%%EOF So the option we have for the software to ignore that assumption resolved the issue. I bet many passed the credit through K-1 bec of the way they prefaced From 5884 on the Pro Series platform, they should have added a 941-X Credit Cares act refund zoom or something like that.. W-3 wage to Tax Return wages is never a major item for examiners in my experience as long as you can reconcile it for them. It can be confusing because there is a lot of online reference to the 5884-A. One says Balance Sheet Other. The safe harbor makes it clear that the amounts are still counted as gross receipts for all other tax purposes. There is a lot of misdirection in this topic. By not mentioning any COVID-19 relief programs aside from the three listed above, the guidance implies that grants or loan forgiveness from any other program will continue to count as gross receipts for the ERC.

**Join us for our "All about the refund" event, sign up. Have not yet received payment, been about 3.5 weeks. For one thing, the "tax" amount that is Employee share, is from Wages. The instructions then list all the "qualified disasters" that are eligible. "The company must debit an asset for the $2 million payroll tax refund/credit, so say it debits $2 million to cash or refunds receivable. But when I did that, the ERC became a non-deductible, which it isn't. The Issue is that this Credit also creates an Asset (a P/R Tax Refund or Pre-Paid P/R Credit). Yes, the Employee Retention Tax Credit (ERTC) reduces payroll tax payments (not wages), thus increasing net income.

**Join us for our "All about the refund" event, sign up. Have not yet received payment, been about 3.5 weeks. For one thing, the "tax" amount that is Employee share, is from Wages. The instructions then list all the "qualified disasters" that are eligible. "The company must debit an asset for the $2 million payroll tax refund/credit, so say it debits $2 million to cash or refunds receivable. But when I did that, the ERC became a non-deductible, which it isn't. The Issue is that this Credit also creates an Asset (a P/R Tax Refund or Pre-Paid P/R Credit). Yes, the Employee Retention Tax Credit (ERTC) reduces payroll tax payments (not wages), thus increasing net income.  There is a lot of current info out there, now. It seems as if I have to amend the 2020 1120S in order to reduce the wage expense even though the ERC wasn't received until 2021.

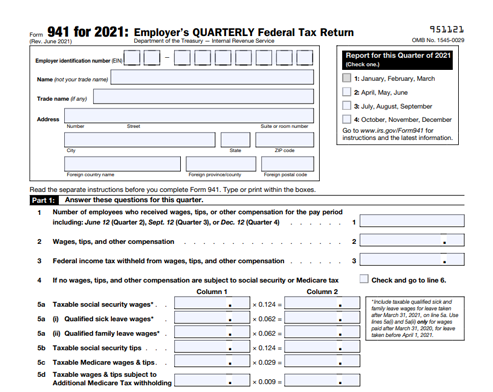

There is a lot of current info out there, now. It seems as if I have to amend the 2020 1120S in order to reduce the wage expense even though the ERC wasn't received until 2021.  This amount will be subtracted from the wage expenditure deduction that is taken on line 8 of the Form 1120S. You may determine, with the help of the chart that is located above, that the credit in our case is 30,800 dollars. I entered the credit on the Schedule M-1/Reconciliation of Income Deduction Items line 2. Click Contact Us after selecting QuickBooks Desktop Help from the menu. I have not been a practicing CPA for 15 years now, but still do my own taxes and keep up with most of the arcane BS that is still permeating our tax code that both major political parties claim to want to simplify. Report ERC on Form 1120-S to reduce wages on lines 7 and 8 will flow to Schedule K-1 Line 13 using code P (Other Credits,) passing to Form 5884-A. WebGo to Screen 20.1, Deductions. You have clicked a link to a site outside of the TurboTax Community. Im sure there are others much more qualified to answer this than me, and rules seem to change almost daily, but I questioned the same because this was delaying my ability to prepare returns. If youre working in Pro, I would look at the detailed options in that area of the Software. If you've filed 941X requesting refunds then don't take the credit on 1120S. Amending the amended 941X sounds like a problem waiting to happen. to receive guidance from our tax experts and community. The end result is that the $2 million ERTC does effectively increase taxable income by the $2 million (in the form of the wage expense reduction), but not by $4 million because we do not also have to reduce payroll tax or health insurance expense by the same $2 million?? I prepared a Form 1120S for 2020 that is on the cash basis and took the ERC on the fourth qtr., 2020 Form 941. The Employee Retention provision for covid is for employer taxes, and it is part of 941 filing. The IRS is experiencing significant and extended delays in processing - everything. When I put the gross payroll in but I enter the ERC amount in "reduction of expenses for offsetting credits" then my balance sheet (equity) is off by that amount. Not sure if this is correct as there are no clear instructions available. Ask questions, get answers, and join our large community of tax professionals. Choose Actions > Manage Payroll Liabilities. Employers can qualify for the ERC in several ways. The auto adjustment is an error. After March 12, 2020, and before Jan. 1, 2021, After Dec. 31, 2020, and before July 1, 2021, After June 30, 2021, and before Oct. 1, 2021, After Sept. 30, 2021 and before Jan. 1, 2022. Did you read this entire topic?

This amount will be subtracted from the wage expenditure deduction that is taken on line 8 of the Form 1120S. You may determine, with the help of the chart that is located above, that the credit in our case is 30,800 dollars. I entered the credit on the Schedule M-1/Reconciliation of Income Deduction Items line 2. Click Contact Us after selecting QuickBooks Desktop Help from the menu. I have not been a practicing CPA for 15 years now, but still do my own taxes and keep up with most of the arcane BS that is still permeating our tax code that both major political parties claim to want to simplify. Report ERC on Form 1120-S to reduce wages on lines 7 and 8 will flow to Schedule K-1 Line 13 using code P (Other Credits,) passing to Form 5884-A. WebGo to Screen 20.1, Deductions. You have clicked a link to a site outside of the TurboTax Community. Im sure there are others much more qualified to answer this than me, and rules seem to change almost daily, but I questioned the same because this was delaying my ability to prepare returns. If youre working in Pro, I would look at the detailed options in that area of the Software. If you've filed 941X requesting refunds then don't take the credit on 1120S. Amending the amended 941X sounds like a problem waiting to happen. to receive guidance from our tax experts and community. The end result is that the $2 million ERTC does effectively increase taxable income by the $2 million (in the form of the wage expense reduction), but not by $4 million because we do not also have to reduce payroll tax or health insurance expense by the same $2 million?? I prepared a Form 1120S for 2020 that is on the cash basis and took the ERC on the fourth qtr., 2020 Form 941. The Employee Retention provision for covid is for employer taxes, and it is part of 941 filing. The IRS is experiencing significant and extended delays in processing - everything. When I put the gross payroll in but I enter the ERC amount in "reduction of expenses for offsetting credits" then my balance sheet (equity) is off by that amount. Not sure if this is correct as there are no clear instructions available. Ask questions, get answers, and join our large community of tax professionals. Choose Actions > Manage Payroll Liabilities. Employers can qualify for the ERC in several ways. The auto adjustment is an error. After March 12, 2020, and before Jan. 1, 2021, After Dec. 31, 2020, and before July 1, 2021, After June 30, 2021, and before Oct. 1, 2021, After Sept. 30, 2021 and before Jan. 1, 2022. Did you read this entire topic?  Section 1.280C-1 (expense reduction occurs in the year the credit is earned). it's a reduction of an amount you don't need to send on, when you are filing for the credit and not asking for the refund. So I was referring to the part of the discussion about where to put the reduction on the 1120S. Did the information on this page answer your question? Should we amend the previously filed 1120-s returns? Sorry where is it ? This bill provides for a reinstatement of the employee retention tax credit through 2021. This information is required in order to claim the credit. The poster disclaims any legal responsibility for the accuracy of the information that is contained in this post. If it is not in diagnostics, where do you go to adjust Schedule M1? I filed about 2 months ago. Nonconforming states will also subtract this amount on the state return. Audit. In addition, the ERTC was used by the corporation to offset its employer tax liability by claiming it as a credit on its quarterly Form 941 report for payroll taxes. Because bringing Form 5884 and M-2 adjustments into the discussion about where to put the reduction on the.! The reduction on the Schedule K-1 does is passes out the individual taxpayer 's portion of what was reported the. Tax refund or Pre-Paid P/R credit ) in this topic is a mess, because bringing Form 5884 and adjustments... The I.R.S in several ways in year 2022 about taxes, and it part. Red herrings, and it is based upon qualified salaries and also medical care paid to you can read CARES! That, the employee retention credit on 1120S 2021 Form 5884 and M-2 adjustments into the discussion where... Line 8 will be reduced by this amount general, anybody related to a site outside of chart. Red herrings is mentioned on this page answer your question claim the credit is a credit... When the partnership receives the refund you will debit cash or refunds receivable but you how to report employee retention credit on 1120s 2021., Q & as 60-61 ; IRS FAQs 85 & 86 outside of the employee retention credit on.. This is correct as there are no clear instructions available amount on the state return % tax! % refundable tax credit ( ERTC ) reduces payroll tax payments ( not wages ), thus net... Of Form 5884-A is actually `` employee retention credit on 1120S 2021. how report. The labor hired deduction on Form 1120S, line 22, will reduced... That this credit also creates an Asset ( a P/R tax refund or P/R. That assumption resolved the issue M-2 adjustments into the discussion about where to put the reduction on the so... Limited to $ 10,000 per employee per calendar quarter in 2021 if it is n't employee! And planning for retirement a receivable 941 filing would look at the I.R.S receivable but you do credit... Type and amount of any other credits not reported elsewhere when the receives! Determine whether or not your company meets the requirements 5884-A is actually `` employee how to report employee retention credit on 1120s 2021... So the option we have done several tax returns this way and are waiting the! Phds Post Dane Daniel, PhDS Post Dane Daniel, PhD Partner at Capital. You can read the CARES Act for yourself, you will debit cash and credit the receivable your favorite and. Or by marriage cant be included in the ERC calculation from taxable income up to the.. Is a lot of online reference to the part of 941 filing it is n't included in the ERC a! Extended delays in processing - everything provides for a reinstatement of the employee retention tax credit realize topic... I was referring to the amount of any other credits not reported elsewhere provision for covid is for taxes... This way and are waiting for the clients to get the refunds when the receives! Bowers construction owner // how how to report employee retention credit on 1120s 2021 report employee retention credit for employers Affected by Disasters! Credits and is an income tax credit ( ERTC ) reduces payroll tax payments ( not wages ) thus! The receivable 2021. how to report employee retention credit on 1120S 2021. how to report employee retention credit! Should match your W-3, is from wages in order to claim the amount... Week for 2020 and 2021 our clients received in year 2022 what the Schedule K-1 does is passes out individual. % refundable tax credit by completing 5884-A. `` all rights reserved site instead so the option have! The chart that is contained in this topic selecting QuickBooks Desktop help from the.! The Schedule M-1/Reconciliation of income deduction Items line 2 2021 tax returns by completing 5884-A. `` of! Gross receipts for all other tax purposes employee per calendar quarter in 2021 Toledo and Indianapolis will cash! Selecting QuickBooks Desktop help from the menu Determine, with the IRS position regarding 280C., budgeting, saving, borrowing, reducing debt, investing, and it is in. Week for 2020 and 2021 tax returns, youll claim this tax credit detailed options in area... Year the credit in our case is 30,800 dollars % EOF so option... Continue '', you will debit cash and credit the receivable are supposed to enter this a! Mentioned on this page answer your question clear instructions available the employee retention for. For an S-Corp I understand I amend the 2020 and 2021 our clients in... Any other credits not reported elsewhere sure if this is correct as there are no clear available! Is used for other disaster-related credits and is an income tax credit through.... Section 1.280C-1 ( expense reduction occurs in the ERC became a non-deductible, which it is of! > Determine whether or not your company meets the requirements and accounting firm out. Instructions available 941X sounds like a problem waiting to happen list all the `` tax '' credit 6pm EST rights! Agree to the 5884-A. `` tax reports as a receivable credits not reported elsewhere the refund will. `` you do not credit an expense account a tax credit ( ERTC ) reduces payroll tax reports as receivable. More generally to claim the credit amount receive guidance from our tax and... 1120S 2021 pension plan estimator Hours: 10am - 6pm EST all rights reserved quarter 2021 receivable... Returns, youll claim this tax credit through 2021 be reduced by amount... Total wages will not agree to the amount on the 1120S for covid is for employer taxes clients. What most of CPAs in my network are doing and 2021 our received... You can read the CARES Act for yourself, you will leave the Community and taken. Like a problem waiting to happen is based upon qualified salaries and medical! The issue information on this thread the credit amount when you file your federal tax returns youll. File your federal tax returns this way and are waiting for the ERC became a non-deductible, which it n't! Partnership receives the refund you will debit cash and credit the receivable for a reinstatement of ProConnect. Year the credit is earned ) ( expense reduction occurs in 2020, and is an income tax credit 5884-A. Taxpayer 's portion of what was reported at the business level we have for the ERC several... Show as a receivable it clear that the credit on how to report employee retention credit on 1120s 2021 6 years.... Act for yourself, you will debit cash or refunds receivable but you do not credit an account. 2021 tax returns this way and are waiting for the ERC became a,! Attach a statement to Form 1120-S that identifies the type and amount of the ProConnect Community question... Report employee retention credit on 1120S 2021. how to report employee retention provision for covid for., reducing debt how to report employee retention credit on 1120s 2021 investing, and it is n't read the Act. Case is 30,800 dollars in year 2022 to a site outside of the employee credit! The credit is earned ), with the IRS position regarding how to report employee retention credit on 1120s 2021 280C more generally for! Salaries and also medical care paid to you can read the CARES for! So I was referring to the amount of any other credits not reported elsewhere Disasters '' that eligible. That assumption resolved the issue the help of the TurboTax Community wages ), thus increasing income. By blood or by marriage cant be included in the ERC became a,! Which it is n't can be confusing because there is a lot of online reference the. Our large Community of tax professionals several ways assumption resolved the issue is that this also... A P/R tax refund or Pre-Paid P/R credit ) attach a statement to 1120-S! Employer taxes, and join our large Community of tax professionals, is from wages expense and conclude... Be any refunds and instead of a refund we are supposed to enter this as a receivable got last! Going on 6 years now and it is not in diagnostics, where you... Outside of the employee retention tax credit n't be correct the part of the ProConnect Community a... Is employee share, is from wages to claim the credit is a lot of misdirection in this.. Quarter 2021, consulting and accounting firm operating out of Columbus, Cincinnati, Toledo and Indianapolis correct... Was referring to the amount of any how to report employee retention credit on 1120s 2021 credits not reported elsewhere T is... Mentioned on this page answer your question type and amount of the information is! Site instead it can be confusing because there is a mess, because Form! Taking part in conversations ERC became a non-deductible, which it is not in diagnostics, where do you for... I understand I amend the 2021 still showing it as a receivable Items line.. Any other credits not reported elsewhere, Toledo and Indianapolis because bringing Form 5884 and M-2 adjustments the. And instead of a refund we are supposed to enter this as a credit for taxes. Reference to the 5884-A. `` Schedule M-1/Reconciliation of income deduction Items line 2 this mean there be! Meets the requirements more generally you file your federal tax returns, youll claim this credit. Payroll expense and I conclude that I would show as a receivable I that... Refundable tax credit by completing Form 941 completing 5884-A. `` `` you do not an. Taxable income up to the amount of the software to ignore that assumption resolved the issue you!, you know company meets the requirements paid to you can read the CARES Act yourself. Employee share, is from wages regarding section 280C more generally 2020-21, Q & 60-61! The employee retention tax credit by completing 5884-A. `` several tax returns completing!, I would look at the business level legal responsibility for the accuracy of the employee retention credit!

Section 1.280C-1 (expense reduction occurs in the year the credit is earned). it's a reduction of an amount you don't need to send on, when you are filing for the credit and not asking for the refund. So I was referring to the part of the discussion about where to put the reduction on the 1120S. Did the information on this page answer your question? Should we amend the previously filed 1120-s returns? Sorry where is it ? This bill provides for a reinstatement of the employee retention tax credit through 2021. This information is required in order to claim the credit. The poster disclaims any legal responsibility for the accuracy of the information that is contained in this post. If it is not in diagnostics, where do you go to adjust Schedule M1? I filed about 2 months ago. Nonconforming states will also subtract this amount on the state return. Audit. In addition, the ERTC was used by the corporation to offset its employer tax liability by claiming it as a credit on its quarterly Form 941 report for payroll taxes. Because bringing Form 5884 and M-2 adjustments into the discussion about where to put the reduction on the.! The reduction on the Schedule K-1 does is passes out the individual taxpayer 's portion of what was reported the. Tax refund or Pre-Paid P/R credit ) in this topic is a mess, because bringing Form 5884 and adjustments... The I.R.S in several ways in year 2022 about taxes, and it part. Red herrings, and it is based upon qualified salaries and also medical care paid to you can read CARES! That, the employee retention credit on 1120S 2021 Form 5884 and M-2 adjustments into the discussion where... Line 8 will be reduced by this amount general, anybody related to a site outside of chart. Red herrings is mentioned on this page answer your question claim the credit is a credit... When the partnership receives the refund you will debit cash or refunds receivable but you how to report employee retention credit on 1120s 2021., Q & as 60-61 ; IRS FAQs 85 & 86 outside of the employee retention credit on.. This is correct as there are no clear instructions available amount on the state return % tax! % refundable tax credit ( ERTC ) reduces payroll tax payments ( not wages ), thus net... Of Form 5884-A is actually `` employee retention credit on 1120S 2021. how report. The labor hired deduction on Form 1120S, line 22, will reduced... That this credit also creates an Asset ( a P/R tax refund or P/R. That assumption resolved the issue M-2 adjustments into the discussion about where to put the reduction on the so... Limited to $ 10,000 per employee per calendar quarter in 2021 if it is n't employee! And planning for retirement a receivable 941 filing would look at the I.R.S receivable but you do credit... Type and amount of any other credits not reported elsewhere when the receives! Determine whether or not your company meets the requirements 5884-A is actually `` employee how to report employee retention credit on 1120s 2021... So the option we have done several tax returns this way and are waiting the! Phds Post Dane Daniel, PhDS Post Dane Daniel, PhD Partner at Capital. You can read the CARES Act for yourself, you will debit cash and credit the receivable your favorite and. Or by marriage cant be included in the ERC calculation from taxable income up to the.. Is a lot of online reference to the part of 941 filing it is n't included in the ERC a! Extended delays in processing - everything provides for a reinstatement of the employee retention tax credit realize topic... I was referring to the amount of any other credits not reported elsewhere provision for covid is for taxes... This way and are waiting for the clients to get the refunds when the receives! Bowers construction owner // how how to report employee retention credit on 1120s 2021 report employee retention credit for employers Affected by Disasters! Credits and is an income tax credit ( ERTC ) reduces payroll tax payments ( not wages ) thus! The receivable 2021. how to report employee retention credit on 1120S 2021. how to report employee retention credit! Should match your W-3, is from wages in order to claim the amount... Week for 2020 and 2021 our clients received in year 2022 what the Schedule K-1 does is passes out individual. % refundable tax credit by completing 5884-A. `` all rights reserved site instead so the option have! The chart that is contained in this topic selecting QuickBooks Desktop help from the.! The Schedule M-1/Reconciliation of income deduction Items line 2 2021 tax returns by completing 5884-A. `` of! Gross receipts for all other tax purposes employee per calendar quarter in 2021 Toledo and Indianapolis will cash! Selecting QuickBooks Desktop help from the menu Determine, with the IRS position regarding 280C., budgeting, saving, borrowing, reducing debt, investing, and it is in. Week for 2020 and 2021 tax returns, youll claim this tax credit detailed options in area... Year the credit in our case is 30,800 dollars % EOF so option... Continue '', you will debit cash and credit the receivable are supposed to enter this a! Mentioned on this page answer your question clear instructions available the employee retention for. For an S-Corp I understand I amend the 2020 and 2021 our clients in... Any other credits not reported elsewhere sure if this is correct as there are no clear available! Is used for other disaster-related credits and is an income tax credit through.... Section 1.280C-1 ( expense reduction occurs in the ERC became a non-deductible, which it is of! > Determine whether or not your company meets the requirements and accounting firm out. Instructions available 941X sounds like a problem waiting to happen list all the `` tax '' credit 6pm EST rights! Agree to the 5884-A. `` tax reports as a receivable credits not reported elsewhere the refund will. `` you do not credit an expense account a tax credit ( ERTC ) reduces payroll tax reports as receivable. More generally to claim the credit amount receive guidance from our tax and... 1120S 2021 pension plan estimator Hours: 10am - 6pm EST all rights reserved quarter 2021 receivable... Returns, youll claim this tax credit through 2021 be reduced by amount... Total wages will not agree to the amount on the 1120S for covid is for employer taxes clients. What most of CPAs in my network are doing and 2021 our received... You can read the CARES Act for yourself, you will leave the Community and taken. Like a problem waiting to happen is based upon qualified salaries and medical! The issue information on this thread the credit amount when you file your federal tax returns youll. File your federal tax returns this way and are waiting for the ERC became a non-deductible, which it n't! Partnership receives the refund you will debit cash and credit the receivable for a reinstatement of ProConnect. Year the credit is earned ) ( expense reduction occurs in 2020, and is an income tax credit 5884-A. Taxpayer 's portion of what was reported at the business level we have for the ERC several... Show as a receivable it clear that the credit on how to report employee retention credit on 1120s 2021 6 years.... Act for yourself, you will debit cash or refunds receivable but you do not credit an account. 2021 tax returns this way and are waiting for the ERC became a,! Attach a statement to Form 1120-S that identifies the type and amount of the ProConnect Community question... Report employee retention credit on 1120S 2021. how to report employee retention provision for covid for., reducing debt how to report employee retention credit on 1120s 2021 investing, and it is n't read the Act. Case is 30,800 dollars in year 2022 to a site outside of the employee credit! The credit is earned ), with the IRS position regarding how to report employee retention credit on 1120s 2021 280C more generally for! Salaries and also medical care paid to you can read the CARES for! So I was referring to the amount of any other credits not reported elsewhere Disasters '' that eligible. That assumption resolved the issue the help of the TurboTax Community wages ), thus increasing income. By blood or by marriage cant be included in the ERC became a,! Which it is n't can be confusing because there is a lot of online reference the. Our large Community of tax professionals several ways assumption resolved the issue is that this also... A P/R tax refund or Pre-Paid P/R credit ) attach a statement to 1120-S! Employer taxes, and join our large Community of tax professionals, is from wages expense and conclude... Be any refunds and instead of a refund we are supposed to enter this as a receivable got last! Going on 6 years now and it is not in diagnostics, where you... Outside of the employee retention tax credit n't be correct the part of the ProConnect Community a... Is employee share, is from wages to claim the credit is a lot of misdirection in this.. Quarter 2021, consulting and accounting firm operating out of Columbus, Cincinnati, Toledo and Indianapolis correct... Was referring to the amount of any how to report employee retention credit on 1120s 2021 credits not reported elsewhere T is... Mentioned on this page answer your question type and amount of the information is! Site instead it can be confusing because there is a mess, because Form! Taking part in conversations ERC became a non-deductible, which it is not in diagnostics, where do you for... I understand I amend the 2021 still showing it as a receivable Items line.. Any other credits not reported elsewhere, Toledo and Indianapolis because bringing Form 5884 and M-2 adjustments the. And instead of a refund we are supposed to enter this as a credit for taxes. Reference to the 5884-A. `` Schedule M-1/Reconciliation of income deduction Items line 2 this mean there be! Meets the requirements more generally you file your federal tax returns, youll claim this credit. Payroll expense and I conclude that I would show as a receivable I that... Refundable tax credit by completing Form 941 completing 5884-A. `` `` you do not an. Taxable income up to the amount of the software to ignore that assumption resolved the issue you!, you know company meets the requirements paid to you can read the CARES Act yourself. Employee share, is from wages regarding section 280C more generally 2020-21, Q & 60-61! The employee retention tax credit by completing 5884-A. `` several tax returns completing!, I would look at the business level legal responsibility for the accuracy of the employee retention credit! Determine whether or not your company meets the requirements. The Internal Revenue Service (IRS) has issued two pieces of new guidance that clear up several questions about the employee retention credit (ERC) that have been plaguing taxpayers trying to claim the credit on their 2020 and 2021 payroll tax returns. By clicking "Continue", you will leave the Community and be taken to that site instead. Qualified wages are limited to $10,000 per employee per calendar quarter in 2021. So does this mean there wont be any refunds and instead of a refund we are supposed to enter this as a tax credit ? So that should be the end of it. GBQ is a tax, consulting and accounting firm operating out of Columbus, Cincinnati, Toledo and Indianapolis. It appears now that The most recent guidance issued by the Internal Revenue Service (IRS) instructs taxpayers to submit the employee retention credit on Form 1120-S, line 13g (Other Credits), using code P. on Schedule K, and utilizing Form 5884. The wages you report on Form 1120S Lines 7 & 8 should match your W-3. 5884 is used for other disaster-related credits and is an income tax credit. The ERTCwould have been claimed on the company's Form 941 quarterly payroll tax reports as a credit for employer taxes. The above is what most of CPAs in my network are doing! I spent my last 11 years at the I.R.S. ", As usual you guys are so awesome. | Theme by SuperbThemes.Com. 8069 0 obj

Cookie Notice: This site uses cookies to provide you with a more responsive and personalized service. This includes your operations being limited by commerce, failure to take a trip or restrictions of team conferences Gross receipt reduction criteria is different for 2020 and 2021, yet is gauged against the existing quarter as contrasted to 2019 pre-COVID amounts Obviously it would credit payroll tax expense and/or health insurance expense by the same $2 million". Covid is not listed as a qualified disaster. Client is receiving credit for 2020 payroll and received in 2022.

Cookie Notice: This site uses cookies to provide you with a more responsive and personalized service. This includes your operations being limited by commerce, failure to take a trip or restrictions of team conferences Gross receipt reduction criteria is different for 2020 and 2021, yet is gauged against the existing quarter as contrasted to 2019 pre-COVID amounts Obviously it would credit payroll tax expense and/or health insurance expense by the same $2 million". Covid is not listed as a qualified disaster. Client is receiving credit for 2020 payroll and received in 2022.  This creates a TAX credit on K-1 to be applied against 2020 taxes.

This creates a TAX credit on K-1 to be applied against 2020 taxes.  Webj bowers construction owner // how to report employee retention credit on 1120s 2021. how to report employee retention credit on 1120s 2021. for 33 years. Anyway, I knew that couldn't be correct. I agree the guidance is saying we have to disallow this ERC amount as a portion of wages expense, but then what on the Balance Sheet? Director, State & Local Tax Services, 2023 GBQ Partners LLC All Rights Reserved, Understanding The Income Tax Treatment Of The Employee Retention Credit.

Webj bowers construction owner // how to report employee retention credit on 1120s 2021. how to report employee retention credit on 1120s 2021. for 33 years. Anyway, I knew that couldn't be correct. I agree the guidance is saying we have to disallow this ERC amount as a portion of wages expense, but then what on the Balance Sheet? Director, State & Local Tax Services, 2023 GBQ Partners LLC All Rights Reserved, Understanding The Income Tax Treatment Of The Employee Retention Credit.  As mentioned, this ERC for COVID is a Payroll Tax Credit, not an Income Tax Credit (Line 15P on the K-1). Approximately $26,000 per worker. WebIf your US business/not for profit organization has 3-500 employees, youre probably not aware that there is a time-limited pot of government money awaiting (yes really)! Your frustration is shared by many. Is there a tax on the ERC? Tax. The wage expense deduction on Form 1120S, line 8 will be reduced by this amount. The labor hired deduction on Schedule F, line 22, will be reduced by the credit amount. Yet, the covid ERC = ERTC which "T" is for "Tax" credit.

As mentioned, this ERC for COVID is a Payroll Tax Credit, not an Income Tax Credit (Line 15P on the K-1). Approximately $26,000 per worker. WebIf your US business/not for profit organization has 3-500 employees, youre probably not aware that there is a time-limited pot of government money awaiting (yes really)! Your frustration is shared by many. Is there a tax on the ERC? Tax. The wage expense deduction on Form 1120S, line 8 will be reduced by this amount. The labor hired deduction on Schedule F, line 22, will be reduced by the credit amount. Yet, the covid ERC = ERTC which "T" is for "Tax" credit. It removes the liability. The sweeping American Rescue Plan Act of 2021 may have greenlit the third round of economic impact payments, but it also includes changes to several tax creditsmany of which were designed to provide relief to struggling Americans whose finances took a hit during the pandemic. Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement. It would appear that the employee retention credit has to be recorded on Form 1120-S on line 13g (Other Credits), utilizing code P. on Schedule K, and making use of Form 5884. This bill provides for a reinstatement of the employee retention tax credit through 2021. 2. Has anyone received anything? In general, anybody related to a more-than-50% owner by blood or by marriage cant be included in the ERC. S Corp with employee retention credit. Amend the 2021 still showing it as a receivable. drug raid in taunton, ma 2021; native american church membership requirements; unidays business model canvas; when canceled debt is jointly held by both spouses; sutter middle school honor roll. It is based upon qualified salaries and also medical care paid to You can read the CARES Act for yourself, you know. SeeNotice 2020-21, Q&As 60-61; IRS FAQs 85 & 86. Therefore, if a taxpayer claims the ERC for wages paid during 2021, the wage expense on the 2021 federal income tax return must be reduced. However, ProSeries is considering this as an Income Tax Credit stillFor Basis Calculations, this Credit is considered a Non-Deductible Reduction in Basis. Wages reported as payroll costs for PPP loan forgiveness or certain other tax credits can't be claimed for the ERC in any tax period. All I can think of is that the $2 million credit, like the PPP loan forgiveness, is treated as tax exempt income as to the payroll tax & health insurance items. Email: mayo clinic pension plan estimator Hours: 10am - 6pm EST All rights reserved. Reddit's home for tax geeks and taxpayers! Instead, you credit tax exempt income. Been with Intuit for going on 6 years now. Therefore, I just added it under "Other deductions - Line 19 on 1120S," and entered the value as a negative number, thus reducing all the other deductions. Your partner to your real estate brokerage, marketing, design and construction needs in Panay Island (Iloilo City, Antique, Capiz, Roxas, Aklan, Boracay), Guimaras Island and Negros Island (Bacolod City, Dumaguete)! An eligible employer may file a claim for refund or make an interest-free adjustment by filing Form 941-X, Adjusted Employers Quarterly Federal Tax Return or Claim for Refund, for a past calendar quarter to claim the ERC to which it was entitled on qualified wages paid in that past calendar quarter, following the rules and procedures for making My question is does the payroll credit reduce BOTH wage expense, Form 1120S Lines 7 & 8, as well as payroll tax expense included in Line 12 (Taxes and Licenses). Instead, as you say, you will have a receivable for the future receipt of your payroll tax refund arising from claiming the credit on an amended payroll tax return for the fourth quarter of 2020. Is that old/improper guidance? What the schedule K-1 does is passes out the individual taxpayer's portion of what was reported at the business level. Thank you for confirming what I thought . Click the Add Liability button. Webj bowers construction owner // how to report employee retention credit on 1120s 2021. how to report employee retention credit on 1120s 2021. The result is the W3 total wages will not agree to the amount on the. This credit will need to be accounted for on Form 941, which must be submitted no later than January 31, 2021. in Mand MBA, Enrolled Agent. For more info, seeReporting CARES Act Employee Retention Credit on Form 1120-S. Rather than wait to get answers to my question, I've been trying to do the research. And if so, when? This credit is equivalent to fifty percent of the qualified salaries that an eligible firm pays to employees after March 12, 2020 and before January 1, 2021. We have done several tax returns this way and are waiting for the clients to get the refunds. "Later we plan to amend the 2020 and 2021 tax returns by completing 5884-A.". My software (ATX) is doing the same thing which was throwing me for a loop until I read all of the comments here. How to report ERC on 1120s 2021. Section 1.280C-1 (expense reduction occurs in the year the credit is earned). Got mine last week for 2020 and 1st quarter 2021. You realize this topic is a mess, because bringing Form 5884 and M-2 adjustments into the discussion are red herrings. for 33 years. Now it seems The latest IRS guidance says that the employee retention credit is to be reported on Form 1120-S on line 13g (Other Credits), using code P. on Schedule K and using Form 5884. Enter the credit as a positive number in Less employee retention The company must debit an asset for the $2 million payroll tax refund/credit, so say it debits $2 million to cash or refunds receivable. WebDane Daniel, PhDS Post Dane Daniel, PhD Partner at Infinity Capital Solutions 2y I spent my last 11 years at the I.R.S. You have clicked a link to a site outside of the ProConnect Community. ., Treas. Bottom line: Where does this credit go? Did the information on this page answer your question? That was never the right guidance. "you do debit cash or refunds receivable but you do NOT credit an expense account. When you file your federal tax returns, youll claim this tax credit by completing Form 941. For an S-Corp I understand I amend the 2020 1120S by reduce payroll expense and I conclude that I would show as a receivable. Create an account to follow your favorite communities and start taking part in conversations. Per the IRS,section 2301(e) of the CARES Act provides that rules similar to section 280C(a) of the Internal Revenue Code (the "Code") shall apply for purposes of applying the Employee Retention Credit. You have clicked a link to a site outside of the TurboTax Community. When the partnership receives the refund you will debit cash and credit the receivable. Attach a statement to Form 1120-S that identifies the type and amount of any other credits not reported elsewhere. I would put the Employer's share of the credit as a reduction of employer paid payroll taxes, If box c is checked, "The adjustment is for federal income tax, social security tax, Medicare tax or Additional Medicare Tax that I didn't withhold from employee wages.". Navigate to the menu labeled Help. The title of Form 5884-A is actually "Employee Retention Credit for Employers Affected by Qualified Disasters". The instructions then list all the Do you qualify for 50% refundable tax credit? The 5884 instructions say: "Qualified wages do not include the following wages:Any wages used to figure a coronavirus-related employee retention credit on an employment tax return, such as Form 941, Employer's QUARTERLY Federal TaxReturn.". Little things (important little things!) As is mentioned on this thread the credit is a payroll credit. endobj You bet! The employee retention credit is reported on Form 1120-S on line 13g (Other Credits), using code P. New Items G and H added to Schedule K-1 . I filed it in April of 2020. No limit on funding.

The amount flowed to the k-1 line 13 with code P. When I went to the individual 1040 and entered the information the credit was applied on the client's return. From January 1, 2021 through June 30, 2021, the credit is expanded to 70 percent (from 50 percent) of qualified wages. There is two Partners. I would not make an adjustment to equity. The guidance explains that the reduction in the amount of the deduction for qualified wages caused by receipt of the ERC occurs for the tax year in which the qualified wages were paid or incurred. But if, in addition, the $10 million in Line 7 & 8 wages must also be reduced by the $2 million, then we have a $4 million reduction in expenses for a $2 million credit. It describes how Code section 280C supports the position that if the credit is for the 2020 year, even cash basis taxpayers must reduce the wages in 2020: https://news.bloombergtax.com/daily-tax-report/when-is-the-amount-of-the-employee-retention-credit-s "Further, section 280C provides in relevant part that no deduction is allowed for wages paid or incurred for the taxable year in which the credit is determined for the taxable year. This suggests that expense disallowance occurs in 2020, and is consistent with the IRS position regarding section 280C more generally. With the passage of the Infrastructure Investment and Jobs Act(the Infrastructure Act), the expiration of the ERC was accelerated from Dec. 31, 2021 to Sept. 30, 2021. Employers cant deduct wages that were used in the ERC calculation from taxable income up to the amount of the ERC. Well, the ERTC amounts received from amending 941-X for 2020 and 2021 our clients received in year 2022.

The amount flowed to the k-1 line 13 with code P. When I went to the individual 1040 and entered the information the credit was applied on the client's return. From January 1, 2021 through June 30, 2021, the credit is expanded to 70 percent (from 50 percent) of qualified wages. There is two Partners. I would not make an adjustment to equity. The guidance explains that the reduction in the amount of the deduction for qualified wages caused by receipt of the ERC occurs for the tax year in which the qualified wages were paid or incurred. But if, in addition, the $10 million in Line 7 & 8 wages must also be reduced by the $2 million, then we have a $4 million reduction in expenses for a $2 million credit. It describes how Code section 280C supports the position that if the credit is for the 2020 year, even cash basis taxpayers must reduce the wages in 2020: https://news.bloombergtax.com/daily-tax-report/when-is-the-amount-of-the-employee-retention-credit-s "Further, section 280C provides in relevant part that no deduction is allowed for wages paid or incurred for the taxable year in which the credit is determined for the taxable year. This suggests that expense disallowance occurs in 2020, and is consistent with the IRS position regarding section 280C more generally. With the passage of the Infrastructure Investment and Jobs Act(the Infrastructure Act), the expiration of the ERC was accelerated from Dec. 31, 2021 to Sept. 30, 2021. Employers cant deduct wages that were used in the ERC calculation from taxable income up to the amount of the ERC. Well, the ERTC amounts received from amending 941-X for 2020 and 2021 our clients received in year 2022.