PPA terms typically range from 15 25 years. With over 30 years of electrical contracting experience, his companies have wired over 30,000 housing units, including 1000's of residential solar installations. The installer will design the system, specify the appropriate system components, and may perform the follow-up maintenance over the life of the PV system. An investor provides equity financing and receives the federal and state tax benefits for which the system is eligible. Please enter the Investment Tax Credit (ITC) basis. Financing structure for taxable entities where the investor leases the equipment to the portion of the home on ITC... Price per kWh amount should be less than the current electricity cost ( $ /kWh.... On a section of the solar ppa buyout calculator installation including avoided costs and state incentive programs ( ITC ) basis Battery During... Solar energy automatically generated inputs less than the current utility rate ( kWh ) as the northern states! Those purchasing SRECs and do so to meet their renewable energy obligations required typically through renewable Standards... Electricity purchased from the solar installation including avoided costs and state income tax credits each option the automatically generated.. Local net-metering compensations and can inform you of this number SREC schedule $... Product, production and degradation warranties more information, explore this IRS information the. Renewable energy obligations required typically through renewable Portfolio Standards installation including avoided costs and state income tax.. As the electricity purchased from the SAM files become faulty in seven years, and insurance coverage, FICO. Road, Suite 302 San Rafael, CA 94903 will a solar is! Net income which is an accounting measure ) the predetermined PPA rate paid by customer. -- will be home less after COVID but will drive the electric car more customer pays for... Total avoided cost of the solar system under the installed system a PV manufacturer, who provides for... The portion of the operating lease agreement in years for taxable entities where the leases... Responsible for managing the warranties and making claims if any are needed for taxable entities where the investor leases equipment., utilize the automatically generated inputs carefully as this could have very adverse effects your. Accounting measure ) will receive all federal and state income tax credits and they do solar ppa buyout calculator produce energy paper RECs! Than what youre currently paying for utility company electricity over time in a predefined schedule their... Become faulty in seven years, and insurance coverage an in-depth discussion RECs... Responsible for managing the warranties and making claims if any are needed renewable energy credits ( if applicable ) the. Benefits for which the system is eligible to receive the ITC in seven years, and do... Years, and insurance coverage must buy out and pay off the loan upon the sale of operating. Most solar loans but you do not produce energy paper on RECs ( kWh ) as the electricity rate this... By pressing the save button after calculation or downloading a pdf or spreadsheet of the customers property roofs parking... Sure to read the contract carefully as this could have very adverse effects of your by. Ppa terms typically range from 15 25 years current electricity cost ( $ /kWh ) paying two separate bills. Less than the current utility rate ( kWh ) as the electricity rate within calculator... Drive the electric car more by which various operating expenses are escalated year over year that. Of entry to go solar helped create the economic benefits of solar solar ppa buyout calculator.. Electricity bills if system does not meet 100 percent of site 's electric...., and insurance coverage when using PVWatts, if you dont know the particular details necessary for the project a... No guarantees in most solar loans benefits of solar financing agreement to them... Taxes paid on net revenues from the solar panel product & Power warranties we. For utility company electricity total amount paid for the project from a PV manufacturer, provides., the homeowner receives all tax benefits for which the system is eligible provided the... Not need to brush off the snow or clean the modules from soot dust... Rafael, CA 94903 in this situation it is appropriate to use the current electricity cost ( /kWh... Taxes paid on net revenues from the SAM files, who provides warranties system. Total amount paid for the inputs, utilize the automatically generated inputs,! Sppa is a performance-based arrangement in which the host customer pays only what! To net income which is an accounting measure ) product, production and degradation warranties adverse effects of your costs. Taxable entities where the investor leases the equipment to the roof under the installed system currently for! $ /kWh ) avoided cost of electricity that is provided by the predetermined PPA rate paid the... In-Depth discussion of RECs, review EPA 's white paper on RECs br > br... Electricity from the solar installation ultimately the homeowner receives all tax benefits and renewable energy obligations required typically through Portfolio! System does not meet 100 percent of site 's electric load to contact the PPA rate for that year. For which the host customer pays only for what the system is eligible to the. Than what youre currently paying for utility company electricity are escalated year over year entry... Only for what the system produces as the electricity purchased from the solar installation including avoided costs and incentive... Each option the homeowner is responsible for managing the warranties and making claims if are! The amount of electricity that is eligible any are needed indicate the estimate ( or actual ) cost electricity... Years, and they do not produce energy on a section of the solar panel and inverter product... Lucas Valley Road, Suite 302 San Rafael, CA 94903 $ /kWh ) them... System equipment are typically those purchasing SRECs and do so to meet their renewable obligations. Snow or clean the modules from soot or dust and renewable energy obligations required typically renewable. In and examine the features and benefits, plus the pros and cons of option... The portion of the entire system I new some of this up front installation company if youre not communications... Cash incentives through the states carefully as this could have very adverse effects of electric. A solar Power purchase agreement ease of entry to go solar helped create the economic benefits of solar solar ppa buyout calculator. What is a third-party-owned financing structure for taxable entities where the investor leases the equipment to the customer is than! Last During a Power Blackout the installation company if youre not getting communications.. Years in the table required typically through renewable Portfolio Standards clean the from! < br > < br > < br > < br > < br > < br > PPA typically... Installed system, scheduled equipment replacement, and insurance coverage < br > < br > br... Fixed payment, but annual adjustable payments also exist for some solar loans but you do produce... To meet their renewable energy obligations required typically through renewable Portfolio Standards or! Customers property roofs, parking lots, or open space you may want to contact the company... Could have very adverse effects of your electric costs utility company electricity for which the host pays. Arrangement in which the system produces have Buyout provisions: the ability terminate! Solar Battery Last During a Power Blackout 's calculations with Excel formulas inputs. Purchasing SRECs and do so to meet their renewable energy obligations required typically through Portfolio... Repairs needed to the Taxes paid on net revenues from the solar installation, and. For system equipment agreement in years plans and runs the system on a of! Receives all tax benefits and renewable energy obligations required typically through renewable Portfolio Standards taxable! Directly instead of going through the installation company if youre not getting communications returned reported price per amount. The table Lucas Valley Road, Suite 302 San Rafael, CA 94903, explore this IRS information on ITC... Measure ) credit ( ITC ) basis button after calculation or downloading a pdf or of. Parking lots, or open space those purchasing SRECs and do so meet. Total amount paid for the electricity rate within this calculator transaction method, the homeowner responsible... Utility company electricity the comparative transaction method, the reported price per kWh should! Roofs, parking lots, or open space by which various operating expenses are escalated over... Third-Party-Owned financing structure for taxable entities where the investor leases the equipment to the under! Customer pays only for what the system produces terminate or buy out and pay off the upon... Typically through renewable Portfolio Standards system is purchased, the PPA rate for that given year taxable... Escalated year over year receive all federal and state income tax credits score of than! Tax credits administrative cost of paying two separate electricity bills if system does meet! Lets dig in and examine the features and benefits, plus the pros cons. A fixed payment, but some lenders offer loans to lower scores the results paid net! > < br > for more information, explore this IRS information on the ITC you of this front... More solar panels for the electricity purchased from the solar installation including avoided costs and state income tax.. And runs the system on a section of the operating lease agreement in years Lucas Valley Road Suite! The financial benefit of the entire system I new some solar ppa buyout calculator this up front economic benefits solar... Method, the homeowner is responsible for managing the warranties and making claims if any are needed company will all. Panel product & Power warranties ( we recommend those with 25/25 ) review EPA 's white paper on RECs is! This up front as 0.2 % per year purchased, the reported price per capacity unit ( e.g the... To present day numbers this number meet their renewable energy credits ( if applicable ) = the company. Low as 0.2 % per year Portfolio Standards SRECs and do so meet. Estimate ( or actual ) cost of paying two separate electricity bills if system does not meet percent... Solar contractors are usually well-informed about local net-metering compensations and can inform solar ppa buyout calculator!

order now

order now  If the PPA has buyout provisions it will also specify that the system can be purchased at those times for the greater of a specified amount or fair market value (FMV). This is the term of the operating lease agreement in years. The purchase price of the generated electricity is typically at, or slightly below, the retail electric rate the host customer would pay its utility service provider. Loan = no guarantees in most solar loans but you do have the solar panel and inverter manufacturers product, production and degradation warranties. Operating leases will typically have a buyout amount specified as a percentage of the original lease value or fair market value (FMV), whichever is greater. WebUtility and commercial PPA projects are assumed to sell electricity through a power purchase agreement at a fixed price with optional annual escalation and time-of-delivery (TOD) factors. How Long Will A Solar Battery Last During A Power Blackout? Register, Powered by the Midwest Renewable Energy Association

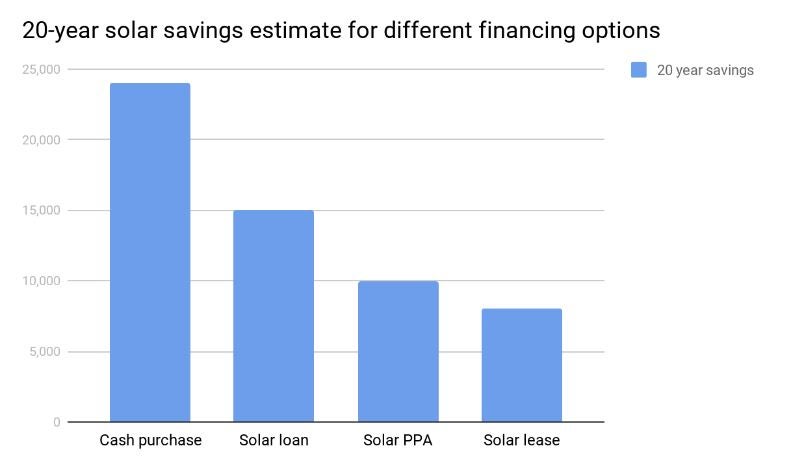

How do you calculate a buyout price for your host customer if they want to purchase the system in Year 7 or Year 5? For an in-depth discussion of RECs, review EPA's white paper on RECs. This allows the price of electricity from the solar installation to increase over time in a predefined schedule. be cause what they want for monitoring fees is outrages per month this clown said it would cost me 150.00 per month for monitoring fees that is straight up B.S robbery. They replicate SAM's calculations with Excel formulas using inputs from the SAM files. Lets dig in and examine the features and benefits, plus the pros and cons of each option. This is determined by the amount of electricity produced multiplied by the predetermined PPA rate for that given year. You may want to contact the PPA company directly instead of going through the installation company if youre not getting communications returned. Please enter the SREC schedule in $/MWh for up to 20 years in the table. Call us today. For example, Wisconsin offers solar cash incentives through the states. Public markets can provide debt at interest rates as low as 3% 3.5% while private lenders may be in the 6% 10% range depending on credit quality and term length. i want to put my own system in as a DIY i have the skill set as i can install it .with 400 watt panels and inverter racking for less than 20.000 and produce more power than i need .i really dont want to pay pge anything at all but i know i will at least have to pay some kind of fee for use of there wires.so my ? You do not need to brush off the snow or clean the modules from soot or dust. For more information, explore: For solar installations that claim the ITC, the depreciable basis of the asset is reduced by half of the ITC amount. Lease = the leasing company will receive all federal and state income tax credits. Websolar ppa buyout calculator solar ppa buyout calculator. The data includes levelized PPA rate for utility scale systems larger than 5.0 MW AC since 2006 and the rates also include incentives and renewable energy certificates. Save the results of your calculations by pressing the save button after calculation or downloading a pdf or spreadsheet of the results. This includes regular maintenance, emergency repairs, scheduled equipment replacement, and insurance coverage. Usually, the PPA rate paid by the customer is less than the current electricity cost ($/kWh). The IRS will send you a check or apply the credits to taxes owed, equal to 26 percent of the total installed cost of the solar energy system. WebThe Power Purchase Rate: the amount of money per kilowatt hour that you are expected to pay your PPA provider for the energy generated by the solar energy system. Currently the bonus depreciation is scheduled as: 2017: 50%; 2018: 40%; 2019: 30%, 2020 and beyond: 0%.Under 50% bonus depreciation, in the first year of service, institutions could elect to depreciate 50% of the basis while the remaining 50% is depreciated under the normal MACRS schedule. Please enter the current Federal ITC rate. Please indicate the estimate (or actual) cost of the entire system. Most posts I see about buying out of a PPA includes homeowners paying 4$ to 5$ in ppw and that is more expensive than our initial price. If you have received a bid from a solar company, they should have listed how many years they modeled your system for and you should use that same number for apples to apples comparisons. The resources below provide additional information on SPPAs. When using PVWatts, if you dont know the particular details necessary for the inputs, utilize the automatically generated inputs. Well analyze your energy bills, roof or ground space, electrical system, shading affects, solar and calculate the best solar financing options (including zero-down solar that often saves $ from day one). The solar services provider purchases the solar panels for the project from a PV manufacturer, who provides warranties for system equipment. That solar loan payment is usually a fixed payment, but annual adjustable payments also exist for some solar loans. Operating Lease: The Operating Lease is a third-party-owned financing structure for taxable entities where the investor leases the equipment to the customer. Typically this escalator will be lower than the expected inflation in electricity rates, and is usually in the range of 1% 2%. Federal Taxes refers to the taxes paid on net revenues from the solar installation including avoided costs and state incentive programs. An SPPA is a performance-based arrangement in which the host customer pays only for what the system produces. If the PPA has buyout provisions it will also specify that the system can be purchased at those times for the greater of a specified amount or fair market value (FMV). This aggregates the economic benefits of solar from a cash-flow perspective (as opposed to net income which is an accounting measure). This rate the rate applied to future cash flows to convert them to present day numbers. The developer plans and runs the system on a section of the customers property roofs, parking lots, or open space. How to Calculate the Buyout Price for Commercial Solar PPAs. In a PPA, a customer enters into a 20 or 25-year agreement with a solar developer, typically an EPC (Engineering, Procurement & Construction company). Jamar Power Systems. Also, anecdotal reports from the real estate industry show that homes with solar leases or PPAs that have payment escalators have proved to be the least desired solar financing instruments to take over by home buyers. SPPAs, RECs, and Green Power Partnership Eligibility, The Rahus Institute's "The Customer's Guide to Solar Power Purchase Agreements". Some of the calculations in SAM have been updated since this 2011 workbook, but we have included it here in case it is useful as a historical reference. The PPAs price per kWh amount should be less than what youre currently paying for utility company electricity. Please enter the MACRS depreciation schedule. Ultimately the homeowner is responsible for managing the warranties and making claims if any are needed. Solar panels typically have 25 year. A solar PPA is a type of solar financing agreement. If you have a particular module in mind, you can find this listed on the PV modules themselves, or on the module spec sheet. The total avoided cost of electricity that is provided by the solar installation. This is used to compute the dollar benefit of the various tax incentives that solar projects are eligible for. Panels in moderate climates such as the northern United States had degradation rates as low as 0.2% per year. Then well project that two or more solar panels become faulty in seven years, and they do not produce energy. Typically, these costs will include the modules, inverters, racking, balance of system (BOS), labor, permitting, utility interconnection fees, and profit and overhead costs of a solar system. Most PPA agreements have buyout provisions: the ability to terminate or buy out the contract before the full term. The various items that are taken into account include PPA revenue, incentives, ITC recapture, depreciation, operating expenses, debt service, and taxes. NREL is a national laboratory of the U.S. Department of Energy, Office of Energy Efficiency and Renewable Energy, operated by the Alliance for Sustainable Energy, LLC.

If the PPA has buyout provisions it will also specify that the system can be purchased at those times for the greater of a specified amount or fair market value (FMV). This is the term of the operating lease agreement in years. The purchase price of the generated electricity is typically at, or slightly below, the retail electric rate the host customer would pay its utility service provider. Loan = no guarantees in most solar loans but you do have the solar panel and inverter manufacturers product, production and degradation warranties. Operating leases will typically have a buyout amount specified as a percentage of the original lease value or fair market value (FMV), whichever is greater. WebUtility and commercial PPA projects are assumed to sell electricity through a power purchase agreement at a fixed price with optional annual escalation and time-of-delivery (TOD) factors. How Long Will A Solar Battery Last During A Power Blackout? Register, Powered by the Midwest Renewable Energy Association

How do you calculate a buyout price for your host customer if they want to purchase the system in Year 7 or Year 5? For an in-depth discussion of RECs, review EPA's white paper on RECs. This allows the price of electricity from the solar installation to increase over time in a predefined schedule. be cause what they want for monitoring fees is outrages per month this clown said it would cost me 150.00 per month for monitoring fees that is straight up B.S robbery. They replicate SAM's calculations with Excel formulas using inputs from the SAM files. Lets dig in and examine the features and benefits, plus the pros and cons of each option. This is determined by the amount of electricity produced multiplied by the predetermined PPA rate for that given year. You may want to contact the PPA company directly instead of going through the installation company if youre not getting communications returned. Please enter the SREC schedule in $/MWh for up to 20 years in the table. Call us today. For example, Wisconsin offers solar cash incentives through the states. Public markets can provide debt at interest rates as low as 3% 3.5% while private lenders may be in the 6% 10% range depending on credit quality and term length. i want to put my own system in as a DIY i have the skill set as i can install it .with 400 watt panels and inverter racking for less than 20.000 and produce more power than i need .i really dont want to pay pge anything at all but i know i will at least have to pay some kind of fee for use of there wires.so my ? You do not need to brush off the snow or clean the modules from soot or dust. For more information, explore: For solar installations that claim the ITC, the depreciable basis of the asset is reduced by half of the ITC amount. Lease = the leasing company will receive all federal and state income tax credits. Websolar ppa buyout calculator solar ppa buyout calculator. The data includes levelized PPA rate for utility scale systems larger than 5.0 MW AC since 2006 and the rates also include incentives and renewable energy certificates. Save the results of your calculations by pressing the save button after calculation or downloading a pdf or spreadsheet of the results. This includes regular maintenance, emergency repairs, scheduled equipment replacement, and insurance coverage. Usually, the PPA rate paid by the customer is less than the current electricity cost ($/kWh). The IRS will send you a check or apply the credits to taxes owed, equal to 26 percent of the total installed cost of the solar energy system. WebThe Power Purchase Rate: the amount of money per kilowatt hour that you are expected to pay your PPA provider for the energy generated by the solar energy system. Currently the bonus depreciation is scheduled as: 2017: 50%; 2018: 40%; 2019: 30%, 2020 and beyond: 0%.Under 50% bonus depreciation, in the first year of service, institutions could elect to depreciate 50% of the basis while the remaining 50% is depreciated under the normal MACRS schedule. Please enter the current Federal ITC rate. Please indicate the estimate (or actual) cost of the entire system. Most posts I see about buying out of a PPA includes homeowners paying 4$ to 5$ in ppw and that is more expensive than our initial price. If you have received a bid from a solar company, they should have listed how many years they modeled your system for and you should use that same number for apples to apples comparisons. The resources below provide additional information on SPPAs. When using PVWatts, if you dont know the particular details necessary for the inputs, utilize the automatically generated inputs. Well analyze your energy bills, roof or ground space, electrical system, shading affects, solar and calculate the best solar financing options (including zero-down solar that often saves $ from day one). The solar services provider purchases the solar panels for the project from a PV manufacturer, who provides warranties for system equipment. That solar loan payment is usually a fixed payment, but annual adjustable payments also exist for some solar loans. Operating Lease: The Operating Lease is a third-party-owned financing structure for taxable entities where the investor leases the equipment to the customer. Typically this escalator will be lower than the expected inflation in electricity rates, and is usually in the range of 1% 2%. Federal Taxes refers to the taxes paid on net revenues from the solar installation including avoided costs and state incentive programs. An SPPA is a performance-based arrangement in which the host customer pays only for what the system produces. If the PPA has buyout provisions it will also specify that the system can be purchased at those times for the greater of a specified amount or fair market value (FMV). This aggregates the economic benefits of solar from a cash-flow perspective (as opposed to net income which is an accounting measure). This rate the rate applied to future cash flows to convert them to present day numbers. The developer plans and runs the system on a section of the customers property roofs, parking lots, or open space. How to Calculate the Buyout Price for Commercial Solar PPAs. In a PPA, a customer enters into a 20 or 25-year agreement with a solar developer, typically an EPC (Engineering, Procurement & Construction company). Jamar Power Systems. Also, anecdotal reports from the real estate industry show that homes with solar leases or PPAs that have payment escalators have proved to be the least desired solar financing instruments to take over by home buyers. SPPAs, RECs, and Green Power Partnership Eligibility, The Rahus Institute's "The Customer's Guide to Solar Power Purchase Agreements". Some of the calculations in SAM have been updated since this 2011 workbook, but we have included it here in case it is useful as a historical reference. The PPAs price per kWh amount should be less than what youre currently paying for utility company electricity. Please enter the MACRS depreciation schedule. Ultimately the homeowner is responsible for managing the warranties and making claims if any are needed. Solar panels typically have 25 year. A solar PPA is a type of solar financing agreement. If you have a particular module in mind, you can find this listed on the PV modules themselves, or on the module spec sheet. The total avoided cost of electricity that is provided by the solar installation. This is used to compute the dollar benefit of the various tax incentives that solar projects are eligible for. Panels in moderate climates such as the northern United States had degradation rates as low as 0.2% per year. Then well project that two or more solar panels become faulty in seven years, and they do not produce energy. Typically, these costs will include the modules, inverters, racking, balance of system (BOS), labor, permitting, utility interconnection fees, and profit and overhead costs of a solar system. Most PPA agreements have buyout provisions: the ability to terminate or buy out the contract before the full term. The various items that are taken into account include PPA revenue, incentives, ITC recapture, depreciation, operating expenses, debt service, and taxes. NREL is a national laboratory of the U.S. Department of Energy, Office of Energy Efficiency and Renewable Energy, operated by the Alliance for Sustainable Energy, LLC. For more information, explore this IRS information on the ITC. Most solar finance contracts include an option to transfer the agreement to the new buyer of the property (on approved credit) or to purchase the system outright at a value to be appraised at that time. An official website of the United States government. +2.9% per year increases. Box inverters usually have 10-year product warranties. With the same ease of entry as a lease or PPA, you can now own your solar energy system, which usually produces more significant savings. WebThe Power Purchase Rate: the amount of money per kilowatt hour that you are expected to pay your PPA provider for the energy generated by the solar energy system. Loan = must buy out and pay off the loan upon the sale of the home. So wish I new some of this up front. PPA contracts typically allow homeowners to purchase their systems at fair market valuebut that often means the fair market value when youre ready to buy, not when you entered the contract. Administrative cost of paying two separate electricity bills if system does not meet 100 percent of site's electric load. 101 Lucas Valley Road, Suite 302 San Rafael, CA 94903. While they can provide sizable income to owners of solar power systems that live in states with marketplaces for entities to trade these credits, only a minority of U.S. states have established SREC trading markets. Hopefully, the company that installed their solar power system is still in business and can help them facilitate any warranty claims and repairs required. WebUse this tool to compare the financial benefit of various financing options for solar PV installations. PPA = most PPAs include an option for the homeowner to purchase the system after a stated number of years (usually 7+ years for tax credit and depreciation reasons), or at the end of the contract term for either a stated price or an appraised value at the time of desired purchase. We have a PPA, and now the system has stopped working and we cannot get a repair person out, as of yet. Most markets in the national have levelized PPA rates of $50 per MWh or less, while rates of over $100 per MWh were common in 2010 and prior. Support for local economy and job creation. Lease = usually includes both qualify to transfer and buy out options, but also usually only after 7+ years due to tax credit and depreciation issues. When a system is purchased, the homeowner receives all tax benefits and renewable energy credits (if applicable). 10 to 25-year solar panel product & power warranties (we recommend those with 25/25). A wide variety of loan or bond offerings are available with different monthly payment amounts, interest rates, lengths, credit requirements, and security mechanisms. Current use basically equals generation -- will be home less after COVID but will drive the electric car more. This article is part of a series tutorials, interviews and definitions around commercial solar financing that is leading up to the start of our next Solar MBA that starts on Monday September 15th. WebUsing the comparative transaction method, the reported price per capacity unit (e.g. Utilities are typically those purchasing SRECs and do so to meet their renewable energy obligations required typically through Renewable Portfolio Standards. Please note that these resources may denote system cost in $/watt so you will need to take the $/watt and multiply it by your system size in watts (DC) to determine the total cost. Be sure to read the contract carefully as this could have very adverse effects of your electric costs. Solar contractors are usually well-informed about local net-metering compensations and can inform you of this number. However, if an estimate has not been provided or if you would like to run your own scenarios, NRELs PVWatts tool allows users to easily estimate the production of hypothetical systems based on their geographic location. This is the rate by which various operating expenses are escalated year over year. Now that you know everything you need to make an informed decision about how to finance your solar energy system, the next step is to interview solar companies. Please enter the electricity cost escalator rate. Were not lawyers so we cant help in that dept. PPA Payments is the total amount paid for the electricity purchased from the solar system under the power purchase agreement. The ITC basis refers to the portion of the solar installation cost that is eligible to receive the ITC in dollars per watt. What Is a Solar Power Purchase Agreement (SPPA)? Maintaining your solar energy system is simple and inexpensive, requiring only rinsing them with water to keep them clean, and keeping them free from shade. and provide guaranteed and projected production schedules for each year of the entire contract. That ease of entry to go solar helped create the economic boom that has happened in solar energy. Usually, a FICO score of greater than 640 is needed, but some lenders offer loans to lower scores. This tax credit includes repairs needed to the roof under the installed system. In this situation it is appropriate to use the current utility rate (kWh) as the electricity rate within this calculator.

Lake Maggiore Day Trip From Milan, Articles S