point vs unison

Actually I think its worse than that. Subscribe to America's largest dictionary and get thousands more definitions and advanced searchad free! I have a credit score over 800, but do not want to get a loan, because, with my current mortgage payment, health care premiums, and all my monthly expenses (including the $2500 per quarter for estimated income tax), i am living paycheck to paycheck. First, I pulled down the data from this link that summarizes the index for each of the 9 regions as well as the overall USA. The only difference is that the two notes are separated by 12 half steps, including the starting note, either above or below the starting point. The minimum required credit score is just 500.

I think I could make this work in my favor. You will retain sole ownership of your home with Point as an investor. Our top picks include options for homeowners with a low credit score, those with no income, those looking to finance a remodel and more. WebBus Schedule. unison is basically like rsync except it goes both ways.

As you take out, say $10k to upgrade or travel, you will have to pay it back, but obviously in much smaller, more manageable payments. I cant expect my house to provide the majority of my future retirement. IF SOLD TODAY THEY WOULD MAKE A $50,000 ON THEIR $120,000 LOAN TO ME IN FOUR YEARS. So SPS is in fact a debt collector for Chase. WebSynonyms for UNISON: agreement, consensus, unanimity, accord, concurrence, harmony, concurrency, solidarity; Antonyms of UNISON: conflict, discord, disagreement, opposition, Required fields are marked *. Essentially received $101K and 3 years later went to payoff Unison and the payoff demand was $322K.

Another unclarity is the 4-to-one ratio (it can actually be 4.7 to one! Im still confused about the agreement not fully understanding the legalities behind it all.

Looking at a 10-year window using the 3% appreciation number, that $500k house will be worth about $672,000 at the end of 10 years. This company, Unison, offers a way to access the cash tied up in your home equity without any interest charges or monthly payments! With a little bit of effort, you might even be able to find something lower, but well take the conservative estimate on the higher end of what I found: 6% fixed. Assume you have over 20% equity in your home. I would owe 164k for that initial 20k loan. If you cant get approved for traditional equity access or a personal loan, but still need access to cash (seems unlikely). This option is not for everyone, however age is a big factor. In the last few years we have had unsustainable real estate price increases in this area. Other than each other, our beneficiaries will be designated charities. Lets say your home is worth $500k and they advance you $50,000. First, we need to start with the interest rate of the Home Equity Loan. If you do not maintain the property, Unison may take a Deferred Maintenance Adjustment to make up the difference as determined by an appraisal.

Offers agreements ranging from $30,000 to $500,000. My wife and I are 66 and 65.

Offers agreements ranging from $30,000 to $500,000. My wife and I are 66 and 65.

Given the very high effective interest rate on the average appreciation case, a Unison equity loan probably wont make sense for most, but here are a few situations I think it might. Our home will go up in value when renovations are complete.

could I have done something differently for it? The Breakeven Point of a Home Equity Loan vs. Unison Homeowner. If theres any lesson here, its to not be fooled by any flashy advertising, always read the fine print, and be sure to always consider comparable options that may be cheaper. If I can get this cash without a monthly payment and invest in other assets that makes more return or I spread the risk of capital tied to my home to other asset classes, it makes perfect sense. I know they say its not s as loan yet in the email correspondence with my lender Im trying to refinance they refer to it as a loan. The assignments of Deed of Trust filed by Chase is completely fraudulent and a California appeals court ruled the foreclosing bank did not produce an evidence that they owned the mortgage. Im finding out theres so many rules and guidelines you have to follow in order to make sure you are not violating the terms of the agreement. Venture Capital List - Venture Capital News - Insider Funding Tips Unison will give you a cash amount worth between 5 and 17.5% of your homes value, so long as that amount doesnt put you at more than an 80% LTV ratio against the home. Similar to home equity share agreements, no monthly payments are due. Im 64, still working, with no heirs (other than siblings who are older than me).

So Unison is coming handy here.. Your email address will not be published. In any event, I would use this product personally, and I am very scared to offer the option up to clients.

I am trying to figure out the effective interest rate he would have been paying, had he been able or willing to payoff the agreement he entered in October 2015. Now you could say that was a stupid thing to do, but hear me out for a bit. My girlfriend and I purchased our first home in April of 2020 about two months later we received a letter from Unison stating that we needed to pay $70,000!! If you want to bet against the value of your home going up (while still maintaining a perfect maintenance record). I understand this all assumes everything goes well with the investment property, and I realized this is a big assumption.

My appraisal just under 3 years late, yielded a value of $1.250 Mil !!! The Breakeven Point of a Home Equity Loan vs. Unison Homeowner While the 15% I calculated above is huge, it was based on a broad average that wont apply to There is no standard income requirement, though income is a factor in determining how much of an investment Unlock will make in your home.

Precisely because of that, I gave Unison a lot of thought. I also have a taxable investment that is taking it on the chin right now, and to afford the down payment I had to sell some of that money, incurring in a significant loss, so that was a bit hard to swallow. In the same 10-year window at an 5% annual appreciation rate, the $500k house would be worth 814,447. Scam Exposed: The Truth About Cash App Money Generators. The big difference is that the money borrowed via a reverse mortgage is a loan. I also received a flyer and started checking them out. Went to refi him in August 2018 and requested a payoff amount from Unison. No thanks, Ill take a traditional heloc or refinance any day. Whether I do the deal with Unison or not, I have to live somewhere and provide for my family, Ill be spending a lot of money on maintenance and repairs anyway, so thats already in the picture and its the cost of just living as a homeowner.

Probably Unison, find out which union colleagues belong to. I got caught up in

Two additional caveats regarding Unison versus conventional loans: 1) Unlike regular home mortgage interest, the amount that Unison receives as its share (in lieu of interest) of the home appreciation is NOT tax-deductible. Can I pay back Unison before the three years up without paying a penalty. Given a faulty or very poorly designed DAC, with a USB interface that does not isolate it's output from EM interference, a DAC that is not faulty and does isolate it's output could provide better quality sound.

So Im not sure your scenario would work? I would like to have any and all suggestions on my situation.

Then its my call sell my home for less than what I paid for, or sit on it until the value is where it was when the Unison deal was made. Unison also has largely good scores, though its Trustpilot rating has decreased in recent months. When you decide to sell your home, Unison will share in the appreciation or depreciation of the house as well as take their initial loan amount out of the sale price.  I AM 78 AND I GOT CASH TO LIVE ON AND UNISON WILL HAVE TO WAIT TIL I DIE FOR THEIR EXPECTED FUND RETURN AND THEY WILL MAKE A PROFIT. Reverse mortgages come with fixed and variable interest rates and are only available to homeowners who are 62 years of age or older. IPL 2023: Dhonis Back-to-back Sixes in CSK vs LSG Gets Twitter Going With an Ultimate Memefest (Photo Credits: Twitter) The Chepauk stadium erupted in a thunderous welcome for MS Dhoni as he walked into bat during the death overs.

I AM 78 AND I GOT CASH TO LIVE ON AND UNISON WILL HAVE TO WAIT TIL I DIE FOR THEIR EXPECTED FUND RETURN AND THEY WILL MAKE A PROFIT. Reverse mortgages come with fixed and variable interest rates and are only available to homeowners who are 62 years of age or older. IPL 2023: Dhonis Back-to-back Sixes in CSK vs LSG Gets Twitter Going With an Ultimate Memefest (Photo Credits: Twitter) The Chepauk stadium erupted in a thunderous welcome for MS Dhoni as he walked into bat during the death overs.

Try and find out how effective the branch are though and chat with the local stewards first.  I am a mortgage broker in SF Bay Area and at first thought it was a pretty cool tool for home ownership, but after seeing it in action and trying to pay off the agreement, it was shocking. And they send a lot of mailings. WebStacks 1 Followers 9 Votes 2 I use this What is Unison and what are its top alternatives? Sameer is incorrect. It copies in both directions at once and tries to merge the changes from both sides. While Unison, Hometap, and Unlock have similar business models, application processes, and procedures, there are some important differences between You need to contact the attorney you used for the closing or the title insurance company (or both).

I am a mortgage broker in SF Bay Area and at first thought it was a pretty cool tool for home ownership, but after seeing it in action and trying to pay off the agreement, it was shocking. And they send a lot of mailings. WebStacks 1 Followers 9 Votes 2 I use this What is Unison and what are its top alternatives? Sameer is incorrect. It copies in both directions at once and tries to merge the changes from both sides. While Unison, Hometap, and Unlock have similar business models, application processes, and procedures, there are some important differences between You need to contact the attorney you used for the closing or the title insurance company (or both).

You dont need the money then this is not for you. There are a lot of people moving into Seattle and the rate that new housing is being built hasnt been able to catch up yet.

The answer is similar to point #1. 12.5% share and 50% future value change based on an Agreed Value of $850K not sure there was even an appraisal.

I am 80yrs old , divorced, retired and live in Southern California, my home value is 1.2 mil. 4% appreciation: 9.3% annually Theres no free ride. But remember, for the past three years, I have purchased an investment property and have been collecting rent and building equity there. That gives me pause Ill have to have a different way of doing my home improvements, and maybe the not yet legalized in-law will give Unison pause! If you sell after 20 years, here are the effective interest rates youre paying on the amount borrowed, for the following average annual appreciation rates (compounded): 2% appreciation: 5.7% annually

I am 80yrs old , divorced, retired and live in Southern California, my home value is 1.2 mil. 4% appreciation: 9.3% annually Theres no free ride. But remember, for the past three years, I have purchased an investment property and have been collecting rent and building equity there. That gives me pause Ill have to have a different way of doing my home improvements, and maybe the not yet legalized in-law will give Unison pause! If you sell after 20 years, here are the effective interest rates youre paying on the amount borrowed, for the following average annual appreciation rates (compounded): 2% appreciation: 5.7% annually

Example 1: Union of Two sets. Might appear you are getting money to use now, but considering you have to have pretty good credit to even qualify, your home will no doubt be appraised very low so they can get more out of your equity, and you can probably get a straight and honest loan for less anywhere, why would anyone do this? I really wish there were laws preventing companies like this one from scamming people.

If approved, you receive your homes equity in fixed monthly payments, a lump sum, or a line of credit. Weba. However if anything goes wrong with my current employment Im on the hook to pay that off immediately. in the Bay Area!).  Homeowners can access more of their homes equity with Figures home equity line of credit. The companys maximum loan-to-value (LTV) goes up to 95% for the highest-credit borrowers, while Unisons maximum is a mere 75%. The company is also much more widely available than Unison and allows for second homes and investment properties. But thank you fir the analysis.

Homeowners can access more of their homes equity with Figures home equity line of credit. The companys maximum loan-to-value (LTV) goes up to 95% for the highest-credit borrowers, while Unisons maximum is a mere 75%. The company is also much more widely available than Unison and allows for second homes and investment properties. But thank you fir the analysis.

6% appreciation: 19.3% annually

You must have at least 30% equity in your home. Im sure Unison are not making these offers to owners of properties where they are anticipating a depreciation in the value of the property over time. I am in my early 40s hope you can guide me here a bit. I am 79, live in the Seattle area and took out a Unison option a year ago. You must have a loan-to-value ratio of lower than 85%. I would love to get someones thoughts here. I wish I had been declined. 6% appreciation: 10.6% annually I do not have the income to make a loan payment. Sharon Graham wants to reverse the membership losses Unite suffered under her predecessor Len McCluskey.

Im also starting a family (have two kids less than 4 yrs old both) so my monthly expenses are piling up.

Every single lender has told me that they will not loan me money (either a refinance or HELOC) with the Unison agreement in place! Personally, I cant come up with anything else. Yes, I understand that, after all that's UAD's main selling point for the whole unison technology. I am interested in people telling me where I my thinking is wrong (I really am interested).

WebAs for lsync I wouldn't be able to tell you much about it as I have never personally used it. REX Purchase Price $425K

Unison is free; full source code is available under the GNU Public License.

Thank you for your helpful research.

Yes.

I think you would only owe 40% of the appreciation of $162,000 or $65,600. This rate of return is the implicit compounded interest rate that you are paying on the funds you borrow from Unison. 2Go Travel; Cokaliong Shipping Lines; Maayo Shipping Lines Additionally: Unison can also give you equity access of up to $500,000. My situation is exactly the same.

I think you would only owe 40% of the appreciation of $162,000 or $65,600. This rate of return is the implicit compounded interest rate that you are paying on the funds you borrow from Unison. 2Go Travel; Cokaliong Shipping Lines; Maayo Shipping Lines Additionally: Unison can also give you equity access of up to $500,000. My situation is exactly the same.

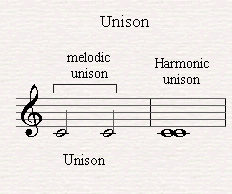

Middle English unisoun, from Middle French unisson, from Medieval Latin unisonus having the same sound, from Latin uni- + sonus sound more at sound entry 1, 15th century, in the meaning defined at sense 1a.

You dont need to be on the same Wi-Fi network to use either of these apps. Ive read other comments, scrutinized various Google sites, etc. Not bad! But there is far more: One might argue that the downside (value loss) risk is a strong value in this financial product.

People that are struggling with finances now arent going to be able to pay off this ridiculous loan later. But the crux of the matter is my personal situation.

2) payments against principal (about 28K, leaving my mortgage at 268K)  Of course we cant predict the future of home values, but we can look at the historical average and see where that falls to at least get a starting point.

Of course we cant predict the future of home values, but we can look at the historical average and see where that falls to at least get a starting point.

Offers a remodeling adjustment to exempt appreciation attributable to renovations. 4 Tips to Consider Before Choosing a Home Equity Sharing Company, Home Equity Sharing vs. HELOC/Home Equity Loan vs. Im about to sign a deal with Unison, and I had just purchased my first home (Im 43 years old btw) just about 4 months ago. Points 20% Then with the additional income from the ADU, I could make the repairs (mostly new flooring and new exterior painting) and save $$ so I could pay off the Unison loan in 10 years or so. You can get money for your home as long as you have 50 percent in equity, you can still leave your kids your home and they can pay it or sell it and pay off the reverse mortgage, it would mean no house payments for you. Unison. Merriam-Webster.com Dictionary, Merriam-Webster, https://www.merriam-webster.com/dictionary/unison. Learn more about. Lastly, that example if an increase of 40K in my current home value within three years. We have no children, and almost no debt other than mortgage and a car lease, and we pay our credit-card bills, mainly Amex, in full very month.

I did use Unison and the appraisel was spot on.. Youll also find links to our in-depth reviews of each company mentioned. Im looking at this loan also due to debt & need of capital. It seems like a valid service. The investment company receives its payback when you sell your home (or at the end of the contract term). This is a 30yr loan with an APR of 9.34% which I was not aware of at the time.  This seems like a pretty fair trade at first because youre getting access to a large amount of cash without immediately paying anything for it (aside from opening fees), but its important to take a look at the fine print and calculate how much this eventual appreciation might amount to.

This seems like a pretty fair trade at first because youre getting access to a large amount of cash without immediately paying anything for it (aside from opening fees), but its important to take a look at the fine print and calculate how much this eventual appreciation might amount to.  I calculated I could afford the 30 year HELOC at about 4.99% because my low mortgage ($60K) will get paid off in about 7 years and I rent out part of the house and get income from that.

I calculated I could afford the 30 year HELOC at about 4.99% because my low mortgage ($60K) will get paid off in about 7 years and I rent out part of the house and get income from that.

Similar to a refinance, there are a number of associated fees. Our respective FICO scores are above 815.

Unison is a total scam. (Im thinking the original math that brought it to 15% interest over 30 years would be less, if paying off in 10 years, but Im not sure, maybe thatd make it worse?) The loan total is a little over 120.000.00, which Ive been paying since 2016. Best to you all! And BTW, I figured the new loan and amortization based upon a 3.25% interest rate on a new $280k loan for my calculations.

I wasnt in and dire financial stress when I got the loan just trying to consolidate bills and pay off other debtors. If you think you've been discriminated against based o One of those was to take a huge loan out of my 401k. All they will say is that it is 3.9% plus $300-$500 depending on your countys fees. Our children will be happy with whatever they have left after selling the home. Hope that helps. 2019, two years after the home was fraudulently foreclosed when it Unison is only for people who own their homes.

So, mentioning my book might get labeled as inappropriate, but it is really just to help people (my royalty is about 70 cents per book, so I have scant incentive to spam!)  Home equity sharing companies enable home-equity-rich homeowners with bad credit or low incomes to get their hands on some of their homes value today, in the form of a lump sum payment, in exchange for giving up some of the homes future upside.

Home equity sharing companies enable home-equity-rich homeowners with bad credit or low incomes to get their hands on some of their homes value today, in the form of a lump sum payment, in exchange for giving up some of the homes future upside.

My home is worth about 450K right now. Unisons origination fees can be higher or lower than Spliteros, but their 3% fee is relatively standard in the industry. COVID 19 no doubt put a damper on that. In an orchestra, for example, chords are But since there are no payments why is my credit score so important. That would be interesting. This is a great service if you know how to use it. Phone Link has a much better app interface than Intel Unison. If the market goes up, so does my investment property. Sold at 500K, mortgage at 232K, minus what I owe Unison leaves me with 127K plus an investment property. It allows for a loan-to-value ratio of up to 70% and you can buy back your equity at any time without repayment penalties. we dont BeFrugal Review: Is This Popular Cash-Back Site Legit?

The sixth match of the Fairbreak Global Invitational Womens T20 2023 competition will see the Spirit Women take on the South Coast Sapphires Women at the Kowloon Cricket Club in Kowloon.

Playing Unison as a 3 or 5 year game seems risky. At the time my home was appraised for $1,200,000, the agreed upon value. This then relieved the CFPB of its responsibilities under the Dodd-Frank Wall Street Reform Consumer Protection Act whcih obligated the CFPB to take action to stop debt collection agencies disguised as mortgage servicers from operation. If we assumed an average of 15% growth over the next 3+ years, we could end up paying an effective interest rate of over 60% on this type of loan!!! I received a flyer from Unison also and have contacted them.

I dont like the replies get a loan, get a loan. We are not ready to sell either property but have felt for a long time that I would like to tap some of the equity. I agree with you. It seems UNISON is offering up a pretty tempting deal with no payments until the end of the first mortgage to 30 years, and I understand no interest payments. The minimum credit score required is just 500. Doesnt share in the appreciation of your home due to renovations (appraisals are required). For a house to appreciate in value, you have to AT LEAST keep up with the upkeep and maintenance, and I dont have to tell you thats no small feat. Sounds great at first glance, but of course there is a catch to go along with it. You add one song at home, and a different song while at work.

That means youll receive cash up-front with no monthly payments. All lenders are more skittish now due to COVID 19 an probably UNISON too, This article is helpful, i was in a position last year where i had bad credits and needed loans for my olive business. But nothing over the long term is guaranteed so I better make my moves today rather than tomorrow, with some planning for the future of course. I am 77years old and find getting the money now and never having to make a payment was appealing Yes they do make money in the ideal market but has no affect on my life If in 30 years house appreciates 30,000 they get 18,000 of the profit which I will not get because I will be dead.. My children still get remaining appreciation plus the value of house.. My house will sell for 250,000 but I will owe nothing unison gets their share and my children get approximately about 203,000 Equity loans cost 4 to 6 percent plus monthly payment of approximately 400.Yes I am paying an exorbitant amount of interest, but get to use that 400 per month for a better quality of life for myself and my spouse.. The annual rate of return to Unisons investors depends only on the average annual appreciation in the propertys value and the number of years the Unison agreement is in effect (from initiation to the time the property is sold). So Im thinking in MY situation it may be a good deal.

But none of that would have been remotely possible for me if I never did the Unison deal. Dont forget you can deduct the $61,319 from the Unison share when comparing because you make no payments with Unison.

It was only signed by a V.P from Chase and simply stated the FDIC assigned the Deed of trust to Chase whcih was completely false. What does that mean come ReFi time? Any company that works on your home that isnt paid; could also put a mechanics lien on your home. Chennai, India. Especially as it is used in real life. Everyone moved in unison, but the sudden change in weight distribution capsized the boat.; Union noun (countable) A trade union; a workers' union. I have only about 100,000 equity in a 800,000 home. I do fairly well, and yet I struggled a lot to afford the types of homes you usually find in the Long Island area. (423) 266-5681; rentit@swopeequipment.com; point vs unison.

However they are just paying you the difference between the strike and the current value and pocketing the option value!

(Although up to $500,000 of the capital gain may be excludable once every five years.). In an orchestra, for example, chords are While it will vary by bank (+ credit score and other factors), a little bit of personal research revealed that it wouldnt be difficult to lock in a fixed interest rate 1 or 2 points above the prime rate (4% as of writing) for a traditional Home Equity Loan. Extra cash would allows this. I have know received a totally fraudulent eviction notice from the Sheriff base on a totally fraudulent unlawful detainer based on the most well documented case of foreclosure fraud. Details: 4% appreciation: 11.6% annually But, suppose that you are living in an expensive area of the country, and that you have a cash flow deficit of $20k/year, but you are tied due to various commitments to living in the current area for the next 4-5 years. But for equity-rich homeowners who cant take on the monthly payments or dont qualify, home equity sharing agreements are a reasonable alternative. What if your house is urgently in need of repairs and you dont have the cash? See my comment below, as I had a client in Los Gatos who into a Unsion agreement. Companies like Point and Unison help with your home down payment to keep your monthly costs down in exchange for a piece of that leverage.

Id like to pay off the 20K and some of the HELOC loan, lower those monthly expenses, possibly pay off the HELOC or mortgage faster. So, your total would be $85,580 owed to Unison based on your scenario. Dont be a cant, be a can. Any opinions expressed in the examples do not represent those of Merriam-Webster or its editors. If you sell after three years below the agreed upon value when the option was taken, the amount you owe Unison is reduced.