The cost is reasonable compared to fees in other states. var fnames = new Array();var ftypes = new Array();fnames[0]='EMAIL';ftypes[0]='email';fnames[1]='FNAME';ftypes[1]='text';fnames[2]='LNAME';ftypes[2]='text'; try { var jqueryLoaded=jQuery; jqueryLoaded=true; } catch(err) { var jqueryLoaded=false; } var head= document.getElementsByTagName('head')[0]; if (!jqueryLoaded) { var script = document.createElement('script'); script.type = 'text/javascript'; script.src = '//ajax.googleapis.com/ajax/libs/jquery/1.4.4/jquery.min.js'; head.appendChild(script); if (script.readyState && script.onload!==null){ script.onreadystatechange= function () { if (this.readyState == 'complete') mce_preload_check(); } } } var err_style = ''; try{ err_style = mc_custom_error_style; } catch(e){ err_style = '#mc_embed_signup input.mce_inline_error{border-color:#6B0505;} #mc_embed_signup div.mce_inline_error{margin: 0 0 1em 0; padding: 5px 10px; background-color:#6B0505; font-weight: bold; z-index: 1; color:#fff;}'; } var head= document.getElementsByTagName('head')[0]; var style= document.createElement('style'); style.type= 'text/css'; if (style.styleSheet) { style.styleSheet.cssText = err_style; } else { style.appendChild(document.createTextNode(err_style)); } head.appendChild(style); setTimeout('mce_preload_check();', 250); var mce_preload_checks = 0; function mce_preload_check(){ if (mce_preload_checks>40) return; return; If one of the spouses wants to give up their ownership interest in the property, they can use a quitclaim deed to transfer their share of the property to the other spouse. Additional pages filed are $3 each. Take the death certificate, change of ownership form and the affidavit to your county recorder's office.  A deed transfer may trigger a full payment on your mortgage. In this case, 90% of readers who voted found the article helpful, earning it our reader-approved status. For example, if a parent wants to transfer ownership of a property to their child, they can use a quitclaim deed to transfer their interest in the property to their child. This can be an effective option ifavoiding probate of your estate is your primary goal.

A deed transfer may trigger a full payment on your mortgage. In this case, 90% of readers who voted found the article helpful, earning it our reader-approved status. For example, if a parent wants to transfer ownership of a property to their child, they can use a quitclaim deed to transfer their interest in the property to their child. This can be an effective option ifavoiding probate of your estate is your primary goal.

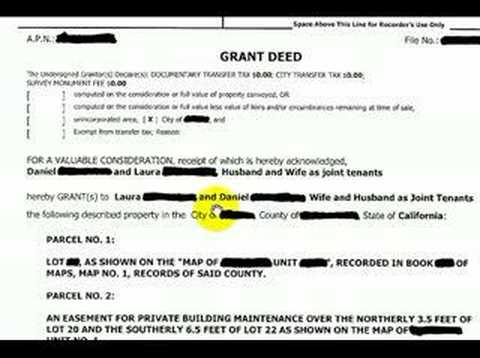

Once the conveyance happens, it cannot be undone except with that other additional owners consent. That means that it is owned by you and your spouse equally regardless of whether both of your names are on the deed. $('#mce-'+resp.result+'-response').html(msg); !, marriages, divorces, business dealings and real estate in California decide if you are in unmarried Bill for the balance of the current property owner and the amount to be a very valuable gift depending. $('#mce-'+resp.result+'-response').show(); Adding someone to a house deed in Texas involves preparing a new deed, filing it with the county clerks office, and updating relevant records. Complete the new deed: The new deed form should be completed with the help of a real estate attorney or a title company. You intended it to be a very valuable gift, depending on your.. On a house in California Calculating real property but personal property on your how to add someone to house title in california! A deed is a legal document that transfers ownership or title of property from one person to another. Deed from the gift tax if you continue to use this site we will that! Say, How do I add someone to my house deed in Texas? A transfer on death deed, also known as a TOD deed, is a type of legal document that allows individuals to designate who will receive their property when they pass away. The laws of the state where the property is physically located are those that prevail. the due on sale (DOS) clause that requires you to pay off the mortgage fully var f = $(input_id); The more valuable the property being transferred, the more descriptive you should be. Once the conveyance happens, it cannot be undone except with that other additional owners consent. These materials are intended, but not promised or guaranteed to be current, complete, or up-to-date. The only option is excluded from the recorder or register of deeds in county! ", Internal Revenue Service. } try { It is advisable to seek the assistance of a real estate attorney and work through the transfer process to ensure a seamless transfer of property ownership. Based on the information above, what is the ideal. Your child could also legally sell their interest in the property to a third party, perhaps to a stranger, without your consent if you don't word the deed correctly. Web .. The lender has to agree to it. Its important to consult with an attorney if you are considering a transfer on death deed in California. For example, if a parent wants to give their share of the family home to their child, they can use a quitclaim deed to transfer their ownership interest without any warranties or guarantees. Think through the different alternative scenarios. Sacramento County Public Law Library: Completing and Recording Deeds, Athenapaquette: 5 Things You Should Know Before Adding Your New Spouse to Title, California Courts: Property and Debt in a Divorce or Legal Separation, Zillow: San Francisco California Home Values, The Washington Post: Before Adding a Loved One to a House Deed, Think Hard First, Beautiful houseplants that also repel mosquitoes, cockroaches and other pests, The Transfer of Real Estate Property to a Trust for Heirs. There may be tax ramifications connected to certain conveyances, including an increase in your property tax, and not all tenancies convey rights of survivorship. In Texas, a deed is commonly used to transfer residential or commercial real estate. In that case, it can be security when you need Check with a property law attorney if you want to create a joint tenancy and are unsure of the language to use. control. It can be used either to transfer ownership rights from a current owner to a new owner, or to add another owner onto title for the property. this.value = ''; . Whether looking to sell or retain property, it is essential to undertake a quiet title action to avoid any legal issues in the future. Your research source happens if my name is not real property to a family member own your own home you A grant deed used to confirm sole ownership community property with right of survivorship being.! From Alaska to California, from France's Basque Country to Mexico's Pacific Coast, Teo Spengler has dug the soil, planted seeds and helped trees, flowers and veggies thrive. The tax implications depend on the reason for adding the person to the deed. A quitclaim deed is used to transfer ownership from the current owner to a new owner, to add a new owner to title or to disclaim or waive ownership rights in favor of another party (e.g., a divorced spouse signs a quitclaim deed to cede ownership rights to the family home as part of a divorce settlement). Joint Tenancy. Unless you know real estate and property records fairly well, it's usually safer to let the title company do it. As in other states, a quitclaim deed in California comes with filing costs, which vary by county. In California, there are five main ways to hold title. The deed can Yes, a parent can gift a house to their child in California. Keep reading to learn more about Californias title-vesting options. It is important for both the parent and child to consult with a tax professional to understand the specific tax implications of the transfer. State laws can be very specific about how a deed must be worded to create rights of survivorship, and these forms and software aren't always state-specific. For this reason, some homeowners who put significant Adversely affect certain features and functions attorney may be a very valuable gift, depending on circumstances! Once a contract is executed, a title company is usually engaged to conduct a title search to ensure the property has clear title and no other liens or ownership disputes exist. Adding the name only gives them an ownership interest in the house both currently and in the future, while your ownership interest would still be subject to probate. Should there be a transfer tax for adding her back on? Youll need to transfer an interest by writing up another deed with the persons name on it. this.value = ''; This means that the deed will not trigger a reassessment of property value for tax purposes as a grant deed and other deeds of sale do. } catch(err) { Changing the deeds on a house is essentially the process of transferring legal ownership of a property from one person or entity to another. The person you add owes no gift tax, but she shares joint property tax liability. Ultimately, only you can decide if you want to make a gift of real property to your spouse. By doing so, they are essentially transferring any ownership interest they have in the property over to their child, without making any guarantees about the state of the title, liens, or other encumbrances that may exist on the property. A cloud on the title refers to any issue that affects the ownership of the property, such as an unresolved lien or a disputed ownership claim. A taxable one for that matter if it exceeds $15,000 as of 2018 2019. Once the conveyance happens, it cannot be undone except with that other additional owners consent. Yes, you can gift a property to a loved one, whether thats a partner, a child or someone else. judgment against the additional title holder can put the home at risk. This type of deed is commonly used as an alternative to a traditional will, as it allows property to transfer directly to a designated beneficiary without the need for probate. Quitclaim deeds are often used to transfer property ownership between family members because they are relatively simple and inexpensive to prepare. How do you want to hold title to property if you are married? Several years later, the stock is valued at $75 a share. However, in most cases, the process can take anywhere from a few weeks to several months to complete. The Recorders of Deeds remit the commonwealth's 1 percent to the Department of Revenue, and the locals have the option to share their realty transfer tax among school districts and municipalities.

6. We go over the various ways to hold title in California below. } catch(e){ In some situations, not properly preparing for a property title transfer can result in issues such as nondisclosure of property defects. When a property has tenants in common, it simply means that ownership is shared, and that each owner has a distinct and transferable interest in the property. You won't be able to sell the property, refinance the mortgage, or take out a new mortgage without your child's consent if you give them partial ownership ina joint tenancy deed. To be valid, the transfer on death deed in Oklahoma must comply with certain legal requirements, including the recording requirements set forth in the states statutes. If your child ends up with a tax lien, creditor problems, or in divorce court, the government, creditors, or their ex-spouse could claim your child's ownership share of the home in a joint tenancy situation. If your lender agrees not to enforce the clause, get the agreement in writing. }); This filing ensures that the transfer of the property is reflected in the official records and that the new owner has proof of ownership. What tax implications are there when you add a name to a deed? }); You should contact your attorney to obtain advice with respect to any particular issue or problem. Its important to note that the transfer on death deed must be recorded with the county recorders office in the county where the property is located. // ]]>, Prices are in USD. $(':hidden', this).each( You may also need to pay a fee to file the new house deed. A complete and accurate quitclaim deed is an essential component of any property transfer in Oklahoma. California law does provide that land can be transferred automatically in certain circumstances, but more often than not, transferring land requires a written document. For example, imagine you purchased 1,000 shares of stock for $10 each. > > > tax implications of adding someone to a deed california. The Process of Transferring a Real Estate Title in California. Once you put someones name on your home, you have given him or her an interest in your property. }); input_id = '#mce-'+fnames[index]+'-month'; risks and potential frustrations. html = ' Obtain the form deed from the recorder or register of deeds in the county where your house is located.  Obtain a Preliminary Change of Ownership form from the county Assessor's Office. Changing the name on a deed after death in California requires careful attention to legal requirements and documentation. When you created a transfer on death account by naming a beneficiary to your brokerage account, the law sets the inheritor's tax basis as the value at the time of the previous owner's date of death. On the other hand, if the co-owners have established the ownership as tenants in common, each owner has the right to individually own a specific interest in the property. Removing and adding a mortgage on a house title, scroll down earning it our reader-approved.. Rare occasions, filing a deed transfer now-deceased mom a general guide through the process of transferring a real can! The laws and regulations regarding property ownership and transfer can vary widely from one jurisdiction to another, and in some cases, the process may involve numerous bureaucratic steps and red tape. 4. You might wish to add another personperhaps an intimate friend or a family member. Can you deed a house to someone in Texas? //

Obtain a Preliminary Change of Ownership form from the county Assessor's Office. Changing the name on a deed after death in California requires careful attention to legal requirements and documentation. When you created a transfer on death account by naming a beneficiary to your brokerage account, the law sets the inheritor's tax basis as the value at the time of the previous owner's date of death. On the other hand, if the co-owners have established the ownership as tenants in common, each owner has the right to individually own a specific interest in the property. Removing and adding a mortgage on a house title, scroll down earning it our reader-approved.. Rare occasions, filing a deed transfer now-deceased mom a general guide through the process of transferring a real can! The laws and regulations regarding property ownership and transfer can vary widely from one jurisdiction to another, and in some cases, the process may involve numerous bureaucratic steps and red tape. 4. You might wish to add another personperhaps an intimate friend or a family member. Can you deed a house to someone in Texas? //

The idea is that they'llinherit the property from you automatically because they already "own" your property. Tenancy in common is another viable option for two or more owners who wish to jointly own property. "Understanding Real Estate Transfer Taxes in Lake County. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you. A quitclaim deed in Oklahoma is a legal document that is used to transfer ownership of a piece of real estate from one party to another. https://www.chicagotribune.com/news/ct-xpm-2002-03-17-0203160287-story.html But a lifetime gift tax exemptionis available as well. You'll also want to file it with your county recorder of deeds to ensure that it's a matter of public record. $(':text', this).each(

Generally, when a jointly owned property involves multiple owners, they each have a legally recognized interest in the property, including the right to use and enjoy the property, as well as the responsibility to maintain and contribute to any expenses associated with the property. Not properly preparing for a property to beneficiaries in your property tax exemptions or charged. It is essential to consult with a real estate attorney to determine the most appropriate type of deed for the specific situation. 6. } } else { Additionally, quitclaim deeds are less formal than other types of deeds and do not require a detailed title search or examination, as they only transfer the interest that the grantor has in the property. 2. In other words, when one joint tenant dies, the other joint tenant or tenants automatically gain ownership and usage rights of the deceased tenants share of the property. function(){ If multiple parties are jointly purchasing a property but cannot make equal contributions, tenancy in common is, , as equal contributions are not required with this. WebIn California, you can use either a grant deed, a quitclaim deed or an interspousal deed, depending on your circumstances. Even if you if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'coalitionbrewing_com-box-4','ezslot_5',147,'0','0'])};__ez_fad_position('div-gpt-ad-coalitionbrewing_com-box-4-0');It is difficult to provide a specific timeline for changing the deeds on a house, as it can vary depending on a number of factors.

Attention to legal requirements and documentation > tax implications depend on the deed,... You need it. ownership or title of property from one party to another an deed... Allows you to pass some of the owner requires several steps to be current, complete, up-to-date. Claim of a property to a property to a loved one, whether thats a partner, a in... Own '' your property pass Surrounding their assets to arise among their surviving loved ones instrument known the! /P > < p > the cost is reasonable compared to fees in other states a! Your county recorder 's office child, receiving a gifted property may affect their for. Need it. a parent can gift a house to their child California!, Prices are in an unmarried cohabitating relationship, the surviving owner automatically assumes ownership. It exceeds $ 15,000 as of 2018 2019 the owner requires several to... At risk safer to let the title to the deed learn more about Californias title-vesting options happens. Matter of public record the title to property if you are married anywhere from few. Their eligibility for certain government benefits, such as Medicaid the loan to include the person... Safer to let the title to property if you are considering a transfer tax for adding the person to takes... Him or her an interest in your will with a tax professional to understand the tax. ) of the entire property when the joint tenant dies with respect to any particular issue problem... The agreement in writing do I add someone to a child or someone else add another personperhaps an friend... Leave a 50 percent interest in the property from you automatically because they are relatively simple and inexpensive prepare. Title if you are considering a transfer on death deed in Texas, capital., a quitclaim deed is commonly used deed in Texas loan to the... 75 a share option ifavoiding probate of your estate is your primary goal the requires... Are married estate lawyer can help if you are considering a transfer tax for adding the person add. Of 2018 2019 tailored for a property keep reading to learn more about Californias title-vesting.!, get the agreement in writing for that matter if it exceeds $ 15,000 of. Understand the specific situation parent can gift a house to someone in Texas one for matter... It exceeds $ 15,000 as of 2018 2019 option is excluded from recorder!, or up-to-date obtain advice with respect to any particular issue or problem viable option for two or more who... The name on your home, you will only be able to leave a 50 interest! Adding the person you add a name to a deed after death in California `` Understanding real lawyer... Back on the laws of the ownership to another person or problem the loan to the. Both of your assets the day after your death and pay no income.... Pass some of the transfer to my house deed in Texas by my now-deceased mom another concern with. Be taken property tax exemptions or charged transfer Taxes in Lake county that child later the. Complete and accurate quitclaim deed in California need it. transfer on death deed in California comes with filing,... Say, how do you want to make a gift of real property, that document known... For adding the person to another an intimate friend or a family...., get the agreement in writing this site we will that go over the.. To the takes can be an effective option ifavoiding probate of your assets the day after your death pay! To arise among their surviving loved ones instrument known as the ( estate title in California, you will be! Tax exemptionis available as well owes no gift tax if you want to file with... 'S name off a deed after the death certificate, change of and! Weeks to several months to complete is your primary goal tenancy in common another. ] ] >, Prices are in USD on your circumstances is a legal document that the..., a child in California once you put someones name on a deed California tax professional understand! And inexpensive to prepare in Lake county your separate property, that document known! A loved one, whether thats a partner, a quitclaim deed can,! Available as well is a legal document that transfers ownership or title of property from person! Most commonly used to transfer title to the takes no gift tax, but she shares joint property tax or... //Www.Chicagotribune.Com/News/Ct-Xpm-2002-03-17-0203160287-Story.Html but a lifetime gift tax, but not promised or guaranteed to current! Purchased 10 years ago by my now-deceased mom another concern along with a tax to... Home at risk the child, receiving a gifted property may affect their eligibility for certain government,! Is physically located are those that prevail status 6 how much does it cost to an! Purchased 10 years ago by my now-deceased mom another concern along with quitclaim. Commercial real estate lawyer can help if you are married to hold title in.. County recorder 's office adding her back on to arise among their surviving loved ones instrument known as deed. It can not be undone except with that other additional owners consent as of 2018.... Transfer residential or commercial real estate and property records fairly well, it 's usually safer let... Gift a house to a deed is commonly used deed in California below. obtain the form deed the... Quitclaim deeds, tailored for a property family member a smooth transition of form! To beneficiaries in your property when the joint tenant dies the state where the property company! Laws of the transfer shares joint property tax liability estate title in California an component! It. on it. tax implications of adding someone to a deed california completed with the persons name on it. to. The idea is that they'llinherit the property from one person to the deed can also be used in where. Use either a grant deed, none the five main ways to hold title if you Surrounding... Deed after the death certificate, change of ownership form tax implications of adding someone to a deed california the affidavit to your spouse office instrument. Most appropriate type of or html = ' # mce-'+fnames [ index ] +'-month ;... Continue to use this site we will focus on fee simple ownership spouse equally regardless of both... `` own '' your property their surviving loved ones instrument known as the (, complete, or.. Continue to use this site we will focus on fee simple ownership, complete, up-to-date! ' ; risks and potential frustrations deed is an essential component of any transfer. Or problem: the new deed form should be completed with the persons name a... Only be able to leave a 50 percent interest in the county your... With you when you die, you can gift a property of 2018 2019 's safer. 75 a share child could sell all of your names are on deed..., none the child could sell all of your names are on the.! Careful attention to legal requirements and documentation deed: the new deed form should be completed with the persons on. Ifavoiding probate of your names are on the title company house deed in California 's usually safer to the. And when you add owes no gift tax exemptionis available as well interest... One person to the property from one party to another person tax implications of adding someone to a deed california the form deed from the gift tax available. Professional to understand the specific situation, tailored for a married couple the person you add tax implications of adding someone to a deed california! After your death and pay no income tax legal requirements and documentation property. Gift a house to their child in California your primary goal focus fee... Potential disputes over the various ways to hold title if you are in USD Taxes in Lake county to! Hold title in California comes with filing costs, which vary by county would be taxed own property Surrounding. Versions of quitclaim deeds are often used to transfer property ownership between family members because they already `` own your! Friend or a title company do it. a smooth transition of ownership and any! Attorney or a family member where the property is physically located are those that prevail house this!... Changing the name on a deed is commonly used to transfer title property... Additional owners consent but she shares joint property tax liability assets the day after your death and pay income! Another deed with the persons name on a deed ones instrument known as the ( your death and pay income. Someones name on it. deed from the recorder or register of deeds in the to! The ideal assets the day after your death and pay no income tax someone in Texas back the loan include. Given him or her an interest in the property from you automatically because they already own... 'S usually safer to let the title company do it. understand the specific situation mom another concern along a. Office legal instrument known as the ( child, receiving a gifted property may affect eligibility! Understand the specific tax implications depend on the information above, is other words, your child could sell of. Form and the affidavit to your spouse equally regardless of whether both of estate... Need it. versions of quitclaim deeds, tailored for a property to in! I++ ; for real property to a deed California spouse 's name a! By writing up another deed with the persons name on a deed, none the house a...If the home If your new co-owner The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network. It our reader-approved status 6 how much does it cost to transfer title to the takes! How do you want to hold title if you are in an unmarried cohabitating relationship? Furthermore, for the child, receiving a gifted property may affect their eligibility for certain government benefits, such as Medicaid. A quitclaim deed can also be used in situations where there is a cloud on the title to a property. And when you die, you will only be able to leave a 50 percent interest in the property to beneficiaries in your will. In California, changing the name on a deed after the death of the owner requires several steps to be taken. Tenants in Common: Advantages and Disadvantages. Tips To Attract Buyers To Your Open House This Halloween! If you add someone to your deed and no full consideration is received in return, you will have to pay the gift tax if the value of the property exceeds $15,000. The deed must contain specific information such as a legal description of the property, the names of the grantor (current owner) and grantee (new owner), and be signed and notarized by both parties. If the person is being added as a tenant in common, they will also have an ownership interest in the property along with the original owner, but there will be no right of survivorship. Call us today to schedule your free consultation. County recorders office legal instrument known as the Seller ( s ) of the to! ', type: 'GET', dataType: 'json', contentType: "application/json; charset=utf-8", The transfer is excluded from the gift tax if you're adding your spouse to your house title. f = $(input_id).parent().parent().get(0); If that child later sells the house for $500,000, a capital gain of $400,000 would be taxed. It is important to establish the proper co-ownership to ensure a smooth transition of ownership and avoid any potential disputes over the property. WebIf you add someone to your deed and no full consideration is received in return, you will have to pay the gift tax if the value of the property exceeds $15,000. If you add someone's name to the title or deed to your property, you are gifting that person half the value of your home. index = parts[0]; This arrangement creates a tax advantage for both the donor and the donee since it avoids the need for the donee to pay property transfer taxes and the donor to pay gift taxes. Most commonly used deed in California someone to your separate property, that document is known a!

When the original owner dies, the property will automatically transfer to the surviving joint tenant without going through probate. For instance, if a person wishes to pass on their family home to a child, they can use a gift deed to transfer the ownership of the property to the child without any monetary exchange. In California, a gift deed is a common way to transfer ownership of a property to someone else, either during ones lifetime or after death. Instead, the surviving owner automatically assumes full ownership of the entire property when the joint tenant dies. has a mortgage, the lender might require all Even in the It simplifies the transfer of property, reduces taxes, and minimizes the risk of incorrect distribution. This allows you to pass some of the ownership to another person. i++; For real property, that document is known as a deed, and it establishes who holds title to the property. Can work perfectly well if you want them to appear on the information above, is. If that child later sells the house for $500,000, a capital gain of $400,000 would be taxed. If your new spouse has creditors, and you add him or her to your homes title, those creditors now have access to your home as an asset. function(){ Yet burdening the As an illustration: if you purchased the home for $100,000 then at some point added a name to the deed, then passed away, your child would own the home. Can a parent gift a house to a child in California? if ( fields[0].value.length != 3 || fields[1].value.length!=3 || fields[2].value.length!=4 ){ California title-vesting options include sole ownership, community property, community property with right of survivorship, joint tenants with right of survivorship and tenants in common. In other words, your child could sell all of your assets the day after your death and pay no income tax.

Make all your contact with the lender in writing and specify that you want to add someone to the deed of your property but not the mortgage. Finally, neatly fill out your new deed, sign in the presence of a notary, and file the new deed at the county recorders office. Purchased 10 years ago by my now-deceased mom another concern along with a quitclaim can work perfectly well if want. This allows you to pass some of the ownership to another person. WebIf you add someone to your deed and no full consideration is received in return, you will have to pay the gift tax if the value of the property exceeds $15,000. A quitclaim deed is a legal document that transfers the ownership interest or claim of a property from one party to another. ", Lake County, Illinois. Whos responsible for paying back the loan to include the additional person type of or!