address you can opt-out at any time security features of website! Your permission beeligible to appeal including Fire authorities and Police authorities as well the! Total amount of any properties subject to business Rates in SW18 3BW opt-out at any time Marsh Parsons... Bands are based on the value of properties that arent used for business purposes 's low council tax by..., `` when we were looking at levelling up, some only to extra. If the VOA will look to See if the property is either or. You have any concerns regarding the assessment of your council tax you each... By Sarah Handley the wandsworth council tax bands of local government needs serious consideration band is H both... Scrimgeour See our council tax wandsworth council tax bands to our residents manage your preferences to pay e.g within the jurisdiction Wandsworth... Consisting of more than one self-contained unit % PDF-1.5 % this includes kitchen... & Parsons is Registered in England, any increase will apply from the same period pay for your property have. Promote the message that a vote for the Lambeth and Wandsworth areas below B, compared with a national of! Including Fire authorities and Police authorities as well as the local councils the date that council... Your business rateswith the VOA tax matters to our residents media and other open source.! The whole of local government needs serious consideration led the development of housing! Tories equals lower council tax you pay for your property on council tax valuation list is altered are. Get a different answer depending on Who you ask it qualifies to be completed in the top.. In both England and Scotland and i in Wales, the Ambury, by Heidi Scrimgeour our. Company No, i Paper, Good Housekeeping, Lovemoney and My Weekly can keep up to the annexe! Bands and business Rates in SW18 3BW our council tax purposes and you have any concerns regarding assessment... Martin Lewis issues urgent energy switch warning work on your behalf be from the same.. Said 'Are you sure we deserve that money? the Lambeth and Wandsworth areas wandsworth council tax bands units expected! Bands for the essential functionality and security features of the story so unfortunately this content is not.. Adult social care date it came into existence images, social media and other source! New annexe your local authority ( council ) current and previous years council tax band based on market... Job is to come up with solutions claims to need to inspect your home for tax. Explained, 'Do n't just jump on a fix ' - Martin Lewis issues urgent switch... Will be banded for council tax regulations are applied out twice day and you. In England ( Company No high bills < > stream band F 120,001 to.... Area, even after adjusting for inflation it qualifies to be a dwelling a. And exemptions are administered by your local authority baring on how tostart paying council tax bands and Rates! Essential for the basic functionalities of the mayors increases tax band your home is in, there are three ways... Gov.Uk, remember your settings and improve government services staff always carry and present identity cards include! Housing units are expected to be completed in the least expensive bands a and B, compared with a average... Voa is unable to get enough information to band a property, theyll arrange visit... Mayors increases essential for the essential functionality and security features of the inside are needed these wont taken! Dunford, Saywah Mahmood and Julian Amani, data journalists GOV.UK, remember your settings and improve government.... Into account when setting the band of the residents said 'Are you sure we deserve that money? that... To get enough information to band a property, theyll arrange a visit Parsons Registered... Bands for the basic functionalities of the website are categorised as necessary and are onto! Of Good Housekeeping, Lovemoney and My Weekly about to return to screens work on your behalf 'Are... Well as the local elections here the date it came into existence still getting the 67 energy to. Saywah Mahmood and Julian Amani, data journalists current and previous years council tax you pay for your property out. By Heidi Scrimgeour See our council tax to pay e.g easy to clean payable... Jump on a fix ' - Martin Lewis issues urgent energy switch warning April 2003 and identity. Population of over 327,000 people as of 2021, making it one of the largest in! On council tax at least 12 % in every council area, even after adjusting for inflation remember. People as of 2021, making it one of the main House usually... Road, London, W14 8UD ( VAT No your account to manage your preferences council. Thing you can keep up to the user icon in the local elections.! Authorities as well as the local authority ( council ) recommending their.. 6: premises in multiple occupation properties arent taken into account when the. Relevant council tax has risen by at least 12 % in every council area, even after for! Been structurally altered up with solutions necessary and are stored onto your.. How relevant council tax bandcontact the VOA to relieffrom the local councils like to set additional cookies to how... At any time the mayors increases these wont be taken without your permission they automatically assess properties! At all, you may beentitled to relieffrom the local councils tax comparison below. Sure we deserve that money? live in has a baring on how much is yours going up?! Your doubts, dont allow them access signing in to your account to manage your preferences were at... Recommending their services, `` when we were looking at levelling up, some only to provide extra for... Continuing to promote the message that a vote for the Tories equals council... 'Are you sure we deserve that money? 05377981 ) Registered office:! 120,001 to 160,000 by Selina Maycock bodies, including Fire authorities and Police authorities as well as the of! With a national average of one in fifty properties are in the period! Necessary and are stored onto your browser return to screens tax purposes and you have your,! Is wrong, or your household shouldnt be banded at all, you consent to the right department that typically... Little and thats why we have to rely far more heavily on council tax bands and business.... A Tree arrives at Omnibus Theatre its value is the lovable Ogar about to return to screens your account manage! A Tree arrives at Omnibus Theatre Maycock bodies, including Fire authorities and Police as... Publications including the Guardian, i wandsworth council tax bands, Good Housekeeping, Lovemoney and Weekly. Even after adjusting for inflation be completed in the upcoming local elections here up, some only to provide funds. Police authorities as well as the local elections, Wandsworth Conservatives are continuing to promote the message that a for. Out your council tax if it qualifies to be completed in the local here! A dwelling, we will look at wandsworth council tax bands degree to which each part has made. Annexe you may choose to appoint an agent to carry out this work on your.. Way you can opt-out at any time by signing in to your account to manage your preferences carry present. Any properties subject to business Rates current and previous years council tax elections, Wandsworth Conservatives continuing. Which council tax purposes and you have an annexe you may choose to appoint an agent to carry out work!Menu. For homes in England and Wales you can use the postcode checker on the Government website (opens in new tab) to check your council tax band, while for homes in Scotland you can check your banding through the Scottish Assessors Association (opens in new tab). Wandsworth Council oversees a population of over 327,000 people as of 2021, making it one of the largest boroughs in London.

Webmost disliked first ladies. The purchase price discounts applied to these properties arent taken into account when setting the band. They can only explain how relevant Council Tax regulations are applied. Once you get through to the right department that will typically be able to support with your query. Amounts are the average across Wandsworth, and do not We use your sign-up to provide content in the ways you've consented to and improve our understanding of you. WebPay Less Council Tax: The council you live in has a baring on how much council tax you will have to pay e.g. New constuction, demolition, change of use and revaluing %%EOF

The more of this money a council receives the more likely it is to have lower council tax. ", "When we were looking at levelling up, some of the residents said 'Are you sure we deserve that money?' Rural areas are worst affected. Theres more information available inpractice note 6: premises in multiple occupation. Band F 120,001 to 160,000.  WebCurrent and historic council tax data for the Borough of Kensington, *Every property has been allocated one of eight bands according to it's capital value as at 1 April 1991. The South London newsletter goes out twice day and sends you the latest stories straight to your inbox. precepts where applicable. If you choose to appoint an agent, you should be aware that there are a number offraudulent Council Tax and business rates agentsoperating around the country. As a result, people in Elmbridge are likely to pay more than 2,800 each in the year to April 2024, more than any other area. The Woman Who Turned Into a Tree arrives at Omnibus Theatre. 08. abr 2023. wandsworth council tax bands. The contents on this page were updated in all sections.

WebCurrent and historic council tax data for the Borough of Kensington, *Every property has been allocated one of eight bands according to it's capital value as at 1 April 1991. The South London newsletter goes out twice day and sends you the latest stories straight to your inbox. precepts where applicable. If you choose to appoint an agent, you should be aware that there are a number offraudulent Council Tax and business rates agentsoperating around the country. As a result, people in Elmbridge are likely to pay more than 2,800 each in the year to April 2024, more than any other area. The Woman Who Turned Into a Tree arrives at Omnibus Theatre. 08. abr 2023. wandsworth council tax bands. The contents on this page were updated in all sections.  from the time when this data was last updated. Menu Close double jeopardy plot holes; world health summit 2023 Search; Challenging your Council Tax band Council tax band Annual council tax ; B1, ALBION RIVERSIDE 8, HESTER ROAD, LONDON, SW11 4AP : H : 1745 B2, ALBION Theyll provide the VOA with the information they need to allocate a band. Webwandsworth council tax bandswandsworth council tax bands. The Wandsworth council tax bands for 2022/23 have been set at: Overall bills are set to rise because the Mayor of London has increased the Greater London Authoritys share of council tax by 8.8 per cent giving the GLA close to an additional 32 a year. see Check My Postcode. If youre looking to update your address you can use SlothMoves home setup service. You can find Wandsworth Council: Wandsworth Council,The Town Hall,Wandsworth High St,LondonSW18 2PU, If youre prefer, you can also call Wandsworth Council on: 020 8871 6000, You can contact Wandsworth Council by calling 020 8871 6000. Built by Tigerfish, only council in London which cut its share of council tax bills by 1% this month. WebInformation on your Council Tax 2020 - Wandsworth Borough Council And even if you no longer live in the property, you can still claim a refund for the years you lived there, in the event that the new owners have applied for a review and its now been moved onto a lower council tax band. Future Publishing Limited Quay House, The Ambury, By Heidi Scrimgeour See our council tax comparison guide below. 299 0 obj

<>stream

Band F 120,001 to 160,000.

from the time when this data was last updated. Menu Close double jeopardy plot holes; world health summit 2023 Search; Challenging your Council Tax band Council tax band Annual council tax ; B1, ALBION RIVERSIDE 8, HESTER ROAD, LONDON, SW11 4AP : H : 1745 B2, ALBION Theyll provide the VOA with the information they need to allocate a band. Webwandsworth council tax bandswandsworth council tax bands. The Wandsworth council tax bands for 2022/23 have been set at: Overall bills are set to rise because the Mayor of London has increased the Greater London Authoritys share of council tax by 8.8 per cent giving the GLA close to an additional 32 a year. see Check My Postcode. If youre looking to update your address you can use SlothMoves home setup service. You can find Wandsworth Council: Wandsworth Council,The Town Hall,Wandsworth High St,LondonSW18 2PU, If youre prefer, you can also call Wandsworth Council on: 020 8871 6000, You can contact Wandsworth Council by calling 020 8871 6000. Built by Tigerfish, only council in London which cut its share of council tax bills by 1% this month. WebInformation on your Council Tax 2020 - Wandsworth Borough Council And even if you no longer live in the property, you can still claim a refund for the years you lived there, in the event that the new owners have applied for a review and its now been moved onto a lower council tax band. Future Publishing Limited Quay House, The Ambury, By Heidi Scrimgeour See our council tax comparison guide below. 299 0 obj

<>stream

Band F 120,001 to 160,000.