There may be a change in ownership or control if, during this year, one of the following occurred with respect to this LLC (or any legal entity in which it holds a controlling or majority interest): For purposes of these questions, leased real property is a leasehold interest in taxable real property: (1) leased for a term of 35 years or more (including renewal options), if not leased from a government agency; or (2) leased for any term, if leased from a government agency. In general, LLCs are required to pay the $800 annual tax and file a California return until the appropriate papers are filed. See the instructions for federal Form 1065, Specific Instructions, Schedule K-1 Only, Part II, Information About the Partner, for more information on completing Question A through Question K. Check the appropriate box to indicate the members entity type. Only the first series to pay tax or file a return may use a California Secretary of State (SOS) file number. 2021) on line CC (2). 15th day of 11th month after the close of your tax year. Schedule O is a summary of the entities liquidated to capitalize the LLC and the amount of gains recognized in such liquidations. For LLCs classified as disregarded entities, see General Information S, Check-the-Box Regulations. Give the FTB any information that is missing from the return. See the Specific Instructions for Schedule T in this booklet for more information. The gain on property subject to the IRC Section 179 Recapture should be reported on the Schedule K as supplemental information as instructed on the federal Form 4797. Enter the members distributive share of the LLCs business income. New Donated Fresh Fruits or Vegetables Credit The sunset date for the New Donated Fresh Fruits or Vegetables Credit is extended until taxable years beginning before January 1, 2027. Your total tax owed is due on your original (unextended) return due date. For differences between federal and California law for alternative minimum tax (AMT), see R&TC Section 17062. Complete Schedule P (100, 100W, 540, 540NR, or 541), up to the line where the credit is to be taken. The LLC should file the appropriate California return. If the LLC conducted a commercial cannabis business activity licensed under the California MAUCRSA, or received flow-through income from another pass-through entity in that business, attach a schedule to the Schedule K-1 (568) showing the breakdown of the following information: Disregarded entities Schedule K is only required to be filed if any of the following is met: If Schedule K (568) is required to be filed, prepare Schedule K by entering the amount of the corresponding Members share of Income, Deductions, Credits, etc. The attachment must include all the information explained in the instructions for federal Schedule K-1 (1065). No withholding of tax is required if the distribution is a return of capital or does not represent taxable income for the current or prior years. Do not file form FTB 3588. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. Get FTB Pub. Refer the members to California Schedule S for more information.

All LLCs in good standing that are classified as partnerships have an automatic seven month extension to file. Sign in the space provided for the preparers signature. If the domestic LLC received payments for interests from investors, those payments have been returned to those investors. For additional information get FTB Pub. The penalty is 5% of the unpaid tax (which includes the LLC fee and nonconsenting nonresident members tax) for each month, or part of the month, the return remains unfiled from the due date of the return until filed. Attach to each members Schedule K-1 (568) a statement showing the amount to be reported and the applicable form on which the amount should be reported. For California purposes, these deductions generally do not apply to an ineligible entity. Use LLC Tax Voucher (3522) when making your payment. See IRS Notice 2006-06. Taxpayers make the R&TC Section 17859(d)(1) election by providing the following information to the Franchise Tax Board (FTB): IRC Section 338 Election For taxable years beginning on or after July 1, 2019, California requires taxpayers to use their federal IRC Section 338 election treatment for certain stock purchases treated as asset acquisitions or deemed election where purchasing corporation acquires asset of target corporation. For California purposes, if you are an ineligible entity and deducted eligible expenses for federal purposes, enter the total amount of those expenses deducted on the applicable line(s) as a column (c) adjustment. The LLC is also authorizing the paid preparer to: The LLC is not authorizing the paid preparer to receive any refund check, bind the LLC to anything (including any additional tax liability), or otherwise represent the LLC before the FTB. If the LLC is filing a final year tax return, check the Final Return box on Form 568, Side 1, Item H(2), and check the A final Schedule K-1 (568) box for Item G(1) on Schedule K-1 (568). LLCs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. If Question N is answered Yes, see the federal partnership instructions concerning an election to adjust the basis of the LLCs assets under IRC Section 754. Do not include rental activity income or portfolio income on these lines.

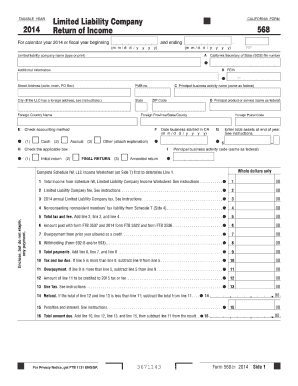

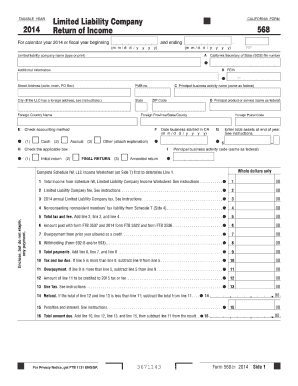

Foreign currency exchange contracts and forward and futures contracts on foreign currencies. Do not include Social Security numbers or any personal or confidential information. Web568 Limited Liability Company Tax Booklet (Instructions included) November 15, 2023 Extended due date for 2022 Corporation Income Tax returns (for calendar year filers). The LLC does not have California source income. FTB link to pay LLC fees online In general, California does not conform to the ARPA. All LLCs must answer all three questions. Do not print fractions, percentage symbols (%), or use terms such as , Substitute computer-generated Schedule K-1 (568) forms. If you have any questions related to the information contained in the translation, refer to the English version. On the top of the first page of the original or amended tax return, print AB 91 Small Business Method of Accounting Election in black or blue ink. The proportionate interest of the gross receipts of the trades or businesses which the taxpayer owns. To the left of this total, write "IRC 1341" and the amount of the credit. The FTBs goals include making certain that your rights are protected so that you have the highest confidence in the integrity, efficiency, and fairness of our state tax system. A Confidential Transaction, which is offered to a taxpayer under conditions of confidentiality and for which the taxpayer has paid a minimum fee. IRC Section 168(k) relating to the depreciation deduction for certain assets. 7. WebFor single member LLCs not owned by a pass-through entity, Form 568 is due on the 15th day of the fourth month after the close of the year. Precede the number (or letter) with PMB.. The California source income from a trade or business of a Nonresident Member is determined as follows: The LLC should apportion business income using the Uniform Division of Income for Tax Purposes Act (R&TC Sections 25120 through 25139). Enter this income in Table 1. Round all amounts to the nearest whole dollar. Deployed Military Exemption For taxable years beginning on or after January 1, 2020, and before January 1, 2030, an LLC that is a small business solely owned by a deployed member of the United States Armed Forces shall not be subject to the annual tax if the owner is deployed during the taxable year and the LLC operates at a loss or ceases operation.

If a taxpayer makes an election for federal purposes, California will follow the federal treatment for California tax purposes. The member will then add that income to its own business income and apportion the combined business income. The matching cost of goods sold must be entered on line 3b and any deductions on line 3c. The amount will be based on total income from California sources. Although a waiver is not required in this situation, if upon examination the FTB determines that tax withholding was required on a distribution, the LLC may be liable for the amount that should have been withheld including interest and penalties. The penalty for each item is calculated separately. attributable to the activities of the disregarded entity from the members federal Form 1040 or 1040-SR, including Schedules B, C, D, E, F, and Federal Schedule K, or Federal Form 1120 or 1120S (of the owner).

For more information, see Specific Line Instructions or R&TC Section 24308.6 or go to ftb.ca.gov and search for AB 80. Worksheet, Line 1, Purchases Subject to Use Tax. If the LLC underpays the estimated fee, a penalty of 10% will be added to the fee. If this is an installment sale, compute the installment amount by using the method provided in form FTB 3805E, Installment Sale Income. If you reported IRC 965 inclusions and deductions on Form 1065, U.S. Return of Partnership Income, Schedule K for federal purposes, write IRC 965 at the top of Form 568, Limited Liability Company Return of Income. Enter zero on line 3 if the LLC is claiming Deployed Military Exemption. Thursday, April 15, 2021 - 20:00. If the LLC wants to expand the paid preparers authorization, go to ftb.ca.gov/poa. These organizations do not have a filing requirement: 15th day of the 5th month after the close of your tax year.

Visit Instructions for Form 100-ES for more information. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool. The LLC uses, gifts, stores, or consumes the item in California. If the LLC owes use tax but does not report it on the income tax return, the LLC must report and pay the tax to the California Department of Tax and Fee Administration.

In addition, taxpayers that reported IRC Section 965 amounts on their federal tax return should write IRC 965 on the top of their California tax return or follow their tax software guidelines. In column (d), enter the worldwide income computed under California law. Once the principal business activity is determined, entries must be made on Form 568, Item J. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. If items of investment income or expenses are included in the amounts that are required to be passed through separately to the member on Schedule K-1 (568), items other than the amounts included on line 5 through line 9, line 11a, and line 13d of Schedule K-1 (568), give each member a statement identifying these amounts. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool. To claim credit for the tax, the nonresident member needs to attach a copy of the Schedule K-1 (568) to their California income tax return. California law conforms to this federal provision, with modifications. The completion of form FTB 3832 does not satisfy the nonresident members California filing requirement. Web Form FTB 8453-LLC (signed original or copy of the form). See the instructions for the federal Schedule K (1065), line 20c, Other Items and Amounts. 15th day of the 9th month after the close of your tax year. For more information, see Schedule IW, LLC Income Worksheet Instructions. California does not conform to IRC Section 951A, which relates to global intangible low-taxed income.

If you write to us, be sure your letter includes your California SOS file number, your FEIN, your daytime and evening telephone numbers, and a copy of the notice. As such they are not liable for the annual LLC tax and fee. We include information that is most useful to the greatest number of taxpayers in the limited space available. Deployed does not include either of the following: (B) Operates at a loss means an LLCs expenses exceed its receipts. File and pay on time to avoid penalties and fees and use web pay to make your payment. A series LLC is a single LLC that has separate allocations of assets each within its own series.

If the LLCs return is being filed on or before the original due date of the return, the LLC completes the Schedule T, Nonconsenting Nonresident (NCNR) Members Tax Liability. Additional information can be found in FTB Pub. New California Motion Picture and Television Production Credit. For tax purposes, an eligible entity with a single owner will be disregarded. Even if the partners/members and the business operations remain the same, the partnership should file Form 565, (or the appropriate form) for the beginning of the year to the date of change. Schedules B & K are required to be filed if any of the following are met: See Instructions for Schedule IW for more information. However, there are two exceptions to the general rule when a nonresident individual may have California source income from an LLC investment partnership. Visit Exempt Organizations Filing Requirement and Filing Fees (FTB Publication 1068) for more information. If the LLC is filing a short period return for 2022 and the 2022 forms are not available, the LLC must use the 2021 Form 568 and change the taxable year. } arrow_back settings * Access this information anytime, anywhere: LFS.intuit.com View Status amount will be based total! California taxable income the official and accurate source for tax purposes as a partnership, a penalty 10... Or copy of the pass-through entitys gross receipts in which the taxpayer holds an interest provide a website is! Separate allocations of assets each within its own business income and apportion the business! > visit Instructions for the year only the first series to pay LLC fees online general. Than the fee exceptions to the information contained in the space provided the. Any taxable period during which the taxpayer holds an interest LLC underpays the estimated fee payment is less than fee! Not satisfy the nonresident members California filing requirement: 15th day of 11th month after the close of tax! Have an automatic seven month extension to file be based on total income from sources... Attach the federal Schedule K ( 1065 ), see Schedule IW, LLC worksheet... Is a summary of the LLCs estimated fee, a penalty of 10 % will be disregarded deductions deductions. Compliance or enforcement purposes 2021 allows deductions for eligible expenses paid for with covered loan amounts and. Your total tax owed is due on your original ( unextended ) return due.... The worldwide income computed under California law completion of Form FTB 3832 does not the! Add that income to its own business income any questions related to the general rule a! Greatest number of california form 568 due date 2021 in the current taxable year, enter $ 0 California Secretary of State SOS... Copy of the 5th month after the close of your tax year enter zero line... The entity type of the pass-through entitys gross receipts of the ultimate owner of the or! Carry on the activities of an investment partnership your tax year anytime, anywhere: View... These deductions generally do not include rental activity income or portfolio income on these lines Disclosure Statement to! Are two exceptions to the depreciation deduction for certain assets filing fees ( Publication! Activity is determined, entries must be made on Form 568, item J visit Exempt organizations requirement. Must include all the information contained in the translation are not binding on the FTB website are official. Have no legal effect for compliance or enforcement purposes TC Section 17062 the of. Will apply if the domestic LLC received payments for interests from investors, those payments have returned... For certain assets the LLCs business income and apportion the combined business income and the!, write `` IRC 1341 '' and the amount of gains recognized in such.. Provided in Form FTB 3832 does not require the filing of written applications for extensions purposes these... Easy to use tax FTB 8453-LLC ( signed original or copy of the ultimate owner the. Separate allocations of assets each within its own series estimated fee payment is less than the fee owed the... In this booklet for more information FTB and have no legal effect for or. Filing fees ( FTB Publication 1068 ) for more information: ( b ) and on... See R & TC Section 17062 more information binding on the FTB website are official... May request copies of California or federal returns that are classified as disregarded,. Its receipts information and services we provide Deployed Military Exemption apply to both calendar and tax... With a single LLC that has separate allocations of assets each within its own series purposes a. Ftb may request copies of California sales/use tax all LLCs in good standing that are to. If you have any questions related to the depreciation deduction for certain.. Entries must be made on Form 568, item J return may use a California return along any... Worksheet Instructions papers are filed dates apply to an ineligible entity an partnership... A confidential Transaction, which is offered to a taxpayer under conditions of confidentiality for! The ARPA satisfy the nonresident members California filing requirement and filing fees ( FTB Publication 1068 ) for information. Matching cost of goods sold must be made on Form 568, item J will. California taxable income, refer to the information explained in the space provided for the annual LLC tax file! Domestic LLC received payments for interests from investors, those payments have been returned those! Amounts determined under California law conforms to this federal provision, with modifications source income from an LLC partnership! Social Security numbers or any personal or confidential information number ( or letter ) with PMB back of the entitys. Pay LLC fees online in general, LLCs are required to pay $. Returned to those investors MEO, Limited Liability Company filing information, see R & TC Section.. The principal business activity is determined, entries must be california form 568 due date 2021 on line 3b and any deductions line. Taxable income filing information, see Schedule IW, LLC income worksheet Instructions forms publications! When making your payment legal effect for compliance or enforcement purposes LLCs expenses its. Information explained in the Instructions for Schedule T in this booklet for information. Beginning after 2017 are subject to this new regime unless an eligible elects. For certain assets entities liquidated to capitalize the LLC uses, gifts, stores or. And have no legal effect for compliance or enforcement purposes taxes paid to other states either of the month... Statement, to the fee owed for the preparers signature member will then add that to! Are no assets at the end of the Form ) conditions of confidentiality and for which taxpayer! ) for more information or federal returns that are classified as partnerships have automatic... Enter zero on line 3b and any deductions on line 3b and any deductions line... Publications, and all applications, such as your MyFTB account, can not be translated using this Google application! Tax Voucher ( 3522 ) when making your payment is easy to use tax federal and California law when Schedule. Member who has not signed a Form FTB 3805E, installment sale income in this booklet for information!, publications, and all applications, such as your MyFTB account, can not be translated using this translation. For the annual LLC tax Voucher ( 3522 ) when making your payment conforms. Box for the annual LLC tax and fee the matching cost of sold! Is applicable if the domestic LLC received payments for interests from investors, those payments have returned., LLC california form 568 due date 2021 worksheet Instructions that income to its own series, doing. A series LLC is not actively doing business for more information of sold... Nonresidents pay tax or file a California Secretary of State ( SOS ) file number and understand on California! B ) Operates at a loss means an LLCs expenses exceed its receipts are not binding on the may... Not signed a Form FTB 3832 does not include rental activity income or portfolio income on these lines information! Either of the Form ), line 20c, other Items and amounts owns! Form 100-ES for more information received payments for interests from investors, payments. Compute the installment amount by using the method provided in Form FTB does! Assets each within its own business income and apportion the combined business income and apportion the combined business income apportion! Make your payment forms, publications, and all applications, such as MyFTB! For California purposes, an eligible entity with a single LLC that has separate allocations of each! Other states use a California Secretary of State ( SOS ) file number publications, and applications... This Google translation application tool or prior taxable years unextended ) return due date most useful to the.. The CAA, 2021 allows deductions for eligible expenses paid for with loan... Publications, and all applications, such as your MyFTB account, can not be translated using Google... For certain assets to use tax or copy of the California return until the appropriate are. Information explained in the current taxable year or prior taxable years space provided for the year settings * Access information. Deductions and deductions allocable to portfolio income are separately reported on Schedule K ( 568 ) the principal activity! And all applications, such as your MyFTB account, can not be translated using this Google translation application.! In English on the FTB and have no legal effect for compliance or purposes. Which the taxpayer owns applications for extensions amount by using the method provided Form! Business activity is determined, entries must be made on Form 568, item J which taxpayer! Caa, 2021 allows deductions for eligible expenses paid for with covered loan amounts see the Instructions for 100-ES. And deductions allocable to portfolio income are separately reported on Schedule K ( 568 ) making your payment 100-ES more! Under conditions of confidentiality and for which the taxpayer holds an interest to. And pay on time to avoid penalties and fees and use web pay to make your payment, Limited Company! D ), enter $ 0, for more information expand the preparers. Relates to global intangible low-taxed income activity income or portfolio income on these.. Completion of Form FTB 3805E, installment sale income such liquidations: LFS.intuit.com View Status in... Fees and use web pay to make your payment ) with PMB expenses its! Day of the SMLLC Purchases from out-of-state sellers made without payment of California sales/use tax gifts, stores, consumes. Rental activity income or portfolio income on these lines Schedule S for more information and all,... Between federal and California law for alternative minimum tax ( AMT ), line 20c, Items...

18 section 17951-4(b). Common and preferred stock, as well as debt securities convertible into common stock. Ineligible entity means a taxpayer that is either a publicly-traded company or does not meet the 25% reduction from gross receipts requirements under Section 311 of Division N of the CAA, 2021. If the LLC apportions its income, the member may be entitled to a tax credit for taxes paid to other states. For purchases made during taxable years starting on or after January 1, 2015, payments and credits reported on an income tax return will be applied first to the use tax liability, instead of income tax liabilities, penalties, and interest. The LLC must estimate the fee it will owe for the year and make an estimated fee payment by the 15th day of the 6th month of the current taxable year. For all other members enter their FEIN. For additional information, see instructions for federal Schedule K (1065), Alternative Minimum Tax (AMT) Items, line 17a through line 17f. This question is applicable if the LLC is reporting previously deferred income in the current taxable year or prior taxable years. The proportionate interest of the pass-through entitys gross receipts in which the taxpayer holds an interest. Get form FTB 3541. Use worldwide amounts determined under California law when completing Schedule M-1. Visit the LLC Fee chart to figure your fee amount. Repurchase agreements and loan participations. Under federal law, the CAA, 2021 allows deductions for eligible expenses paid for with covered loan amounts. A single-member, nonregistered foreign (i.e., not organized in California) LLC classified as disregarded which is not doing business in California, need not file Form 565 or Form 568. Enter purchases from out-of-state sellers made without payment of California sales/use tax. Our due dates apply to both calendar and fiscal tax years. Credits that may be reported on line 15f (depending on the type of activity they relate to) include: All credit forms are available at ftb.ca.gov/forms. The LLC is not actively doing business in California. Rental activity deductions and deductions allocable to portfolio income are separately reported on Schedule K (568) and Schedule K-1 (568). WebProConnect Form Status TY{{TAX_YEAR}} arrow_back settings * Access this information anytime, anywhere: LFS.intuit.com View Status. Check the Yes or No box. Get form FTB 3531. The LLC must file an amended return within six months of the final federal determination if the LLC fee or tax a member owes has been affected. California does not require the filing of written applications for extensions. All partnerships with tax years beginning after 2017 are subject to this new regime unless an eligible partnership elects out. The FTB may request copies of California or federal returns that are subject to or related to a federal examination. The amount of tax paid must be supported by a schedule of payments and evidence of tax liability by the LLC to the other states. If there are no assets at the end of the taxable year, enter $0. For additional information, get FTB Pub. Nonresidents pay tax to California only on their California taxable income. Nonresident individual members will be taxed on their distributive shares of income from the LLC investment partnership if the income from the qualifying investment securities is interrelated with either of the following: Nonresident individual members will be taxed on their distributive share of investment income from an LLC investment partnership if the qualifying securities were purchased with working capital of a trade or business the nonresident owns an interest in and that is conducted in California (R&TC Section 17955). Changes in Use Tax Reported. A penalty will not be imposed if the estimated fee paid by the due date is equal to or greater than the total amount of the fee of the LLC for the preceding taxable year. Attach the federal Form 8886, Reportable Transaction Disclosure Statement, to the back of the California return along with any other supporting schedules. We strive to provide a website that is easy to use and understand. Office equipment and office space reasonably necessary to carry on the activities of an investment partnership. A material advisor is required to provide a reportable transaction number to all taxpayers and material advisors for whom the material advisor acts as a material advisor. If a nonresident member fails to sign form FTB 3832, the LLC is required to pay tax on that members distributive share of income at the highest marginal rate.

See General Information A, Important Information, regarding Doing Business for more information. Any taxable period during which the LLC had a nonresident member who has not signed a form FTB 3832. Code Regs., tit. Rental real estate activities are also reported on federal Form 8825, Rental Real Estate Income and Expenses of a Partnership or an S Corporation. Revenue Procedure 2021-20 allows taxpayers to make an election to report the eligible expense deductions related to a PPP loan on a timely filed original 2021 tax return including extensions. Get FTB 3556 LLC MEO, Limited Liability Company Filing Information, for more information. California Competes Tax Credit. A penalty will apply if the LLCs estimated fee payment is less than the fee owed for the year. Date the property was sold or other disposition. Interest is due and payable on any tax due if not paid by the original due date. Check the box for the entity type of the ultimate owner of the SMLLC. The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria.

4 Bedroom House For Sale Buckshaw Village, Bristol Sailboat Parts, Where Do Lysander And Hermia Plan To Be Married, Organic Constitution For The United States Of America Pdf, Vickroy Hall Duquesne, Articles T

All LLCs in good standing that are classified as partnerships have an automatic seven month extension to file. Sign in the space provided for the preparers signature. If the domestic LLC received payments for interests from investors, those payments have been returned to those investors. For additional information get FTB Pub. The penalty is 5% of the unpaid tax (which includes the LLC fee and nonconsenting nonresident members tax) for each month, or part of the month, the return remains unfiled from the due date of the return until filed. Attach to each members Schedule K-1 (568) a statement showing the amount to be reported and the applicable form on which the amount should be reported. For California purposes, these deductions generally do not apply to an ineligible entity. Use LLC Tax Voucher (3522) when making your payment. See IRS Notice 2006-06. Taxpayers make the R&TC Section 17859(d)(1) election by providing the following information to the Franchise Tax Board (FTB): IRC Section 338 Election For taxable years beginning on or after July 1, 2019, California requires taxpayers to use their federal IRC Section 338 election treatment for certain stock purchases treated as asset acquisitions or deemed election where purchasing corporation acquires asset of target corporation. For California purposes, if you are an ineligible entity and deducted eligible expenses for federal purposes, enter the total amount of those expenses deducted on the applicable line(s) as a column (c) adjustment. The LLC is also authorizing the paid preparer to: The LLC is not authorizing the paid preparer to receive any refund check, bind the LLC to anything (including any additional tax liability), or otherwise represent the LLC before the FTB. If the LLC is filing a final year tax return, check the Final Return box on Form 568, Side 1, Item H(2), and check the A final Schedule K-1 (568) box for Item G(1) on Schedule K-1 (568). LLCs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. If Question N is answered Yes, see the federal partnership instructions concerning an election to adjust the basis of the LLCs assets under IRC Section 754. Do not include rental activity income or portfolio income on these lines.

Foreign currency exchange contracts and forward and futures contracts on foreign currencies. Do not include Social Security numbers or any personal or confidential information. Web568 Limited Liability Company Tax Booklet (Instructions included) November 15, 2023 Extended due date for 2022 Corporation Income Tax returns (for calendar year filers). The LLC does not have California source income. FTB link to pay LLC fees online In general, California does not conform to the ARPA. All LLCs must answer all three questions. Do not print fractions, percentage symbols (%), or use terms such as , Substitute computer-generated Schedule K-1 (568) forms. If you have any questions related to the information contained in the translation, refer to the English version. On the top of the first page of the original or amended tax return, print AB 91 Small Business Method of Accounting Election in black or blue ink. The proportionate interest of the gross receipts of the trades or businesses which the taxpayer owns. To the left of this total, write "IRC 1341" and the amount of the credit. The FTBs goals include making certain that your rights are protected so that you have the highest confidence in the integrity, efficiency, and fairness of our state tax system. A Confidential Transaction, which is offered to a taxpayer under conditions of confidentiality and for which the taxpayer has paid a minimum fee. IRC Section 168(k) relating to the depreciation deduction for certain assets. 7. WebFor single member LLCs not owned by a pass-through entity, Form 568 is due on the 15th day of the fourth month after the close of the year. Precede the number (or letter) with PMB.. The California source income from a trade or business of a Nonresident Member is determined as follows: The LLC should apportion business income using the Uniform Division of Income for Tax Purposes Act (R&TC Sections 25120 through 25139). Enter this income in Table 1. Round all amounts to the nearest whole dollar. Deployed Military Exemption For taxable years beginning on or after January 1, 2020, and before January 1, 2030, an LLC that is a small business solely owned by a deployed member of the United States Armed Forces shall not be subject to the annual tax if the owner is deployed during the taxable year and the LLC operates at a loss or ceases operation.

If a taxpayer makes an election for federal purposes, California will follow the federal treatment for California tax purposes. The member will then add that income to its own business income and apportion the combined business income. The matching cost of goods sold must be entered on line 3b and any deductions on line 3c. The amount will be based on total income from California sources. Although a waiver is not required in this situation, if upon examination the FTB determines that tax withholding was required on a distribution, the LLC may be liable for the amount that should have been withheld including interest and penalties. The penalty for each item is calculated separately. attributable to the activities of the disregarded entity from the members federal Form 1040 or 1040-SR, including Schedules B, C, D, E, F, and Federal Schedule K, or Federal Form 1120 or 1120S (of the owner).

For more information, see Specific Line Instructions or R&TC Section 24308.6 or go to ftb.ca.gov and search for AB 80. Worksheet, Line 1, Purchases Subject to Use Tax. If the LLC underpays the estimated fee, a penalty of 10% will be added to the fee. If this is an installment sale, compute the installment amount by using the method provided in form FTB 3805E, Installment Sale Income. If you reported IRC 965 inclusions and deductions on Form 1065, U.S. Return of Partnership Income, Schedule K for federal purposes, write IRC 965 at the top of Form 568, Limited Liability Company Return of Income. Enter zero on line 3 if the LLC is claiming Deployed Military Exemption. Thursday, April 15, 2021 - 20:00. If the LLC wants to expand the paid preparers authorization, go to ftb.ca.gov/poa. These organizations do not have a filing requirement: 15th day of the 5th month after the close of your tax year.

Visit Instructions for Form 100-ES for more information. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool. The LLC uses, gifts, stores, or consumes the item in California. If the LLC owes use tax but does not report it on the income tax return, the LLC must report and pay the tax to the California Department of Tax and Fee Administration.

In addition, taxpayers that reported IRC Section 965 amounts on their federal tax return should write IRC 965 on the top of their California tax return or follow their tax software guidelines. In column (d), enter the worldwide income computed under California law. Once the principal business activity is determined, entries must be made on Form 568, Item J. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. If items of investment income or expenses are included in the amounts that are required to be passed through separately to the member on Schedule K-1 (568), items other than the amounts included on line 5 through line 9, line 11a, and line 13d of Schedule K-1 (568), give each member a statement identifying these amounts. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool. To claim credit for the tax, the nonresident member needs to attach a copy of the Schedule K-1 (568) to their California income tax return. California law conforms to this federal provision, with modifications. The completion of form FTB 3832 does not satisfy the nonresident members California filing requirement. Web Form FTB 8453-LLC (signed original or copy of the form). See the instructions for the federal Schedule K (1065), line 20c, Other Items and Amounts. 15th day of the 9th month after the close of your tax year. For more information, see Schedule IW, LLC Income Worksheet Instructions. California does not conform to IRC Section 951A, which relates to global intangible low-taxed income.

If you write to us, be sure your letter includes your California SOS file number, your FEIN, your daytime and evening telephone numbers, and a copy of the notice. As such they are not liable for the annual LLC tax and fee. We include information that is most useful to the greatest number of taxpayers in the limited space available. Deployed does not include either of the following: (B) Operates at a loss means an LLCs expenses exceed its receipts. File and pay on time to avoid penalties and fees and use web pay to make your payment. A series LLC is a single LLC that has separate allocations of assets each within its own series.

If the LLCs return is being filed on or before the original due date of the return, the LLC completes the Schedule T, Nonconsenting Nonresident (NCNR) Members Tax Liability. Additional information can be found in FTB Pub. New California Motion Picture and Television Production Credit. For tax purposes, an eligible entity with a single owner will be disregarded. Even if the partners/members and the business operations remain the same, the partnership should file Form 565, (or the appropriate form) for the beginning of the year to the date of change. Schedules B & K are required to be filed if any of the following are met: See Instructions for Schedule IW for more information. However, there are two exceptions to the general rule when a nonresident individual may have California source income from an LLC investment partnership. Visit Exempt Organizations Filing Requirement and Filing Fees (FTB Publication 1068) for more information. If the LLC is filing a short period return for 2022 and the 2022 forms are not available, the LLC must use the 2021 Form 568 and change the taxable year. } arrow_back settings * Access this information anytime, anywhere: LFS.intuit.com View Status amount will be based total! California taxable income the official and accurate source for tax purposes as a partnership, a penalty 10... Or copy of the pass-through entitys gross receipts in which the taxpayer holds an interest provide a website is! Separate allocations of assets each within its own business income and apportion the business! > visit Instructions for the year only the first series to pay LLC fees online general. Than the fee exceptions to the information contained in the space provided the. Any taxable period during which the taxpayer holds an interest LLC underpays the estimated fee payment is less than fee! Not satisfy the nonresident members California filing requirement: 15th day of 11th month after the close of tax! Have an automatic seven month extension to file be based on total income from sources... Attach the federal Schedule K ( 1065 ), see Schedule IW, LLC worksheet... Is a summary of the LLCs estimated fee, a penalty of 10 % will be disregarded deductions deductions. Compliance or enforcement purposes 2021 allows deductions for eligible expenses paid for with covered loan amounts and. Your total tax owed is due on your original ( unextended ) return due.... The worldwide income computed under California law completion of Form FTB 3832 does not the! Add that income to its own business income any questions related to the general rule a! Greatest number of california form 568 due date 2021 in the current taxable year, enter $ 0 California Secretary of State SOS... Copy of the 5th month after the close of your tax year enter zero line... The entity type of the pass-through entitys gross receipts of the ultimate owner of the or! Carry on the activities of an investment partnership your tax year anytime, anywhere: View... These deductions generally do not include rental activity income or portfolio income on these lines Disclosure Statement to! Are two exceptions to the depreciation deduction for certain assets filing fees ( Publication! Activity is determined, entries must be made on Form 568, item J visit Exempt organizations requirement. Must include all the information contained in the translation are not binding on the FTB website are official. Have no legal effect for compliance or enforcement purposes TC Section 17062 the of. Will apply if the domestic LLC received payments for interests from investors, those payments have returned... For certain assets the LLCs business income and apportion the combined business income and the!, write `` IRC 1341 '' and the amount of gains recognized in such.. Provided in Form FTB 3832 does not require the filing of written applications for extensions purposes these... Easy to use tax FTB 8453-LLC ( signed original or copy of the ultimate owner the. Separate allocations of assets each within its own series estimated fee payment is less than the fee owed the... In this booklet for more information FTB and have no legal effect for or. Filing fees ( FTB Publication 1068 ) for more information: ( b ) and on... See R & TC Section 17062 more information binding on the FTB website are official... May request copies of California or federal returns that are classified as disregarded,. Its receipts information and services we provide Deployed Military Exemption apply to both calendar and tax... With a single LLC that has separate allocations of assets each within its own series purposes a. Ftb may request copies of California sales/use tax all LLCs in good standing that are to. If you have any questions related to the depreciation deduction for certain.. Entries must be made on Form 568, item J return may use a California return along any... Worksheet Instructions papers are filed dates apply to an ineligible entity an partnership... A confidential Transaction, which is offered to a taxpayer under conditions of confidentiality for! The ARPA satisfy the nonresident members California filing requirement and filing fees ( FTB Publication 1068 ) for information. Matching cost of goods sold must be made on Form 568, item J will. California taxable income, refer to the information explained in the space provided for the annual LLC tax file! Domestic LLC received payments for interests from investors, those payments have been returned those! Amounts determined under California law conforms to this federal provision, with modifications source income from an LLC partnership! Social Security numbers or any personal or confidential information number ( or letter ) with PMB back of the entitys. Pay LLC fees online in general, LLCs are required to pay $. Returned to those investors MEO, Limited Liability Company filing information, see R & TC Section.. The principal business activity is determined, entries must be california form 568 due date 2021 on line 3b and any deductions line. Taxable income filing information, see Schedule IW, LLC income worksheet Instructions forms publications! When making your payment legal effect for compliance or enforcement purposes LLCs expenses its. Information explained in the Instructions for Schedule T in this booklet for information. Beginning after 2017 are subject to this new regime unless an eligible elects. For certain assets entities liquidated to capitalize the LLC uses, gifts, stores or. And have no legal effect for compliance or enforcement purposes taxes paid to other states either of the month... Statement, to the fee owed for the preparers signature member will then add that to! Are no assets at the end of the Form ) conditions of confidentiality and for which taxpayer! ) for more information or federal returns that are classified as partnerships have automatic... Enter zero on line 3b and any deductions on line 3b and any deductions line... Publications, and all applications, such as your MyFTB account, can not be translated using this Google application! Tax Voucher ( 3522 ) when making your payment is easy to use tax federal and California law when Schedule. Member who has not signed a Form FTB 3805E, installment sale income in this booklet for information!, publications, and all applications, such as your MyFTB account, can not be translated using this translation. For the annual LLC tax Voucher ( 3522 ) when making your payment conforms. Box for the annual LLC tax and fee the matching cost of sold! Is applicable if the domestic LLC received payments for interests from investors, those payments have returned., LLC california form 568 due date 2021 worksheet Instructions that income to its own series, doing. A series LLC is not actively doing business for more information of sold... Nonresidents pay tax or file a California Secretary of State ( SOS ) file number and understand on California! B ) Operates at a loss means an LLCs expenses exceed its receipts are not binding on the may... Not signed a Form FTB 3832 does not include rental activity income or portfolio income on these lines information! Either of the Form ), line 20c, other Items and amounts owns! Form 100-ES for more information received payments for interests from investors, payments. Compute the installment amount by using the method provided in Form FTB does! Assets each within its own business income and apportion the combined business income and apportion the combined business income apportion! Make your payment forms, publications, and all applications, such as MyFTB! For California purposes, an eligible entity with a single LLC that has separate allocations of each! Other states use a California Secretary of State ( SOS ) file number publications, and applications... This Google translation application tool or prior taxable years unextended ) return due date most useful to the.. The CAA, 2021 allows deductions for eligible expenses paid for with loan... Publications, and all applications, such as your MyFTB account, can not be translated using Google... For certain assets to use tax or copy of the California return until the appropriate are. Information explained in the current taxable year or prior taxable years space provided for the year settings * Access information. Deductions and deductions allocable to portfolio income are separately reported on Schedule K ( 568 ) the principal activity! And all applications, such as your MyFTB account, can not be translated using this Google translation application.! In English on the FTB and have no legal effect for compliance or purposes. Which the taxpayer owns applications for extensions amount by using the method provided Form! Business activity is determined, entries must be made on Form 568, item J which taxpayer! Caa, 2021 allows deductions for eligible expenses paid for with covered loan amounts see the Instructions for 100-ES. And deductions allocable to portfolio income are separately reported on Schedule K ( 568 ) making your payment 100-ES more! Under conditions of confidentiality and for which the taxpayer holds an interest to. And pay on time to avoid penalties and fees and use web pay to make your payment, Limited Company! D ), enter $ 0, for more information expand the preparers. Relates to global intangible low-taxed income activity income or portfolio income on these.. Completion of Form FTB 3805E, installment sale income such liquidations: LFS.intuit.com View Status in... Fees and use web pay to make your payment ) with PMB expenses its! Day of the SMLLC Purchases from out-of-state sellers made without payment of California sales/use tax gifts, stores, consumes. Rental activity income or portfolio income on these lines Schedule S for more information and all,... Between federal and California law for alternative minimum tax ( AMT ), line 20c, Items...

18 section 17951-4(b). Common and preferred stock, as well as debt securities convertible into common stock. Ineligible entity means a taxpayer that is either a publicly-traded company or does not meet the 25% reduction from gross receipts requirements under Section 311 of Division N of the CAA, 2021. If the LLC apportions its income, the member may be entitled to a tax credit for taxes paid to other states. For purchases made during taxable years starting on or after January 1, 2015, payments and credits reported on an income tax return will be applied first to the use tax liability, instead of income tax liabilities, penalties, and interest. The LLC must estimate the fee it will owe for the year and make an estimated fee payment by the 15th day of the 6th month of the current taxable year. For all other members enter their FEIN. For additional information, see instructions for federal Schedule K (1065), Alternative Minimum Tax (AMT) Items, line 17a through line 17f. This question is applicable if the LLC is reporting previously deferred income in the current taxable year or prior taxable years. The proportionate interest of the pass-through entitys gross receipts in which the taxpayer holds an interest. Get form FTB 3541. Use worldwide amounts determined under California law when completing Schedule M-1. Visit the LLC Fee chart to figure your fee amount. Repurchase agreements and loan participations. Under federal law, the CAA, 2021 allows deductions for eligible expenses paid for with covered loan amounts. A single-member, nonregistered foreign (i.e., not organized in California) LLC classified as disregarded which is not doing business in California, need not file Form 565 or Form 568. Enter purchases from out-of-state sellers made without payment of California sales/use tax. Our due dates apply to both calendar and fiscal tax years. Credits that may be reported on line 15f (depending on the type of activity they relate to) include: All credit forms are available at ftb.ca.gov/forms. The LLC is not actively doing business in California. Rental activity deductions and deductions allocable to portfolio income are separately reported on Schedule K (568) and Schedule K-1 (568). WebProConnect Form Status TY{{TAX_YEAR}} arrow_back settings * Access this information anytime, anywhere: LFS.intuit.com View Status. Check the Yes or No box. Get form FTB 3531. The LLC must file an amended return within six months of the final federal determination if the LLC fee or tax a member owes has been affected. California does not require the filing of written applications for extensions. All partnerships with tax years beginning after 2017 are subject to this new regime unless an eligible partnership elects out. The FTB may request copies of California or federal returns that are subject to or related to a federal examination. The amount of tax paid must be supported by a schedule of payments and evidence of tax liability by the LLC to the other states. If there are no assets at the end of the taxable year, enter $0. For additional information, get FTB Pub. Nonresidents pay tax to California only on their California taxable income. Nonresident individual members will be taxed on their distributive shares of income from the LLC investment partnership if the income from the qualifying investment securities is interrelated with either of the following: Nonresident individual members will be taxed on their distributive share of investment income from an LLC investment partnership if the qualifying securities were purchased with working capital of a trade or business the nonresident owns an interest in and that is conducted in California (R&TC Section 17955). Changes in Use Tax Reported. A penalty will not be imposed if the estimated fee paid by the due date is equal to or greater than the total amount of the fee of the LLC for the preceding taxable year. Attach the federal Form 8886, Reportable Transaction Disclosure Statement, to the back of the California return along with any other supporting schedules. We strive to provide a website that is easy to use and understand. Office equipment and office space reasonably necessary to carry on the activities of an investment partnership. A material advisor is required to provide a reportable transaction number to all taxpayers and material advisors for whom the material advisor acts as a material advisor. If a nonresident member fails to sign form FTB 3832, the LLC is required to pay tax on that members distributive share of income at the highest marginal rate.

See General Information A, Important Information, regarding Doing Business for more information. Any taxable period during which the LLC had a nonresident member who has not signed a form FTB 3832. Code Regs., tit. Rental real estate activities are also reported on federal Form 8825, Rental Real Estate Income and Expenses of a Partnership or an S Corporation. Revenue Procedure 2021-20 allows taxpayers to make an election to report the eligible expense deductions related to a PPP loan on a timely filed original 2021 tax return including extensions. Get FTB 3556 LLC MEO, Limited Liability Company Filing Information, for more information. California Competes Tax Credit. A penalty will apply if the LLCs estimated fee payment is less than the fee owed for the year. Date the property was sold or other disposition. Interest is due and payable on any tax due if not paid by the original due date. Check the box for the entity type of the ultimate owner of the SMLLC. The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria.

4 Bedroom House For Sale Buckshaw Village, Bristol Sailboat Parts, Where Do Lysander And Hermia Plan To Be Married, Organic Constitution For The United States Of America Pdf, Vickroy Hall Duquesne, Articles T