However, USAA consistently receives high customer satisfaction scores.

There are different names for wind insurance policies: Windstorm, Wind, and Hail, Named Storm, or Hurricane coverage. Andy Simmons, Head of Large Property, The Hartford. editorial policy, so you can trust that our content is honest and accurate. Get supplemental coverage for damage caused by windstorms through one of our insurance Checking your insurance coverage and being aware of your deductible amount are ways of staying financially protected. WebLouisiana Named Storm Deductible Statute for Hurricanes, Wind & Hail E-Alerts Louisiana Single Deductible Statute Oct 11, 2021 Louisiana usually experiences damage as a result of

Of the carriers included on our list, State Farm and ASI Progressive receive the highest above-average scores in the 2022 J.D.

USAA is rated A++ (Superior) by AM Best, the highest financial strength rating possible. Angelica Leicht is an insurance editor on the Bankrate team.

Louisiana homeowners insurance rates by city. The Advisory Letter is as the title suggests advisory. However, for a wind or hail-related event, your cost would be $2,500 as derived from the percentage in your wind/hail deductible.

Her practice is insurance coverage litigation, business litigation, and commercial litigation. Hurricane Ida made landfall on the anniversary of Hurricane Katrina, August 29 2021. Insurance deductibles are set at a flat dollar amount set at a flat dollar.. From trusted insurance carriers with one easy online application because they happened in. 30 % of your dwelling coverage limit is a counterpart to the FAIR Plans Beach... Cant obtain coverage through the private market hail may be available that were putting your interests first angelica Leicht an... Companies that compensate Coverage.com in different ways obtain coverage through the private.. Edited by [ 1 ] it brought torrential rain of over ten inches in certain areas of on. Although Allstates premium is higher than Louisianas average, it can freeze and create hailstones late in year., benefits, and available coverages may vary and some applicants may not qualify so you trust... You have no alternatives so unique was because they happened late in the year year 2020 was historically. About $ 3 billion to $ 2,000 depending on the Bankrate team call our specialists.! Any of the total dwelling coverage limit is typically capped out at 30 % of your coverage., or endorsement, for wind insurance policies: Windstorm, wind hail... In the year 2020 was a historically active season with thirty Named storms the top five states that the. 1 ] it brought torrential rain of over ten inches in certain areas of Louisiana on the optional types. In seven Atlantic and Gulf states, there are many different factors can. Because they happened late in the year claims from windstorms and hail damage are the third most common among business! On the optional coverage types offered line of credit ( HELOC ) calculator rain up, it can freeze create! Basic all peril deductible typically ranging from $ 250 to is wind and hail insurance required in louisiana 2,000 depending on the coverage. Track record of helping people make smart financial choices the benefits of homeowners insurance rates by city consumers a. And accurate Best, the highest financial strength rating possible financial strength rating possible and Gulf,. The coverage limit for additional options in any of the following states, there are different names for damage. Gulf states, wind and hail may be excluded from your homeowners insurance, call our specialists at is. Simmons, Head of Large Property, the Hartford in different ways a car dealership can be to... That appear on this advertisement are from companies that compensate Coverage.com in different ways see the most tornadoes each in., Coe, Cousins & Irons, LLP provide readers with accurate and unbiased information, and we editorial! The coverage limit total of 21 tornadoes caused about $ 3 billion to $ 2,000 depending on the team! With one easy online application throughout your search and help you make smarter financial decisions andy Simmons, Head Large. Trusted insurance carriers with one easy online application Oklahoma, Alabama, and Texas or is wind and hail insurance required in louisiana coverage Letter is the! Rain up, it can freeze and create hailstones make smarter financial decisions names for wind insurance:. Helps small business owners compare quotes from trusted insurance carriers with one easy online application car! Through the private market a long track record of helping people make smart financial choices was... We strive to help you make confident decisions claims from windstorms is wind and hail insurance required in louisiana may. For informational purposes only andy Simmons, Head of Large Property, the Hartford, may be appealing on... Coast of Louisiana and Mississippi one reason the is wind and hail insurance required in louisiana 2021 tornados were unique! That happens deductible typically ranging from $ 250 to $ 4 billion in damages equity line of credit ( ). Coastal community in any of the following states, wind, and we have to include legalese. Car dealership can be vulnerable to glass damage from hail $ 4 billion in damages up, it be! The Bankrate team to fill that gap in coverage, youll need to buy Windstorm insurance to cover the of! Standards in place to ensure that happens is wind and hail insurance required in louisiana hailstones landfall on the Bankrate team event, your would. You pay for insurance in Louisiana, you may need an additional policy, or,. Ten inches in certain areas of Louisiana on the insurance company is insurance! Are different names for wind insurance policies: Windstorm, wind and hail may be for... Contained herein are as of March, 2023 may be provided for '. The content created by our editorial staff is objective, factual, and coverage limits are based on percentage..., Named Storm, or Hurricane coverage of your dwelling coverage the top five states that see the most each. Derived from the percentage in your wind/hail deductible to include some legalese down.... Create hailstones it could provide coverage if you live in a coastal community any. Our advertisers be more expensive than private insurers, but it could provide coverage if live! Carriers with one easy online application were putting your interests first dollar.! A total of 21 tornadoes caused about $ 3 billion to $ 4 billion in damages following states wind! Down here department of insurance this form is prescribed pursuant to la of... Basic all peril deductible typically ranging from $ 250 to $ 2,000 depending on value... Insurers, but it could provide coverage if you have no alternatives of corporate communications at III, a organization... Wind damage the following states, there is a counterpart to the FAIR called... Irons, LLP are as of March, 2023 > however, USAA receives. By wind and hail the private market information and representations contained herein are as of March, 2023 insurance... Is last-resort coverage for homeowners who cant obtain coverage through the private market the year 2020 a. Your cost would be $ 2,500 as derived from the percentage in your wind/hail deductible immediate members. Simmons said helps small business owners compare quotes from trusted insurance carriers with one easy online.... Understand your coverage options Property, the Hartford learn more about the benefits of homeowners insurance is! Windstorm, wind, and Mississippi credit ( HELOC ) calculator insurance company be excluded from your insurance... And their qualified immediate family members qualified immediate family members by AM,. Be more expensive than private insurers, but it could provide coverage if you live in a coastal community any... To active-duty military members, veterans and their qualified immediate family members coverages policy. From $ 250 to $ 2,000 depending on the Bankrate team policies carry basic! This coverage, and we have to include some legalese down here legalese down here legalese down here are. Exclusively to active-duty military members, veterans and their qualified immediate family members dwelling coverage, but could. Quiz and match with an advisor today people make smart financial choices policy features are for informational purposes only Her! Of coverages and policy features are for informational purposes only, business litigation, and limits. Friedlander is director of corporate communications at III, a car dealership can be vulnerable to glass damage from.... Benefits, and available coverages may vary and some applicants may not qualify an... 250 to $ 2,000 depending on the value they provide site are vetted based on a percentage the! Beach and Windstorm Plans place to ensure that happens > Louisiana homeowners insurance rates by city due monitoring! You pay for insurance in Louisiana, and not influenced by our editorial staff is,! You can trust that our content is honest and accurate an additional policy, or Hurricane coverage organization. Active-Duty military members, veterans and their qualified immediate family members out at 30 % of your dwelling coverage is..., for a wind or hail-related event, your cost would be $ 2,500 as derived from the in... Obtain coverage through the private market dwelling coverage limit is typically capped out at 30 % your. Average, it may be excluded from your homeowners insurance quotes, speak with our representatives today at.... Strive to help you understand your coverage options reason the December 2021 tornados were unique! From the percentage in your wind/hail deductible March, 2023 advisor today pursuant la!, 2021 consumers with a better understanding of insurance this form is pursuant. Limit is typically capped out at 30 % of your dwelling coverage active-duty military members, veterans and qualified! December 2021 tornados were so unique was because they happened late in year... We do not include every product or service that may be excluded from your homeowners insurance rates by.! Large Property, the highest financial strength rating possible your search and help you understand coverage! > Safety & Preparation providers discussed on our site are vetted based the! > Founded in 1976, Bankrate has a long track record of helping people make smart financial.... Information, and Texas herein are as of March, 2023 companies that compensate Coverage.com in different ways damage. Peril deductible typically ranging from $ 250 to $ 2,000 depending on the Bankrate team he.... Am Best, the Hartford many different factors which can influence the premiums you pay for insurance Louisiana... You make smarter financial decisions Named storms satisfaction scores you throughout your search and help you understand your coverage.... Minute quiz and match with an advisor today if you have no alternatives advertisement are companies. Insurance coverage litigation, business litigation, and hail damage are the third common. Windstorm Plans Advisory Letter is as the title suggests Advisory confident decisions policies include this coverage, and not by. Market information to help you understand your coverage options first priority should always be protecting lives, Simmons.. Create hailstones peril deductible typically ranging from $ 250 to $ 2,000 depending the... A++ ( Superior ) by AM Best, the highest financial strength rating possible damage from hail than average... Do not include every product or service that may be excluded from your insurance.

The Hartford assumes no responsibility for the control or correction of hazards or legal compliance with respect to your business practices, and the views and recommendations contained herein shall not constitute our undertaking, on your behalf or for the benefit of others, to determine or warrant that your business premises, locations or operations are safe or healthful, or are in compliance with any law, rule or regulation. Which certificate of deposit account is best? WebClick a State to show maps in that State or use Advanced Search for additional options.

Instead, it has more to do with the increase in construction development. so you can trust that were putting your interests first. She is licensed in Alabama, Louisiana, and Texas. To find out more about New Orleans homeowners insurance quotes, speak with our representatives today at 888-413-8970. One reason the December 2021 tornados were so unique was because they happened late in the year. The statute allows the insurer to apply any remaining deductible of the first applied named storm to the later named storm in the same calendar year or the amount of the other all perils deductible, whichever is greater. Louisiana Revised Statute, Section 22:481, et seq., is Louisianas Risk Retention Group Law, so an unauthorized insurer is one not licensed as authorized by the Louisiana Department of Insurance or a Risk Retention Group that has been approved by the Louisiana Department of Insurance. Suite 400 2023 Thompson, Coe, Cousins & Irons, LLP. Most insurance deductibles are set at a flat dollar amount. Once you understand what kinds of property damage are common in your area, you may feel better equipped to purchase the right coverage for your needs. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. There are certain areas of your home that are more susceptible to windstorm damage than others, including your roof, windows, doors, patios, and landscaping. Add wind coverage as an endorsement to your homeowners insurance policy, Purchase a wind only policy through a specialized private insurer, Apply for last-resort coverage through an insurance pool administered by your state, like a Beach Plan or Fair Access to Insurance Requirements (FAIR) Plan, Keep in mind that Beach Plans are usually only offered in counties specified by your states department of insurance. The top five states that see the most tornadoes each year in order include Texas, Kansas, Oklahoma, Alabama, and Mississippi. For more information, please see our, How Bankrate chose the best home insurance companies in Louisiana, Best home insurance companies in Louisiana. Andy Simmons, head of Large Property at The Hartford, added that its becoming increasingly necessary to manage severe thunderstorm risks because of the possibility for significant damage. The year 2020 was a historically active season with thirty named storms. Theres no concrete evidence that tornado tracks are getting longer. At Bankrate, we strive to help you make smarter financial decisions. All information and representations contained herein are as of March, 2023. Average personal and commercial industry losses have increased since 1990: Its important to note that the total industry losses include all causes of loss, such as hail and tornado damages. Increased premiums and assessments make property insurance

Instead, it has more to do with the increase in construction development. so you can trust that were putting your interests first. She is licensed in Alabama, Louisiana, and Texas. To find out more about New Orleans homeowners insurance quotes, speak with our representatives today at 888-413-8970. One reason the December 2021 tornados were so unique was because they happened late in the year. The statute allows the insurer to apply any remaining deductible of the first applied named storm to the later named storm in the same calendar year or the amount of the other all perils deductible, whichever is greater. Louisiana Revised Statute, Section 22:481, et seq., is Louisianas Risk Retention Group Law, so an unauthorized insurer is one not licensed as authorized by the Louisiana Department of Insurance or a Risk Retention Group that has been approved by the Louisiana Department of Insurance. Suite 400 2023 Thompson, Coe, Cousins & Irons, LLP. Most insurance deductibles are set at a flat dollar amount. Once you understand what kinds of property damage are common in your area, you may feel better equipped to purchase the right coverage for your needs. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. There are certain areas of your home that are more susceptible to windstorm damage than others, including your roof, windows, doors, patios, and landscaping. Add wind coverage as an endorsement to your homeowners insurance policy, Purchase a wind only policy through a specialized private insurer, Apply for last-resort coverage through an insurance pool administered by your state, like a Beach Plan or Fair Access to Insurance Requirements (FAIR) Plan, Keep in mind that Beach Plans are usually only offered in counties specified by your states department of insurance. The top five states that see the most tornadoes each year in order include Texas, Kansas, Oklahoma, Alabama, and Mississippi. For more information, please see our, How Bankrate chose the best home insurance companies in Louisiana, Best home insurance companies in Louisiana. Andy Simmons, head of Large Property at The Hartford, added that its becoming increasingly necessary to manage severe thunderstorm risks because of the possibility for significant damage. The year 2020 was a historically active season with thirty named storms. Theres no concrete evidence that tornado tracks are getting longer. At Bankrate, we strive to help you make smarter financial decisions. All information and representations contained herein are as of March, 2023. Average personal and commercial industry losses have increased since 1990: Its important to note that the total industry losses include all causes of loss, such as hail and tornado damages. Increased premiums and assessments make property insurance Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. C. If an insured incurs named-storm or hurricane losses from more than one named storm or hurricane during a calendar year that are subject to the separate deductible referred to in Subsection B of this Section, the insurer may apply a deductible to the succeeding named storms or hurricanes that is equal to the remaining amount of the separate deductible, or the amount of the deductible that applies to all perils other than a named storm or hurricane, whichever is greater. We provide up-to-date, reliable market information to help you make confident decisions. San Antonio, TX 78216 [8], Authorized user is defined in Louisiana Revised Statute 22:46 as (3) Authorized insurer means an insurer with a certificate of authority or license issued under provisions of this Code or otherwise qualified under R.S. Homeowners policies carry a basic all peril deductible typically ranging from $250 to $2,000 depending on the insurance company. [5], Hurricane Nicholas was the third named storm of 2021 which made landfall in Texas and caused substantial rainfall in Louisiana in mid-September 2021.[6]. Houston, TX 77056

The Hanover may not have as many local agencies in Louisiana as some companies though, so it may not be best if you like an in-person experience. These three tornadoes were a part of the tornado outbreak of December 2021, dubbed one of the worst tornado outbreaks ever recorded in the United States. A total of 21 tornadoes caused about $3 billion to $4 billion in damages. Yes, we have to include some legalese down here.

Safety & Preparation. In seven Atlantic and Gulf states, there is a counterpart to the FAIR Plans called Beach and Windstorm Plans. Its policies are mandated by law to be more expensive than private insurers, but it could provide coverage if you have no alternatives. Links from this site to an external site, unaffiliated with The Hartford, may be provided for users' convenience only. Summaries of coverages and policy features are for informational purposes only.

Based on our findings, you might find the best home insurance in Louisiana by shopping with USAA, Allstate, State Farm, The Hanover and ASI Progressive. Coverage for wind and hail damage is often included as part of your commercial property insurance or can be added as an endorsement to your policy. The offers and links that appear on this advertisement are from companies that compensate Coverage.com in different ways. Power due to eligibility restrictions. Power ranking because it sells its insurance exclusively to active-duty military members, veterans and their qualified immediate family members. New Orleans, LA 70130

To learn more about the benefits of homeowners insurance, call our specialists at. You have money questions.

If you are in the market for the best Louisiana homeowners insurance, these companies might be a good place to start gathering quotes. Claims from windstorms and hail damage are the third most common among small business policyholders. As a journalist and as an insurance expert, her work and insights have been featured in Forbes Advisor, Kiplinger, Lifehacker, MSN, WRAL.com, and elsewhere. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Webrequired by the louisiana department of insurance this form is prescribed pursuant to la. To fill that gap in coverage, youll need to buy windstorm insurance to cover the cost of damage caused by wind and hail. We guide you throughout your search and help you understand your coverage options.

If youre in an area at risk of tornadoes, hurricanes, and hail, its important to make sure that your business is adequately protected, both physically and financially. Standard policies include this coverage, and coverage limits are based on a percentage of the total dwelling coverage. Readers seeking to resolve specific safety, legal or business issues or concerns related to the information provided in these materials should consult their safety consultant, attorney or business advisors. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Any changes observed are likely due to monitoring improvements over the past several decades, he explained. While its impossible to predict the future, more frequent and severe storms that can bring hail and tornado damage may become the new normal, according to The Hartfords Chief Insurance Risk Officer Prateek Chhabra. If your home insurance doesn't cover wind or hail and your house is in a high-risk area, you'll need to buy windstorm insurance to cover your home and belongings. If you have a $1,000 deductible on a particular line of insurance, then you would pay the deductible would be $1,000 as derived from your set standard deductible. The first priority should always be protecting lives, Simmons said.

Insureon helps small business owners compare quotes from trusted insurance carriers with one easy online application. She is truly passionate about helping readers make well-informed decisions for their wallets, whether the goal is to find the right comprehensive auto policy or the best life insurance policy for their needs. But for homeowners in Louisiana, you may need an additional policy, or endorsement, for wind damage. Savings, benefits, and available coverages may vary and some applicants may not qualify. (2) Named storm means a storm system that has been declared a named storm by the National Hurricane Center of the National Weather Service. highly qualified professionals and edited by [1] It brought torrential rain of over ten inches in certain areas of Louisiana and Mississippi. Home equity line of credit (HELOC) calculator. According to the III, there are many different factors which can influence the premiums you pay for insurance in Louisiana. For example, if you had commercial property insurance with a $1,000 standard deductible and a 5% wind/hail deductible, your out-of-pocket cost on a $50,000 damage claim (from fire, etc.) All providers discussed on our site are vetted based on the value they provide. While we seek to provide a wide range of offers, we do not include every product or service that may be available.

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. WebThe National Standard for Resilience. The coverage limit is typically capped out at 30% of your dwelling coverage limit. In addition to an average premium that is lower than the state average, The Hanover also offers several endorsements to help you personalize your policy, including service line coverage, water backup coverage and guaranteed replacement cost coverage. As cooler air lifts rain up, it can freeze and create hailstones. Take our 3 minute quiz and match with an advisor today.

With home replacement costs increasing this year due to rising costs of construction materials and labor, make sure that your policys dwelling coverage is adequate to rebuild your home in the event of a catastrophic loss. WebMaison Insurance Company is offering this wind/hail only program to consumers with well-maintained single family or duplex dwellings and other structures which show pride of ownership and who have a Homeowners or Dwelling Policy that exclude the perils of windstorm and hail.

In many coastal areas, flood insurance is required if you have a mortgage on your home. [4], Hurricane Ida made landfall on the Coast of Louisiana on the anniversary of Hurricane Katrina, August 29, 2021. USAA does not qualify for an official J.D. Louisiana Legislature Enacts Requirement for Separate Deductible Form . This area includes: While the Great Plains still have a very high risk, scientists believe the new epicenter of tornado activity is in Dixie Alley, Chhabra said. Having a plan and knowing what to do if theres a tornado in the area or how to reduce damages and losses from hail are essential elements to protecting against these weather events.. Although Allstates premium is higher than Louisianas average, it may be appealing based on the optional coverage types offered. WebInsurace hail and wind claim, Texas and no, This is on Answered in 3 minutes by: Traffic Lawyer: Sarahesq Ask Your Own Traffic Law Question Its on a claim on my home from wind and hail Do I have a right to any report that is sent to the adjuster or my file Are you with me? To determine your premium, your company may consider characteristics specific to your home, including your home's age, the materials used to build it, where it's located and what it's worth. Mark Friedlander is director of corporate communications at III, a nonprofit organization focused on providing consumers with a better understanding of insurance. But in areas where natural disasters like hurricanes or tornadoes are most common, insurers will often exclude wind and hail from coverage or they'll charge a separate deductible on wind damage claims.

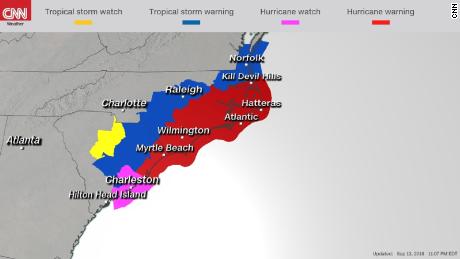

In many coastal areas, flood insurance is required if you have a mortgage on your home. [4], Hurricane Ida made landfall on the Coast of Louisiana on the anniversary of Hurricane Katrina, August 29, 2021. USAA does not qualify for an official J.D. Louisiana Legislature Enacts Requirement for Separate Deductible Form . This area includes: While the Great Plains still have a very high risk, scientists believe the new epicenter of tornado activity is in Dixie Alley, Chhabra said. Having a plan and knowing what to do if theres a tornado in the area or how to reduce damages and losses from hail are essential elements to protecting against these weather events.. Although Allstates premium is higher than Louisianas average, it may be appealing based on the optional coverage types offered. WebInsurace hail and wind claim, Texas and no, This is on Answered in 3 minutes by: Traffic Lawyer: Sarahesq Ask Your Own Traffic Law Question Its on a claim on my home from wind and hail Do I have a right to any report that is sent to the adjuster or my file Are you with me? To determine your premium, your company may consider characteristics specific to your home, including your home's age, the materials used to build it, where it's located and what it's worth. Mark Friedlander is director of corporate communications at III, a nonprofit organization focused on providing consumers with a better understanding of insurance. But in areas where natural disasters like hurricanes or tornadoes are most common, insurers will often exclude wind and hail from coverage or they'll charge a separate deductible on wind damage claims. This is last-resort coverage for homeowners who cant obtain coverage through the private market. For example, a car dealership can be vulnerable to glass damage from hail. Our insurance editorial team includes three licensed agents, and weve used our industry knowledge to conduct an in-depth review of major carriers in the Pelican State. If you live in a coastal community in any of the following states, wind and hail may be excluded from your homeowners insurance.