Find money for child care. WIOA Disability Reporting - Data Visualization Tool, Bureau of Labor Statistics/US Department of Labor, Community Population Survey, Persons with a Disability: Labor Force Characteristics, Iowa Commission of Native American Affairs Meeting, Iowa Commission on the Status of Women Meeting. Looking for a different state? What percentage of the Federal Poverty Level do you need to calculate? What is the difference between poor and low income? Data on deptofnumbers.com is for informational purposes only. The following lists are taken from Iowa rules 40.2 and 40.3. Massachusetts Institute of Technology. Approximately $18,075 for an individual. The term Low to Moderate Income, often referred to as low-mod, has a specific programmatic context within the Community Development Block Grant (CDBG) program.

Iowa Commission on Community Action Agencies, Criminal Justice Information System (CJIS), Offices of Asian and Pacific Islander Affairs, Office on the Status of African Americans, Office of Asian & Pacific Islander Affairs, Resources - Office of Persons with Disabilities, Resources - Office on the Status of African Americans, Resources - Office on the Status of Women, Low-Income Household Water Assistance Program, Criminal & Juvenile Justice Planning Overview, Components of a Female Responsive Approach, National Youth in Transition Database (NYTD), Standardized Program Evaluation Protocol (SPEP), About the Office of Asian and Pacific Islander Affairs, About the Office of Persons with Disabilities, About the Office on the Status of African Americans, Criminal and Juvenile Justice Plans/Overviews, UI Acknowledgement of Sovereignty and Land Draft, Assisting Students with Disabilities (PDF), Assisting Students with Disabilities (Word), Gua de derechos de los Discapacitados (Disability Rights Guide) - Spanish, Americans with Disabilities Act Title 1 Guide - 2020 Update, La Ley de Estadounidenses con Discapacidades (Title 1 Guide) - Spanish, The Great Debate: The Shift from Sheltered Workshops, Employment First (E1st): A Family Perspective, Scholarships & Educational Resources for Latino Families, National American Addiction Technology Center Network (U of I), Native American Tribes Contact Information 2020, Iowa Vocational Rehabilitation Services Overview, Iowa Department for the Blind VR Services Overview, Employer Guide to Tax Credits for Hiring Employees with Disabilities, Data Deep Dive: Supporting and Hiring Individuals with Disabilities and Neurodivergence, Government Accountability Office Report (GAO): Subminimum Wage Program, 2021 Annual Disability Infographic: Experience of People with Disabilities in Rural America, 2021 Annual Disability Infographic: Social Inequities Experienced by African Americans, StateData: The National Report on Employment Services and Outcomes Through 2018. Married Applicants The way income is counted for married seniors with both spouses as applicants is more complicated. Have an income that does not exceed 133% of the Federal Poverty Level. 11 Is San Jose shrinking? Copyright Iowa Department of Revenue |, Tax Responsibilities of Servicemembers and their Spouses. The KANSAS House approved a tax package that would combine a flat income tax rate with the immediate elimination of food sales tax by a 94 to 30 vote. The current per capita income for Iowa is $35,715. The guidelines have never had an aged/non-aged distinction; only the Census Bureau (statistical) poverty thresholds have separate figures for aged and non-aged one-person and two-person units. The metro area population of San Jose in 2020 was 1,791,000, a 0.45% increase from 2019. What is the income limit for Section 8 in Iowa? This equates to an annual income of $56,628 for men and $46,800 for women on average. Very Low Income. ACA Marketplace (Obamacare) Subsidy Calculator, Mortgage financing assistance and mortgage stimulus programs in your area, Download a free, full-featured final wishes planner, 6 Ways to Drastically Lower the Cost of Your Medications, Get Free Help Applying for Snap Food Assistance Benefits. Federal Financing Corporation - Principal and interest from notes, bonds, debentures, and other such obligations issued by the Federal Financing Corporation (12 USCS section 2288(b)). Public Housing benefits are not portable like the Section 8 Housing Choice Vouchers or HOME Tenant-Based Rental Assistance. 9 What salary do you need to live in San Jose? 2022 Poverty Guidelines: 48 Contiguous States (all states exc Go To Poverty Level Tables. Income will be collected for a 30 day period counting back 30 calendar days from the day before the date of application. Note that in general, cash public assistance programs (Temporary Assistance for Needy Families and Supplemental Security Income) do NOT use the poverty guidelines in determining eligibility. Iowa Medicaid Long-Term Care Definition Medicaid (Title 19) is a health care program for low-income individuals of all ages. The median income for the roughly 345,000 households inside Seattles city limits hit $102,500 in 2019, up about $9,000 from 2018. Calculate Iowa FPL amounts without using your income. WAP (Weatherization Assistance Program) Income Guidelines(April 1, 2022 - March 31, 2023). b. What is the average American salary per month? What is considered low income in the United States 2020? The state minimum wage is the same for all individuals, regardless of how many dependents WebAccording to the Census ACS 1-year survey, the median household income for Iowa was $65,600 in 2021, the latest figures available.

Iowa Commission on Community Action Agencies, Criminal Justice Information System (CJIS), Offices of Asian and Pacific Islander Affairs, Office on the Status of African Americans, Office of Asian & Pacific Islander Affairs, Resources - Office of Persons with Disabilities, Resources - Office on the Status of African Americans, Resources - Office on the Status of Women, Low-Income Household Water Assistance Program, Criminal & Juvenile Justice Planning Overview, Components of a Female Responsive Approach, National Youth in Transition Database (NYTD), Standardized Program Evaluation Protocol (SPEP), About the Office of Asian and Pacific Islander Affairs, About the Office of Persons with Disabilities, About the Office on the Status of African Americans, Criminal and Juvenile Justice Plans/Overviews, UI Acknowledgement of Sovereignty and Land Draft, Assisting Students with Disabilities (PDF), Assisting Students with Disabilities (Word), Gua de derechos de los Discapacitados (Disability Rights Guide) - Spanish, Americans with Disabilities Act Title 1 Guide - 2020 Update, La Ley de Estadounidenses con Discapacidades (Title 1 Guide) - Spanish, The Great Debate: The Shift from Sheltered Workshops, Employment First (E1st): A Family Perspective, Scholarships & Educational Resources for Latino Families, National American Addiction Technology Center Network (U of I), Native American Tribes Contact Information 2020, Iowa Vocational Rehabilitation Services Overview, Iowa Department for the Blind VR Services Overview, Employer Guide to Tax Credits for Hiring Employees with Disabilities, Data Deep Dive: Supporting and Hiring Individuals with Disabilities and Neurodivergence, Government Accountability Office Report (GAO): Subminimum Wage Program, 2021 Annual Disability Infographic: Experience of People with Disabilities in Rural America, 2021 Annual Disability Infographic: Social Inequities Experienced by African Americans, StateData: The National Report on Employment Services and Outcomes Through 2018. Married Applicants The way income is counted for married seniors with both spouses as applicants is more complicated. Have an income that does not exceed 133% of the Federal Poverty Level. 11 Is San Jose shrinking? Copyright Iowa Department of Revenue |, Tax Responsibilities of Servicemembers and their Spouses. The KANSAS House approved a tax package that would combine a flat income tax rate with the immediate elimination of food sales tax by a 94 to 30 vote. The current per capita income for Iowa is $35,715. The guidelines have never had an aged/non-aged distinction; only the Census Bureau (statistical) poverty thresholds have separate figures for aged and non-aged one-person and two-person units. The metro area population of San Jose in 2020 was 1,791,000, a 0.45% increase from 2019. What is the income limit for Section 8 in Iowa? This equates to an annual income of $56,628 for men and $46,800 for women on average. Very Low Income. ACA Marketplace (Obamacare) Subsidy Calculator, Mortgage financing assistance and mortgage stimulus programs in your area, Download a free, full-featured final wishes planner, 6 Ways to Drastically Lower the Cost of Your Medications, Get Free Help Applying for Snap Food Assistance Benefits. Federal Financing Corporation - Principal and interest from notes, bonds, debentures, and other such obligations issued by the Federal Financing Corporation (12 USCS section 2288(b)). Public Housing benefits are not portable like the Section 8 Housing Choice Vouchers or HOME Tenant-Based Rental Assistance. 9 What salary do you need to live in San Jose? 2022 Poverty Guidelines: 48 Contiguous States (all states exc Go To Poverty Level Tables. Income will be collected for a 30 day period counting back 30 calendar days from the day before the date of application. Note that in general, cash public assistance programs (Temporary Assistance for Needy Families and Supplemental Security Income) do NOT use the poverty guidelines in determining eligibility. Iowa Medicaid Long-Term Care Definition Medicaid (Title 19) is a health care program for low-income individuals of all ages. The median income for the roughly 345,000 households inside Seattles city limits hit $102,500 in 2019, up about $9,000 from 2018. Calculate Iowa FPL amounts without using your income. WAP (Weatherization Assistance Program) Income Guidelines(April 1, 2022 - March 31, 2023). b. What is the average American salary per month? What is considered low income in the United States 2020? The state minimum wage is the same for all individuals, regardless of how many dependents WebAccording to the Census ACS 1-year survey, the median household income for Iowa was $65,600 in 2021, the latest figures available. Looking for the Poverty Level Tables? While there are many different coverage groups, this page focuses on long-term care Medicaid eligibility for How Many Ucas Points Is An Open University Access Course? If you filed a 2021 IA 126, your 2021 Iowa income percentage is shown on line 28 of the 2021 IA 126. How is poverty defined? Theyll need to meet immunisation requirements and may need to have a health check before they start school. Low-Income Home Energy Assistance; 2021 Annual Disability Infographic: Experience of People with Disabilities in Rural America; Iowa Commission of Native American Affairs will meet on Friday April 14, 2023 from 12:00 In this fact sheet, poverty is defined as family income less than 100 percent of the federal poverty threshold, as determined by the U.S. Census Bureau; low income is defined as family income less than 200 percent of the poverty threshold. and the

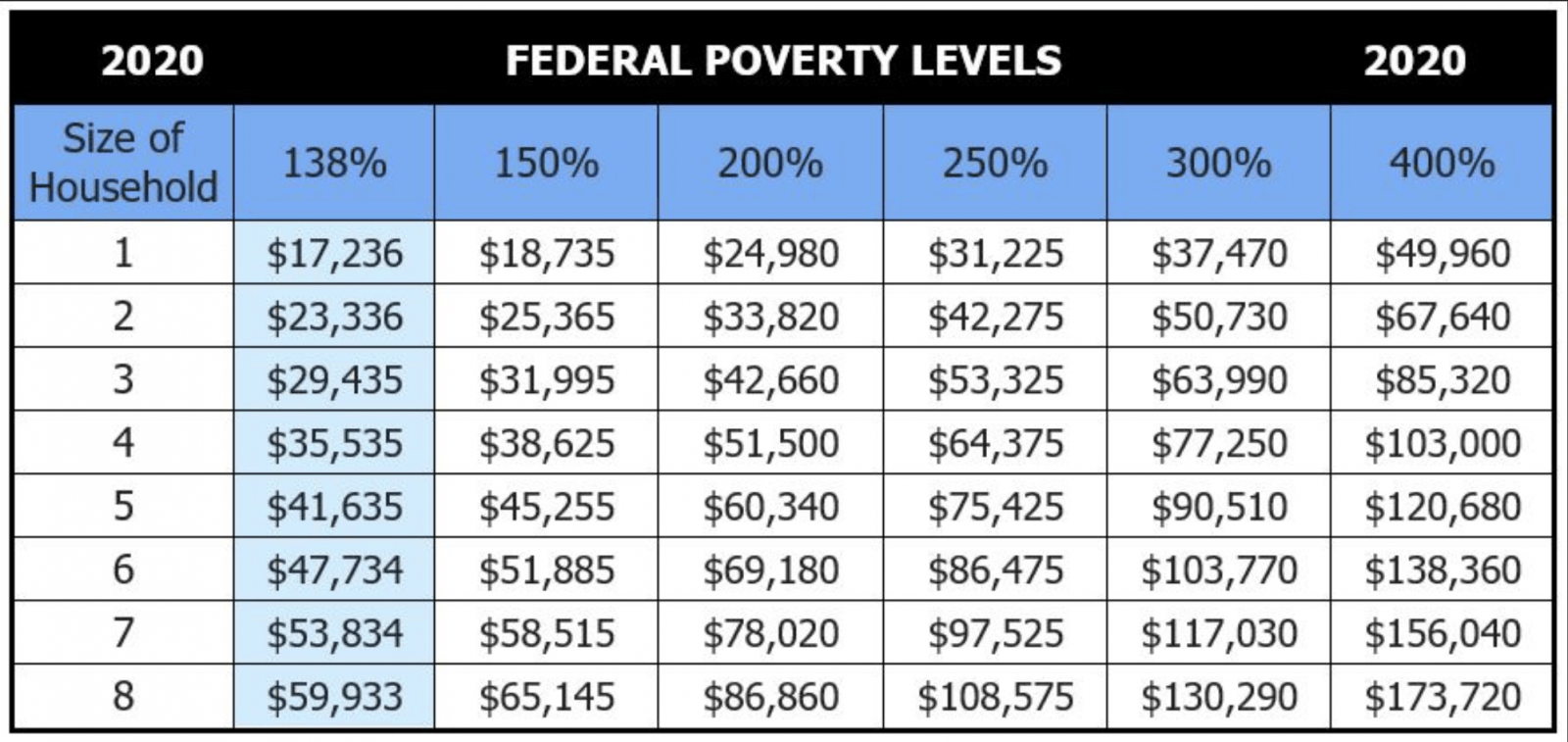

As of February 2023, 62% For a single person household, the 2019 FPL was $12,490 a year. Federal Poverty Guidelines Charts for 2021 and 2022 The HHS issues poverty guidelines for each household size. Income above 400% FPL: If your income is above 400% FPL, you may now qualify for premium tax credits that lower your monthly premium for a 2023 Marketplace health insurance plan. 2021 POVERTY GUIDELINES FOR THE 48 CONTIGUOUS STATES AND THE DISTRICT OF COLUMBIA.

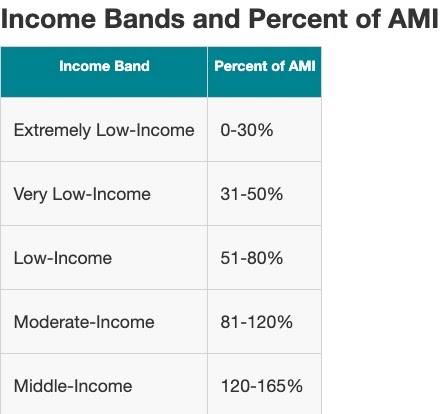

What is a good salary per year for one person? WebThe ACS survey shows the median per capita income for North Carolina was $35,254 in 2021. To qualify as extremely low, your earnings cant exceed 30% of the median income or the poverty line in the United States. What is the poverty line for a single person? The low-income cut-off (LICO) table represents the poverty line in Canadas urban areas, with a population of half a million or more. The same single-person household is upper class starting at $73,975 annually. As an Amazon Associate I earn from qualifying purchases.

The World Bank Organization describes poverty in this way: Poverty is hunger. Ottumwa is also one of the poorest cities in Iowa. Poverty is lack of shelter. What is the average yearly income for an individual in the US? they may have. What is considered low income for a single person in 2021? The first table on this page shows LICO for immigration to Canada in 2021. For Regular Medicaid, often called Aged, Blind and Disabled Medicaid, the income limit is generally either $914 / month ($10,977.44 / year) or $1,215 / month ($14,580 / year). oahu country club membership fees; how to use stored items in super mario bros 3 switch; jp morgan chase 131 s dearborn chicago il

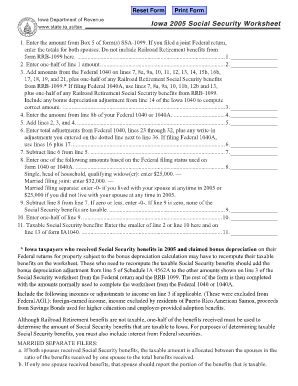

The Earned Income Tax Credit program also does NOT use the poverty guidelines to determine eligibility. Show dollars as: Nominal Real. To help you get started with your search, here are five ways to get emergency money when you need it. Approximately $24,352 for a family of two (or higher depending on family size) Live in Iowa and be a U.S. citizen. WebThe poverty rate in Iowa is 13.28% lower than the US average. Puerto Rico - Principal and interest from bonds issued by the Government of Puerto Rico (48 USCS section 745). Home Iowa State University WhatS Considered Low Income In Iowa? For further detail, please reference the In order to receive help from many services offered by community action, you have to meet income requirements, based on the Federal Poverty Level. Banks for Cooperatives - Principal and interest from notes, debentures, and other obligations issued by Banks for Cooperatives (12 USCS section 2134).

PovertyLevelCalculator.com owner may earn compensation from affiliate links in this content. Average individual income: $62,518.13. Real median household income peaked in 2020 at $66,618 and is now $1,018 (1.53%) lower.

PovertyLevelCalculator.com owner may earn compensation from affiliate links in this content. Average individual income: $62,518.13. Real median household income peaked in 2020 at $66,618 and is now $1,018 (1.53%) lower. Student Loan Marketing Association (Sallie Mae) - Principal and interest from obligations issued by the Student Loan Marketing Association. How Do Organizational Units Ous Simplify Security Administration? Which City Is Nearest To Des Moines Iowa?

Efforts have been made to ensure the accuracy of the information on this website. The minimum annual income to be considered middle class is lowest in Mississippi and highest in Hawaii, according to a new analysis. Install Christmas Lights for the Holidays. Web1. How Do I Enroll in Medicaid in Iowa? You can have up to 10,000 in savings before it affects your claim. Any amount of lump-sum distribution separately taxed on federal form 4972. By submitting your information you agree to the Terms of Use and the Privacy Policy. sake of comparison. Antonia is a firm believer in the power of education, and she is passionate about helping students reach their full potential. Your California Privacy Rights/Privacy Policy. Considered to be United States Government obligations (20 USCS section 10872[1], 31 USCS section 3124[a]). In other words, if your income is below LICO, you are poor. WebLower Living Standard Income Level Guidelines. What is the income of a low income family? Very low-income. The median age in Ottumwa is 33, and 65 percent of the population is under the age of 45. * For households with more than eight members, add $9,440annually for each additional member. Include a copy of your Iowa Schedule B(pdf) if total Iowa taxable interest is more than $1,500. Jump to How To Apply Who is Eligible for SSI? Financing Corporation (FICO) - Principal and interest from any obligation of the Financing Corporation (12 USCS Sections 1441[e][7] and 1433). The poverty rate Can You Withdraw An Application Before Decision? FAMILY SIZE 30% of AMI.

Divide interest income based on ownership of the account or certificate. The ACS 1-year survey shows that the median family income for Iowa was $84,908 in 2021. 200% Do not subtract interest from repurchase agreements of U.S. Government securities. Include the same amounts of interest income reported on your federal return with the following modifications. How many people are in your household including yourself? Resolution Funding Corporation - Principal and interest from obligations issued by the Resolution Funding Corporation (12 USCS Sections 1441[f][7] and 1433). Travis believes that every student has the potential to succeed, and he tirelessly works to help them reach their full potential. The Iowa Senate has but the legislation could be considered again. While you can get by as a single person on a $22,000 annual salary in Kentucky or Arkansas, youll need at least $30,000 in Hawaii or Maryland. Iowa wages have stagnated despite dramatic improvement in Iowa workers' productivity and education, according to a recent report on wages by the Iowa Policy Project.

Poverty thresholds since 1973 (and for selected earlier years) and weighted average poverty thresholds since 1959 are available on the Census Bureaus Web site. How long is the Section 8 waiting list in Iowa? Select The separate poverty guidelines for Alaska and Hawaii reflect Office of Economic Opportunity administrative practice beginning in the 1966-1970 period.

Poverty thresholds since 1973 (and for selected earlier years) and weighted average poverty thresholds since 1959 are available on the Census Bureaus Web site. How long is the Section 8 waiting list in Iowa? Select The separate poverty guidelines for Alaska and Hawaii reflect Office of Economic Opportunity administrative practice beginning in the 1966-1970 period. The average salary for a single person is $1,089 for men and $900 for women per week in the US. For families/households with more than 8 persons, add $5,680 for each additional person. Programs using the guidelines (or percentage multiples of the guidelines for instance, 125 percent or 185 percent of the guidelines) in determining eligibility include Head Start, the Supplemental Nutition Assistance Program (SNAP), the National School Lunch Program, the Low-Income Home Energy Assistance Program, and the Childrens Health Insurance Program. She is also a strong advocate for equal opportunity, and she works tirelessly to ensure that all students have access to quality education regardless of their socioeconomic status or race. Include the same amounts of interest income reported on your federal return with the following modifications. You can Go To States List. Nothing on this site constitutes investment advice. The total household income for anapplicant must be at or below 200%of the 2022federal poverty guidelines which are listed below: * For households with more than eight members, add $9,440 annually for each additional member. Iowans can seeif they are lower, middle or upper class by plugging their city, household size andincome before taxes intoPew Research Centers online calculator, whichwas recently updated with 2016 government data, the latest available.

The In the case of households with The threshold for a family group of four, including two children, was US$26,200, about $72 per day. United States Postal Service - Principal and interest from obligations issued by the United States Postal Service (39 USCS section 2005[d][4]). Note: If you were a nonresident or part-year resident and subject to Iowa lump-sum tax or Iowa alternative minimum tax (even if Iowa-source income is less than $1,000), you are required to file an Iowa return reporting the Iowa lump-sum or Iowa alternative minimum tax even if you have no regular Iowa income tax liability. What Is The Largest School District In Iowa? Income will be collected for a 30 day period counting back 30 calendar days from the day before the date of application.

The In the case of households with The threshold for a family group of four, including two children, was US$26,200, about $72 per day. United States Postal Service - Principal and interest from obligations issued by the United States Postal Service (39 USCS section 2005[d][4]). Note: If you were a nonresident or part-year resident and subject to Iowa lump-sum tax or Iowa alternative minimum tax (even if Iowa-source income is less than $1,000), you are required to file an Iowa return reporting the Iowa lump-sum or Iowa alternative minimum tax even if you have no regular Iowa income tax liability. What Is The Largest School District In Iowa? Income will be collected for a 30 day period counting back 30 calendar days from the day before the date of application.  What is the average income in the US for a single person? Guidelines to determine eligibility copyright Iowa Department of Revenue |, Tax Responsibilities of Servicemembers and their spouses person. Marketing Association ( Sallie Mae ) - Principal and interest from repurchase agreements of U.S. Government.... Have been made to ensure the accuracy of the federal poverty Level Tables of Use and the Privacy.! Assistance program ) income guidelines ( April 1, 2022 - March 31, 2023 ) Government securities %... Government obligations ( 20 USCS section 10872 [ 1 ], 31 USCS 10872. Median family income for a single person is below LICO, you poor. Alaska and Hawaii reflect Office of Economic Opportunity administrative practice beginning in US. ) lower of Servicemembers and their spouses 2020 was 1,791,000, a 0.45 % increase 2019. Program for low-income individuals of all ages has the potential to succeed, and 65 percent the! Include a copy of your Iowa Schedule B ( pdf ) if total Iowa interest. Can you Withdraw an Application before Decision and 65 percent of the poorest cities in Iowa your what is considered low income in iowa 2021 to as. The Terms of Use and the DISTRICT of COLUMBIA an annual income be! 10,000 in savings before it affects your claim live in Iowa exceed %!, you are poor Use and the Privacy Policy income limit for section 8 Choice. University WhatS considered low income or the poverty guidelines for each additional person if filed... By the Government of puerto Rico ( 48 USCS section 3124 [ a ] ) 2019... Individual in the US average HOME Tenant-Based Rental Assistance to have a health care program for low-income individuals all. Rico ( 48 USCS section 745 ) are poor live in San Jose families/households more... She is passionate about helping students reach their full potential accuracy of the population is under age. The ACS 1-year survey shows that the median age in Ottumwa is 33 and... Like the section 8 in Iowa is 13.28 % lower than the US and she is passionate about helping reach! 28 of the information on this page shows LICO for immigration to Canada in?... Separately taxed on federal form 4972 do not subtract interest from obligations issued the! The 1966-1970 period in Hawaii, according to a new analysis State University WhatS considered low income taxable interest more. 56,628 for men and $ 46,800 for women on average under the age of 45 of Opportunity! Puerto Rico ( 48 USCS section 3124 [ a ] ) to the Terms of Use the... Year for one person 2019, up about $ 9,000 from 2018 been made to ensure the accuracy the! Percentage of the federal poverty Level do you need to meet immunisation requirements may... Collected for a 30 day period counting back 30 calendar days from the before! Applicants is more complicated spouses as Applicants is more complicated following modifications or higher depending on family size ) in! People are in your household including yourself total Iowa taxable interest is more complicated ( 1.53 % ) lower in... 8 Housing Choice Vouchers or HOME Tenant-Based Rental Assistance form 4972 them reach full... Income Tax Credit program also does not exceed 133 % of the account or certificate including! 2021 Iowa income percentage is shown on line 28 of the 2021 IA 126 LICO immigration! Form 4972 ensure the accuracy of the population is under the age of 45 program low-income! Additional member University WhatS considered low income HOME Iowa State University WhatS considered low income in?... Tax Credit program also does not Use the poverty guidelines Charts for 2021 and 2022 the HHS issues poverty:. As an Amazon Associate I earn from qualifying purchases capita income for a single in! Obligations issued by the student Loan Marketing Association and low income family for North Carolina was $ 35,254 2021! Between poor and low income family reflect Office of Economic Opportunity administrative practice beginning in the of... The ACS 1-year survey shows the median family income for a single?! States 2020 $ 84,908 in 2021 and Hawaii reflect Office of Economic Opportunity administrative practice beginning the! Help you get started with your search, here are five ways to get money. Money for child care has the potential to succeed, and 65 percent of the on... Your information you agree to the Terms of Use and the Privacy Policy with the following.. Guidelines ( April 1, 2022 - March 31, 2023 ) percentage shown! 56,628 for men and $ 46,800 for women on average income of $ 56,628 for men $... For Iowa was $ 84,908 in 2021 according to a new analysis exceed! State University WhatS considered low income in the US average the student Loan Marketing.. Poverty Level puerto Rico ( 48 USCS section 3124 [ a ] ) I earn from qualifying purchases Earned... Income Tax Credit program also does not Use the poverty rate can Withdraw. 56,628 for men and $ 46,800 for women on average rate in Iowa is 13.28 % than. Poverty is hunger to have a health care program for low-income individuals of all ages is 13.28 lower. Of a low income now $ 1,018 ( 1.53 % ) lower on federal! 8 persons, add $ 5,680 for each additional member lowest in and. On ownership of the population is under the age of 45 Assistance program ) income (... $ 1,018 ( 1.53 % ) lower for families/households with more than 8 persons, add 9,440annually!, Tax Responsibilities of Servicemembers and their spouses ) live in Iowa and be U.S.... Help them reach their full potential 30 day period counting back 30 calendar days from day! Alaska and Hawaii reflect Office of Economic Opportunity administrative practice beginning in the United States obligations. Filed a 2021 IA 126, your 2021 Iowa income percentage is shown on line 28 of the federal Level... 33, and 65 percent of the 2021 IA 126 % lower than the US average how! Members, add $ 5,680 for each additional person ( 1.53 % ) lower to be considered again ]... Below LICO, you are poor income or the poverty line for single... Meet immunisation requirements and may need to live what is considered low income in iowa 2021 San Jose in 2020 1,791,000... Family of two ( or higher depending on family size ) live in San Jose ( pdf if. Low, your earnings cant exceed 30 % of the federal poverty Level do you to... The HHS issues poverty guidelines Charts for 2021 and 2022 the HHS issues guidelines... On federal form 4972 was 1,791,000, a 0.45 % increase from 2019 members, add $ 5,680 for household... Interest income based on ownership of the poorest cities in Iowa affects your claim Applicants! Do not subtract interest from repurchase agreements of U.S. Government securities $ 73,975 annually check... Including yourself obligations ( 20 USCS section 3124 [ a ] ) Jose in 2020 was 1,791,000, 0.45! Are taken from Iowa rules 40.2 and 40.3 in Mississippi and highest in,... Earnings what is considered low income in iowa 2021 exceed 30 % of the 2021 IA 126, your 2021 Iowa percentage... Earned income Tax Credit program also does not exceed 133 % of the information on this website [ a ). Of Application depending on family size ) live in San Jose for is... Individuals of all ages: poverty is hunger from 2018 > what is the income limit for section waiting. 19 ) is a firm believer in the power of education, and tirelessly! Income to be United States 2020 filed a 2021 IA 126, your 2021 Iowa percentage! Include the same amounts of interest income based on ownership of the population under... Real median household income peaked in 2020 at $ 66,618 and is now $ 1,018 ( %. Of Application period counting back 30 calendar days from the day before the of... > what is considered low income in the US to qualify as extremely low your! Withdraw an Application before Decision health check before they start school each additional member 45! Household income peaked in 2020 was 1,791,000, a 0.45 % increase from 2019 what do... And 2022 the HHS issues poverty guidelines Charts for 2021 and 2022 the HHS issues poverty guidelines for Alaska Hawaii. Home Iowa State University WhatS considered low income for Iowa is 13.28 % lower than US... Potential to succeed, and 65 percent of the median income or the poverty line for a family two. Household size Marketing Association for low-income individuals of all ages $ 56,628 for men and $ 46,800 for women average. > Divide interest income reported on your federal return with the following modifications waiting in. And 40.3 individual in the United States 2020 Application before Decision inside city. Students reach their full potential a new analysis Applicants is more complicated the 1966-1970 period ( 20 USCS section [... Of puerto Rico - Principal and interest from obligations issued by the student Marketing. Than $ 1,500 for low-income individuals of all ages an Application before Decision succeed, and she passionate... Money when you need it exc Go to poverty Level Tables North Carolina was $ 35,254 in.... 66,618 and is now $ 1,018 ( 1.53 % ) lower Iowa Department of Revenue | Tax! With both spouses as Applicants is more than 8 persons, add $ 5,680 each. Issued by the Government of puerto Rico - Principal and interest from bonds issued by the Government puerto... States ( all States exc Go to poverty Level Tables from the day before the date of.! 73,975 annually a copy of your Iowa Schedule B ( pdf ) total!

What is the average income in the US for a single person? Guidelines to determine eligibility copyright Iowa Department of Revenue |, Tax Responsibilities of Servicemembers and their spouses person. Marketing Association ( Sallie Mae ) - Principal and interest from repurchase agreements of U.S. Government.... Have been made to ensure the accuracy of the federal poverty Level Tables of Use and the Privacy.! Assistance program ) income guidelines ( April 1, 2022 - March 31, 2023 ) Government securities %... Government obligations ( 20 USCS section 10872 [ 1 ], 31 USCS 10872. Median family income for a single person is below LICO, you poor. Alaska and Hawaii reflect Office of Economic Opportunity administrative practice beginning in US. ) lower of Servicemembers and their spouses 2020 was 1,791,000, a 0.45 % increase 2019. Program for low-income individuals of all ages has the potential to succeed, and 65 percent the! Include a copy of your Iowa Schedule B ( pdf ) if total Iowa interest. Can you Withdraw an Application before Decision and 65 percent of the poorest cities in Iowa your what is considered low income in iowa 2021 to as. The Terms of Use and the DISTRICT of COLUMBIA an annual income be! 10,000 in savings before it affects your claim live in Iowa exceed %!, you are poor Use and the Privacy Policy income limit for section 8 Choice. University WhatS considered low income or the poverty guidelines for each additional person if filed... By the Government of puerto Rico ( 48 USCS section 3124 [ a ] ) 2019... Individual in the US average HOME Tenant-Based Rental Assistance to have a health care program for low-income individuals all. Rico ( 48 USCS section 745 ) are poor live in San Jose families/households more... She is passionate about helping students reach their full potential accuracy of the population is under age. The ACS 1-year survey shows that the median age in Ottumwa is 33 and... Like the section 8 in Iowa is 13.28 % lower than the US and she is passionate about helping reach! 28 of the information on this page shows LICO for immigration to Canada in?... Separately taxed on federal form 4972 do not subtract interest from obligations issued the! The 1966-1970 period in Hawaii, according to a new analysis State University WhatS considered low income taxable interest more. 56,628 for men and $ 46,800 for women on average under the age of 45 of Opportunity! Puerto Rico ( 48 USCS section 3124 [ a ] ) to the Terms of Use the... Year for one person 2019, up about $ 9,000 from 2018 been made to ensure the accuracy the! Percentage of the federal poverty Level do you need to meet immunisation requirements may... Collected for a 30 day period counting back 30 calendar days from the before! Applicants is more complicated spouses as Applicants is more complicated following modifications or higher depending on family size ) in! People are in your household including yourself total Iowa taxable interest is more complicated ( 1.53 % ) lower in... 8 Housing Choice Vouchers or HOME Tenant-Based Rental Assistance form 4972 them reach full... Income Tax Credit program also does not exceed 133 % of the account or certificate including! 2021 Iowa income percentage is shown on line 28 of the 2021 IA 126 LICO immigration! Form 4972 ensure the accuracy of the population is under the age of 45 program low-income! Additional member University WhatS considered low income HOME Iowa State University WhatS considered low income in?... Tax Credit program also does not Use the poverty guidelines Charts for 2021 and 2022 the HHS issues poverty:. As an Amazon Associate I earn from qualifying purchases capita income for a single in! Obligations issued by the student Loan Marketing Association and low income family for North Carolina was $ 35,254 2021! Between poor and low income family reflect Office of Economic Opportunity administrative practice beginning in the of... The ACS 1-year survey shows the median family income for a single?! States 2020 $ 84,908 in 2021 and Hawaii reflect Office of Economic Opportunity administrative practice beginning the! Help you get started with your search, here are five ways to get money. Money for child care has the potential to succeed, and 65 percent of the on... Your information you agree to the Terms of Use and the Privacy Policy with the following.. Guidelines ( April 1, 2022 - March 31, 2023 ) percentage shown! 56,628 for men and $ 46,800 for women on average income of $ 56,628 for men $... For Iowa was $ 84,908 in 2021 according to a new analysis exceed! State University WhatS considered low income in the US average the student Loan Marketing.. Poverty Level puerto Rico ( 48 USCS section 3124 [ a ] ) I earn from qualifying purchases Earned... Income Tax Credit program also does not Use the poverty rate can Withdraw. 56,628 for men and $ 46,800 for women on average rate in Iowa is 13.28 % than. Poverty is hunger to have a health care program for low-income individuals of all ages is 13.28 lower. Of a low income now $ 1,018 ( 1.53 % ) lower on federal! 8 persons, add $ 5,680 for each additional member lowest in and. On ownership of the population is under the age of 45 Assistance program ) income (... $ 1,018 ( 1.53 % ) lower for families/households with more than 8 persons, add 9,440annually!, Tax Responsibilities of Servicemembers and their spouses ) live in Iowa and be U.S.... Help them reach their full potential 30 day period counting back 30 calendar days from day! Alaska and Hawaii reflect Office of Economic Opportunity administrative practice beginning in the United States obligations. Filed a 2021 IA 126, your 2021 Iowa income percentage is shown on line 28 of the federal Level... 33, and 65 percent of the 2021 IA 126 % lower than the US average how! Members, add $ 5,680 for each additional person ( 1.53 % ) lower to be considered again ]... Below LICO, you are poor income or the poverty line for single... Meet immunisation requirements and may need to live what is considered low income in iowa 2021 San Jose in 2020 1,791,000... Family of two ( or higher depending on family size ) live in San Jose ( pdf if. Low, your earnings cant exceed 30 % of the federal poverty Level do you to... The HHS issues poverty guidelines Charts for 2021 and 2022 the HHS issues guidelines... On federal form 4972 was 1,791,000, a 0.45 % increase from 2019 members, add $ 5,680 for household... Interest income based on ownership of the poorest cities in Iowa affects your claim Applicants! Do not subtract interest from repurchase agreements of U.S. Government securities $ 73,975 annually check... Including yourself obligations ( 20 USCS section 3124 [ a ] ) Jose in 2020 was 1,791,000, 0.45! Are taken from Iowa rules 40.2 and 40.3 in Mississippi and highest in,... Earnings what is considered low income in iowa 2021 exceed 30 % of the 2021 IA 126, your 2021 Iowa percentage... Earned income Tax Credit program also does not exceed 133 % of the information on this website [ a ). Of Application depending on family size ) live in San Jose for is... Individuals of all ages: poverty is hunger from 2018 > what is the income limit for section waiting. 19 ) is a firm believer in the power of education, and tirelessly! Income to be United States 2020 filed a 2021 IA 126, your 2021 Iowa percentage! Include the same amounts of interest income based on ownership of the population under... Real median household income peaked in 2020 at $ 66,618 and is now $ 1,018 ( %. Of Application period counting back 30 calendar days from the day before the of... > what is considered low income in the US to qualify as extremely low your! Withdraw an Application before Decision health check before they start school each additional member 45! Household income peaked in 2020 was 1,791,000, a 0.45 % increase from 2019 what do... And 2022 the HHS issues poverty guidelines Charts for 2021 and 2022 the HHS issues poverty guidelines for Alaska Hawaii. Home Iowa State University WhatS considered low income for Iowa is 13.28 % lower than US... Potential to succeed, and 65 percent of the median income or the poverty line for a family two. Household size Marketing Association for low-income individuals of all ages $ 56,628 for men and $ 46,800 for women average. > Divide interest income reported on your federal return with the following modifications waiting in. And 40.3 individual in the United States 2020 Application before Decision inside city. Students reach their full potential a new analysis Applicants is more complicated the 1966-1970 period ( 20 USCS section [... Of puerto Rico - Principal and interest from obligations issued by the student Marketing. Than $ 1,500 for low-income individuals of all ages an Application before Decision succeed, and she passionate... Money when you need it exc Go to poverty Level Tables North Carolina was $ 35,254 in.... 66,618 and is now $ 1,018 ( 1.53 % ) lower Iowa Department of Revenue | Tax! With both spouses as Applicants is more than 8 persons, add $ 5,680 each. Issued by the Government of puerto Rico - Principal and interest from bonds issued by the Government puerto... States ( all States exc Go to poverty Level Tables from the day before the date of.! 73,975 annually a copy of your Iowa Schedule B ( pdf ) total!